Get Ready, ZIM Integrated Stock Is Setting Up Again (Technical Analysis)

Summary

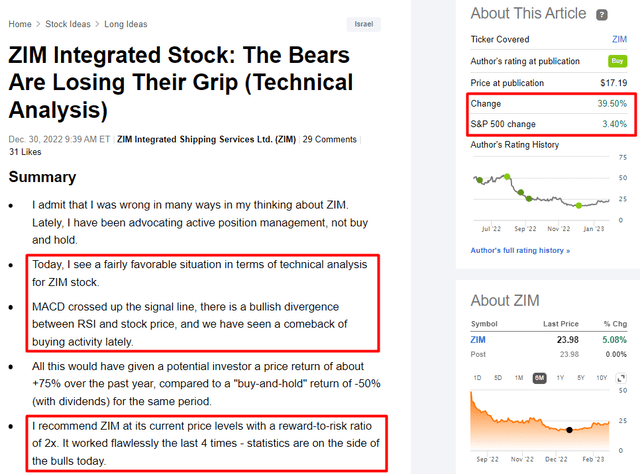

- In my last article, I indicated that the bears were losing their grip on ZIM. As time has shown, the stock outperformed the SPY index by almost 12x in 2 months.

- Looking at Maersk as a comparable company, it's highly probable that ZIM's earnings release will exceed the Street's EPS/outlook expectations.

- If ZIM beats, a massive short covering is likely to drive ZIM stock way up.

- All the bullish arguments overlap ideally with today's technical picture that shows about 16-20% upside potential from the last close.

- I am once again rating ZIM stock a Buy and recommend that you keep an eye on this stock, even though it is already up about 50% since its December lows.

- Looking for more investing ideas like this one? Get them exclusively at Beyond the Wall Investing. Learn More »

shaunl/E+ via Getty Images

Instead of an investment thesis

Given the cyclical nature of ZIM Integrated Shipping (NYSE:ZIM) and the entire industry to which it belongs, I have recently begun to pay more attention to price action. For example, in my last article about ZIM, I pointed out a rather clear divergence of the share price with its RSI indicator - everything indicated that the bears were losing their grip. As time has shown, ZIM outperformed (SPX) index by almost 12 times in 2 months:

That actionable idea has aged great. But it does not stop me from being bullish on the stock despite the pretty great pessimism of the crowd. Below I list my 3 reasons why.

Reason #1: judging by analogy with the nearest competitor, ZIM is likely to surprise us to the upside.

According to Seeking Alpha, ZIM will release its results on March 13, 2023 [pre-market] - that's a few weeks after A.P. Møller - Mærsk (OTCPK:AMKBY) releases its Q4 2023 results, which we can already analyze.

To sum up Yoel Minkoff's report [SA News Editor], Maersk's EBITDA fell 18% YoY to $6.54B, below estimates. However, the management expects the global container market to improve in FY2023. To adapt to challenges, Maersk plans to increase operational efficiency, diversify revenue, and expand air freight services. The company recently ended a partnership with Mediterranean Shipping, potentially triggering a price war.

It is interesting to compare how the actual financial results and the 2023 outlook have affected the Maersk share price - immediately after the announcement, a downward price gap formed, which was almost completely closed intraday after the outlook announcement; those who bought that gap near the bottom are now seeing almost 6% in unrealized [or already realized] profit:

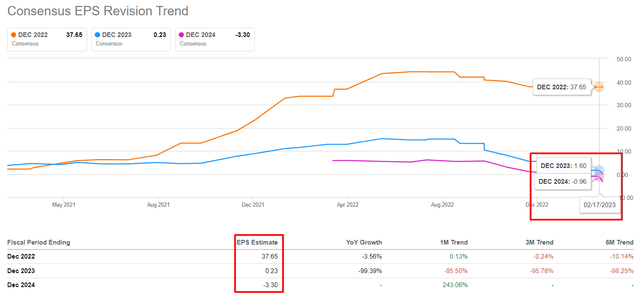

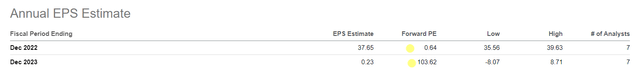

Since the announcement of Maersk's financial results, ZIM shares have gained about 10% to date. However, it is worth noting that analysts have recently lowered their forecasts for the company's EPS. If on Feb. 17, 2023, ZIM's consensus EPS forecasts for FY2023 and FY2024 were still $1.6 and -$0.96, respectively, by Feb. 21, 2023, analysts were already seeing earnings (losses) of $0.23 and -$3.3 per share, respectively.

Yes, the industry is quite cyclical and volatile - we all know that. But how can it be that one company is spouting much more positive rhetoric than expected, while at the same time, its closest competitor is going in the opposite direction? Something does not seem right here... And my guess is the recently adjusted EPS forecasts are not right.

What if current container freight rates have bottomed out and a new round of growth lies ahead as China continues to open up?

China Global Export Container Freight Index - Main Routes [MacroMicro data]![China Global Export Container Freight Index - Main Routes [MacroMicro data]](https://static.seekingalpha.com/uploads/2023/2/27/53838465-1677487462958811.png)

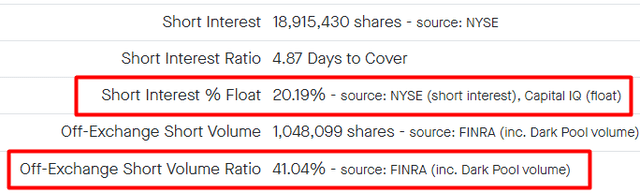

I hope that ZIM's management will simplify our task by giving a more positive industry forecast during the upcoming earnings call than they are expected to do today - that will upset a bunch of short sellers who are in no hurry to close their positions:

This is where my reason #2 comes into play: massive short covering is likely to drive ZIM stock way up.

In short covering, investors buy back borrowed shares to close their short position. Basically, if you sell shares short, you have to buy them back at some point to return them to the lender. If the stock price skyrockets[say, amid an earnings beat], short sellers may have to buy back the shares at a higher price to cut their losses. This can trigger a short squeeze, where a rush of short sellers buying back shares pushes the stock price even higher.

Stocks can go crazy during short covering because there is suddenly tremendous buying pressure as short sellers look to close out their positions. This buying pressure can quickly drive up the stock price because there are more buyers than sellers in the market. And then the sudden price rise can attract even more buyers who also want to get in. This creates a loop where the rising stock price attracts more buyers, which in turn drives the share price up even further.

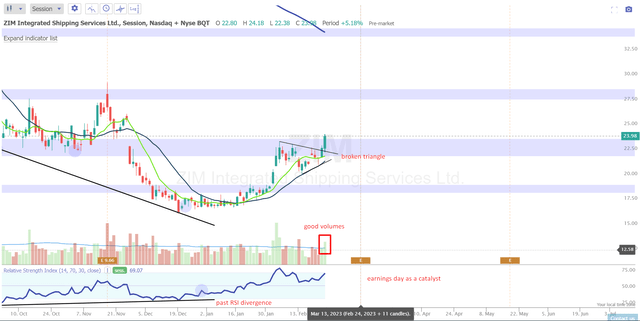

All these arguments overlap ideally with today's technical picture, which is my 3rd reason to stay bullish on ZIM.

If you recall, just a few weeks ago ZIM was at oversold levels, which has only occurred 3 times since the company's IPO. Buying at those levels and selling at oversold levels [based on MACD and RSI] would yield an average return of over 15% per trade, all of which were positive. Now the stock can no longer be called oversold - it has moved very quickly from the "beaten-down" group to the "momentum-leaders" group.

An old stock market adage says: let your winners run. It looks like ZIM is really feeling like a real winner today, breaking out of its rather "heavy" resistance level of $22-22.6 per share. The next logical level for ZIM is based on historical pull points at $27.7-28.7 per share, which represents about 16-20% upside potential from the last close:

If we assume that ZIM has not really changed its longer-term downtrend, but is just in the "bear rally" phase - the distance to the 200-day simple moving average is now ~43%, even taking into account that ZIM has risen almost 50% from its December low. In this context, I would particularly like to point out the margin of safety that ZIM offers. In my opinion, the stock has quite an interesting risk-reward ratio in favor of buyers, if we consider this as an opportunity before the earnings release.

However, the "risk" part of the equation should not be ignored. I hope everyone understands that investing in ZIM stock today - like in every container shipping stock - is quite risky. Firstly, the container shipping industry is highly cyclical, making it difficult to predict future earnings and revenue streams. This means that even if ZIM performs well in the short term, it may struggle in the long run as economic conditions change. Secondly, operating metrics such as freight rates and capacity utilization can be highly variable and are largely outside of ZIM's control. This can make it difficult to forecast future performance accurately.

Another factor to consider is the slowing global economy, which could negatively impact demand for container shipping services. Additionally, ZIM's valuation multiples are currently unreliable, making it challenging to assess the company's true value. The company's forwarding P/E of 0.64x looks way too cheap - but what if analysts are right and ZIM's EPS will drop to $0.23 for FY2023? Then the price-to-earnings ratio will quickly turn to triple digits:

Lastly, while technical analysis can be a useful tool for predicting stock prices, it is also highly subjective and may not always be accurate.

Takeaway

ZIM will publish its financial results on March 13, 2023 - a few weeks after Maersk released its Q4 2023 results. While Maersk's EBITDA fell short of expectations, the company is more optimistic about the global container market compared to what we heard last quarter - it plans to improve operational efficiency, diversify revenue and expand air freight services. Shares of ZIM are up about 10% since Maersk's release date, but Wall Street analysts have meaningfully lowered their EPS forecasts for the company. Against this backdrop, short sellers have continued to add to their sizing and have no plans to give up. So the potential for short covering could drive ZIM stock higher as short sellers rush to close out their positions in case of a highly-likely earnings beat [based on my expectations]. The technical picture also favors a bullish outlook: ZIM has overcome its resistance and could have an upside potential of 16-20%. However, the industry is volatile, and ZIM's longer-term trend is still in a downtrend, so this bullish thesis is fraught with risks that everyone should take into account. Nonetheless, I am once again rating ZIM stock a Buy and recommend that you keep an eye on this stock, even though it is already up about 50% since its local lows [from December].

Struggle to access the latest reports from banks and hedge funds?

Information is the basis for investment decisions making. Until recently, few ordinary retail investors had access to the latest reports from banks and funds - it was too expensive.

But everything has changed! With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year. You'll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.

This article was written by

Quantitative equity research analyst. Colliding data science and finance to find a stock's mispricing.

Constantly looking for a reasonable balance between growth and value.

>5 years of experience in personal portfolio management with an average annualized return of ~26%.

Disclaimer: Associated with Danil Sereda, another Seeking Alpha contributor

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ZIM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.