ChargePoint: No Pain, No Gain

Summary

- ChargePoint stock has stalled after a remarkable recovery in January that saw it surging nearly 70% to its recent highs.

- Is it finally time for CHPT to emerge from the storm that battered it for two long years?

- ChargePoint bears have likely reloaded their bets at its February highs, expecting the company to slip up at its upcoming earnings release on March 2.

- We highlight why CHPT may have weathered the worst of its storm.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

jetcityimage

Unprofitable EV charging leader ChargePoint Holdings, Inc. (NYSE:CHPT) will release its FQ4'23 earnings report on March 2.

Even though ChargePoint is projected to notch revenue growth of nearly 98% for FY23 (in line with the company's midpoint guidance), its adjusted gross margin is expected to finish at about 19%, as we highlighted in our previous update.

ChargePoint bulls could point out that FQ4 could see an inflection in its gross margin recovery, expected to be about 22%.

As such, it should lift ChargePoint's ability to narrow its operating losses further in FY24, benefiting from the secular growth in EV market share.

ChargePoint recently announced a partnership with Stem, known for its "AI-driven" energy solution. Accordingly, the partnership will allow ChargePoint to leverage Stem's battery storage system to lower EV charging infrastructure operating costs. Hence, it's intended to accelerate the adoption rate for ChargePoint's platform solutions, driving its growth forward.

However, investors need to note that the US government's requirements for federal funding could face structural challenges from July 2024. Accordingly, "the cost of charger components manufactured in the US must reach at least 55%, or the project will not be eligible for federal grants."

As such, while the US government's support should help to accelerate its goal of developing 500K charging stations before 2030, it could also lead to cost increases.

Bloomberg reported that Zerova Technologies, which manufactures EV charging systems, highlighted that the Inflation Reduction Act or IRA could lead to higher costs for consumers.

As the Biden Administration focuses on reshoring manufacturing capabilities for its EV supply chain, Zerova believes "the cost for charging infrastructure could double due to the IRA."

Therefore, we believe investors must assess the profitability inflection for ChargePoint carefully. Unintended cost increases delaying its adoption could slow its profitability ramp and prolong the pain for investors, despite its aggressive top-line growth estimates.

Notwithstanding, the secular growth drivers for ChargePoint in the US and Europe remain strong. US EV penetration is expected to increase, with EV sales projected to rise to 1.8M from 2022's 900K units.

Europe's energy crisis has lifted the impetus for the region to accelerate its clean energy ambitions. Hence, the backdrop for ChargePoint is constructive.

Moreover, Tesla's (TSLA) recent decision to open up its charging network to non-Tesla users should help widen EV adoption to non-premium EV owners, benefiting the country's nascent EV ambitions.

Despite that, Wall Street estimates suggest that ChargePoint's near 100% growth for FY23 will not likely be repeated in FY24.

Accordingly, ChargePoint is projected to deliver revenue growth of 57% and an adjusted operating margin of -32%. However, it's still a significant improvement from FY23's adjusted operating margin estimates of -64.5%.

Hence, we believe the critical underpinning for ChargePoint to deliver in FY24 will be its path toward profitability.

Analysts and investors will likely digest management's commentary and outlook on its gross margin recovery. Any sign of weakness will probably see CHPT hammered, as its short interest as a percentage of float remains elevated at nearly 20%.

Hence, the short sellers are still betting that ChargePoint's turnaround story is far from realization, as they likely reloaded at its recent highs.

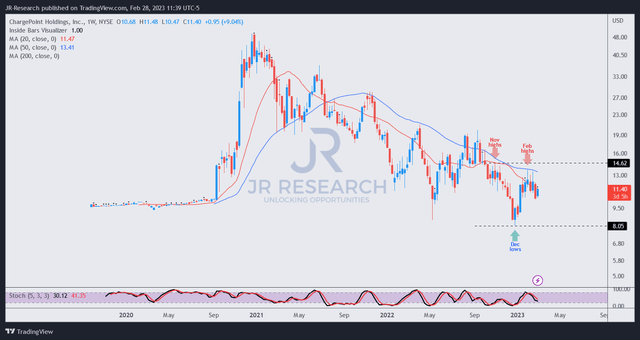

CHPT price chart (weekly) (TradingView)

Playing the long side on CHPT has been a losing business for the bulls over time. Taking a glance at CHPT's medium-term price chart is enlightening.

The right way to play this over the past two years is to go short at critical resistance zones and then cover at oversold levels.

Notwithstanding, bulls could still use inflection points at oversold levels to play the mean-reversion trade with a well-defined profit/stop-loss target. However, we won't encourage investors to hold the bag for unprofitable stocks like CHPT that don't have sustainable free cash flows as a core defense.

Our assessment suggests that CHPT's late December lows could be the turning point in its downtrend bias.

However, the rejection at its recent February highs is troubling, suggesting that its upward recovery has continued to fail at its 50-week moving average or MA (blue line).

However, with the return of risk-on sentiment and the potential underperformance of value stocks over growth moving ahead, the worst in CHPT seems to be over as the market continues its recovery.

If ChargePoint could point to a faster recovery of its gross margin at its upcoming earnings card, breaking above its February highs should be within reach moving ahead.

Rating: Speculative Buy (Reiterated).

Note: As with our cautious/speculative ratings, investors must consider appropriate risk management strategies, including pre-defined stop-loss/profit-taking targets, within an appropriate risk exposure.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you'll also gain access to exclusive resources including:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Unlock the secrets of successful investing with JR Research - led by founder and lead writer JR. Our dedicated team is laser-focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular marketplace service - specializing in a price-action-based approach to uncovering the opportunities in growth and technology stocks, backed by in-depth fundamental analysis. Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis. We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups. Join us and start seeing experiencing the quality of our service today.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.