Winners Of REIT Earnings Season

Summary

- Nearly 200 U.S. REITs have reported fourth-quarter earnings results over the past month, providing critical information on the state of the real estate industry in a period defined by post-pandemic uncertainty.

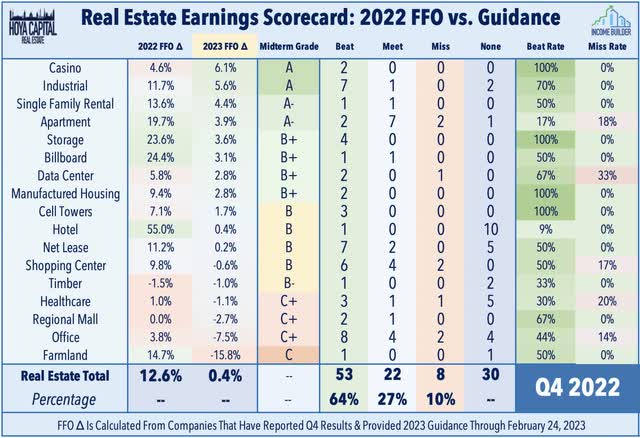

- Rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet.

- Bifurcation is back: After delivering broad-based double-digit growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others.

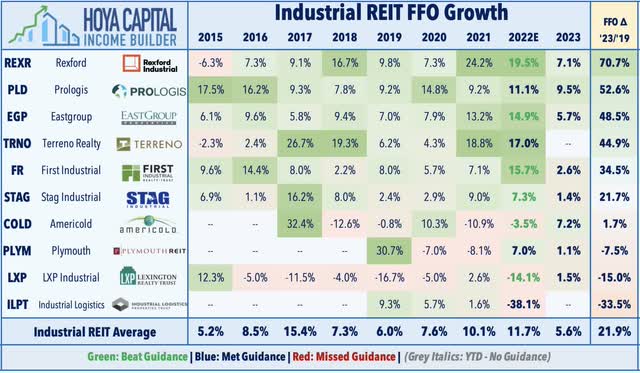

- Our focus was on 2023 FFO guidance. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit growth. Technology REITs see 2-3% growth, while retail REITs see flat growth. Many Office REITs and several Healthcare REITs forecast double-digit FFO declines.

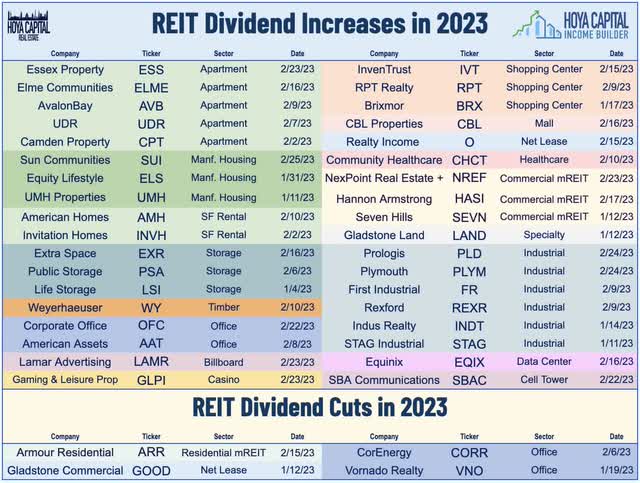

- Dividend sustainability was also in focus. 36 REITs have hiked their dividends this year, tracking slightly behind last year's record pace, but we've already seen more reductions than last year's total. External growth remains challenged for now, but REITs will have opportunities as reality sets in for many over-levered private-market property owners.

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

DenisTangneyJr

Real Estate Earnings Recap: Part 1

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on February 27th. In Part 1 of our Earnings Recap, we cover the nine best-performing property sectors, and in Part 2 later this week, we cover the nine remaining property sectors.

Nearly 200 U.S. REITs have reported fourth-quarter earnings results over the past month, providing critical information on the state of the real estate industry in a period defined by significant economic and interest rate uncertainty. Rising rate concerns overshadowed a surprisingly strong slate of reports and generally encouraging commentary across most property sectors. Among the 83 REITs that provide full-year Funds From Operations ("FFO") guidance, 53 REITs (64%) reported FFO that exceeded the midpoint of their prior outlook, while just 8 REITs (10%) missed their guidance. FactSet reports that 71% of REITs beat consensus analyst FFO estimates - the third-best across the 11 industry groups - while 71% also beat consensus revenue estimates - the fourth-best across the 11 industry groups.

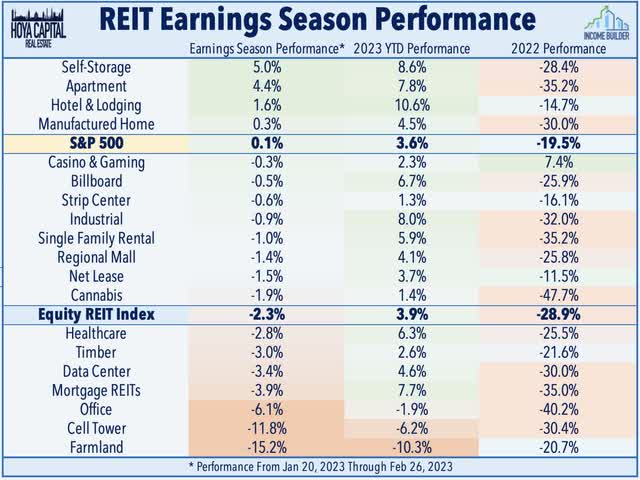

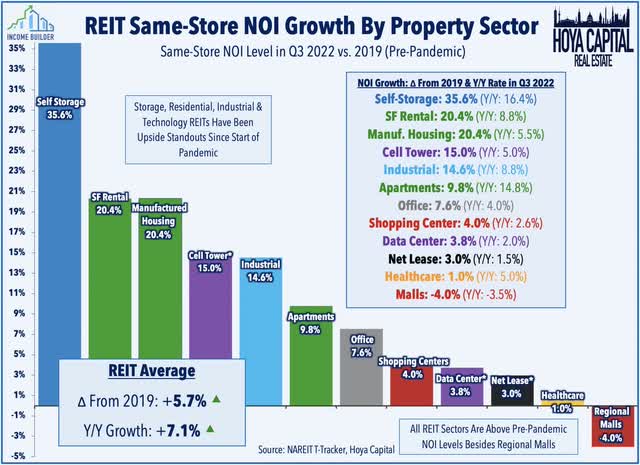

Our focus was on 2023 FFO guidance which showed that sector-by-sector bifurcation is back. After delivering broad-based double-digit growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Among the major property sectors, Residential and Industrial REITs were upside standouts on the guidance front, forecasting mid-single-digit FFO growth for 2023. Technology REITs see 2-3% growth - a bit disappointing given their lofty valuations - while retail REITs see flat-to-slightly-negative growth. Many Office REITs, several Healthcare REITs, and a handful of REITs across other property sectors forecast more significant double-digit FFO declines as industry-specific headwinds combine with expense pressures from elevated debt burdens. Stock performance patterns since the start of earnings season have largely lined-up with fundamental performance with storage and apartment REITs leading on the upside while office, farmland, and cell tower REITs have lagged.

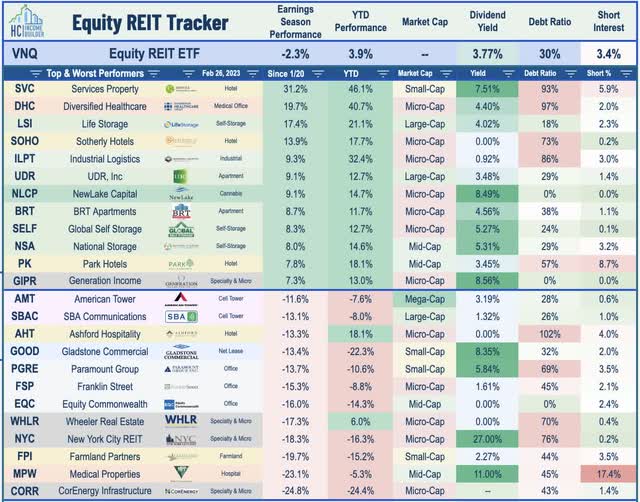

Despite the slowed pace of private market transaction activity, M&A was a theme throughout earnings season, and the top individual performers have been at the center of the action. Service Properties (SVC) has soared more than 30% since the start of earnings season after BP (BP) agreed to acquire TravelCenters of America (TA) at an 84% premium to its prior close - an operator of convenience stores that is partially owned by SVC and its external advisor RMR Group (RMR). Each of the other three RMR-advised REITs have rallied in tandem. Elsewhere, Life Storage (LSI) has surged after it received an $11B takeover bid from its peer Public Storage (PSA) in a proposed all-stock deal worth about $129 a share - a 17% premium to LSI's prior closing price, an offer that LSI has rejected citing undervaluation. Small-cap INDUS Realty (INDT) has also been an upside standout after announcing that it reached an agreement with Centerbridge Partners and GIC Real Estate to be acquired in an all-cash $868M transaction at $67/share - up from the initial $65/share offer that the private equity pair initially proposed in late November.

Dividend sustainability was also in focus, and we've been scouring through earnings calls to glean insights into the outlook for dividend hikes - and in some cases, dividend cuts - this year. We've seen 36 REITs hike their dividends this year, tracking slightly behind last year's record pace of 40 with most of the "usual suspects" - except for a small handful of names that had hiked in Q1 last year but held their dividends steady this go-around. While the path of least resistance remains towards dividend hikes over cuts, a handful of REITs that have been caught flat-footed by the interest rate increases and/or face sector-specific headwinds have been on the wrong side of the equation. Four REITs have reduced their dividends this year - two office REITs, one mortgage REIT, and one net lease REIT - and earnings call commentary suggests that we'll see a handful of additional reductions in the months ahead as over-levered REITs look to redeploy this capital to pay down variable rate debt.

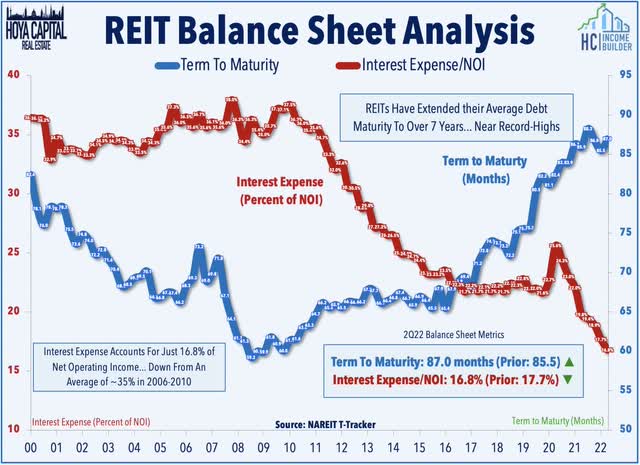

REIT balance sheets - and particularly this variable rate debt exposure - were in focus more than in any earnings season in recent memory - with the lone exception of the infamous Q1 earnings season during April 2020 when "liquidity" was the primary topic of discussion. As we've covered extensively in our State of the REIT Nation reports, most REITs have been preparing for this exact kind of dislocated macro environment, perhaps to the frustration of some investors that turned to higher-leveraged and riskier alternatives in recent years across private markets - including the non-traded REIT platforms from Blackstone (BX), KKR & Co (KKR) and others that are now in focus after suspending investor redemptions following a wave of capital outflows. Considering the pain being felt by some of the more highly-levered public REITs, it's not hard to imagine the looming crisis facing many private market players that lack access to cheap, long-term fixed-rate unsecured debt. External growth for public REITs remains challenged for now, but REITs that played it safe during the "boom times" will likely have opportunities as reality sets in for many over-levered private-market property owners.

Winners of RIET Earnings Season

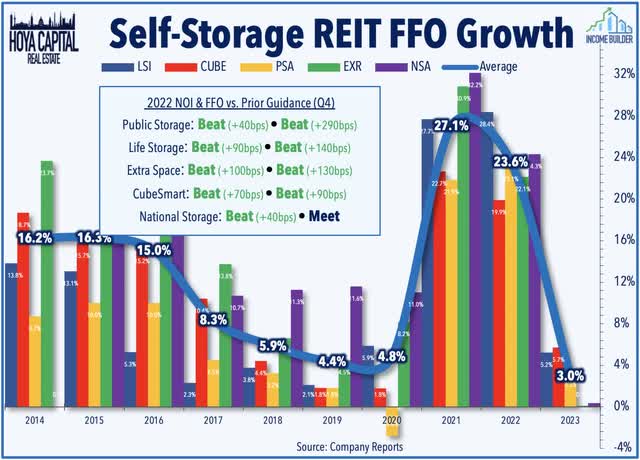

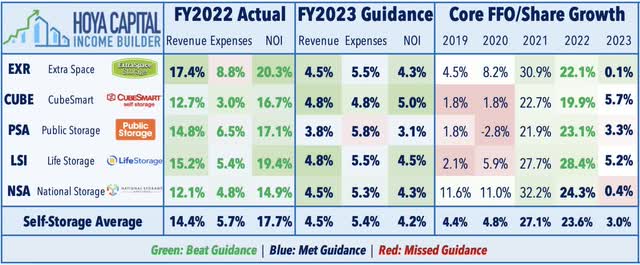

Storage: (Performance Rank: #1) We begin with the top-performing sector of earnings season, where storage REIT earnings results quieted critics forecasting a dismal year of declining rents and oversupply headwinds. The largest storage REITs easily topped their prior FFO and NOI guidance and provided an initial 2023 outlook calling for mid-single-digit earnings growth, buoyed by "sticky" rent growth on existing tenants. CubeSmart (CUBE) was a notable upside standout, reporting that its full-year FFO increased by 19.9% in 2022 and sees FFO growth of another 5.7% in 2023, the highest in the storage sector. CUBE expects same-store revenue and growth of 5% for 2023 as sticky pricing trends on renewals are expected to offset a decline in rental rates for new customers. Similar to Extra Space (EXR), CUBE reported a reacceleration in rent growth since bottoming in November. Elsewhere, Life Storage (LSI) reported sector-leading FFO growth of 28.4% in 2022 and sees another 5.2% growth at the midpoint of its 2023 outlook and provided a preliminary outlook for 2024 as well, noting that it expects "low double-digit FFO per share growth in 2024, with a midpoint of 11%." Public Storage (PSA) has been a laggard this earnings season after forecasting softer growth than its peers.

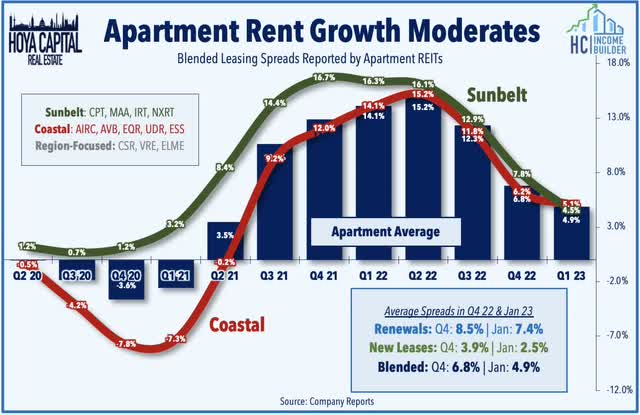

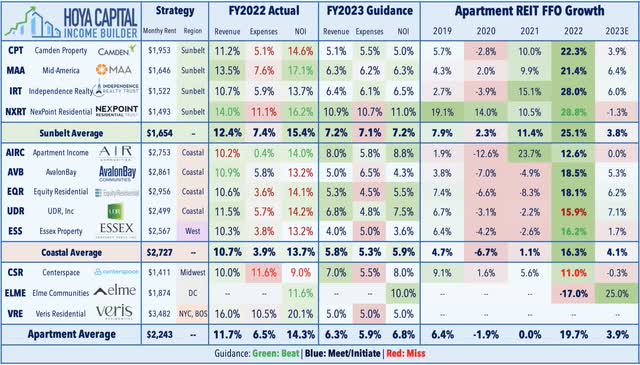

Apartment: (Performance Rank: #2) Apartment REIT earnings results were solid across the board, showing similar "stickiness" to rental rate trends and underscoring the embedded rent growth that is still being unlocked from existing renters even as new lease rent growth cools from historic highs. Buoyed by high-single-digit rent growth on renewed leases, apartment REITs forecast NOI growth of 7% and FFO growth of 4% in 2023 - among the highest in the sector - while nearly half the sector has already raised their dividends this year. UDR (UDR) was the top earnings season performer, lifted by its guidance calling for sector-leading FFO growth of 7.1% in 2023. Sunbelt-focused NexPoint Residential (NXRT) is a close second after reporting the strongest FFO growth at 28.8% in 2022 and noting progress in de-levering its balance sheet and fixing the vast majority its variable rate expense through asset sales, refinancings, and swap agreements. Among the coastal-focused REITs, Apartment Income (AIRC) reported the strongest rent growth metrics with 11.1% blended spreads in Q4 and early 2023.

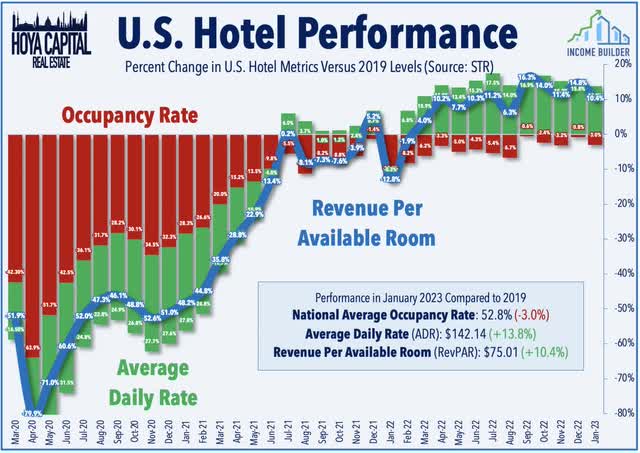

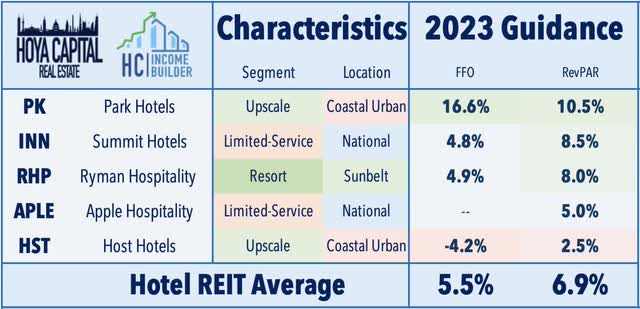

Hotel: (Performance Rank: #3) Also among the top-performing sectors this earnings season, Hotel REIT results showed surprisingly solid demand in late 2022 and into early 2023 as an uptick in business travel has offset a moderation in leisure demand. Encouraging, we saw a much-anticipated return of full-year guidance for a handful of REITs, including Park Hotels (PK), which has been among the upside standouts after providing full-year guidance calling for 17% FFO growth this year. Sunstone (SHO) - one of the hardest-hit REITs early in the pandemic due to its urban-heavy and business-focused portfolio mix - has also been a leader after reporting a notable rebound in business and group travel in recent months, bringing its total Revenue Per Available Room ("RevPAR") to within 3% of 2019-levels. Ryman (RHP) has also been an upside standout after reporting very strong leisure demand in late 2022 - driving comparable RevPAR growth of 20% above 2019-levels. RHP - one of three hotel REITs to provide full-year guidance - foresees FFO growth of 5% in 2023 which would be 14.5% above 2019-levels. Travel demand trends have been relatively strong in early 2023 per recent TSA Checkpoint data, with January throughput exceeding pre-pandemic levels.

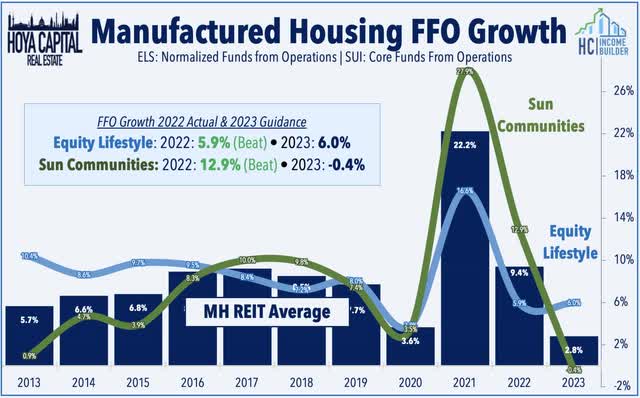

Manufactured Housing: (Performance Rank: #4) Equity LifeStyle (ELS) has been an upside standout after providing guidance calling for FFO growth of 6.0% - an acceleration from the 5.9% growth it achieved in 2022 - while boosting its dividend by 9.1%. Results from Sun Communities (SUI) showed the anticipated "mean reversion" to its peer following two years of robust outperformance. SUI noted that its full-year FFO rose 12.9% in 2022 - 120 basis points above its prior guidance - and boosted its dividend by 6%, but provided a less upbeat initial outlook for 2023 with expectations of a 0.4% decline in FFO at the midpoint of its range. Strength from its RV and Marina division - which delivered same-property NOI growth of 10.3% and 7.3%, respectively - offset an uncharacteristically soft year for its core manufactured housing segment, which recorded NOI growth of 3.3%. Expense pressures were the key headwind in late 2022 and its 2023 outlook, offsetting upbeat expectations of 6.3% rental rate growth in its MH division, 7.8% rent increases for RVs, and a 7.5% increase in its marina portfolio.

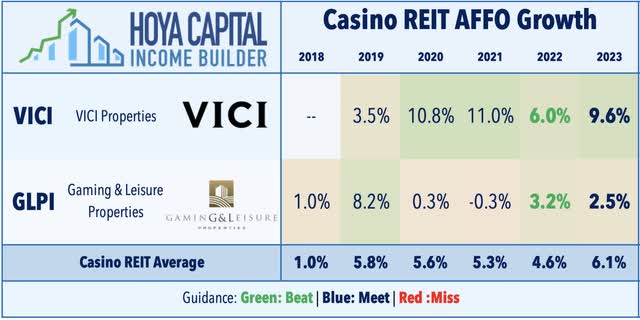

Casino: (Performance Rank: #5) The top-performing sector from 2022, solid casino REIT earnings results helped to carry the momentum into early 2023. VICI Properties (VICI) reported better-than-expected results alongside an upbeat outlook for 2023, noting that its full-year FFO rose 6.0% in 2022 - 80 basis points above its prior growth outlook - and sees FFO growth of 9.6% in 2023 driven by CPI-linked rent escalations and by several recent large acquisitions, including the remaining 50% stake in the MGM Grand/Mandalay Bay that it acquired from Blackstone (BX) in late 2022 and the acquisitions of the PURE Canadian Gaming Casinos in early 2023. Gaming & Leisure Properties (GLPI) reported slightly better-than-expected results and hiked its dividend by 2% to $0.72 alongside a $0.25/share special dividend. GLPI recorded full-year FFO growth of 3.2% in 2022 - 60 basis points above its prior guidance - and sees FFO growth of 2.5% in 2023.

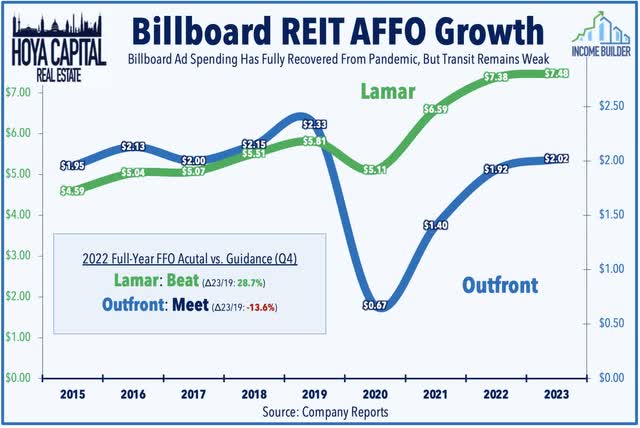

Billboard: (Performance Rank: #6) Entering earnings season with relatively low expectations given that advertising is generally the first line-item that firms cut when times get tough, billboard REITs reported decent results with strength in ad spending from local firms offsetting a pull-back from national brands. Lamar (LAMR) reported solid results and hiked its quarterly dividend by 4% alongside a new $250M stock buyback program. LAMR noted that its full-year FFO rose 12% in 2022 - above its prior outlook - but provided a relatively muted outlook for 2023 with expectations of 1.3% FFO growth, citing "weakness" in demand from national brands offsetting "resilient" demand from local advertisers. Outfront (OUT) reported mixed results, noting that its full-year FFO rose more than 30% in 2022 but sees FFO growth slowing to 5% in 2023, citing "significantly increased interest expense." OUT held its dividend steady but noted that this "dividend level may ultimately prove to be insufficient to meet our REIT requirements for 2023, and an increase may be required later in the year."

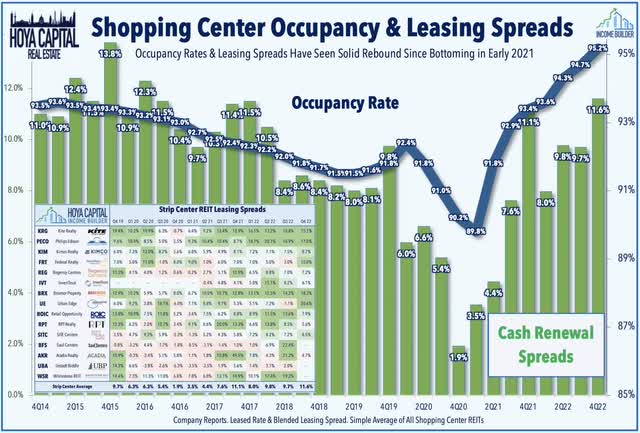

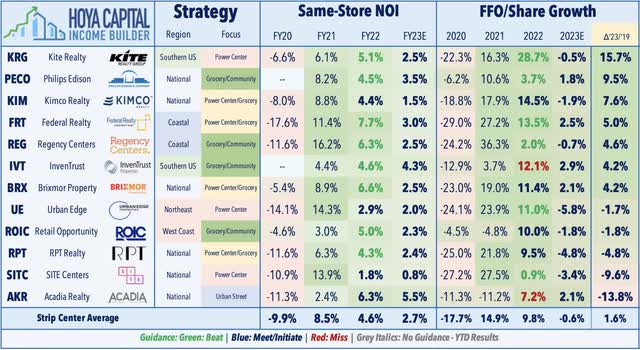

Strip Center: (Performance Rank #7) Continuing a trend of better-than-expected results stretching back to late 2021, fundamentals in the strip center sector remain quite healthy with occupancy rates and leasing spreads that are as strong as they've been since the mid-2010s. Eight of the twelve strip center REITs reported full-year NOI that exceeded their prior outlook, while six of twelve REITs exceeded their prior FFO guidance. Kite Realty (KRG) was the upside standout after reporting full-year FFO growth of 28.7% in 2022 - 330 basis points above its prior guidance - and providing FFO guidance for 2023 that would result in a sector-leading cumulative growth rate of 15.7% since 2019. SITE Centers (SITC) has also been an upside standout after reporting new lease cash spreads of 55.2% and renewal spreads of 7.6%. Notably, SITC commented that several tenants are eying potentially-vacated space from Party City and Bed Bath (BBBY) and that it expects to pursue an "aggressive recapture of space" given the backlog of demand for this space.

Industrial: (Performance Rank: #8) No signs of slowdown, yet. Industrial REITs reported that stellar property-level fundamentals continued into late 2022 and provided an upbeat outlook for 2023. Similar themes of strong-but-normalizing fundamentals that we observed in residential REITs were evident as rent growth on new and renewed leases rose 33% from last year - cooling slightly from the 39% rate in Q3 - but still showing that demand continues to substantially outpace available supply. First Industrial (FR) reported the strongest results of the group, highlighted by cash rental rate increases of 41.1% in Q4 - a notable acceleration over the prior quarter. Results from small-cap Plymouth (PLYM) were also encouraging, reporting same-store NOI growth of nearly 11% in 2022 and commenting that its executing leases early this year "at a higher velocity and rental spreads comparable to the prior year." STAG Industrial (STAG) reported similarly strong demand trends of late, commenting that it has seen spreads accelerate to "25% to 30%."

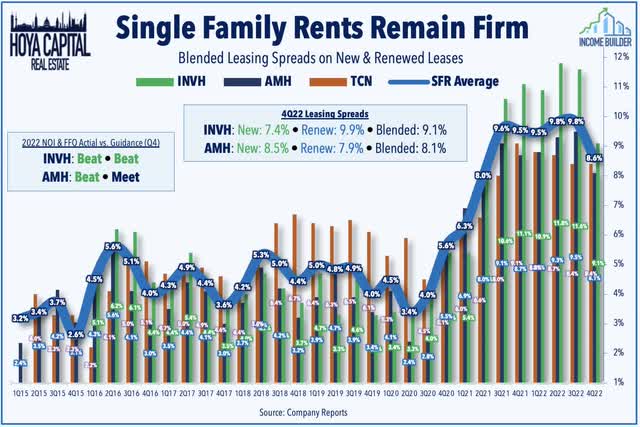

Single-Family Rental: (Performance Rank: #9) Expense headwinds - particularly from property taxes - offset results showing robust high-single-digit rent growth in late 2022 and into early 2023. Invitation Homes (INVH) has been an outperformer after reporting FFO growth of 10.2% for full-year 2022 - 80 basis points above its prior outlook - and forecast FFO growth of 4.3% for full-year 2023. Rental rates remained quite firm in late 2022 despite the broader cooldown in national rent growth and despite its heavy presence in California, where rental operators continue to see depressed rent collection rates due to the ongoing pandemic-era eviction moratorium. American Homes (AMH) has been a laggard, however, after posting mixed results, noting that its full-year FFO rose 13.2% in 2022 - matching its prior guidance - and sees FFO growth of 4.5% for 2023. Of concern, AMH projected same-store expense growth of 9.8% for 2023, citing expectations for a 9% increase in property taxes and a 10% increase in other core property operating expenses. INVH recorded blended rent growth of 9.1% in Q4 and 7.4% in January while AMH reported blended spreads of 8.1% in Q4 and 7.5% in January.

Earnings Recap: Bifurcation is Back

Bifurcation is back: After delivering broad-based double-digit growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit FFO growth this year. Many Office REITs and several Healthcare REITs, however, forecast double-digit FFO declines. Dividend sustainability was also in focus. 36 REITs have hiked their dividends this year, tracking slightly behind last year's record pace, but we've already seen more reductions than last year's total. External growth for public REITs remains challenged for now, but REITs that played it safe during the "boom times" will likely have opportunities as reality sets in for many over-levered private-market property owners. Later this week, we'll publish Part 2 of this REIT Earnings Recap, which will discuss notable results across the other nine property sectors.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth.

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, AIRC, AMH, CUBE, ELS, EXR, FR, GLPI, INVH, KRG, LAMR, LSI, NXRT, OUT, PSA, STAG, SUI, UDR, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.