NeoTV Group Begins U.S. IPO Amid Revenue Drop

Summary

- NeoTV Group Limited filed to raise $55 million in a U.S. IPO, although the final figure may vary.

- The firm hosts Esports events and provides related services in China.

- NeoTV Group has produced sharply declining revenue and has swung to generating losses recently, not a good development.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Edwin Tan

A Quick Take On NeoTV Group Limited

NeoTV Group Limited (NTV) has filed to raise $55.2 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm hosts and promotes E-sports events in China.

NTV wants to expand outside of China but is performing poorly in its existing market.

I’ll provide an update when we learn more IPO details.

NeoTV Overview

Shanghai, China-based NeoTV Group Limited was founded to enable fans to easily connect with Esports events, athletes, and related ecosystem participants in China.

Management is headed by Chairman and CEO Yuxin Lin, who has been with the firm since 2007 and obtained a degree of Associate of Arts Interior Design from the Fashion Institute of Design & Merchandising.

The company’s primary offerings include the following:

Event management

Cloud streaming

IP management

Extended reality technologies.

As of June 30, 2022, NeoTV has booked fair market value investment of $11 million from investors including ZYD Holding Limited.

NeoTV - Customer Acquisition

The company seeks to host and promote Esports events through its connections with fans, participants, influencers, brands, broadcasters and sponsors.

NeoTV's primary revenue comes from "providing integrated services relating to the Esports tournaments business and the production of variety shows."

Selling expenses as a percentage of total revenue have trended higher as revenues have decreased, as the figures below indicate:

Selling | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended June 30, 2022 | 3.1% |

2021 | 2.0% |

2020 | 2.1% |

(Source - SEC.)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling expense, fell to negative (12.2x) in the most recent reporting period, as shown in the table below:

Selling | Efficiency Rate |

Period | Multiple |

Six Mos. Ended June 30, 2022 | -12.2 |

2021 | 13.5 |

(Source - SEC.)

NeoTV’s Market & Competition

According to a 2022 market research report by iResearch China, the Chinese market for Esports was an estimated $23.6 billion in 2021 and is expected to reach $30.8 billion by 2024.

This represents a forecast CAGR of around 9% from 2021 to 2024.

The main drivers for this expected growth are an increase in the usage, availability and broadband connection for smartphones and, temporarily, the COVID-19 pandemic.

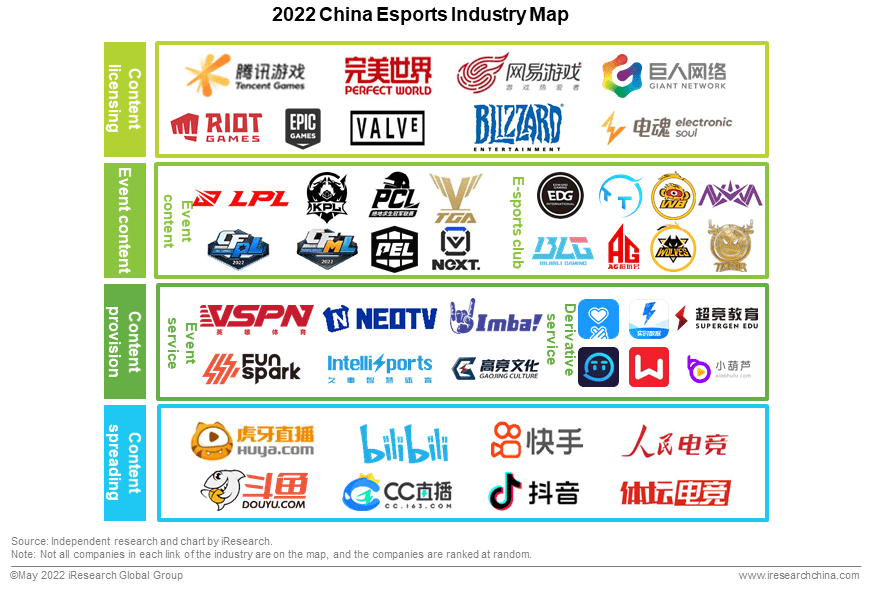

Also, below is a 2022 map of the major players in China's Esports industry:

China Esports Map (iResearch China)

Major competitive or other industry participants include the following:

VSPN

ImbaTV

FUNSPARK

EM ELECTRONIC SPORTS

GaoJing Culture

LiChang E-sports

XianZhi E-sports

PGL

DSPORT

Major internet platform operators.

NeoTV Group Limited Financial Performance

The company’s recent financial results can be summarized as follows:

Declining topline revenue

Sharply reduced gross profit and gross margin

Increased operating losses

Reduced cash used in operations.

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended June 30, 2022 | $ 7,225,221 | -27.5% |

2021 | $ 33,715,193 | 37.5% |

2020 | $ 24,512,720 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended June 30, 2022 | $ 831,583 | -53.3% |

2021 | $ 7,616,955 | 22.4% |

2020 | $ 6,224,012 | |

Gross Margin | ||

Period | Gross Margin | |

Six Mos. Ended June 30, 2022 | 11.51% | |

2021 | 22.59% | |

2020 | 25.39% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended June 30, 2022 | $ (933,740) | -12.9% |

2021 | $ 1,724,685 | 5.1% |

2020 | $ 1,773,033 | 7.2% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Net Margin |

Six Mos. Ended June 30, 2022 | $ (437,101) | -6.0% |

2021 | $ 2,682,857 | 37.1% |

2020 | $ 2,166,869 | 30.0% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended June 30, 2022 | $ (22,137) | |

2021 | $ (508,775) | |

2020 | $ (2,425,309) | |

(Source - SEC.)

As of June 30, 2022, NeoTV had $2.1 million in cash and $9.9 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2022, was negative ($2.9 million).

NeoTV Group Limited IPO Details

NeoTV intends to raise $55.2 million in gross proceeds from an IPO of its ordinary shares, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

approximately 25% for building an ecosystem of overseas Esports event operation and expand business to targeted overseas market;

approximately 25% for increasing investment in research and development;

approximately 25% for advancing E-sports-focused services and infrastructure technologies, including but not limited to live broadcast technology, cloud computing and Metaverse; and

the balance for working capital and general corporate purposes.

(Source - SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said "there were no pending or threatened claims and litigation as of December 31, 2021" and through the issuance date of its financials.

The sole listed bookrunner of the IPO is Prime Number Capital.

Commentary About NeoTV’s IPO

NTV is seeking U.S. public capital market investment to expand its operations overseas and for its various working capital requirements.

NeoTV Group Limited’s financials have shown dropping topline revenue, lowered gross profit and gross margin, and higher operating losses but decreasing cash used in operations.

Free cash flow for the twelve months ending June 30, 2022, was negative ($2.9 million).

Selling expenses as a percentage of total revenue have trended higher as revenue has decreased; its Selling efficiency multiple dropped to negative (12.2x).

The firm currently plans to pay no dividends to retain future earnings for reinvestment back into the firm's growth and working capital requirements.

NTV’s CapEx Ratio indicates it has spent on capital expenditures even as its operating cash flow was negative.

The market opportunity for Esports in China is large and expected to grow at an impressive rate of growth in the coming years, so the company enjoys a positive industry growth dynamic, although it faces stiff competition from a variety of companies.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government’s crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

A significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit for three years by the PCAOB.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has largely been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and representing a very different approach to keeping shareholders up-to-date about management’s priorities.

Prime Number Capital is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (80.0%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include the need to spend heavily on R&D as well as its stated objective of expanding overseas where it may have no experience in doing successfully.

When we learn more about the IPO from management, I’ll provide an opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.