Amyris: Terms Of Givaudan Transaction Disappoint - Sell

Summary

- Amyris finally agreed on the terms of a much-touted strategic transaction with Swiss-based flavour and fragrances giant Givaudan.

- Disclosed terms fall well short of management's promises with upfront cash received likely being closer to $200 million as opposed to the $350 million projected by CEO John Melo.

- The transaction remains subject to regulatory review thus likely resulting in the requirement for Amyris to conduct another dilutive equity offering in the very near future.

- Upfront cash proceeds are going to be reduced by more than $50 million due to the required buyout of joint venture partner Nikkol Group.

- While Amyris will likely manage to stay afloat until the Givaudan transaction closes, management's projections for cost savings this year appear to be way over the top again. Investors should continue to avoid the shares until Amyris finally starts delivering on management's promises.

Craig Barritt

Note:

I have covered Amyris, Inc. (NASDAQ:AMRS) previously, so investors should view this as an update to my earlier articles on the company.

First the good news:

Cash-strapped specialty renewable products developer Amyris finally agreed with Swiss-based flavour and flagrances giant Givaudan on terms of a much-touted strategic transaction:

As part of its 2025 strategy to provide new and superior product offerings to expand its Active Beauty business, Givaudan, the global leader in fragrance & beauty innovation, today announces that it has reached an agreement to acquire certain cosmetic ingredients from Amyris, Inc., including Neossance® Squalane, the highest performant emollient, Neossance® Hemisqualane, the plant-based silicone alternative and CleanScreen™, the sustainable sun protector.

Givaudan and Amyris have signed a long term partnership agreement under which Amyris will continue to manufacture ingredients for Givaudan to use in cosmetics, as well as provide access to their innovation capabilities. Givaudan will become the commercialisation partner for future sustainable beauty ingredients.

(...)

The terms of the deal include a combination of an upfront cash consideration and a performance based earnout, along with a long term manufacturing agreement. Further details have not been disclosed and Givaudan plans to fund the transaction from existing resources. Amyris' active cosmetic ingredients business would have represented approximately USD 30 million of incremental sales to Givaudan's results in 2022 on a proforma basis. The planned transaction remains subject to formal approvals from the relevant regulatory authorities and the transaction is expected to close in the first half of 2023.

Amyris provided additional details in a regulatory filing (emphasis added by author):

On February 21, 2023, Amyris, Inc. (the "Company") and Givaudan SA ("Givaudan") entered into an Asset Purchase Agreement pursuant to which the Company agreed to sell, assign, or license certain of its cosmetic ingredients businesses to Givaudan, including an assignment of certain distribution agreements, a sale of certain trademarks, and a grant of an exclusive, worldwide, irrevocable license to distribute, market and sell Neossance® Squalane emollient, Neossance® Hemisqualane silicone alternative and CleanScreen™ sun protector in cosmetics actives for up to $350 million in near-term contributions from a combination of upfront cash consideration and a three-year performance-based earnout. In addition, the parties entered into a long-term partnership agreement for the manufacturing of cosmetic ingredients by the Company for Givaudan. The total value of near- and long-term contributions is estimated to be approximately $500 million. Closing of the transaction is subject to customary approvals from the relevant regulatory authorities.

And now for the bad news:

The deal still hasn't closed yet and terms appear to be a far cry from what management promised investors.

Here's what has been stated by CEO John Melo on the company's third quarter conference call not even three months ago (emphasis added by author):

Our current business performance, current cash, and Fit to Win improvements provide us with the necessary liquidity to self-fund to the closing of our $350 million of expected upfront funding from our large strategic transaction.

Our strategic transaction regarding the marketing rights of two molecules for $350 million of upfront consideration and up to $500 million of total value remains on track for the fourth quarter. (...)

The combination of our current growth and operating performance, combined with our Fit-to-Win actions and the successful execution of the strategic transaction enable us to self-fund our growth and deliver on sustained profitability. We have no current plans for dilutive financing.

Suffice it to say, the deal didn't close in Q4 thus resulting in the requirement to conduct an emergency capital raise at abysmal terms.

Adding insult to injury, the much-needed upfront cash payment will be nowhere near the $350 million promised by management. Considering the three-year, performance-based earnout agreement, upfront cash to Amyris might be closer to $200 million.

Even worse, the company will have to utilize more than $50 million of the upfront cash proceeds to acquire an additional 49% in the company's Aprinnova joint venture from subsidiaries of Japanese Nikkol Group as the joint venture's manufacturing facility in North Carolina is required for converting Biofene into squalane and other final products.

Please note that the Aprinnova closing date has been extended to March 17 to provide more time for the ongoing anti-trust review.

With the transaction unlikely to close before mid-March and Amyris likely running low on cash again, investors will have to prepare for additional dilution as soon as the 60-day lock-up period related to the most recent offering expires on March 1.

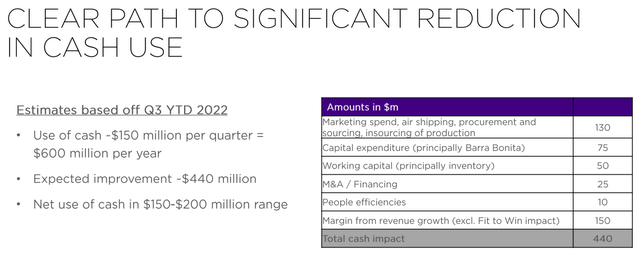

But even if Amyris manages to raise more funds at acceptable terms, the company will be required to reduce cash burn substantially to make it into 2024 without diluting equity holders even further.

While management has promised to do so, Amyris has yet to meet a financial forecast provided by CEO John Melo:

Investors should also note that there might be a reasonable chance for a delay in the company's upcoming annual report on form 10-K with the strategic transaction still in limbo and another dilutive equity offering likely to occur within days.

In addition, the massive decline in the company's stock price over the twelve months might very well require goodwill impairment testing.

Bottom Line

As expected by me two months ago, Amyris' shares have marked new all-time lows in recent sessions as investors prepare for additional near-term dilution or potentially even worse.

While Amyris will likely manage to stay afloat until the Givaudan transaction closes, management's projections for cost savings this year appear to be overly aggressive again. Given this issue, I firmly expect the company to return to the capital markets later this year.

Investors should continue to avoid the shares, until Amyris finally starts delivering on management's promises.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.