CVR Partners: Large Cash Distribution Coming

Summary

- CVR Partners could distribute more than $20 per unit.

- Fertilizer product from Russia continues to find its way into the US market.

- Fertilizer prices continue to fall.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Pgiam

Investment Thesis

CVR Partners (NYSE:UAN) manufactures ammonia and urea ammonium nitrate (''UAN'') solution fertilizer products. The company should be benefitting from the very low natural gas prices. However, for now, the market hasn't fully recognized this consideration.

On top of this, while investors wait for fertilizer prices to strengthen, there's a hefty $10.50 dividend coming for investors on record as of March 6, 2023.

Overall, there's a lot of nuance to the UAN stock. But I remain bullish on UAN.

Brief Note

Recall that CVR Partners is an LP. As such, foreign investors in this name will be liable for massive taxes, not just on the profits, but the whole position. Read more here.

2023 Cash Distribution

In my prior article, I assumed that 2023 would see around a $15 to $20 cash distribution. From the Q4 quarter, UAN is going to distribute $10.50 per common in March 2023.

Furthermore, I'm hoping that this strong cash distribution, together with the $18 million of upfront tax credits, could bring an additional $1.45 of cash distribution per share, allowing the total cash distribution to easily clear my prior $15 assumption. Note, during the earnings call, management said "[tax credits] would potentially add to cash available for distribution for the first quarter of 2023".

Perhaps it's even possible that UAN's total cash distribution this year will clear $20 per unit holder. With the stock at $109 at present, this looks like an enticing risk/reward opportunity.

What's the Downside?

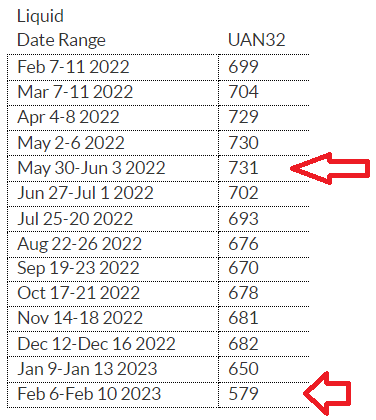

For months on end, UAN32 (the fertilizer) prices have been coming down.

dtnpf website

I know that this shouldn't be happening, but it is happening, and it's pointless to pretend otherwise.

Another element to keep in mind is that Russian fertilizer products continue to be imported,

The U.S. has been a buyer of Russian product and continues to be on both urea and UAN.

So, but that’s been going on for quarters now and it was only affected at the beginning of the war with the Ukraine, where there was a pause in exports to the U.S., but that resumed last summer and has been continuing.

So Russian urea and UAN are coming to the U.S. or being imported here and have been for the last few quarters.

Remember, the bull case back in May of last year was that fertilizer products from Russia would not be coming to the US. That saw UAN's share price jump massively, with shares trading at $150 at one point.

Then, shares got cut by more than 40%, as investors didn't buy into that story. And in hindsight, anyone that was able to get out at the $150 would have done better than sticking around to the current share price. Even including the cumulative cash distribution.

Is There More to This Story?

The main feedstock for ammonia and urea production is natural gas. Meaning that low natural gas prices equal low input costs.

Consequently, I don't believe the market has given much consideration to current natural gas prices. Indeed, back in 2022, natural gas prices were meaningfully higher than they are right now.

Even if natural gas prices were to come up strongly and even double from the current price, I suspect that natural gas prices in 2023-2024 would be no match for natural gas prices in 2022.

Meanwhile, keep in mind that low natural gas prices also impact producers elsewhere around the globe, particularly in Europe. That means that on the back of low natural gas prices, European supply has been coming back online.

The Bottom Line

There are many moving parts to this story. On the one hand, let's face the unavoidable truth, fertilizer products "should" improve, but so far are not doing so.

On the other hand, the cash distribution is mightily strong. And even if I'm wrong, and the cash distribution doesn't cross $20 per unit, there's still an alluring dividend coming in March.

The other aspect that I don't believe investors are paying attention to is that UAN's input costs have fallen significantly since last year. And on top of this, UAN's balance sheet continues to strengthen, leaving Q4 2022 with a net debt position of $460 million compared with $500 million of net debt at the end of the prior year.

And finally, 2023 should not have any planned downtime, as this already happened in last year's Q3 2022. So, sold volumes should be meaningfully stronger in 2023 than in 2022.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.