Kellogg: Focusing On Snacking Is Not A Silver Bullet

Summary

- After a relatively good year, Kellogg is now faced with the challenge of improving gross margins.

- The recently announced restructuring is unlikely to be the silver bullet that many investors are expecting.

- The high dividend yield is also not as attractive once we factor in the probability of future dividend growth.

- Looking for a helping hand in the market? Members of The Roundabout Investor get exclusive ideas and guidance to navigate any climate. Learn More »

Bill Pugliano/Getty Images News

It has been a rough couple of years for Kellogg (NYSE:K) as the company's share price delivered a mere 6% total return since the summer of 2020. At the same time, the broader consumer staples sector continued to deliver superior returns, while one of Kellogg's major peers - General Mills (GIS) had a 36% total return over the same period (more on that here).

High leverage, sluggish growth, lower pricing power when compared to other peers, and an unsustainably high valuation were among the reasons why the company's share price had a very high chances of producing the unsatisfactory returns we saw above.

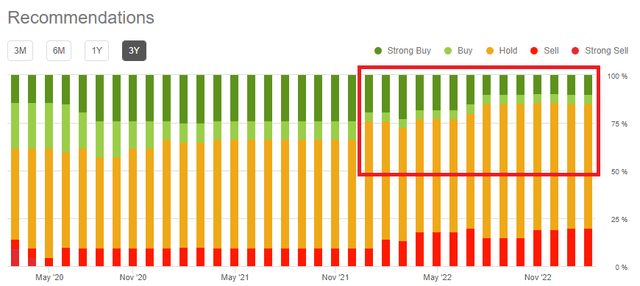

Analysts' ratings were once again late to the party, with the share of buy recommendations declining in late 2021 when the performance gap between Kellogg and the XLP (see the graph above) was at its highest levels.

What followed this wave of downgrades, was a relatively strong performance by Kellogg on the back of improved business momentum and the announcement of a bold plan to turn the company into a snacking powerhouse.

Although I view this as a step in the right direction, there are still challenges ahead for Kellogg - from improving profitability and returning to volume growth, to providing consistent dividend growth and executing its restructuring.

Taking Care Of Cost Inflation

One of the major challenges for all consumer staple businesses in 2022 has been the unprecedented price increase in raw materials.

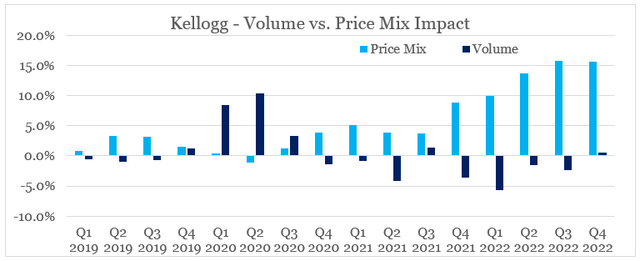

Strategic positioning within higher valued added product categories was an important factor in fending off this high inflation, however, the overall brand portfolio strength was crucial. In that regard, Kellogg delivered an impressive price/mix performance, while volume losses remained largely muted over the course of 2022.

prepared by the author, using data from Kellogg Investor Presentations

In spite of the price increases, gross margin fell to one of its lowest levels in recent history (see below). A fire in one of the company's US cereal plants and a labor strike across all four US cereal plants in 2021 were partially to blame, however, the negative impact has largely dissipated by the last quarter of 2022.

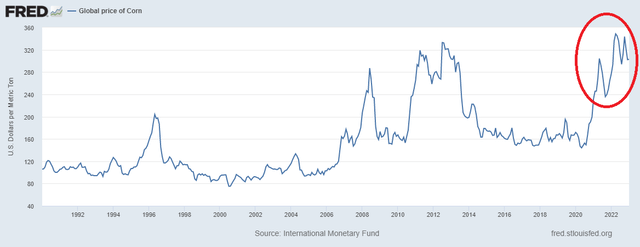

In 2023, the management expects gross margin to somehow stabilize as price realization catches up to input cost inflation. This is indeed encouraging in light of some commodity prices also cooling off. However, prices of key commodities, such as corn for example remain elevated (see below) and the price/mix impact on Kellogg sales would most likely decline in 2023.

Thus, from a gross margin point of view, 2023 will be a challenging year and investors would need to evaluate the impact of the upcoming restructuring.

What About The New Strategy?

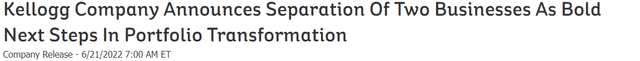

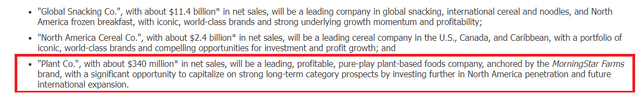

Only a few months after the initial announcement that Kellogg will split into three different companies, the management has already announced changes to its ambitious plant.

The intention was to separate the plant-based business of MorningStar Farms, in addition to the North American Cereal business.

During the last conference call, however, it became clear that this is no longer the case. Kellogg now intends to retain the business, even though it does not fit strategically with most snacking categories.

(...) you'll recall that we were exploring strategic options for the plant based food business which represents about 2% of our company's net sales. Given current market conditions as well as our confidence in this business as a long-term growth vehicle, we have decided to retain it as part of global snacking company.

Source: Kellogg Q4 2022 Earnings Transcript

More importantly, Kellogg's management has made clear that it was the 'stratospheric multiples' of similar businesses that influenced the decision to spin-off the business.

(...) when we began this process, valuation for peer companies were stratospheric compared to where they are today. They've come down quite substantially. So the thesis when we started the process was to truly unlock shareholder value if we could attract the same types of multiples in the public market, we should pursue that. The environment has clearly changed. And when we look at what's on the horizon for this category, we see an imminent shakeout coming. It's happening already.

Source: Kellogg Q4 2022 Earnings Transcript

With the whole product category experiencing headwinds and similar publicly traded businesses falling down to earth, the future prospects of category appear bleak.

There's also another potential problem in Kellogg's strategy of focusing almost exclusively on snacking. Given its fairly limited brand portfolio when compared to companies like Mondelez (MDLZ), Kellogg would need to rely more heavily on outside deals in the future.

(...) we'll definitely look to that because we do have great capabilities in snacking, great route-to-market, and bolt-ons or bigger will be part of our considerations going forward.

Source: Kellogg Q4 2022 Earnings Transcript

Due to its lower international exposure, Kellogg would not be able to quickly scale up smaller regional businesses on a global basis to the same extent that companies like Mondelez and Nestle (OTCPK:NSRGY) could.

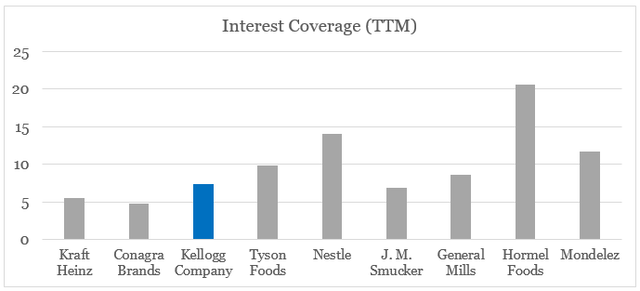

Moreover, Kellogg also has a bigger problem in terms of leverage with its interest coverage being much lower than the peer average.

prepared by the author, using data from Seeking Alpha

Interest expense is also expected to increase significantly in the coming months due to higher interest rates.

Interest expense will increase substantially because of the rise in interest rates worldwide.

Source: Kellogg Q4 2022 Earnings Transcript

All that in combination with the lower gross profitability I touched upon in the first section could easily derail Kellogg's ambitious restructuring plan.

Do Not Rely On The High Dividend Yield

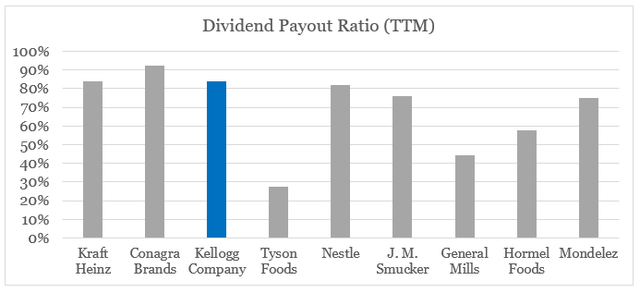

Kellogg's high dividend yield is another reason why the company appears attractive. With a forward dividend yield of 3.5%, the company offers one of the highest yields within its peer group.

prepared by the author, using data from Seeking Alpha

As attractive as this might sound, the dividend payout ratio of Kellogg is also one of the highest within the peer group.

prepared by the author, using data from Seeking Alpha

Although a large global business, such as Nestle, could afford to have a payout ratio of roughly 80%, Kellogg would need to expand both its brand portfolio and geographical reach. This would limit the company's ability to consistently increase its dividend payments and in my view makes Kellogg a far less attractive dividend play than other names in the sector.

As far as dividend growth is concerned, I have recently covered a number of opportunities within the consumer staples industry that are far better positioned to deliver consistent dividend growth over the coming years (see here, here, and here).

Conclusion

Although optimism has returned around Kellogg during 2022, the business remains challenged. Profitability should normalize over the coming months, but returning to pre-2022 levels will be hard to achieve. The strategy to focus on snacking categories is also faced with a number of challenges that will be hard to overcome. Last but not least, the prospects of future dividend increases appear limited.

Looking for better positioned high quality consumer staple businesses to grow their dividends?

You can now gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning. The opportunities laid out in the service also capitalize on inefficiencies in the market associated with short-termism, momentum chasing and narrative driven expectations. For more information follow the link provided.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir's content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.