BXMX: Range Bound Markets Are Ideal For This Buy Write CEF

Summary

- Nuveen S&P 500 Buy-Write Income Fund is an equity buy-write CEF.

- The fund aims to replicate the S&P 500 via its holdings and then writes covered calls on the portfolio.

- On average, the vehicle is writing at the money call options with an average tenor of 38 days.

- The fund has quarterly rather than monthly distributions.

- BXMX has a nice set-up for the current environment - it is positioned defensively via its percent of portfolio coverage and 'in the moneyness' of the options.

Abstract Aerial Art/DigitalVision via Getty Images

Thesis

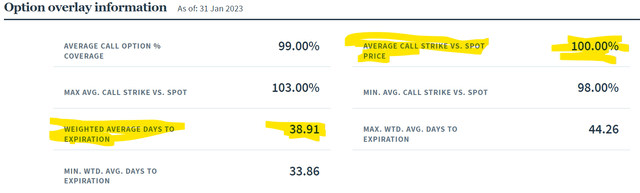

Nuveen S&P 500 Buy-Write Income Fund (NYSE:BXMX) is an equity buy-write CEF. The vehicle aims to replicate the S&P 500 holdings and writes covered calls on most of the portfolio (99% of the portfolio as of the latest data). The fund writes covered calls with a range of strikes and maturity dates:

Options Details (Fund Website)

The items to focus on above are the 'Weighted Average Days to Expiration' and 'Average Call Strike vs. Spot Price'. Ultimately those represent averages of the calls written, and we can see the fund is writing on average at the money call options with an average tenor of 38 days.

The technical explanation from the fund is:

Average Call Strike vs. Spot Price is the average ratio of call option strike prices vs. spot prices, weighted by the notional value of the calls. A figure > 100% indicates that option strike prices, on average, are above their current spot prices and the calls are "out of the money". A figure < 100% indicates that option strike prices, on average, are below spot prices and the calls are "in the money."

Weighted Average Days to Expiration is the average days to expiration for all call options in the Fund's portfolio, weighted by notional values.

We like this aggressive approach of writing at the money calls (on average) since we are bearish the market and it has been range bound so far. 'Aggressive' in this context means defensive. If the fund would write out of the money options then it would set itself to profit less if the market tanked or was range bound. In technical terms at the money call options have higher deltas than out of the money ones (higher strike out of the money calls that is).

We also like the fact the CEF is writing calls on almost all of the portfolio. In today's range bound market covering almost all of the portfolio is the correct way to trade the range. We do not think stocks are going to violently move up from here, hence a higher covered call percentage is the right call.

The fund has proven its mettle being up this year in sync with the index, but exhibiting a much better performance than the S&P 500 in the past year. More importantly its drawdown was only -10% when compared to the index.

We feel BXMX has a nice set-up for the current environment - it is positioned defensively via its percent of portfolio coverage and 'in the moneyness' of the options. Investors who still want to be involved in the equity markets but want a defensive positioning via short vega structures are well served by BXMX currently.

Analytics

- AUM: $1.4 billion.

- Sharpe Ratio: 0.38 (3Y).

- Std. Deviation: 14.3 (3Y).

- Yield: 7.2%

- Premium/Discount to NAV: +1.5%

- Z-Stat: 0.4

- Leverage Ratio: 0%

Performance

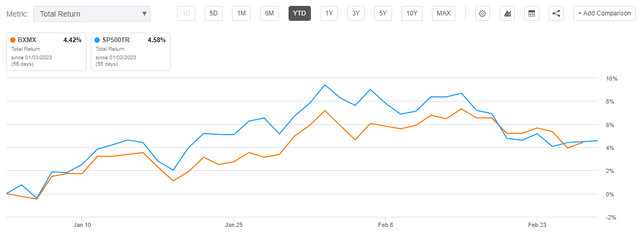

The fund's performance has been in line with the S&P 500 this year:

2023 Performance (Seeking Alpha)

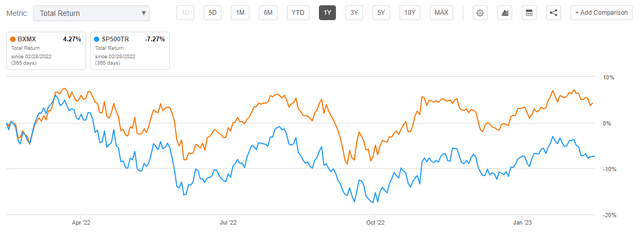

On a 1-year lookback period the CEF outperforms:

We can see that selling volatility has been extremely profitable in the past year, with the CEF outperforming the S&P 500. What is more interesting to notice is the drawdown profile for the fund - the vehicle had a maximum -10% drawdown, as opposed to over -20% for the S&P 500.

During long bull markets the vehicle does give up a significant proportion of the upside:

We can see from the above graph that on a 10-year lookback the fund is up only roughly 100%, versus roughly 200% for the S&P 500 index. The takeaway here is that writing at the money options for the entire portfolio during prolonged bull markets gives up a significant proportion of the upside for a portfolio. The CEF is therefore appropriate for range bound markets or recessions when investors do still want exposure to the index.

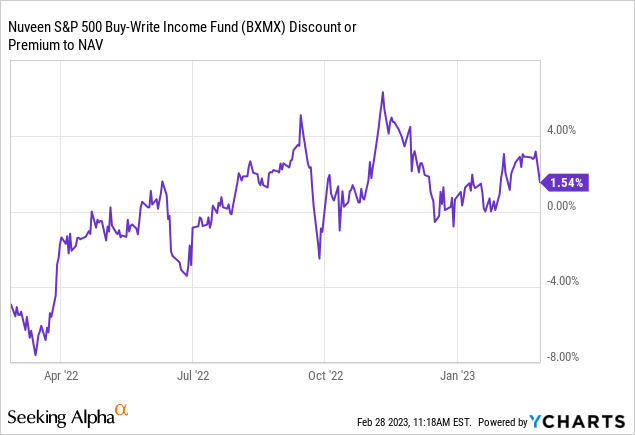

Premium/Discount to NAV

The CEF has a premium/discount to NAV which bounces around in a very tight range:

There is a low beta to risk-on / risk-off markets here, with the fund moving to a discount during the October market rout. That makes the fund fairly attractive since it tends to pass to investors a true performance. Currently this CEF is to be traded on NAV fundamentals rather than discounts or premiums to net asset value.

Conclusion

BXMX is an equity buy-write fund. The vehicle aims to replicate the S&P 500 via its portfolio and then writes covered calls. The fund is set up defensively, on average writing at the money covered calls with a maturity date that is 38 days out. The closer the call options are to spot levels, the higher the delta they exhibit, hence the protection they offer for downside moves. The CEF has done well in the past year, having only a maximum -10% drawdown, and having moved in sync with the index in 2023. We like BXMX's set-up and composition and feel it is an appropriate vehicle to trade range bound markets.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.