Kohl's Earnings: Don't Fall For The Yield

Summary

- Kohl's Corporation reported a shocker of a quarter pre-market.

- Even the best of the retailers are struggling, and Kohl's is not an exception.

- Not all yields are created equal, and Kohl's has little sustainable means to continue its $2.00 per share in annual dividends.

Joe Raedle

Even when banks (and bonds) are rewarding savers a lot more at present than any time in the past decade, it is tempting when you see a stock yielding more than 5%. The allure of capital gains combined with compounding dividend growth make stocks attractive when compared to earning "just" interest. But not all yields are created equal. Generally speaking, the sight of an excessively high yield should rather make you skeptical than happy.

Case in point. Kohl's Corporation (NYSE:KSS). The stock already had a high yield of more than 7% ahead of its just-announced Q4 earnings, and things just got a lot worse (or better if you just look at the yield) pre-market, as the stock has slid up to 10%, as covered here by Seeking Alpha. Before we deep-dive into the dividend coverage, let us quickly recap what I believe is one of the worst earnings reports in my recent memory from a well-known company.

Q4 2022 Earnings Recap

- Kohl's Corporation posted a quarterly loss of $2.49 per share when the expectation was for a profit of 97 cents per share. How you miss by $3.46 being a billion-dollar corporation is beyond me. If I fall short of my company's expectations by more than 200% at work, I am sure I will get fired.

- Revenue came in pretty close to expectations at $6.02 Billion vs $6.03 Billion.

- More importantly, guidance for 2023 also came in well short of expectations, with an EPS range of $2.10 to $2.70 per share. That instantly places pressure on Kohl's ability to pay dividends, as the current annual dividend payout of $2 represents almost 100% of the low end of the EPS guidance. And keep in mind the huge miss in Q4 EPS before you trust the guidance!

Free Cash Flow Misery

As a result of this well-deserved selloff, Kohl's stock now yields north of 8% as of this writing but has all the danger signs of a dividend cut in the making. Readers of my articles know that I prefer using Free Cash Flow ("FCF") over Earnings Per Share ("EPS") due to FCF's robustness as a metric. Let's see how Kohl's FCF coverage looks right now.

- Total shares outstanding: 110 Million

- Current quarterly dividend: 50 cents/share

- Quarterly FCF needed to cover dividends: $55 Million (that is, 110 Million shares times 50 cents per share)

- Trailing Twelve Months' FCF: -$840 Million. Ouch!

- Payout Ratio using TTM FCF: NA.

Things do look a lot better if we use the 5-year quarterly FCF average of $202 Million, which gives Kohl's payout ratio of about 25%, but it is quite evident that even the strongest of retailers are struggling due to a combination of inflation, demand issues, and inventory build-up. In short, the dividend is shaky, to put it mildly, and is beginning to show some classic signs of a junk yield.

Debt and Cash

If a company cannot sustain its dividends through cash flow or operational discipline (cost-cutting, for example), it typically turns to debt if it is religious about its dividends. Kohl's debt is already high enough, as shown below, for a company that has a market cap of $3 Billion. Not to forget, this is not the best of times to borrow.

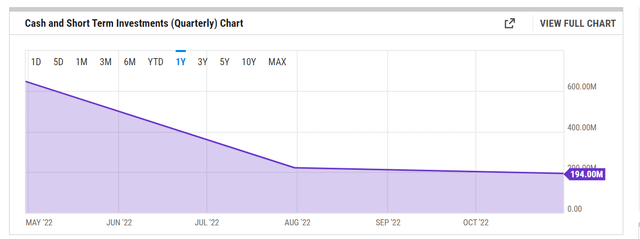

Sometimes, companies tend to turn to their own bank account to keep shareholders happy. That is, instead of borrowing at high rates, it is not uncommon to dip into your reserves to keep your expenses. Kohl's cash and short-term investments have fallen by 70% since May 2022.

In short, neither cash on hand, nor debt, nor free cash flow suggest that Kohl's can sustain its dividends at the current rate. Business fundamentals (primarily worsened by Macro conditions) don't appear in favor of a quick turnaround either.

SA Dividend Grade

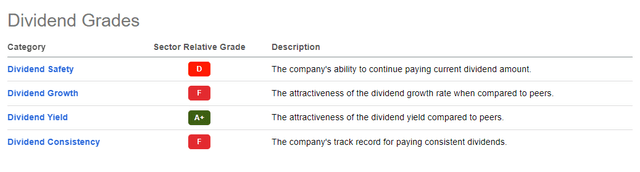

As a final confirmation, Seeking Alpha's dividend grades shown below is flashing many reds, and it looks like a matter of time before the safety indicator turns F.

I, along with a host of other dividend growth investors, prefer an average yield that has safe foundations to step-ladder its way to long-term success. That is, I'd rather have a strong rating on safety, consistency, and growth in that order over yield. Kohl's is in the exact opposite scenario.

KSS Dividend Score (seekingalpha.com)

Conclusion

With inflation showing little signs of slowing down and the Fed far off from its 2% target, investors need to be cautious about their stock picks. This applies even more to retirees seeking income or those working towards income replacement like myself. I would not touch Kohl's Corporation with a ten-foot pole here from any perspective, and especially from a dividend perspective. There may come a time to trade this stock profitably later, but for now, I suggest avoiding Kohl's Corporation stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.