DVYE: Perpetually Out Of Favor

Summary

- DVYE invests in high dividend paying companies in emerging markets.

- The fund sports a 10.1% trailing distribution yield.

- However, historically, DVYE has delivered negative total returns as it has underperformed the tough Emerging Market asset class.

- I believe the underperformance is because DVYE skews towards value, whereas Emerging Market investors tend to seek out growth companies. So DVYE's portfolio is perpetually out of favor.

William_Potter

The iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE) provides exposure to high dividend paying companies in emerging markets. Although the DVYE ETF pays a high 10.1% trailing distribution yield, the fund has delivered negative total returns on all longer-term time frames as its value oriented portfolio is continuously out of favor for investors seeking emerging market exposure who tend to look for growth. I see no reason to invest in DVYE at this time.

Fund Overview

The iShares Emerging Markets Dividend ETF gives investors exposure to high dividend paying companies in emerging markets. The DVYE ETF tracks the Dow Jones Emerging Markets Select Dividend Index ("Index"), an index that measures the performance of 100 leading dividend-paying companies located in emerging markets that are selected by their dividend yields. The index excludes REITs.

The DVYE ETF has $645 million in assets and charges a 0.49% expense ratio.

Portfolio Holdings

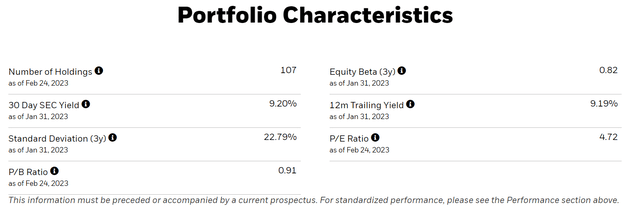

As of February 24, 2023, DVYE's portfolio has 107 holdings with a 30D SEC yield of 9.2% and P/E ratio of 4.7x (Figure 1).

Figure 1 - DVYE portfolio characteristics (ishares.com)

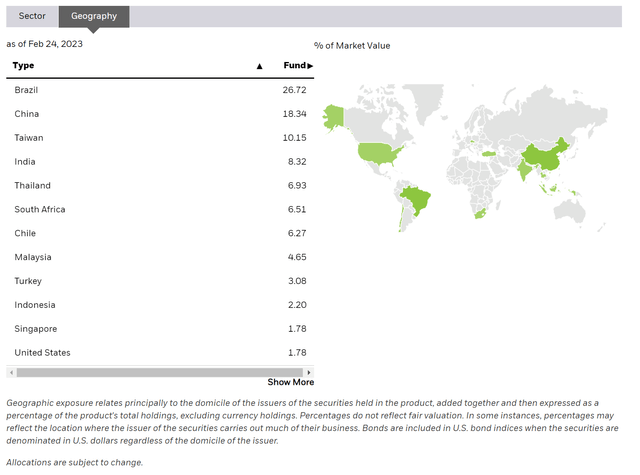

Geographically, the largest country weights in the DVYE ETF are Brazil (26.7%), China (18.3%), Taiwan (10.2%), India (8.3%) and Thailand (6.9%) (Figure 2).

Figure 2 - DVYE geographical weights (ishares.com)

The largest sector exposures of the DVYE ETF are concentrated in Materials (20.4%), Financials (15.6%), Utilities (13.9%), Energy (12.2%), and Real Estate (9.0%) (Figure 3).

Figure 3 - DVYE sector weights (ishares.com)

Distribution & Yield

The DVYE ETF pays a generous quarterly distribution, with trailing 12 month distribution of $2.48 or 10.1% trailing yield. DVYE's distribution rate has historically been very high, ranging from $1.58 in 2016 to $2.39 in 2022 (Figure 4).

Figure 4 - DVYE historical distribution (Seeking Alpha)

Returns

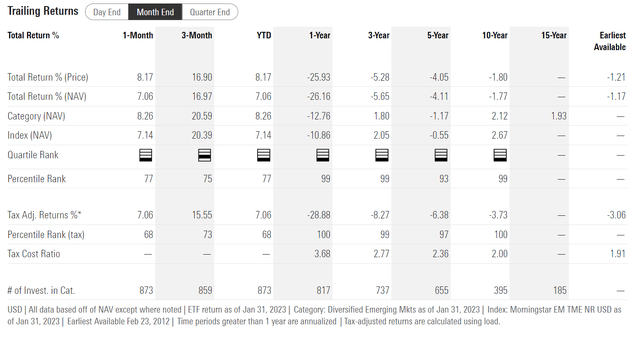

However, despite high distribution yields, DVYE has historically generated poor total returns, with 3/5/10Yr average annual total returns of -5.7%/-4.1%/-1.8% respectively to January 31, 2023 (Figure 5).

Figure 5 - DVYE historical returns (morningstar.com)

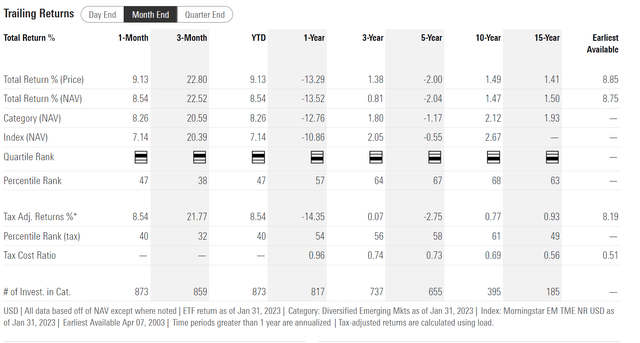

DVYE's poor performance can be partly attributed to poor returns for the Emerging Market asset class overall, which has suffered poor historical returns if we look at the iShares MSCI Emerging Markets ETF (EEM) (Figure 6). EEM has delivered 3/5/10/15Yr average annual returns of 0.8%/-2.0%/1.5%/1.5% respectively to January 31, 2023.

Figure 6 - EEM historical returns (morningstar.com)

However, even accounting for poor performance of the asset class, the DVYE ETF still underperforms on all historical timeframes. I believe this is because investors typically associate emerging markets with higher growth potential than developed markets and so when they invest in emerging market companies, they tend to look for growth characteristics.

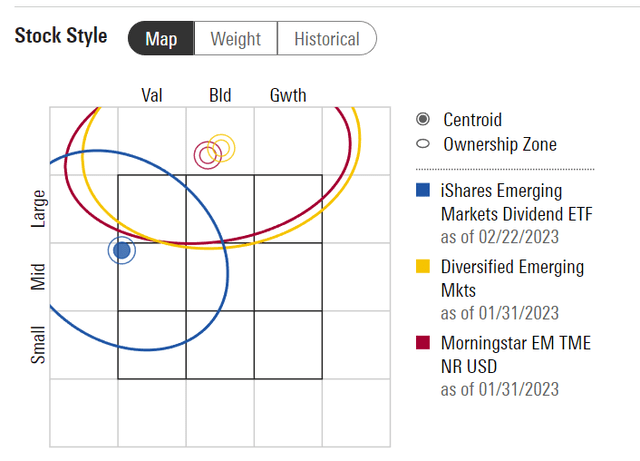

However, DVYE's selection criteria of high dividend yields skew its portfolio towards value characteristics, which tend to be out of favor for emerging market investors (Figure 7). Hence DVYE's portfolio faces a negative investment flow headwind.

Figure 7 - DVYE skews towards value (morningstar.com)

In any event, the result is that since inception, DVYE has delivered negative total returns of -18.6% vs. 8.3% total returns for the EEM ETF and 259.2% total returns for the S&P 500 Index over the same time frame (Figure 8).

Figure 8 - DVYE has delivered negative cumulative total returns since inception (Seeking Alpha)

Conclusion

The DVYE ETF provides exposure to high dividend paying companies in emerging markets. Although the DVYE ETF pays a high distribution yield, the fund has delivered negative total return since inception. I think this is because its value oriented portfolio is continuously out of favor with investors who are seeking emerging market exposure. These investors tend to look for growth. I see no reason to invest in DVYE at this time.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.