First Look At Global X Hydrogen ETF

Summary

- Although there are a lot of options for investors in the clean energy space, it is quite limited for investors in the hydrogen space.

- The industry is still in the concept phase, and individual hydrogen names have a lot of volatility.

- A diversified ETF strategy using Global X Hydrogen ETF is the most appropriate option for most individual investors who lack expertise in the technology.

Vanit Janthra

Background on the Industry

The energy industry is undergoing a significant transformation as the world shifts toward more sustainable and environmentally-friendly sources of energy. This is a big known by now. But the number of options for achieving this transition is growing day after day. There are hydro, wind, solar, nuclear, and geothermal, and we are far from the list being exhaustive. One of the later entrants to this playground is hydrogen energy.

The hydrogen energy industry is emerging as a key player in the green transition towards a more sustainable energy system. Hydrogen's potential applications range from transportation to industrial processes, making it quite versatile. When used as a fuel in a fuel cell (generating electricity through Hydrogen), hydrogen produces only water, making it a clean fuel source. Hydrogen can be obtained from various domestic resources, including natural gas, nuclear power, biomass, and renewable power sources such as solar and wind.

Are there challenges to this industry? Certainly. There are several, in fact. Like any new promising technology in its early stages, it has a long road ahead of it. It has high production costs, there is a lack of storage and transportation infrastructure, and if the use case is vehicles then there is no infrastructure for refueling hydrogen-powered vehicles.

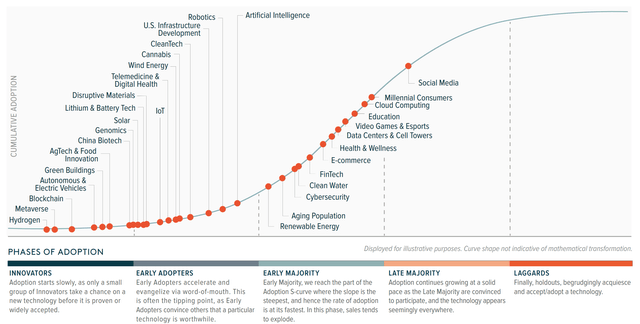

Phases of Adoption - Hydrogen is still in the very early stages of adoption (Global X ETF website)

That being said, the failure rate for an industry still in its early stages of adoption is quite high. Although individual companies look promising they can run into any number of issues ranging from funding, regulatory hurdles, concept failures, etc. The best way to get exposure for such a nascent industry is through an exchange-traded fund, or ETF.

Enter Global X Hydrogen ETF

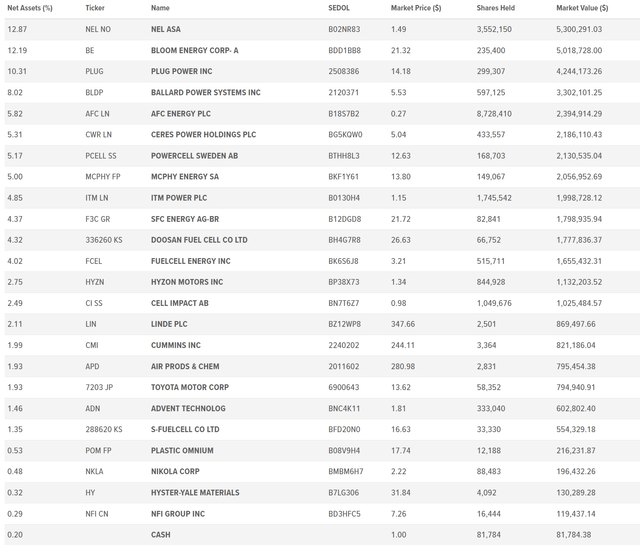

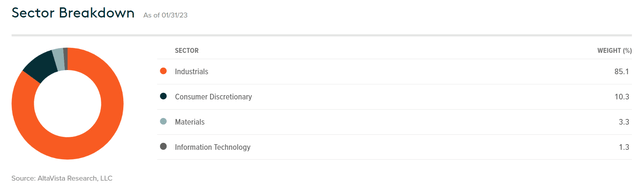

Global X Hydrogen ETF (NASDAQ:HYDR) has as its goal to monitor the progress of businesses that are involved in or are expected to be involved in using hydrogen as a fuel source. Companies may be involved in the following - Production, Fuel Cells, Hydrogen Technology and Hydrogen Integration. It aims to have pure-play (>50% revenue from Hydrogen activities), pre-revenue, or diversified (<50% revenue from Hydrogen activities) categories of companies in its ETF. It restricts the maximum number of companies in the ETF to 40, with each category not contributing more than 25 companies.

All holdings of the HYDR (Global X ETF website) Global X ETF website Global X ETF Website

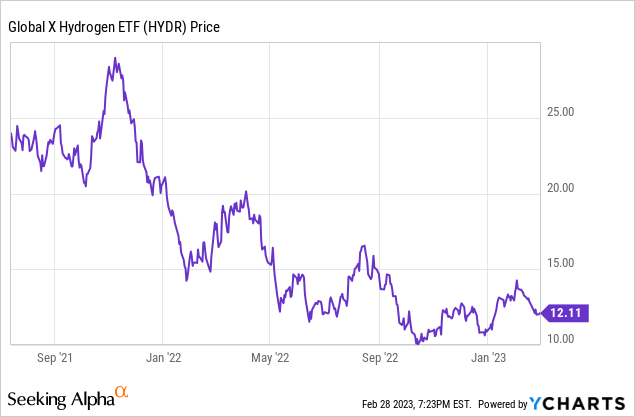

This is a fairly new ETF that is less than two years away from its inception. Its expense ratio is at 0.5%, and its net assets are quite low at approximately $40M. The fund's expense ratio is on the higher side, but since it has global holdings, it could be worth the expense ratio. Also, the current market has been quite brutal for speculative investments, and this ETF is no exception.

Potential and Tailwinds

The outlook of this industry remains bright for now. Forecasts imply that the global hydrogen fuel cell vehicle market could approach $31B in value (a growth of more than 75% from 2021 to 2026).

On a national scale by 2020, 11 countries including Canada, Chile, France, Germany, the Netherlands, Norway, Portugal, Russia, Spain, and the European Union had developed hydrogen strategies. By 2021, more countries had adopted strategies with at least an additional 20, developing strategies of their own.

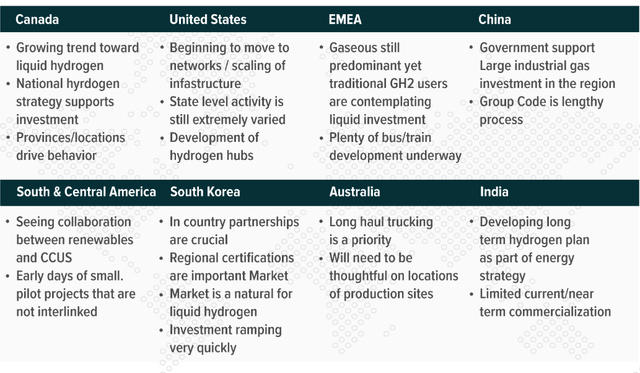

South Korea, Canada, and China have already made progress on equipment certification as well as from actual projects moving to the commercialization stage

Progress Summary of different countries on Hydrogen aspect (Global X ETF Website)

Inflation Reduction Act

1. On August 2022, the US passed Inflation Reduction Act with a big investment in combating climate change. Money dedicated along these initiatives is in the hundreds of billions of dollars, and specifically for hydrogen there is a provision for a tax credit towards low-carbon hydrogen production. The Clean Hydrogen Production Tax Credit offers a 10-year credit of up to $3 per kilogram of clean hydrogen for qualifying production facilities. Depending on the lifetime emissions rate, full or partial credits are available.

2. The funding package also includes approximately $300 million for competitive grant programs that support R&D and the production of sustainable aviation fuels, including hydrogen. Additionally, there is a $2 billion conversion grant for the production of electric vehicles, which includes hydrogen fuel cell electric vehicles.

Tax credits for low-carbon hydrogen production in the U.S. could help turbocharge the industry's development. Currently, the most challenging sectors for decarbonization are fertilizer production, refining processes, and heavy industry transport. Hydrogen production is classified into different categories depending on how they are produced. Tax credits could make sustainably sourced green and blue hydrogen cost-competitive with grey hydrogen, which accounts for almost all of the current supply and is derived from carbon-intensive processes.

Risk, Mitigating risk, and Investment style

Even though we have sufficiently de-risked our investment by going through an ETF, the current environment still makes it a dangerous proposition for investments in this sector. In a worst-case scenario, the continuing decline can possibly make the Assets under Management drop so low that the ETF sponsor can simply liquidate the ETF and return the investor's money. This is why I view its best to prepare the mindset and look at this investment as purely speculative.

In evaluating speculative investments, I mainly check the investment for its upside which we have already established is highly asymmetric, and then make it part of my barbell portfolio.

For a barbell portfolio, you would have extremely safe investments on one end and extremely risky ones on the other end. The safe investments would carry no risk even in the face of extreme market drawdowns (Ex: U.S. Treasury bonds). The aggressive side of the barbell while it has the full risk of losing your entire investment, it also has unlimited upside. The aggressive side also has its risk distributed between "N" such entities (where "N" is the number of investments an investor is comfortable with).

My thought for any potential investor in this sector would be to follow the same approach.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.