NorthWest Healthcare: A Risky REIT With An 8.2% Yield

Summary

- NorthWest Healthcare has a stable portfolio with high occupancy rates of 97% with the majority of leases indexed to inflation.

- However, rising interest rates have put pressure on REIT's balance sheet and eroded AFFO growth.

- The REIT’s distribution payout ratio is near 100% of AFFO, calling the long-term sustainability of the distribution into question.

- In an effort to deal with the rising cost of debt servicing, the REIT is entering into JVs with institutional investors to free up capital and reduce its direct ownership levels.

- NWH is betting on an expanded JV model to repair its balance sheet and earn higher ROE.

peterspiro/iStock via Getty Images

Author's Note: All funds in Canadian currency unless otherwise noted.

Investment Overview

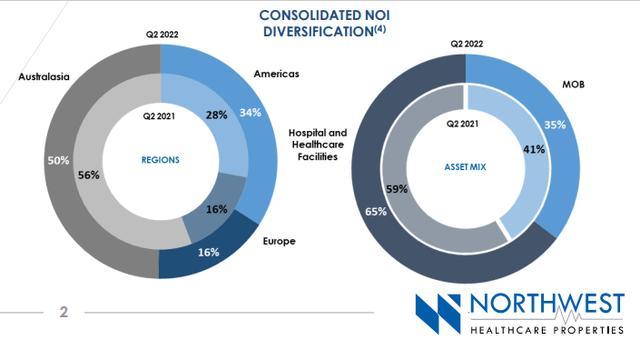

NorthWest Healthcare Properties Real Estate Investment Trust (OTC:NWHUF) (TSX:NWH.UN:CA) owns a resilient portfolio of medical office buildings and hospitals that offers exposure to the defensive and high-activity healthcare property sector. Geographic diversification allows the REIT to allocate capital to markets with the most value potential. This optionality for efficient capital allocation has led to a focus in a few geographic regions with the most opportunity including Brazil, Australia and Northern Europe.

Despite a high quality portfolio, the REIT is low growth and faces balance sheet challenges and shrinking AFFO. NWH is pivoting towards a "capital-light" model that would reduce its direct property portfolio ownership and instead focus on management fees. The REIT is pursuing a number joint venture (JV) transactions that would reduce its capital requirements and free up funds to improve its balance sheet. Investors willing to own units of NWH while the REIT executes on this strategic reformation will collect an attractive 8.2% distribution yield.

REIT Profile

NWH REIT owns a portfolio of 223 medical office buildings, clinics, and hospitals across four continents. These 19M sq ft of the healthcare properties located in major cities in Canada, Brazil, the US, Germany, the United Kingdom, the Netherlands, Australia, and New Zealand. NWH properties enjoy long-term tenant commitments with average weighted leases terms of 14 years.

There is a lot to like about NWH's portfolio. Hospitals and medical office buildings tend to be stable, long-term tenants with funding backed by governments. NWH enjoys stable occupancy, and long lease terms with inflation indexing. The tenant mix is well diversified with 2,100 individual tenants across eight countries.

NWH trades on the Toronto Stock Exchange under the symbol "NHW.UN" with daily average volume of approximately 650K shares. The REIT has a market capitalization of approximately $2.4B and an enterprise value of $7.0B.

NWH Business Profile Mix (NWH)

Joint Venture Strategy

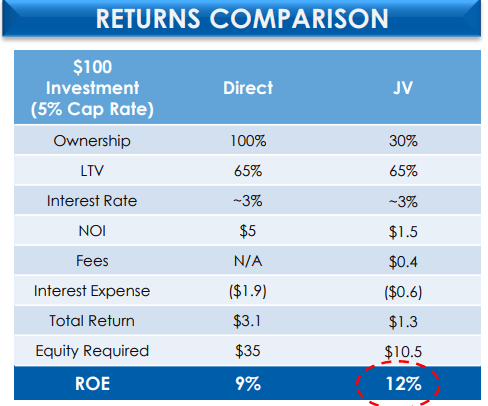

NWH's AFFO per unit is under pressure, shrinking from $0.85 in 2021 to an estimated $0.74 in 2022. The REIT's answer to its balance sheet concerns and shrinking AFFO is to move to a capital-light model that features joint ventures instead of direct property ownership. This would utilize third party capital rather than the REITs and creates opportunity for a management fee structure for NWH.

This strategy has been effective for NWH in several jurisdictions to date including Australasia and Europe. With proforma ROE being 3% higher for a JV than for direct ownership. The REIT owns 30% - 34% interest in its European and Australian JVs portfolios as well as a 28.2% ownership interest in Vital Trust, a New Zealand Stock Exchange - listed REIT.

NWH Returns Comparison, JV vs Direct (NWH)

Doubling down on this strategy, NWH recently announced the closing of a new U.K. joint venture. The new JV initiative reached with a U.K.-based institutional investor comes with an equity commitment of £500M to be funded 85% by third party investor and 15% by the NWH. The JV partner will invest an additional £50M in the REIT's current portfolio. NWH confirmed that this opens the door to additional investment in the U.K. NWH expects to grow the U.K. JV to approximately $1.5B (£1.B). Northwest will deploy the proceeds over a three-year period and will manage the JV portfolio earning market-based fees.

NWH Chairman & CEO, Paul Lana elaborated on the strategic importance of this transaction on the company's most recent earnings call:

This was a key strategic priority for the REIT in 2022 and is highly strategic for the business as it expands the asset management platform and introduces a new institutional investor and further positions the REIT to execute on attractive opportunities as they emerge within the region. Agreements are expected to be finalized by year-end and proceeds from the GBP 50 million investment will be redeployed to repay higher-cost floating rate debt, resulting in interest rate savings as approximately per unit per quarter.

With the U.K. transaction concluded, the REIT's next priority is the closing of a U.S. JV. NWH has updated that it "remains actively engaged with a short list of qualified partners and is working to agree commercial terms in Q1 2023."

Distribution Safety

NWH commenced a dividend program in May 2010, with a monthly distribution of $0.0667, for an annual payout of $0.80. This distribution has been paid consistently for over 12 years now, however the amount has remained unchanged. At current levels, this distribution level equates to a yield of 8.2%, above the REIT's 5-year average yield of 6.84%. The distribution is comprised of 40% other income, 46% return of capital and 14% capital gains.

NWH Dividend Yield (Seeking Alpha)

NWH has a worryingly high AFFO payout ratio. In 2020 and 2021, the REIT paid out 97% and 93% of AFFO. For 2022, the AFFO payout ratio is approximately 103% and is likely to remain above 100% for at least the next few quarters. While I do not see a distribution cut as imminent, a payout ratio of this magnitude is not sustainable. The high payout ratio is likely to keep unit prices range bound for the near term as investors tread cautiously.

Risk Analysis

NWH went into Q2 2022 with a deteriorating balance sheet. The proceeds from the recent JV has helped to free up capital to pay down variable rate debt. As of Q3 2022, a whopping 47% of the REITs debt was set to come due in 2023, forcing the company to refinance at an inopportune time. Following the U.K. JV, the REIT has been actively working on several balance sheet initiatives that extend 2022 and 2023 debt maturities to 2027 and beyond. The approximately $1B refinanced in the last two quarters includes the offering of $155M convertible debentures for fixed interest of 6.25%; and the extensions of two years for $475M in floating rate debt.

NWH has $54M in cash and an available credit line of $179M for total liquidity of $233M. The REIT also has an approved credit facility for an additional $1.06B. This equates to a liquidity ratio of 8%, well below the REIT sector average of 16%. NWH's debt/EBITDA as of Q3 2022 is around 10X, in line with the Canadian REIT sector average. Of the REIT's total debt of approximately $3B, 65% of is fixed rate, with 35% floating rate. This debt profile includes a weighted average interest rate of 4.6%. This compares to the TSX-listed office/industrial REIT sub-sector of 3.2%. The REIT's cap rate of 5.7% implies a higher than average risk/return profile.

The company's geographic dispersion offers many advantages. However, there are some challenges associated with this footprint however, the company potentially exposed to more volatility in developing markets like Brazil. Even with a JV strategy, it will also be a challenge to build scale in multiple geographies simultaneously. Operating in eight different countries also exposes NWH to some currency risk as rental revenue is received in local currency and converted back to C$ for reporting.

Investor Takeaways

NorthWest Healthcare Properties has great assets, high occupancy and attractive long-term leases with long-term commitments and indexing. The REIT's JV strategy is a positive move towards sustainable operating cash flow. The capital-light model should allow for more strategic growth opportunities and generate higher ROE. In the near term, NWH has work to do to improve its debt maturity profile. Despite the attractiveness of the 8.2% yield, the REIT's high AFFO ratio calls the sustainability of the distribution into question. While there are positive developments underway at NWH, I think there are more attractive REITs to consider for total return.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.