IPO Update: Atlas Energy Solutions Readies $387 Million IPO

Summary

- Atlas Energy Solutions has filed proposed terms for a $387 million IPO.

- The firm provides proppant (Sand) and related services to exploration and production firms in the Permian Basin.

- AESI has produced growing revenue and profits and appears well-positioned in a better-managed environment in the Permian Basin.

- My outlook on the IPO is a Buy at up to $21.50 per share.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

BanksPhotos

A Quick Take On Atlas Energy Solutions

Atlas Energy Solutions (AESI) has filed proposed terms to raise $387 million in gross proceeds from the sale of its Class A common stock in an IPO, according to an amended registration statement.

The firm provides proppant [sand] and related services for use in fracking activity in the Permian Basin.

Although the IPO isn’t cheap, given the firm’s growth, profitability, and prospects, my outlook on the IPO is a Buy at up to $21.50 per share.

Atlas Energy Overview

Austin, Texas-based Atlas Energy Solutions Inc. was founded to develop service capabilities to provide proppant to E&P companies in unconventional oil & gas fields in the Permian Basin.

Management is headed by founder, Executive Chairman and CEO Ben M. “Bud” Brigham, who has been with the firm since its inception in 2017 and was previously the founder of Brigham Resources and Brigham Minerals.

Management also intends to create its 'Dune Express', a 'long-haul overland conveyor system to deliver proppant' from its facilities into the Northern Delaware Basin, thereby reducing truck traffic on public roadways and increasing its delivery efficiencies.

As of December 31, 2022, Atlas Energy has booked fair market value investment of $407 million from investors including Permian Dunes Holding Company, Gregory M. Shepard and BlackGold SPV I LP.

Atlas Energy - Customer Acquisition

The firm sells its services to exploration & production companies operating in the Permian Basin area.

The company controls more than '14,500 acres on the giant open dunes [Winkler Sand Trend], which represents more than 70% of the total giant open dune acreage available for mining.'

Selling, G&A expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

Selling, G&A | Expenses vs. Revenue |

Period | Percentage |

2022 | 5.0% |

2021 | 9.9% |

(Source - SEC)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A spend, rose to 12.8x in the most recent reporting period. (Source - SEC)

Atlas Energy’s Market & Competition

As a proxy for the firm’s end market, according to a 2017 market research report by Global Market Insights, the global market for hydraulic fracturing was an estimated $24 billion in 2015 and is expected to exceed $65 billion by 2024.

This represents a forecast CAGR of 12% from 2016 to 2024.

The main drivers for this expected growth are growing energy usage in the commercial and industrial sectors and the development of unconventional oil & gas resources in various regions worldwide.

Also, declining production from existing legacy wells will drive the need for additional exploration and production along with continued advancement of drilling technologies.

Major competitive or other industry participants include:

COVIA

High Roller Sand

Black Mountain Sand

Freedom Proppants

H-Crush

U.S. Silica (SLCA)

Signal Peak Silica

Alpine Silica

Badger Mining Corporation

Vista Proppants and Logistics (VPRL)

Capital Sand Company

Others

Atlas Energy Solutions Inc. Financial Performance

The company’s recent financial results can be summarized as follows:

Sharply growing top line revenue

Increasing gross profit and gross margin

Strong growth in operating profit

Substantially higher cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

2022 | $ 482,724,000 | 180.0% |

2021 | $ 172,404,000 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

2022 | $ 256,308,000 | 300.1% |

2021 | $ 64,067,000 | |

Gross Margin | ||

Period | Gross Margin | |

2022 | 53.10% | |

2021 | 37.16% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

2022 | $ 231,991,000 | 48.1% |

2021 | $ 46,996,000 | 27.3% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

2022 | $ 217,006,000 | 45.0% |

2021 | $ 4,258,000 | 0.9% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

2022 | $ 206,012,000 | |

2021 | $ 21,356,000 | |

(Source - SEC)

As of December 31, 2022, Atlas Energy had $82.0 million in cash and $239.6 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2022 was $116.4 million.

Atlas Energy’s IPO Details

AESI intends to sell 18 million shares of Class A common stock at a proposed midpoint price of $21.50 per share for gross proceeds of approximately $387 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Class A and Class B stockholders will be entitled to one vote per share, but Class B shareholders (the legacy shareholders) will not have economic rights.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $2.9 billion.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 18%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $350.0 million of the net proceeds of this offering to fund the construction of the Dune Express; and

approximately $5.3 million of the net proceeds of this offering to fund general corporate purposes.

(Source - SEC)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management said the company is not currently subject to any legal proceedings that would have an adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Goldman Sachs, BofA Securities, Piper Sandler, and other investment banks.

Valuation Metrics For Atlas Energy Solutions

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

Market Capitalization at IPO | $2,150,000,000 |

Enterprise Value | $2,935,369,000 |

Price / Sales | 4.45 |

EV / Revenue | 6.08 |

EV / EBITDA | 12.65 |

Earnings Per Share | $2.11 |

Operating Margin | 48.06% |

Net Margin | 44.95% |

Float To Outstanding Shares Ratio | 18.00% |

Proposed IPO Midpoint Price per Share | $21.50 |

Net Free Cash Flow | $116,420,000 |

Free Cash Flow Yield Per Share | 5.41% |

Debt / EBITDA Multiple | 0.64 |

CapEx Ratio | 2.30 |

Revenue Growth Rate | 180.00% |

(Source - SEC)

As a reference, a potential public comparable would be U.S. Silica; shown below is a comparison of their primary valuation metrics:

Metric | U.S. Silica | Atlas Energy Solutions | Variance |

EV / Revenue | 1.18 | 6.08 | 415.3% |

EV / EBITDA | 5.75 | 12.65 | 120.1% |

Earnings Per Share | $1.84 | $2.11 | 14.8% |

Revenue Growth Rate | 38.2% | 180.00% | 371.69% |

Net Margin | 5.1% | 44.95% | 776.31% |

(Source - SEC and Seeking Alpha)

Commentary About Atlas Energy

AESI is seeking public investment to fund the development of its Dune Express and for general corporate purposes.

The company’s financials have shown strong growth in top line revenue, increasing gross profit and gross margin, significantly higher operating profit, and sharply increased cash flow from operations.

Free cash flow for the twelve months ended December 31, 2022, was $116.4 million.

Selling, G&A expenses as a percentage of total revenue have dropped as revenue has grown; its Selling, G&A efficiency multiple rose to 13.0x in the most recent reporting period.

Regarding the firm’s dividend plans:

We commenced paying cash distributions in December 2021 and, as of January 31, 2023, have paid $70.0 million in aggregate distributions to our unitholders since that time. We intend to continue to recommend to our board of directors that we regularly return capital to our stockholders in the future through a dividend framework that will be communicated to stockholders in the future.

AESI’s CapEx Ratio indicates it has spent heavily on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing proppant to the fracking industry in the Permian Basin is quite large and will likely stay elevated in the years to come.

Goldman Sachs is the lead underwriter and the only IPO led by the firm over the last 12-month period has generated a return of 89.3% since its IPO.

Risks to the company’s outlook as a public company include the recently volatile pricing action in the oil & gas markets as a result of the Ukraine war, the global pandemic, and related economic changes.

Additionally, the fracking industry is a cyclical business that experiences significant volatility in its revenues, although major E&P firms have moved into the industry and have tended to be more disciplined in their approach to increasing production.

As for valuation expectations, management is asking IPO investors to pay an Enterprise Value / Revenue multiple of approximately 6.1x, several times higher than that of partial competitor U.S. Silica, so the IPO isn’t cheap.

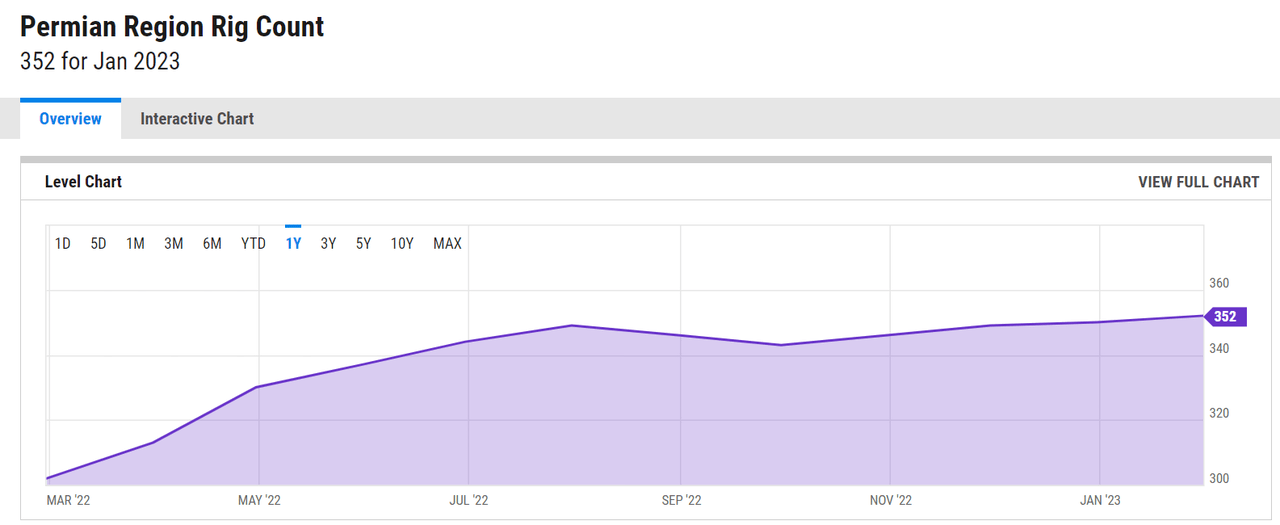

However, rig counts in the Permian basin have been rising over the past year, although they appear to have plateaued, as the chart shows below:

Permian Region Rig Count (YCharts)

Although the fracking industry has been subject to wild swings in activity over the past decade, larger and more disciplined E&P firms have moved into the Permian Basin region.

While they have increased drilling activity in the wake of global oil and gas price increases, it appears they have been more responsible in doing so, potentially leading to a more sustainable rise in business activity for service providers such as Atlas.

Although the IPO isn’t cheap, given the firm’s growth, profitability, and prospects, my outlook on the IPO is a Buy at up to $21.50 per share.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.