American States Water: It Was Too Expensive, But Time To Revisit The 'Hold' Rating

Summary

- When I wrote about American States Water the first time, I considered the company a firm "HOLD". I viewed it as overvalued, despite it being a quality water business.

- My "HOLD" thesis has been vindicated for the past 3 or so months, which is great to see. The company is down in the meantime.

- A 5% move in either direction shouldn't do much to change the foundational thesis for the company, but let's see where we are in terms of rating.

- This is my AWR thesis for the year of 2023.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

vitapix

Dear Readers/Followers,

American States Water (NYSE:AWR) is far from a bad company. But I did take a very clear "HOLD" stance in my last article. Water companies are something I review quite often as of late - and AWR is one of them. They come as attractive investments due to their regulated, ultra-safe business models. In AWR's case, they also add to this with their unregulated service business, which adds an element of growth and "potential" to the mix.

None of that, however, could save AWR from underperforming since my last article.

AWR performance (Seeking Alpha)

Now, obviously this small amount of movement could be well within a margin of error, especially with the company actually being in the green at certain times. I believe though, that the company clearly shows us here that it's not going "much higher" without a sort of external influence, or superb outperformance.

And that's the thing about water companies - outperformance really isn't in their "wheelhouse".

Let's look at the latest thesis and the way we can view it for the coming year

American States Water - Going into 2023

The company is going to be presenting its FY22 a few days from now - and I'll go ahead and update the article with relevant data, and if this changes the thesis in any way that I'm about to present in this piece.

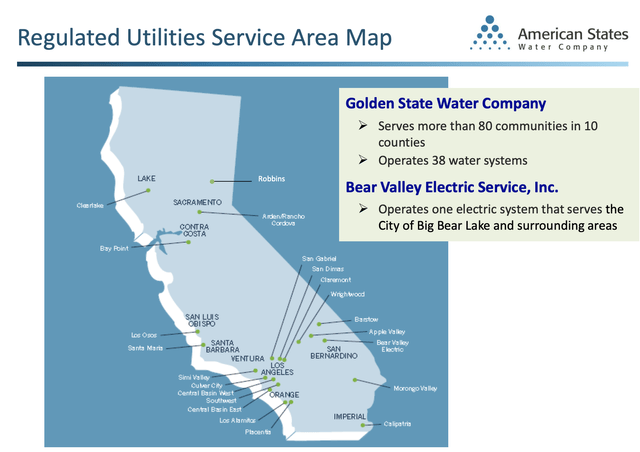

But fundamentals in AWR are simply pretty damn good. It serves over a million people across nines states, and through Golden State Water Company alone, the company provides water service to over a quarter of a million people located in 80 communities across southern California.

AWR is also solidly rated at an A+ - nothing is really going to dislodge this company's trend in terms of earnings, or the slow growth of 4-6% that it averages, and seems likely to average going forward.

AWR has paid dividends for over 68 consecutive years at this point, and what's more, it has increased those dividends every single year, making it one of the few dividend kings out there. The company's fundamentals are why investors sometimes flock to the business. Unfortunately, the second set of factors to an investment is the price paid or the valuation of the business. And while nothing is wrong with the fundamentals, there's everything wrong with the company's valuation here.

Less than 2% yield and a valuation well above the 20-year that allowed an average 26x P/E, means that despite the conservative fundamentals found in this business, there is an expectation of premium at this time that's quite hard to meet given the company's limited growth rate.

What's more, this limited growth rate is expected to remain for the foreseeable future. AWR isn't going to be becoming some sort of growth stock, even with the advantages of its service-related business. We'll get some growth - but the average is below 6% here, which at this multiple implies a very low rate of return going forward - more on that in a bit.

AWR isn't just California - it has operations across several areas in the US, found both on the west and the east coast, though most of its regulated services are found on the west coast, and Cali specifically.

I'm not worried about the 2023 relationship with CPUC or the regulatory environment overall - and there is some potential for tack-on growth thanks to a positive operating environment that includes a fair bit of public utilities that could be considered ripe for privatization if the circumstances are present and favorable.

The biggest risk or concern I see with investing in AWR is the company's exposure to what is essentially one of the more environmentally-impacted areas in all of the US. Drought is very real here, with considerable issues already present (almost half the state classified as being in "Extreme drought", and 92% in Severe), with 2022 being the latest record-setting year in a series of three - and not in a good way.

Of course - AWR can't do anything about this - only we as investors can determine what we should pay for a company that's operating in the midst of such troubles.

I'll repeat my previous article stance for 2023 - that I don't see anything wrong with AWR's overall fundamentals, and I don't expect the company's 4Q22 to bring any massive surprises to the tables. There might be some small variance, but nothing which could, or should be considered serious for the long term.

The serious concern is instead where the company is still valued - and this forms what I believe should be your main issue with AWR as a conservative investment for the coming year.

AWR - The valuation makes an upside very difficult even in 2023

So, the valuation for the company remains very tricky - though perhaps tricky is the wrong word, because to me the thesis is very clear, and why this company cannot be considered a "BUY".

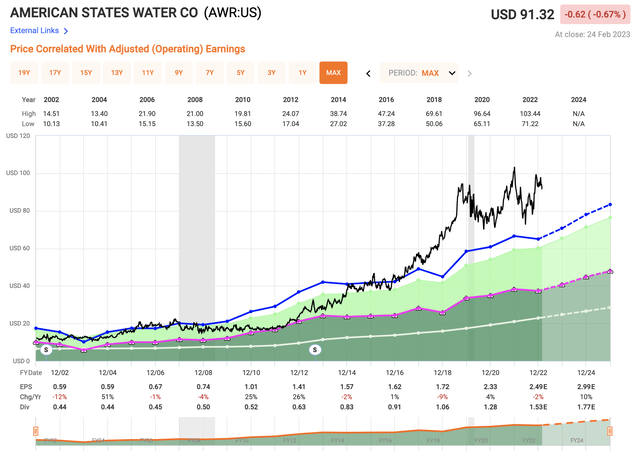

Over the past few years, this company has gone well above its 25-28x P/E average. You can even see that for several years, this company was able to be invested in at almost around a 15x P/E - oh how I wish I had the eyes for the business at that point.

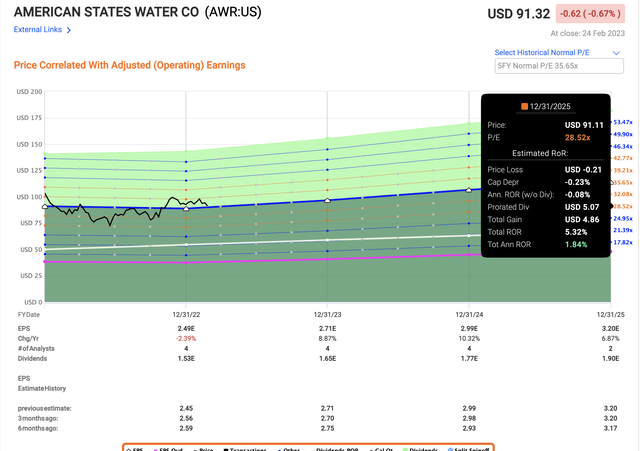

Instead, the conservative upside we're able to see or forecast for AWR here is not even double digits. in fact, if we forecast at the company's long-term average, the return rate on an annual basis is in fact negative at around 1-2%, and even at a 28x P/E, the company's RoR on an annual basis is less than 2% here.

Most analysts following AWR are generally fairly positive on the company. Most analysts are fairly in agreement on what the company's upsides are - good stability, excellent overall safety, not much that can go wrong with what is essentially the company delivering your daily water if you live in one of the areas served by AWR.

However, for those of us watching the company with a bit more cautious eye, we do see what we consider to be quite poor prospects. However, trading at this valuation, the company has a high amount of volatility potential baked into its current thesis. Just take a look at what happened at COVID, after COVID, and again just a year or two ago. Up and down, shifting between P/E valuations of almost 40x, and back down again to below 30x. That's much higher volatility than we've seen the company express at lower multiples - again, implying that there's a bit too much of a premium at this time.

There's also the very real potential for further headwinds that could push the company's share price lower once again. Like what?, you might wonder. Well, AWR is interest-rate sensitive. If interest rates continue to climb, it's not unlikely that the market will assign a higher discount to the business, meaning things likely could go lower.

Inflation is another concern. With both of these prospects currently realistic, and going so far as to say that I believe this will actually happen, I argue that AWR is quite clearly overvalued for this current year of 2023.

I view the realistic range of return potential to be somewhere between negative 0.5% annually to around 5% per year - that's the highest I'm willing to go, and that's assuming a 5% EPS growth rate at a P/E of 32x - and I'm telling you that, because it's way too high even as I'm looking at it.

Analysts are somewhat of a different mindset here though. The current share price for AWR is $91, and 3 analysts following the company are assigning it a $98/share target, updated from around $93/share the previous time I wrote about the business. That's a $5/share bump in around 2 months, and I don't really see the reason for it. Interestingly enough, despite the bump, one more of the analysts following the company left behind his/her "BUY" stance, and is now considering AWR no more than a "HOLD". That gives us both "SELL" and "HOLD" Valuations on the company, and only one "BUY", as opposed to two. The upside to the average is around 7.7%, but I don't agree with it here.

Instead, my own thesis for AWR is as follows:

Thesis For the Common shares

My thesis for AWR is as follows.

- AWR is a dividend king and a water company with an A-rating and extreme levels of overall safety. It has an attractive operating structure and mixes around 80% regulated business with around 20% unregulated. The company has degrees of future-proofing and is a conservative allocator of capital, largely backed by the state of California.

- At the right and attractive price, this company becomes as I see it, a "MUST BUY" - but that time is not today. At nearly 39x normalized P/E, this company is a no go for me here.

- I view AWR as a "HOLD" - and I wouldn't touch it below a PT of $85/share. Even $85/share is high, but at least there I could see a conservative upside, which I really can't see at this price.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company, unfortunately, does not fulfill any of my valuation-specific metrics and criteria and therefore is a "HOLD" here.

Thesis for Options

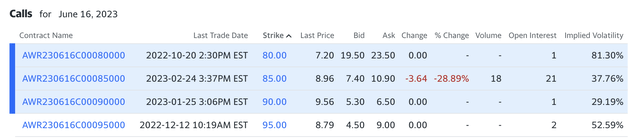

AWR might be an interesting option play, if you want safety and to add some extra yield. Frankly, if I owned AWR at this point and had at least 100 shares, I would sell covered calls. AWR has somewhat of a thin option trade, but I was able to find off-market data and premiums that imply paying at least a 3-4% yield for the June $100-$105/share strikes. That's a price where I absolutely would not mind selling AWR. You could even go for the far more offensive $95/share puts, which would get your effective sales price inclusive of a premium close to $100/share with a very high June premium. Some data here.

Yahoo Finance, AWR Calls (Yahoo Finance)

Insofar as the puts go, I don't see an interesting or good upside available here under the current circumstances. What's more, the prices you'd sell options at are more or less the highest potential prices I would consider realistic for the company - there are better deals out there than going in like this with AWR.

For that reason, unless you own AWR already, I say that currently and for 2023, the company is likely to underperform.

This one is a "HOLD".

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.