SPLV: Multi-Month Lows As Defensive Sectors Trade Down

Summary

- Defensive sectors were a safe place in 2022 amid heightened volatility.

- SPLV, holding a high amount of low-risk areas, has underperformed sharply to start 2023.

- I see the fund as priced expensively with poor price action.

TERADAT SANTIVIVUT

It has been a poor start to the year for defensive niches of the stock market. Utilities and Healthcare, specifically, have seen tough times after outperforming in 2022. Consumer Staples stocks are also quite pricey following last year’s bid to the safety space. Those three sectors are the largest pieces of one popular factor fund: the Invesco S&P 500 Low Volatility ETF (NYSEARCA:SPLV).

According to the issuer, the fund invests in an index tracking 100 securities from the S&P 500 Index with the lowest realized volatility over the past 12 months. Volatility is a statistical measurement of the magnitude of up and down asset price fluctuations over time. The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. Its expense ratio is low at just 0.25%. Invesco lists the forward P/E at 18.9 while tradeability is strong with a bid/ask spread of just 2 basis points and 30-day median volume of 2.3 million shares.

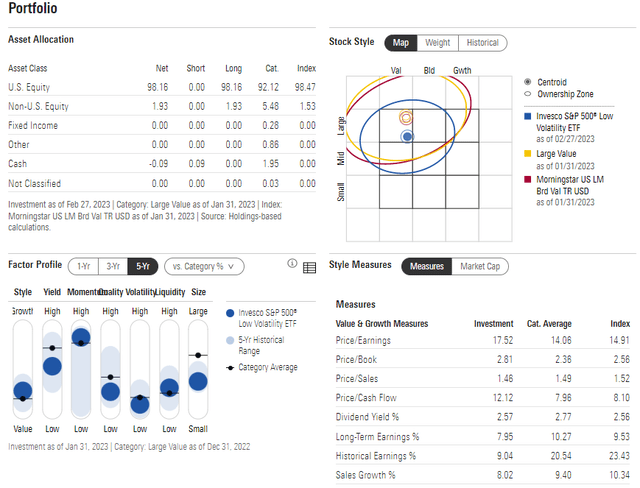

Digging into the portfolio, SPLV is a large-cap value ETF on the Morningstar Style Box and features a moderate yield according to the Factor Profile with high momentum over the last 5 years, though there has been recent relative weakness which we’ll outline. The quality of the fund is low as it does not hold many highly profitable tech names while the liquidity and size factors are low and small, respectively.

On valuation, the fund trades at a near-market P/E multiple of 17.5 per Morningstar with a modest long-term earnings growth rate. In my eye, it is on the expensive side considering the growth you get with the portfolio. Though a 2.6% yield is nicely above that of the S&P 500.

SPLV: Portfolio & Factor Profiles

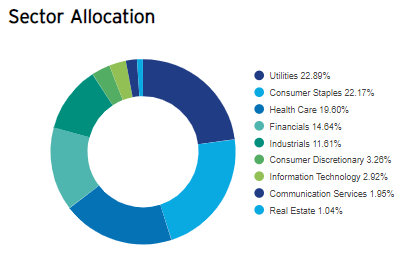

Utilities and Staples are major overweights in SPLV. Healthcare is also a moderate overweight while the long-duration, high-growth areas of Consumer Discretionary, Information Technology, and Communication Services are significant underweights. So, it’s important for investors to recognize that owning SPLV in lieu of the broad market means a major active bet against tech and growth in favor of defensive areas.

SPLV Sector Breakdown: Defensive Sectors Heavy

Invesco

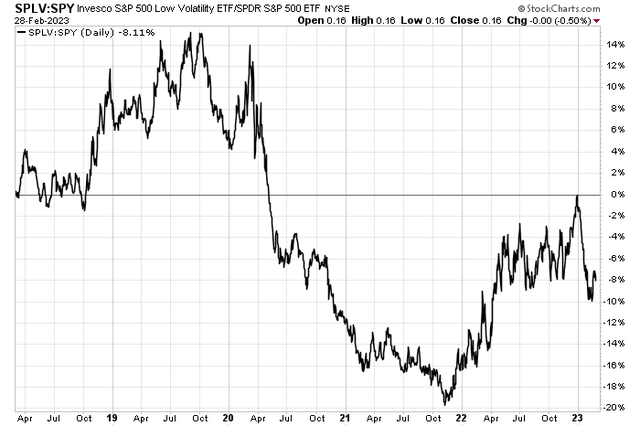

With a high valuation, relative strength has been very weak this year after performing very strongly against the SPX in 2022. But going back further, we see that SPLV produced negative alpha against the broad market from early 2020 through the fall of 2021 as the reopening trade persisted. This is not an encouraging look for SPLV from a relative strength point of view.

SPLV vs SPY Since 2018: Poor Start to the Year

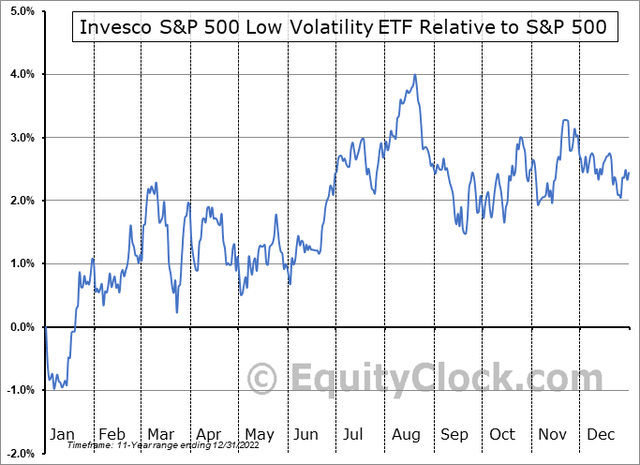

According to data from Equity Clock, SPLV tends to trade about sideways compared to the S&P 500 now through much of June before performing well through mid-August. Yet another “meh” indicator at best at the moment.

SPLV Relative Seasonal Returns to the S&P 500

The Technical Take

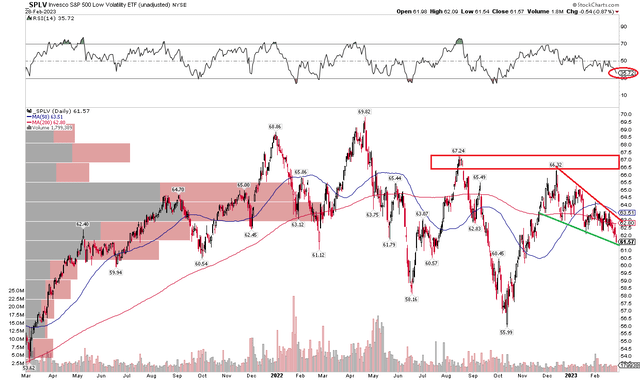

SPLV remains significantly below its Q2 2022 all-time high when fears of a protracted bear market permeated investors’ minds. Now off by more than 10% from that peak, shares are in a bullish falling wedge pattern, but remain below key resistance levels in the $66 to $68 range while the 200-day moving average has turned negatively sloped.

Also, take a look at the RSI momentum indicator at the top of the chart – it confirms a new low in price. In fact, SPLV notched a fresh low since November last year as of Tuesday’s close. The bears appear in control for now, and there is significant volume by price in the $63 to $66 range above where the ETF trades today.

SPLV: Bullish Falling Wedge Below Key Resistance

The Bottom Line

I am a sell on SPLV looking ahead to the next few months. Defensive sectors are trading poorly and SPLV tends to provide lackluster relative returns now through much of June. Perhaps more importantly, the fund’s valuation is high considering the low-growth assets it holds.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.