Why SPDR Gold MiniShares Could Lose Its Appeal

Summary

- Physical gold is likely to fall in value as interest rates rise to curb inflation and the US currency appreciates.

- Recession fears would be positive for a bullish sentiment on gold, but the future does not look as bleak as initially anticipated, so gold doesn't stand much of a chance.

- SPDR Gold MiniShares stock should trend lower as this investment vehicle is a trust that holds physical bars of gold which is expected to decline.

sl-f

Gold Price Outlook

Gold is traded on the London Bullion Market but is also traded via contract futures on the market for these investment vehicles.

Gold futures expiring April 2023 (GCJ2023) were trading at $1,816.90 an ounce at the time of writing, roughly unchanged from their previous close, but down 6.2% from the January 23 high of $1,936.20.

The precious metal is suffering from some headwinds stemming from market fears of further monetary tightening, which the US Federal Reserve [Fed] will almost certainly have to implement as the economy still fails to provide the necessary response to fuel the disinflation process.

The US personal consumption expenditure [PCE] price index, which the Fed uses as an indicator, rose again in January by 5.4% yoy, compared to 5.3% in December.

At this point, a further increase in the cost of money is essential to decelerate inflation, which, if left elevated for too long, could seriously damage household and corporate finances, far outweighing the consequences of a possible recession from the Fed's hawkish stance on interest rates.

But rising interest rates are discouraging investments in gold.

The ability to get a higher interest coupon on fixed-income securities would increase the opportunity cost of owning gold instead of fixed-income securities.

Fixed-income securities are more attractive than zero-yield gold in a rising interest rate environment and this aspect becomes even more apparent when inflation slows as real interest rates rise.

In addition, the rise in interest rates leads to higher cash costs, which means that the precious metal has another competitor in the form of the US dollar.

Largely due to the above factors, analysts are forecasting a lower gold price going forward. Analysts are forecasting gold to fall 1.6% before the end of the current quarter and that the metal will lose 5.2% before the end of this year.

But with gold on track to target a lower price going forward, any securities that follow the metal's price moves are likely to move downwards as well.

Changes in the Gold Price Are a Strong Determinant of the Share Price of SPDR Gold MiniShares

Based on this principle, investors should consider slightly reducing their SPDR Gold MiniShares (NYSEARCA:GLDM) position and using the cash available for other forms of investment, such as bonds or the US dollar, as these securities appear poised to rise further.

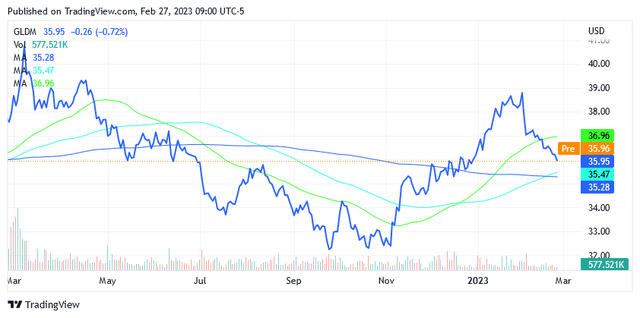

Hand-in-hand, the SPDR Gold MiniShares have tracked the performance of gold over the past year, represented by the benchmark gold futures contract expiring in April 2023 (GCJ2023), as shown in the chart below.

While the yellow metal was down nearly 7%, SPDR Gold MiniShares also lost 4.69%.

In attempting to find a relationship between gold and the trust, a linear model was applied where SPDR Gold MiniShares is the output (or dependent variable) while gold futures contract - April 2023 (GCJ2023) is the input (or the independent variable).

The model was run over the last 252 (let's say one year) daily returns for both securities and no longer, as the market in 2023 will probably look more like 2022 than it did a few years ago. The themes of 2022 such as elevated inflation, anti-inflation monetary tightening, the war in Ukraine, and geopolitical tensions between Western countries and Russia/China are likely to linger into the year 2023 completely.

The model had a high coefficient of determination of more than 75%, which means that the volatility of SPDR Gold MiniShares was largely driven by the changes in the gold futures contract - April 2023.

In more practical terms, the linear regression model shows that SPDR Gold MiniShares shares tend to fall by 87 cents when the commodity falls in value by an average of $1.

The Trust tends to be slightly less volatile than gold prices, but still follows the direction the metal decides from time to time according to the macroeconomic and geopolitical conditions of the moment.

As conditions are currently evolving in a manner inconsistent with bullish sentiment for gold, based on the mathematical relationship shown above, a lower gold price should also be reflected in a lower share price level for SPDR Gold MiniShares shares, so investors may want to soften their position.

About SPDR Gold MiniShares Trust

Investors choose to buy a position in the SPDR Gold MiniShares trust to gain exposure to the price of gold as the purpose of the trust is to reflect the movement of the gold bullion price minus the expenses of administering the trust.

Many investors prefer to invest in gold through MiniShares rather than buying physical gold because the transaction costs implied by the trust are lower than the costs of buying, storing and insuring physical gold.

The Fund was launched on June 25, 2018 and is listed on the NYSE Arca.

MiniShares represents fractional and undivided shares of the trust, while the trust's only assets are physical bullion and may also be some cash from time to time.

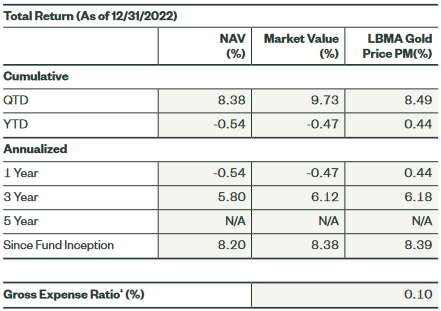

The chart below shows some of the SPDR Gold MiniShares Trust's performance against physical gold so far this year and over the past three months and a few years.

Source: spdrgoldshares.com/gldm/financial-information/

With a gross expense ratio of 0.10%, the SPDR Gold MiniShares Trust would be a cost-effective and convenient way to add exposure to gold, assuming that current macroeconomic and geopolitical conditions allow for a higher price for the precious metal in the period ahead.

The following would be a positive scenario for a bullish gold price, but it seems unlikely at the moment. In this bullish scenario for gold, investors would flock to the metal during a recession caused by the Fed's hawkish stance on interest rates, as they would see gold as a safe haven to protect against the negative impact of the adverse economic cycle on their assets.

According to prominent economists, the worst-case scenario for the economy this year is a soft landing rather than a recession, so gold doesn't appear to be needed as a safe haven asset.

Recently, US Treasury Secretary Janet Yellen said in an interview in Bangalore, India, after the two-day meetings of the Group of 20 finance ministers and central bank governors, that she believes there is more chance of a soft landing than a recession. This is because both the labor market and the balance sheet are holding up very well despite persistent inflation.

Minutes from the first monetary policy meeting in 2023 show that the Fed's policy-making committee believes sustained rate hikes are appropriate to achieve 2% annual inflation, and markets fear that if the Fed moves too fast or too far it could plunge the economy into recession.

However, committee officials who have spoken to the public have expressed their opinion that the Fed can achieve a "soft landing" for the economy and then prevent it from contracting significantly.

SPDR Gold MiniShares Is on The Stock Market

SPDR Gold MiniShares is a publicly traded security and its shares (155,450,000 is the volume of total shares outstanding) are traded on the NYSE Arca. Each share represents 0.019849 ounces of gold.

At the close on Feb. 24, the fund was trading close to its net asset value [NAV], which was $35.94 per share, while the market price was $35.96 per share.

Shares are trading above the 200- and 100-day simple moving average line. Shares are also below the 50-day simple moving average line and they are in proximity to the middle point of the 52 Week Range of $32.12 to $41.14.

Due to the factors outlined in this article, bullion has a downtrend perspective in the upcoming period until the situation turns bullish for the metal.

Since SPDR Gold MiniShares move in tandem with the commodity's price action, there is no point in adding to the position now. SPDR Gold MiniShares shares are currently not trading low, so investors could consider the possibility of selling some shares if the transaction produces an interesting outcome and reallocating funds into other assets such as bonds or US currency, as these have higher chances than the metal to appeal in 2023.

What could lure the precious metal, and therefore SPDR Gold MiniShares stock, into an uptrend is fears of a recession. But while household finances and the labor market continue to show their teeth, there is no real chance of a severe economic downturn today, just a gentle one.

The latter type of economic slowdown is unlikely to generate fears that justify the search for safe gold ahead of the ensuing consequences.

Conclusion

With gold bullion prices expected to trade below current levels, SPDR Gold MiniShares shares, which represent holdings of gold bullion, are unlikely to perform well this year.

Investors may wish to free up some cash to invest in fixed income securities or the US currency as the situation for 2023 moves in favor of these two securities rather than gold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.