S&P, Nasdaq, Dow trade mixed after weak Chicago PMI, consumer confidence

Spencer Platt/Getty Images News

Stocks were lower Tuesday as the weakest Midwest manufacturing number since November helped growth stocks.

The S&P (SP500) was flat, the Dow (DJI) -0.4% fell and the Nasdaq (COMP.IND) +0.2% were up.

"Since Nov.'21, the last trading day of the month has been up 4 times, and down 11, for an average return of -0.30%," BTIG technical strategist Jonathan Krinsky wrote. "All of the up days, however, have been +1.42% or more."

"We haven't had back-to-back positive last days of the month during this stretch, and January was +1.46%. The last day of February has historically been bearish, and has been down eight straight years (avg. -0.54%), and 10 of the last 11."

The 10-year Treasury yield (US10Y) rose 4 basis points to 3.95% and the 2-year (US2Y) rose 1 basis point to 4.80%.

The February Chicago PMI fell unexpectedly to 43.6. The forecast was for a small rise to 45.

The Conference Board's measure of February consumer confidence unexpectedly fell to 102.9. The consensus was for a rise to 108.5.

The S&P/Case-Shiller house price index for December fell to an annual rate of 4.6%, below the consensus of 5.8%.

"We expect a very weak spring housing market, given the back-up in mortgage rates, and a further increase in supply as older homeowners in the suburbs seek to cash-in on the surge in home prices during the pandemic before it all reverses," Pantheon Macro said. "But what might be rational for individuals - get out, while the going is still goodish - will only speed the drop in aggregate home prices."

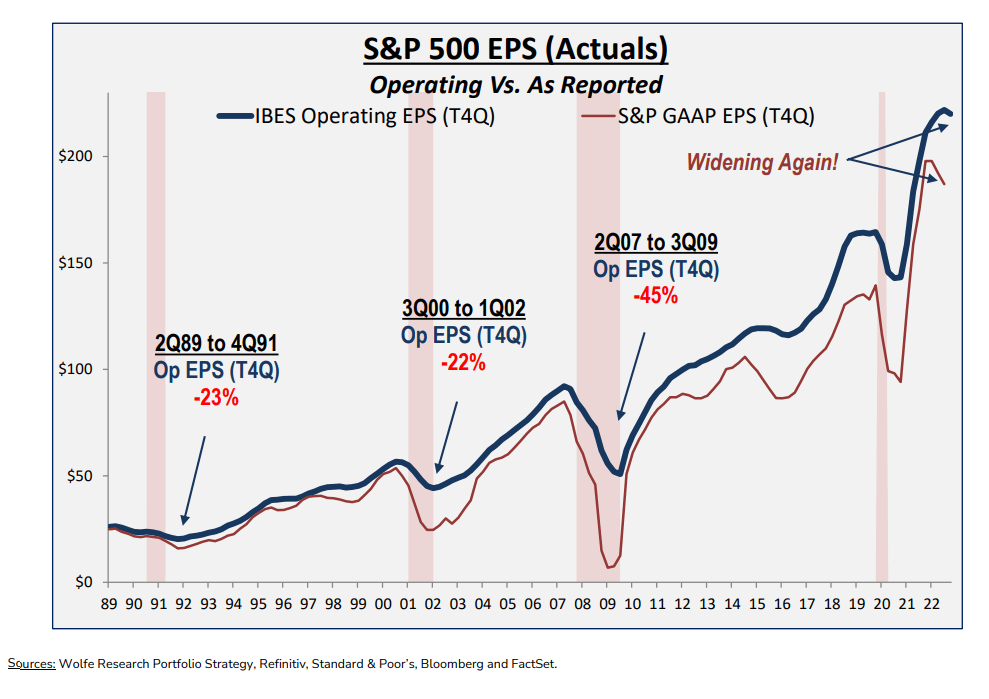

"In our view, bulls should also be concerned about the widening divergence between S&P 500 Operating and Reported GAAP EPS," Wolfe Research said. "Historically, gaps like this have generally occurred before big overall earnings declines." (See chart at bottom.)

See the stocks making the biggest moves this morning.