FRA: Discounted Floating Rate Fund

Summary

- While interest rate hikes might be nearing an end, there are still some left to go that floating rate funds can benefit from.

- FRA continues to trade at an attractive discount, making it a potential option for investors to consider.

- They can bump up their distribution for shareholders even further after a large increase in 2022 due to the continued benefits of rising rates.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Dilok Klaisataporn

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on February 13th, 2023.

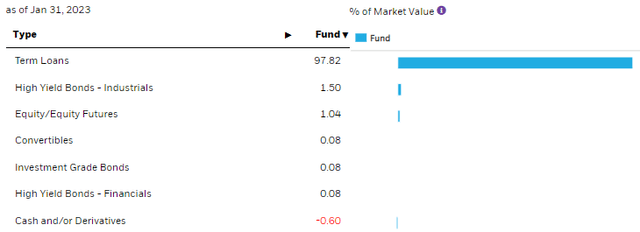

BlackRock Floating Rate Income Strategies Fund (NYSE:FRA) is a fairly straightforward senior loan-invested closed-end fund. They have some derivatives that include credit default swaps and foreign currency exchange contracts, but they are fairly minimal compared to what we can sometimes see in a fixed-income fund. That's one of the reasons why I find the fund attractive. With nearly 98% of the portfolio invested in floating-rate loans, they have benefited substantially from interest rate increases.

We've seen this across the board too. Senior loan funds are rapidly increasing their distributions to shareholders. FRA has been a bit slower, with only one increase in 2022. However, that doesn't mean they don't have the capacity for more boosts or are underperforming peers. Since our last update, we have a new UNII report that shows strong and growing coverage.

Match that with an attractive discount, and you have a fund that could be worth considering to catch the benefits of the tail-end of the interest rate hiking cycle.

A deeper discount being present will help out with the main risks that are in front of the fund. Those include interest rate cuts, credit risks and the discount itself widening further. When something is near longer-term discounts already, a further drop in discounts is generally shorter-lived, and the extent of the drop is reduced.

The Basics

- 1-Year Z-score: -0.16

- Discount: 8.77%

- Distribution Yield: 7.99%

- Expense Ratio: 1.15%

- Leverage: 22.99%

- Managed Assets: $603.3 million

- Structure: Perpetual

FRA's investment objective is "to provide shareholders with high current income and such preservation of capital as is consistent with investments in a diversified, leveraged portfolio consisting of floating-rate debt securities and instruments."

To achieve this investment objective, "at least 80% of its assets in floating rate debt securities, including floating or variable rate debt securities that pay interest at rates that adjust whenever a specified interest rate changes and/or which reset on predetermined dates." As is typical with these sorts of funds - the portfolio "invests a substantial portion of its investments in floating rate debt securities consisting of secured or unsecured senior floating rate loans that are rated below investment grade."

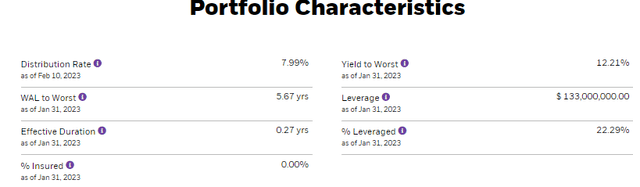

FRA has come down to a level of what could be considered modest leverage. Generally, leveraged funds keep their leverage consistent at around 30%. So seeing anything closer to the 20% level, I'll consider it modest. That being said, it increases the risk and volatility of the fund despite being modest. The upside will always be enhanced, as will the downside when utilizing leverage.

Leverage comes with other risks for CEFs since most are based on a floating rate. That is the case with FRA, so as the loans they hold on their underlying portfolio see an increase in interest rates, the costs of their borrowings will also increase. Since it is a floating rate fund, it's naturally hedged against rising rates on borrowings.

However, deleveraging can be a risk too. Generally, this is viewed as a negative when it's forced, but it can be potentially damaging when it's by management choice too. In this case, they took down leverage that was $223 million in borrowings at the end of 2021. It was $203 million at the end of June 30th, 2022. Now it's down to $133 million.

FRA Portfolio Characteristics (BlackRock)

A reduction in leverage can often mean a reduction in net investment income which is derived from the interest the fund collects minus the fund's expenses. With a decline in NII potential, a decline in the distribution is possible. However, once again, floating rates in its underlying portfolio come in to save the day. As we'll see, it hasn't hurt results but enhanced them for the fund too, relative to peers.

Performance - Beating Peers, Attractive Discount

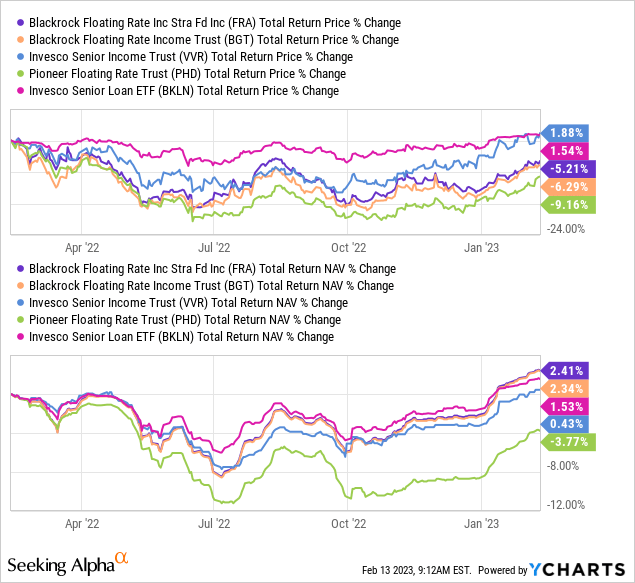

When looking at the performance of the fund in the last year, FRA has done well. I've included the BlackRock Floating Rate Income Trust (BGT), which is a sister fund that is quite similar. I've also included Invesco Senior Income Trust (VVR), a name I recently sold but was happy holding onto through the last year. Then I've also included the Pioneer Floating Rate Trust (PHD), another floating rate fund. Finally, I've included the non-leveraged Invesco Senior Loan ETF (BKLN) to give us some broader context of the overall senior loan sector performance.

Ycharts

As we can see, compared to these peers, FRA has come out on top in the last year in terms of total NAV return performance. That's the performance of the actual underlying portfolio.

On a total share price return basis, VVR has come out on top due to discount shrinkage. Primarily what drove my decision to close my position in VVR. What we can see is that despite being slower to raise distributions, as expected, it hasn't negatively impacted the underlying portfolio results we see from FRA.

To put this performance into greater context. We can see the results of the SPDR S&P 500 ETF (SPY) and Vanguard Total Bond Market ETF (BND) in the last year. These aren't benchmarks, but they give us color for the other assets' actions. On a total NAV return performance, it really was no comparison. However, it was quite competitive on a total share price return and highlighted why we've seen such a discount open up for FRA.

Ycharts

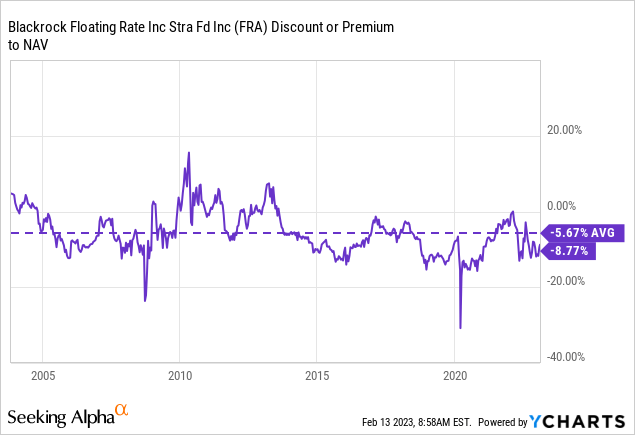

When we last covered the fund, it was at a nearly 12% discount. That's certainly tightened up since then. However, history still shows us that the current discount is fairly attractive. Discounts wider than this level have been fairly short-lived. In particular, the GFC and COVID crash highlights the depths discounts can move to - though generally short-lived.

Ycharts

I believe that we are near the end of interest rate hikes. Therefore, I'm not getting too bullish on senior loan funds, and when there is a chance for an exit, as I've done with VVR, I just might take it. However, a deeper discount can negate some of the headwinds in the future. That's why I'm not as compelled to sell FRA now.

With a recession expected this year, credit risks become an issue due to the chances for companies to default on their loans. Historically, it's not been a huge issue, but depending on the depth of the recession, it can become an issue the deeper and more prolonged a recession.

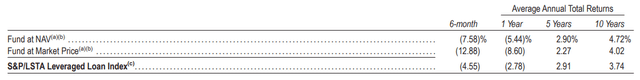

The results of senior loan funds historically have been poor over much of the last decade. The share performance against their benchmark in the last semi-annual report, data as of June 30th, 2022.

FRA Annualized Performance (BlackRock)

They've beaten their benchmark, but it certainly wasn't results we would necessarily brag about. However, this is more the time for senior loan funds due to higher interest rates. In most of the last decade, rates were at 0%, which is the worst period to be considering loans as the loans will pay the lowest interest. Where rates go depends on where the performance will go.

That's why interest rate cuts are also risky if the Fed decides the economy starts to cool down too much. That could happen when inflation starts moving drastically lower and unemployment ticks higher. At this point, they are talking tough, that they'll keep rates higher for longer. We shall see if the economy allows that.

Another risk that can often be overlooked is that, at some point, interest rates become damaging. Floating-rate loans aren't given to companies with sterling balance sheets that pump out profits left and right. Taking a company's borrowing costs from 5% to 10%+ has some financial impact on the borrower. So I'd say that increasing interest rates also have a limit to the level that they are beneficial.

FRA's Distribution

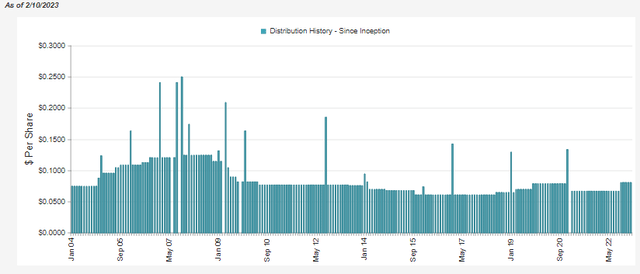

As long as rates are heading higher, there is the capacity for increased distributions from FRA and other senior loan funds.

FRA Distribution History (CEFConnect)

They had a big bump from $0.0667 per month to $0.0804 per month in 2022. The last time we looked at the rolling 3-month NII coverage in their UNII report, it came to 104%.

All else being equal, we should see coverage drop when there is an increase. Of course, we know that it isn't equal in this case. With rising interest rates and a floating rate portfolio, we know interest payments are rising. Instead, we now see that at the end of 2022, NII coverage jumped to 113.7%.

The distribution coverage ratio is based on the last three months. Meaning that it reflects the new increased distribution rate but not entirely reflecting the higher interest rate increases from the Fed during this time.

FRA Distribution Coverage (BlackRock)

Therefore, we would naturally expect another increase at some point fairly soon based on NII coverage probably being even higher than 113.7%. Even if it didn't increase, they're earning enough to warrant an increase at some point. As a regulated investment company, they must pay out most of their income to investors. If not, we could see a large year-end distribution, or the fund could face a 4% excise tax.

FRA's Portfolio

As mentioned in the open, FRA is fairly straightforward. The overwhelming majority of the portfolio is in senior loans or "term loans," as they identify them.

FRA Asset Exposure (BlackRock)

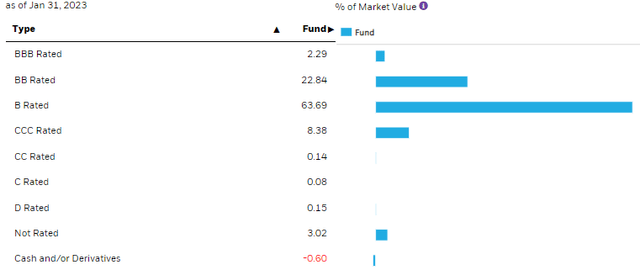

When investing in senior loans, they will be mostly below investment grade, thus, why credit risks become an important consideration when entering a year with an expected recession.

FRA Credit Quality (BlackRock)

With FRA, there is a fair bit allocated to CCC and below. These types of loans start defaulting first, as they are the most susceptible. They are companies that need just about everything to go right for them to succeed. The idea is that with the BlackRock managers' tools and resources, they are able to navigate this type of market and choose the best outcome.

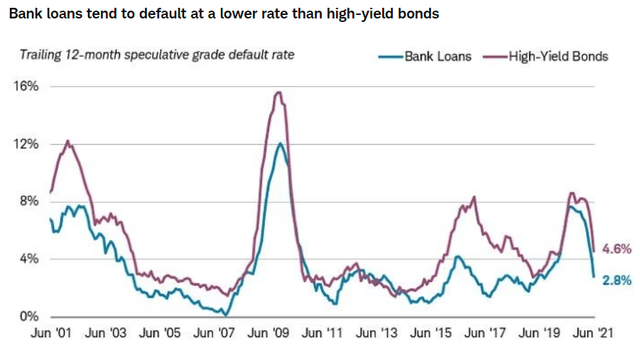

Historically, default rates have been fairly minimal for loans. This has played out when observing the default rates of senior loans and high-yield bonds; it becomes even more apparent generally in times of economic distress. Early 2000's, GFC, ~2015 when global economies started to slow down and the COVID crash. Interestingly, though, during the COVID crash, there did seem to be a higher correlation than in the other periods shown.

Historical Bank Loan default compared to High Yield Bonds (Charles Schwab)

Then there are recoveries to consider. Since they are higher in the capital stack, recovery is higher. Once again, this comes from history.

Over time, loans tend to have significantly higher recovery rates—due to their collateralized nature—than high-yield bonds. In the 12 months ending June 2021, the average recovery rate for loans was $55, compared to just $41.1 for traditional bonds.1 The difference is even wider over the last five years, with the loan recovery rate coming in at $63.4, compared with just $41.6 for bonds.1 This means that when markets take a turn for the worse and defaults start to pick up, loan investors should be better off than traditional high-yield bond investors.

Of course, we take all these loans, and we juice them up with leverage. The results are then amplified with the CEF leverage meaning that when times are tough, and losses start to come in, the losses are increased.

Where a fund counteracts all these risks can be through diversification.

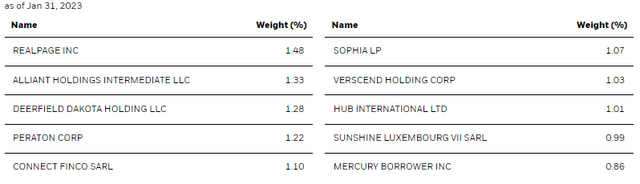

FRA Top Ten Exposure (BlackRock)

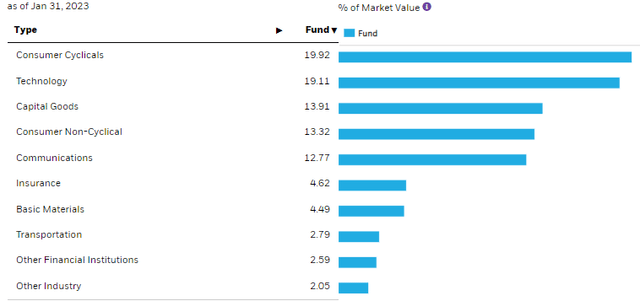

Looking at the top holdings, we see that they represent a fairly minimal level of the entire fund. By the time we get to slot number nine and ten, we are looking at positions that represent below 1% of invested assets. In total, they are carrying 447 positions spread across many different industries. Different industries will be hit to different degrees, and some are more sheltered from losses than others due to being less economically sensitive.

FRA Sector Allocation (BlackRock)

Conclusion

FRA remains an attractive senior loan-focused fund. With interest rate hikes expected to be nearing an end, these funds aren't as attractive as they were a year ago. However, that doesn't mean we can't still find some attractive funds to consider. FRA represents one such opportunity because the fund's discount remains wide relative to its history. NII coverage also remains strong, so another distribution increase or increases would be expected. Even if they don't increase, we've seen that they can still provide solid results. Distributions are important for CEFs, but they aren't the only source of returns for the funds.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have a beneficial long position in the shares of FRA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.