Methanex: Shareholder Returns To Be Fully Unlocked In 2023

Summary

- Methanex posted strong results during early 2022, although these began weakening during the fourth quarter.

- They still generated free cash flow, and absent of their flagship Geismar 3 project, they would sport a very high 14%+ free cash flow yield.

- They have more cash than required to finish this project but aim to repay another $300m of debt before boosting their shareholder returns.

- I expect this to be achieved during 2023, possibly as soon as the second half, but if not, it should be done by the end of the year.

- Given their lack of debt maturities afterward, I expect their shareholder returns should be fully unlocked, and thus, I believe that maintaining my strong buy rating is appropriate.

tmarvin/E+ via Getty Images

Introduction

When last reviewing Methanex (NASDAQ:MEOH) back in late 2022, they sported an interesting outlook for 2023 in light of the dynamic energy market situation, as my previous article discussed. Whereas this time the focus is now on reviewing their latest results and more importantly, updates on their capital allocation strategy for the year ahead that excitingly sees their potential for shareholder returns to be fully unlocked in 2023.

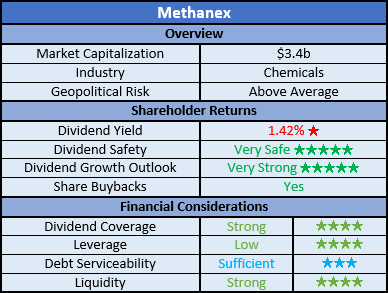

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

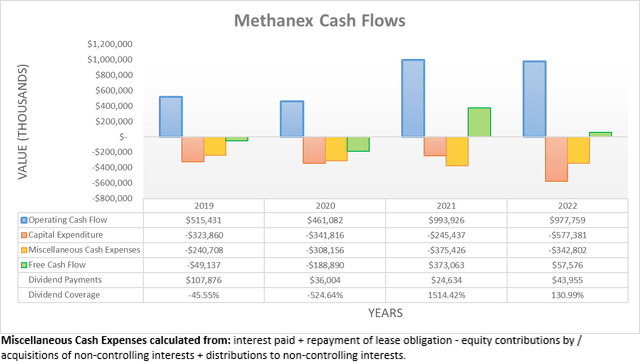

The first nine months of 2022 enjoyed strong cash flow performance, although this began weakening during the fourth quarter. On the surface, this is not necessarily evident with their operating cash flow for the full-year clocking a result of $977.8m, which is only down ever-so-slightly year-on-year versus their previous result of $993.9m during 2021. Whilst their free cash flow plunged year-on-year to only $57.6m during 2022 versus its previous result of $373.1m during 2021, this was due to their dramatically higher capital expenditure on their flagship Geismar 3 project. Despite this temporary drain during 2022, they still provided strong coverage of 130.99% to their accompanying dividend payments of $44m. Absent of their Geismar 3 capital expenditure of $431.7m, they would have otherwise generated $489.3m of free cash flow, which in turn would see a very high free cash flow yield a bit over 14%, given their current market capitalization of approximately $3.4b.

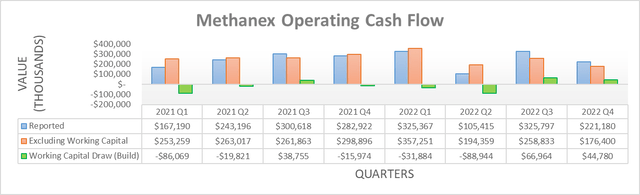

When looking at their quarterly cash flow performance, the slowdown during the fourth quarter of 2022 is more evident. On the surface, their reported operating cash flow of $221.2m was already down noticeably versus some of the earlier quarters, although more importantly was their underlying result of $176.4m that excludes working capital movement. When looking back at their recent history, this is the lowest result since at least the beginning of 2021. Ultimately, this simply highlights the inherent volatility of their industry given its reliance upon commodity markets and thus, it is not necessarily a problem but may possibly foretell weaker results in 2023 if economic weakness continues unabated. This topic was discussed in detail within my previously linked analysis for those interested, whereas the focus today is the updates on their capital allocation strategy for the year ahead alongside the resulting outlook for shareholders.

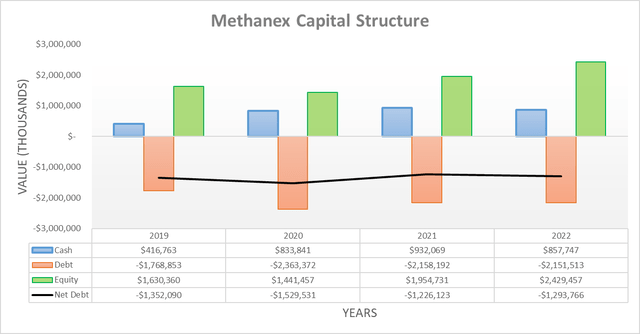

When turning to their capital structure, it shows their net debt edged higher during the fourth quarter of 2022 to $1.294b versus its previous level of $1.189b following the third quarter. This stemmed from management running down their cash balance to fund the remaining capital expenditure for their Geismar 3 project in line with their long-running strategy, which presently sees another $465m remaining, as per the commentary from management included below.

“Our balance sheet is in really good position with about $800 million on the balance sheet with $465 million left to spend on G3 and we're maintaining our minimum cash balances at $300 million.”

-Methanex Q4 2022 Conference Call.

Since their cash balance stands at $857.7m to be exact, it leaves $92.7m of spare cash once accounting for the $465m of remaining capital expenditure on their Geismar 3 project and the $300m they wish to retain as a minimum. As a result, they were asked about their capital allocation strategy in the context of accelerating shareholder returns during their fourth quarter of 2022 conference call. Even though they have this spare cash, it nevertheless seems shareholders will be waiting longer because they are now planning to repay debt ahead of its maturity in 2024, as per the commentary from management included below.

“And then we've said that we want to repay rather than refinance our $300 million bond coming due in 2024 and we think we can do that in stages rather than all at once.“

-Methanex Q4 2022 Conference Call (previously linked).

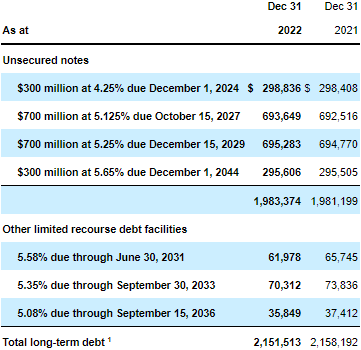

The $300m bond they refer to is an unsecured note that comes due December 2024, as subsequently discussed. Since they already have almost $100m of spare cash and generated almost $500m of free cash flow during 2022 excluding capital expenditure on their Geismar 3 project, they should have no problems achieving this task. This could quite possibly eventuate as soon as the second half of 2023 depending upon their forthcoming operating conditions and thus given their subsequently discussed lack of other short-term debt maturities, it should see their potential for shareholder returns fully unlocked. Even if operating conditions weaken, their history of generating free cash flow absent of their Geismar 3 project capital expenditure indicates such a goal should be achieved before the end of 2023.

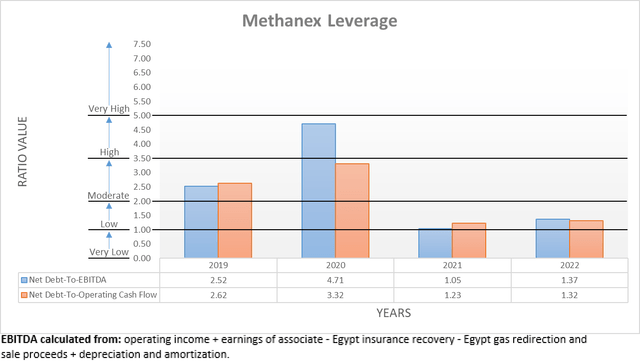

Even ignoring the earnings boost on the horizon from their Geismar 3 project and plans to repay another $300m of debt, their leverage is already low, despite edging slightly higher during the fourth quarter of 2022 on the back of higher net debt and weaker financial performance. To this point, their net debt-to-EBITDA increased to 1.37, whilst net debt-to-operating cash flow increased to 1.32 and thus similar to their previous respective results of 1.15 and 1.10, they remain within the low territory of between 1.01 and 2.00. Whilst I feel this makes further deleveraging unnecessary with refinancing a more normal path, if nothing else at least every dollar of debt shaved away means more scope for shareholder returns in future years.

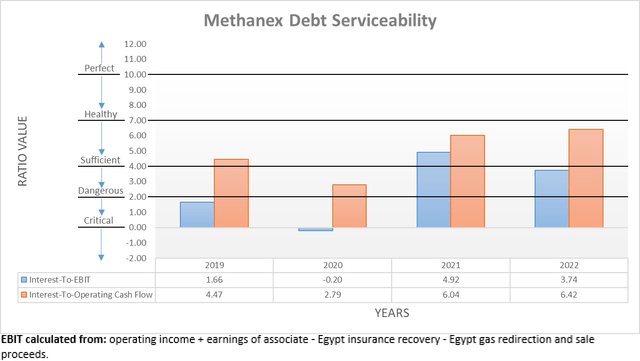

Similar to their leverage, their debt serviceability also took a hit during the fourth quarter of 2022 with their interest coverage dropping to 3.74 and 6.42 when compared against their respective EBIT and operating cash flow, versus their previous respective results of 5.21 and 8.01 following the third quarter. Whilst their interest coverage remains within the range, I consider healthy when compared against their operating cash flow, I prefer to judge on the worse side and as such, the comparison against their EBIT is still within the range I consider sufficient, which thankfully does not stand in the way of shareholder returns.

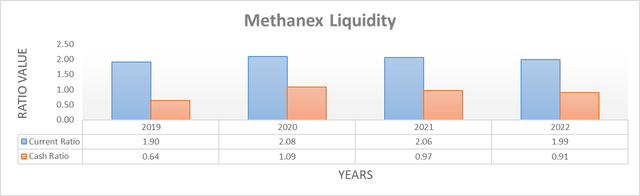

Since they continued running down their cash balance during the fourth quarter of 2022, naturally their liquidity eased but thankfully, it remains strong with their respective current and cash ratios at 1.99 and 0.91 versus their previous results of 2.15 and 1.00 following the third quarter. Whilst not likely to be required given their $300m minimum cash balance, they also have two undrawn credit facilities that hold a total of $600m of availability, if required for an emergency.

When it comes to their debt maturities, once repaying the aforementioned $300m of 2024 unsecured notes, they see no further maturities until October 2027 at the earliest and given its 4.25% interest rate, its repayment saves $12.8m per annum going forwards. Whilst this helps boost their free cash flow, the difference is only minimal given their near-$1b of operating cash flow, which means the bigger implication is actually the multi-year window afterwards whereby they have no maturities and thus, I expect to see their potential for shareholder returns to be fully unlocked towards the end of 2023, if not earlier in the year.

Methanex Q4 2022 6-K

Conclusion

Even though management is acting more fiscally cautious than I feel is necessary given their low leverage, at least it should not be too long of a wait because they should be capable of repaying their debt maturity no later than the end of 2023. If anything, this should actually be achieved as soon as the second half but either way, it seems 2023 will be the year when their potential for shareholder returns is fully unlocked given the multi-year window following without debt maturities.

The boost from the completion of their Geismar 3 project remains to be seen given the inherent volatility of their industry but even without its contribution or related capital expenditure, their very high circa 14% free cash flow yield from 2022 already shows very desirable scope for shareholder returns. The split between share buybacks and dividends remains to be seen but at least the former should lead to more of the latter in the future via a shrinking outstanding share count. Despite their share price enjoying a solid rally since conducting my previous analysis, I believe that maintaining my strong buy rating for MEOH stock is still appropriate as 2023 seemingly makes for a transitional year.

Notes: Unless specified otherwise, all figures in this article were taken from Methanex’s SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.