Okta Is Rising: Improving Profitability, Resilient Revenue Growth

Summary

- OKTA stock soared after releasing solid earnings.

- The key surprise was guidance for strong growth in non-GAAP operating income.

- Even in the current macro environment, Okta is aiming for substantial margin expansion.

- Okta is one of the higher quality names in the tech sector today.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

tsingha25/iStock via Getty Images

Okta (NASDAQ:OKTA) soared after closing out its fiscal year and issuing strong earnings guidance for this upcoming year. OKTA has seen a very difficult fall from grace since late 2021 as the company failed to meet high growth expectations and the broader tech sector underwent a generational valuation reset. The company appears to be gradually earning back Wall Street love, as the stock has once again regained some valuation premium relative to its growth cohort. With improving profitability helping to offset concerns regarding decelerating growth rates, OKTA stock remains as buyable as ever.

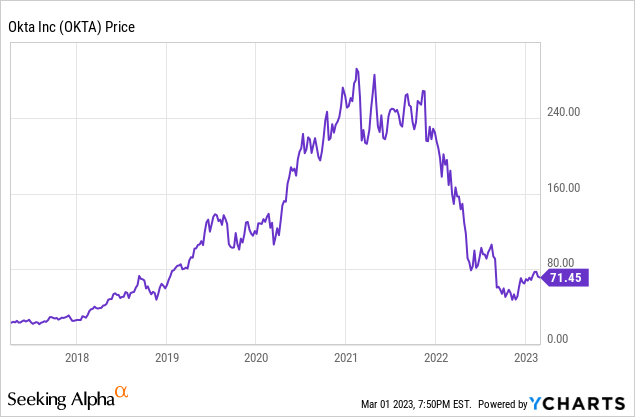

OKTA Stock Price

OKTA should not have traded as high as it did in 2021, but should it be trading lower than it did in 2019?

I last covered OKTA in February where I rated the stock a buy ahead of the earnings print. The stock had already suffered the consequences of retracting guidance several quarters ago, and now appears to have gotten the message: Wall Street is willing to reward tech companies that are focused on near term cash flow.

OKTA Stock Key Metrics

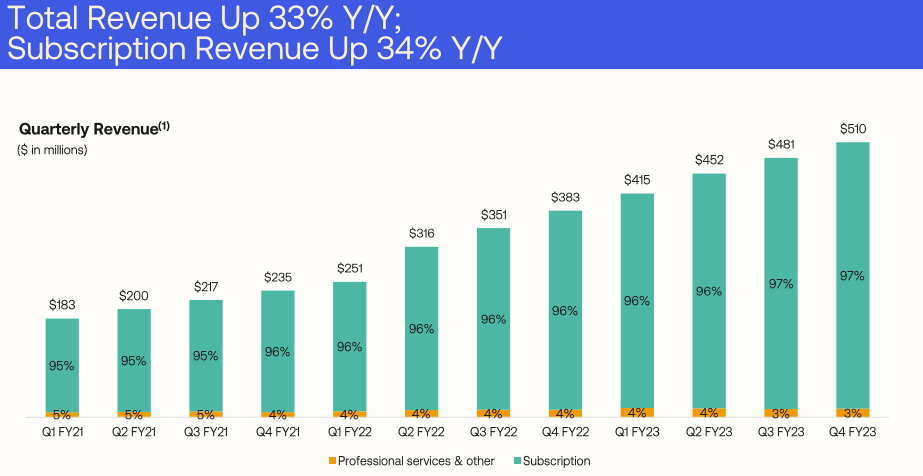

In this most recent quarter, OKTA delivered a surprising revenue beat, with revenue growing 33% to $510 million. OKTA had previously been guiding to only $490 million in revenue.

FY23 Q4 Presentation

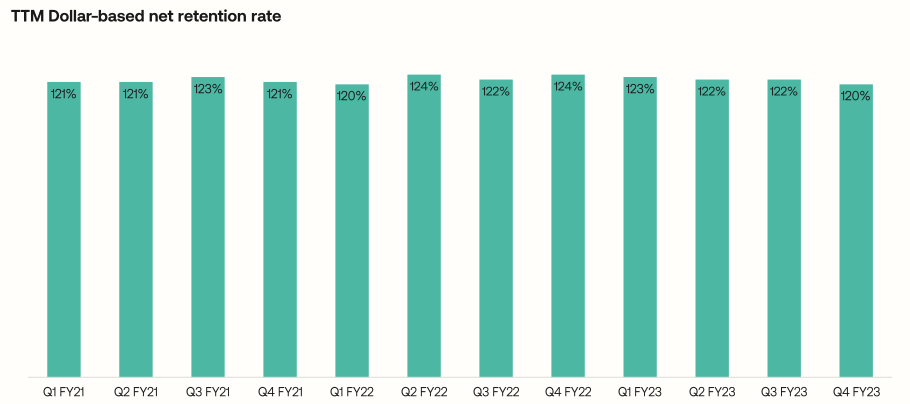

OKTA sustained a strong 120% dollar-based net retention rate.

FY23 Q4 Presentation

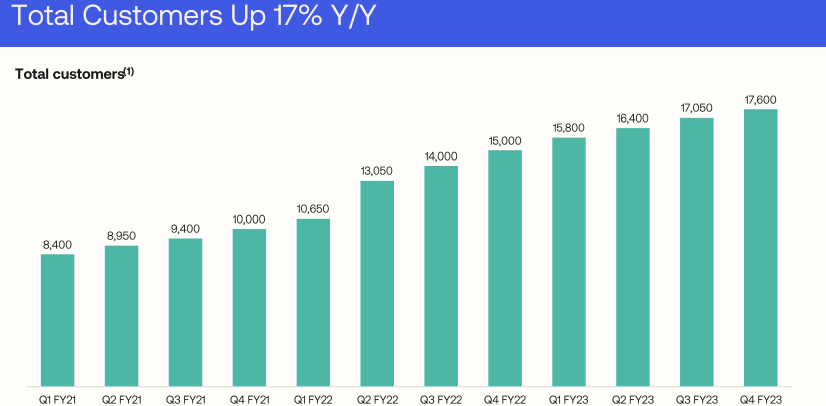

The customer count also grew solidly at 17% YOY, but in this current market environment, investors should be aware that many customers may be very conservative in ramping up spending. OKTA might not realize the full value from these new customers until the macro environment improves.

FY23 Q4 Presentation

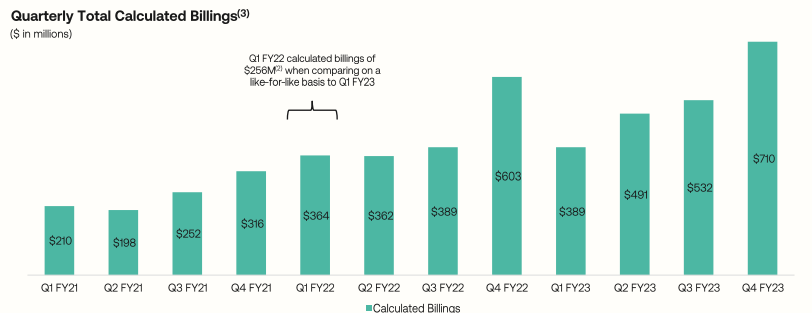

While revenue growth remained top-notch, billings growth was much more modest at just 18% YOY. This wasn’t such a surprise considering that OKTA had already been forecasting slower growth moving forward on account of integration issues related to Auth0 and the tough macro environment.

FY23 Q4 Presentation

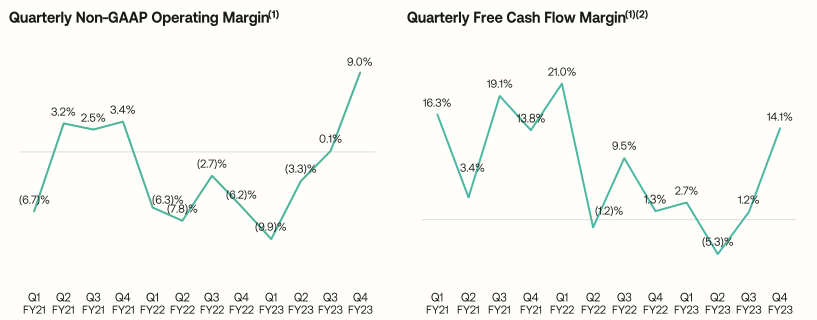

It wasn’t that revenue number that impressed investors. Instead, it was profits. OKTA delivered strong margin expansion with non-GAAP operating margins swinging from negative 6.2% to positive 9%. OKTA also delivered solid free cash flow margins.

FY23 Q4 Presentation

OKTA ended the quarter with $2.6 billion in cash vs. $2.2 billion in convertible debt. While that net cash position is rather slim, I'm not concerned about financial safety considering the strong inflection in profitability.

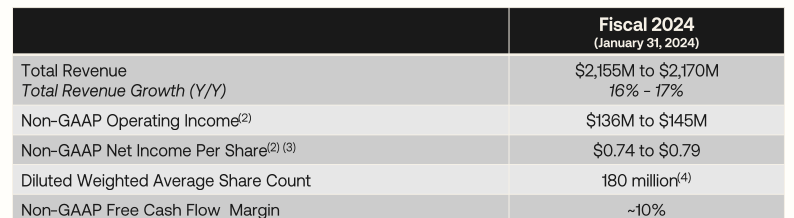

Looking ahead, OKTA has guided for 23% revenue growth to $511 million in the first quarter, with $20 million in projected non-GAAP operating income. Management guided for 17% YOY revenue growth to $2.170 billion for the full year, with $145 million in projected non-GAAP operating income. Management had previously guided for $2.145 billion in revenue, and consensus estimates for earnings were less than half of that. For reference, the company generated a non-GAAP net loss of $7 million for this past fiscal year.

FY23 Q4 Presentation

The slowing growth rate can in part be excused due to the tough macro environment, but OKTA’s ability to drive strong improvements in profitability in spite of those near-term headwinds may be what's driving the strength in the stock price.

Is OKTA Stock A Buy, Sell, or Hold?

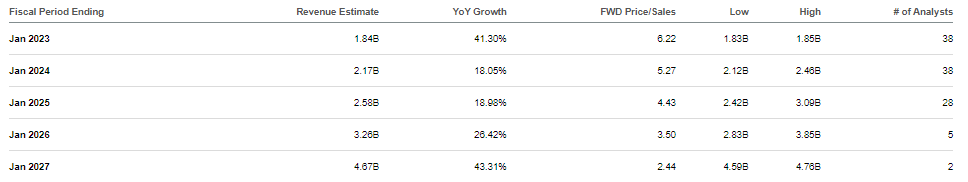

At recent prices, OKTA was trading at around 6x forward sales.

Seeking Alpha

That multiple reflects some relative premium considering the modest 15% to 18% forward growth rate, but is warranted due to the company’s improving profitability picture. OKTA had previously been a “tech darling” largely due to its aggressive medium term revenue growth guidance. Now, it's gradually regaining its darling status but this time due to stronger profit margins.

I still expect the company to generate 30% net margins over the long term. Based on a 1.5x price to earnings growth ratio (‘PEG ratio’) and 18% growth, I can see the stock trading at 8.1x sales, representing over 30% potential upside over the next 12 months. Perhaps tech stocks were previously not “recession-resistant” just one to two years ago, but that may have been more due to the valuation than the business model. While OKTA has been beaten up heavily over the past year, it's worth remembering that enterprise tech revenues may prove more resilient and dependable even in a tough macro environment.

What are the key risks? OKTA has had its share of drama over the past few years, including some integration issues with Auth0, a data breach, and a source code breach. It's unclear if the company will suffer long term reputational consequences. There's a great deal of competition in the identity market and from an outsider looking in, it's not easy to explain why this will not be a commoditized service over the long term. The current macro environment is very difficult and it's possible that OKTA may be able to hit even the modest revenue growth target. That may cause the company to disappoint on its profitability target as well. That said, prior to its recent slide, management had a solid track record of underpromising and overdelivering, and I suspect that this valuation reset has helped in this regard. I continue to see a basket of undervalued tech stocks as being an optimal way to position ahead of a recovery in tech stocks. OKTA fits in such a basket as its combination of profitability and secular growth make it a compelling pick today.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Disclosure: I/we have a beneficial long position in the shares of OKTA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.