FIF: String Of Distribution Increases, Room For More

Summary

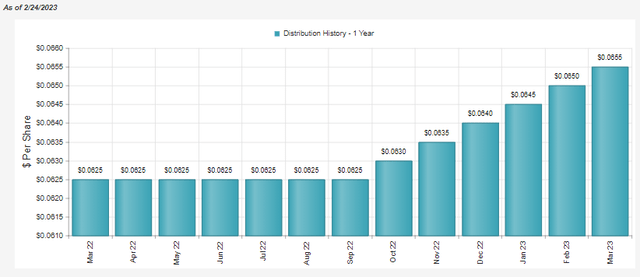

- FIF has given investors 6 distribution increases in the last 6 months.

- Albeit, these are micro raises but trending in the right direction nonetheless.

- With a low distribution yield on the NAV, there is room for further increases.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

sankai

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on February 12th, 2023.

First Trust Energy Infrastructure Fund (NYSE:FIF) operates a portfolio split between energy investments and utility investments. This provides for a fairly stable fund relative to one that holds energy on its own, a highly cyclical sector, as history has shown us. The closed-end fund then puts on a moderate amount of leverage that will amplify the results both to the upside and downside.

The fund has had a string of distribution increases. Increases in each of the last six months. However, they have been 'micro' increases of $0.0005 per month. That being said, an increasing upward trend is certainly something positive regardless. With a low distribution rate on the NAV, they could keep up with this trend for a considerable period of time - barring some sort of black swan event.

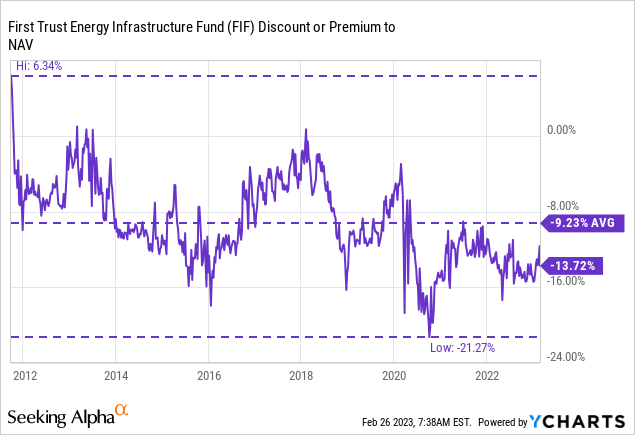

Since our last update, the fund's discount has narrowed. It remains at a level that I believe is attractive and worth considering for investors looking at this type of exposure.

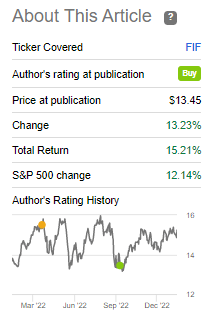

Additionally, the fund has performed quite well since our last update in terms of price change and total returns. They've put up better results relative to the S&P 500 Index. While not a direct comparison, it can provide us with some context of the broader market moves.

FIF Results Since Previous Update (Seeking Alpha)

The Basics

- 1-Year Z-score: 0.18

- Discount: -13.72%

- Distribution Yield: 5.32%

- Expense Ratio: 1.45%

- Leverage: 20.46%

- Managed Assets: $334.6 million

- Structure: Perpetual

The objective of FIF is "to seek a high level of total return with an emphasis on current distributions paid to shareholders." They intend to achieve this through "investing primarily in securities of companies engaged in the energy infrastructure sector. These companies principally include publicly-traded master limited partnerships and limited liability companies taxed as partnerships, MLP affiliates, YieldCos, pipeline companies, utilities and other infrastructure-related companies that derive at least 50% of their revenues from operating, or providing services in support of, infrastructure assets such as pipelines, power generation industries."

To sum up, in fewer words, they invest in anything infrastructure-related in the energy and utility sectors. That leaves them quite flexible in investing within these sectors.

The fund utilizes a fairly moderate amount of leverage. However, when having material exposure to such a cyclical sector as energy isn't a bad thing. Returns are amplified with leverage, whether it is to the upside or downside. We've seen the damage to the downside in leveraged CEFs on full display during the COVID crash.

The other downside for leveraged CEFs is that they borrow on floating rates. While this is true of FIF, they've also hedged against rising rates. At the end of their fiscal year, November 30, 2022, the fund was borrowing $70.3 million, which cost them 4.75%. Through the fiscal year, the average interest rate was 2.28%. That gives us a good idea of the significant impact of higher interest rates.

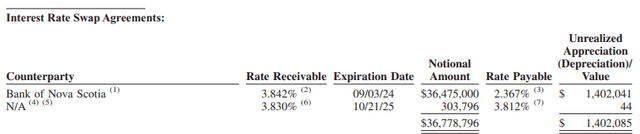

For their hedging, they had implemented interest rate swap agreements.

FIF Interest Rate Swaps (First Trust)

This essentially takes a floating rate and provides for a fixed rate. It leads to potential capital gains to offset the losses. Interestingly, for the fiscal year, they realized losses on these contracts, but unrealized appreciation offset this.

FIF Swap Contracts (First Trust (highlights from author))

The fund also writes options against its portfolio which contributed to gains for the year. This is something important we'll touch on again for the distribution coverage.

Performance - Discount Narrows, But Remains Attractive

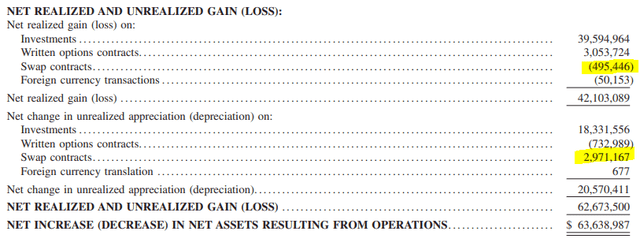

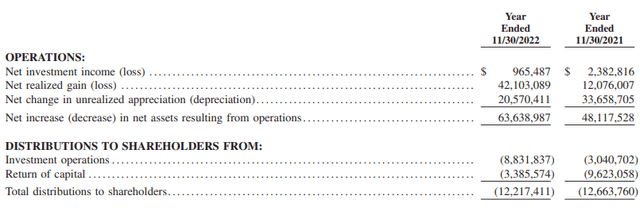

Given the fund's exposure, it only makes sense that the fund did fairly well last year. We can see that in the changes in the gains and losses in their portfolio above when highlighting the swap contracts. Both realized, and unrealized categories contributed to gains under their investment line.

To provide some context, we can include the SPDR S&P 500 ETF (SPY) and Vanguard Total Bond Market ETF (BND).

Ycharts

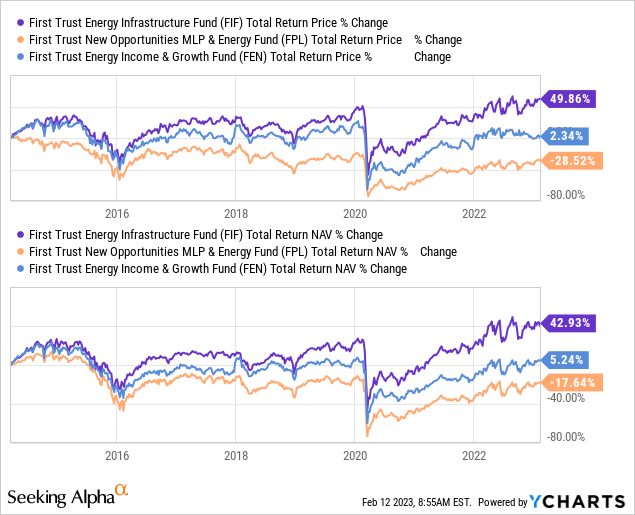

FIF isn't First Trust's only infrastructure-related fund. They also have First Trust New Opportunities MLP & Energy Fund (FPL) and First Trust Energy Income & Growth Fund (FEN).

Over the long term, FIF has been the better performer by a large margin. This simply comes down to their focus on being a more hybrid allocation to energy infrastructure by also incorporating significant exposure to utilities.

Ycharts

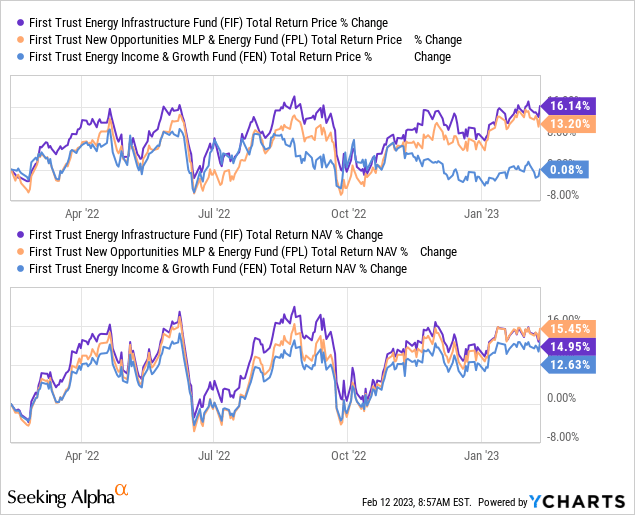

However, recent results show that the returns have been much more similar. This is because they've oriented FPL and FEN to be a more hybrid exposure to FIF as well. So at one point, these funds were quite different. Today, they offer more similar exposure, but it remains to be seen if this will change in the future. Additionally, FPL and FEN remain c-corps instead of regulated investment companies. That means they will continue to be subject to taxes on the fund level - which is an added expense and headwind for these funds. FIF is a regulated investment company.

Interesting to note is that FEN has moved from flirting with a premium to now trading at a large discount. That's why the fund's total return price has been significantly lagging. It seems that type of move would merit an update on FEN itself.

Ycharts

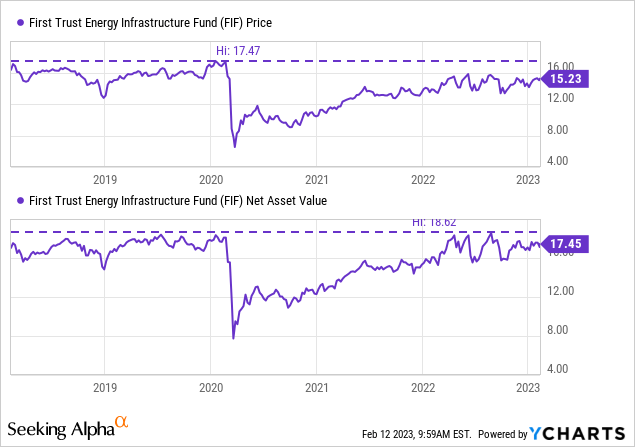

Anyway, to focus back on FIF more specifically, the fund is trading at a deep discount. While the fund traditionally carries a discount almost perpetually, it is near the widest discount we've seen in the fund's history, excluding the COVID crash. During COVID, they slashed their distribution, and the overall market uncertainty sent CEF spiraling to the widest discounts I've seen since covering CEFs.

Distribution - Raise, Raise, Raise

The fund has been having an interesting series of raises with its distribution. Earlier in 2022, I mentioned that I believed they could increase their distribution. I certainly didn't expect it to come in this manner, but a raise or raises were expected.

They've been bumping up by $0.0005 for the last six months now. I'm not sure why they're going about increases in this manner. I find it quite comical, but regardless, it certainly is beneficial for shareholders, especially when the fund is covering its distribution.

FIF Distribution History (CEFConnect)

As we know, CEFs can pay out what they'd like for as long as they'd like. So just because a fund is paying something doesn't mean it's being earned. In this case, we already know the 5.32% distribution rate and 4.59% distribution rate are reasonable and should be sustainable.

In fact, I would suspect that these rates are so low that the fund will continue to struggle to gain traction as investors tend to crowd into those paying the highest distributions.

In looking at the last annual report, one might get shocked at first. Net investment income coverage doesn't even touch 8% in fiscal 2022. This was also a sizeable drop from last year's NII coverage too.

FIF Annual Report (First Trust)

Fear not, though. The MLPs in the fund's portfolio do the heavy lifting of income. The above only reflects the dividend and interest income received in the fund. MLPs contributed $8,742,332 in additional cash flow for the fund. That takes our net distributable income or NDI to nearly 80%.

From that, there is only a fairly small shortfall of coverage that's missing relative to most equity funds and their infrastructure peers even. That's where we can go back to see what they've been able to gain from their written options.

In that case, we see they generated over $3 million from that in the latest year. With that alone, we see the distribution is covered. Writing options is something they can generate gains from in an up, down or flat market, so it's something replicable year after year.

The realized gains and unrealized appreciation in the portfolio become gravy on top. Of course, they've experienced massive losses in prior years, so it's going to recover those losses as it's paying out a low distribution. This is reflected in the fund's NAV making a recovery to pre-COVID levels.

Ycharts

The share price continues to lag, but that's reflected in the fund's widening discount from pre-COVID levels.

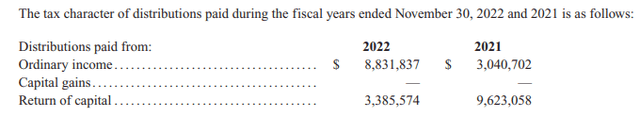

With the fund's capital loss carryforwards, they were able to offset the gains by around $30.233 million. That was enough to make it, so they didn't have to pay a special year-end to investors or pay an excise tax of 4%.

Regulated investment companies, which FIF qualifies for, have to pay out 90% of their NII and 98.2% of their capital gains. If they don't, the 4% excise tax comes in on those earnings above what they don't distribute out. Utilizing loss carryforwards reduces their taxable income, and return of capital also isn't included in taxable income as long as the fund's cost basis is above $0. Going forward, they have no capital loss carryforwards left.

At November 30, 2022, for federal income tax purposes, the Fund had no non-expiring capital loss carryforwards available, to the extent provided by regulations, to offset future capital gains. During the taxable year ended November 30, 2022, this Fund utilized non-expiring capital loss carryforwards of $30,232,987.

It's the same for individual investors, too, in terms of return of capital. That's why ROC can be an excellent way to defer tax obligations. That's why we don't need to panic when we see ROC distributions, especially from a fund that carries MLPs. So despite the fund being out of capital loss carryforwards, distributions could continue to be classified as ROC.

FIF Distribution Classifications (First Trust)

FIF's Portfolio

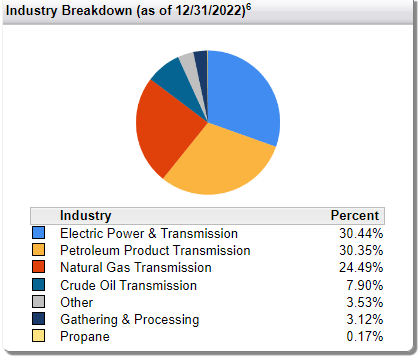

FIF's turnover of 60% reflects that the fund managers can be fairly active in buying and selling. This has been as high as 80% in 2020 and as low as 55% in 2019. Generally speaking, FIF's portfolio isn't drastically altered in terms of its broader exposure.

FIF Industry Breakdown (First Trust)

These weightings tend to stay fairly consistently positioned in the same weightings from update to update. In this case, the electric power and transmission industry reduced its exposure from 35.21%. Petroleum products and natural gas transmission saw their weightings increase from August 31st, 2022.

This could be due to natural portfolio gyrations in the underlying holdings. The energy infrastructure in the last year outperformed the utility side of their portfolio. Without actively rebalancing, we would naturally see the petroleum and natural gas industry weightings rise as they performed better in the last year.

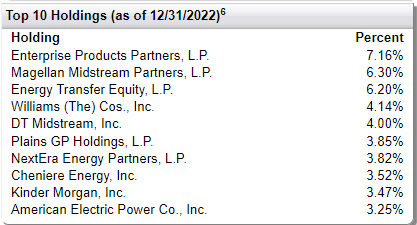

The portfolio is fairly narrowly invested, with around 68 positions. That means that the fund's top weightings become fairly sizeable, with the top ten making up 45.71% of the fund's invested assets.

FIF Top Ten Holdings (First Trust)

Enterprise Products Partners (EPD) is their largest position, and it was their largest position previously as well. Again, reflecting that the fund doesn't change materially from update to update despite the fairly elevated turnover reported.

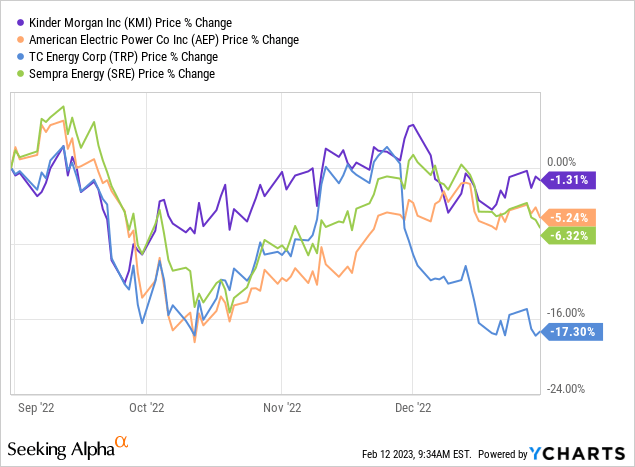

In fact, there were only two changes in the fund's top ten. That included Kinder Morgan (KMI) and American Electric Power Co. (AEP). Those replaced TC Energy (TRP) and Sempra (SRE). Instead of being active changes, some of this is reflected in the performance between the periods reflected.

Ycharts

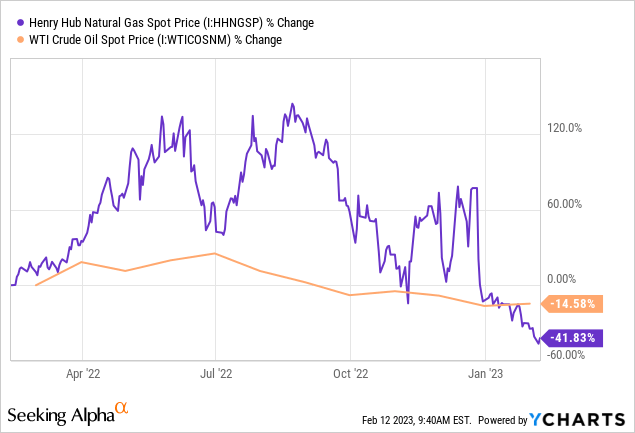

The top holdings in the fund are mostly MLPs or midstream companies. Yet, we know that the fund carries a sizeable allocation to utilities. That should continue to help the fund going forward, especially if we get a recession that everyone expects, as the energy sector could take a larger relative hit. Natural gas prices and crude oil prices have continued to fall. Natural gas, in particular, is having a very rough time after running up to extraordinary levels.

That's the type of cyclicality we've come to know and expect from energy plays. Indeed, the need for energy and particularly fossil fuels, will never truly go away, but just the same, demand will continue to experience highs and lows.

Ycharts

Conclusion

FIF takes a hybrid approach to invest in utilities and energy infrastructure. That helped make the fund relatively more stable if we looked at energy infrastructure peers with a greater emphasis on energy. While that's 'cost' the fund in the last year with lagging results, commodity prices of energy seem to be trending back down after some shockingly higher prices through 2022. If there is a recession on the horizon, energy could be exposed to even more volatility going forward. The utility exposure can help balance that risk out, at least if history is any indicator. The fund's discount remains attractive, and the fund's distribution is trending in the right direction - albeit at a snail's pace.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: May initiate a position in FIF over the next 72 hours.