i-80 Gold: Buy The Dips

Summary

- i-80 Gold has been one of the best-performing gold juniors since going public, with a 36% return over the past two years vs. a 35% decline in the GDXJ.

- This is entirely justified and the outperformance should be even more significant than it has been because i-80 Gold has made two major new discoveries in Nevada.

- Based on its recent discoveries, I see the potential for the company to produce 250,000+ gold-equivalent ounces per annum medium term and 400,000+ ounces long term, with further upside from GCOP/Mineral Point.

- A production profile of this size (400,000 ounces) at industry-leading costs in a Tier-1 mining jurisdiction (Nevada) can easily command a market cap of $2.50+ billion, so I see meaningful long-term upside to this story and see the stock as a steal below US$2.40.

gchapel

It's been a disappointing past year for most investors in the gold space, with the sector struggling to maintain any upside traction and each rally being met with violent selling pressure. However, one name has managed to buck this trend and nearly made a new all-time high in Q4 of last year despite the Gold Miners Index (GDX) sitting more than 35% from its 2020 highs, and this company was i-80 Gold (NYSE:IAUX). The reason for its outperformance? It has made a world-class discovery at its Ruby Hill Project in Nevada, has graduated to producer status at Granite Creek, and looks like it may have tripled its mine life at this mine with the addition of the high-grade South Pacific Zone.

While the holes coming out of Granite Creek have been nothing short of phenomenal with some half ounce per ton or higher gold intercepts over very mineable widths (7.5 meters at 20.2 grams per ton of gold, 15.7 meters at 16.6 grams per ton of gold), the real excitement stems from its southern-most Ruby Hill Project where the company is hitting higher than planned grades at Ruby Deeps/426 Zone, opening up new zones of high-grade gold mineralization (428 Zone), and continues to release high-grade polymetallic intercepts, awakening the hunt for carbonate replacement deposit [CRD] mineralization on the property after a multi-decade exploration hiatus. The most exciting part about this CRD opportunity, though, is that it has a Carlin overprint, with significant gold credits in several of the intercepts.

Hilltop Discovery & Eureka District History

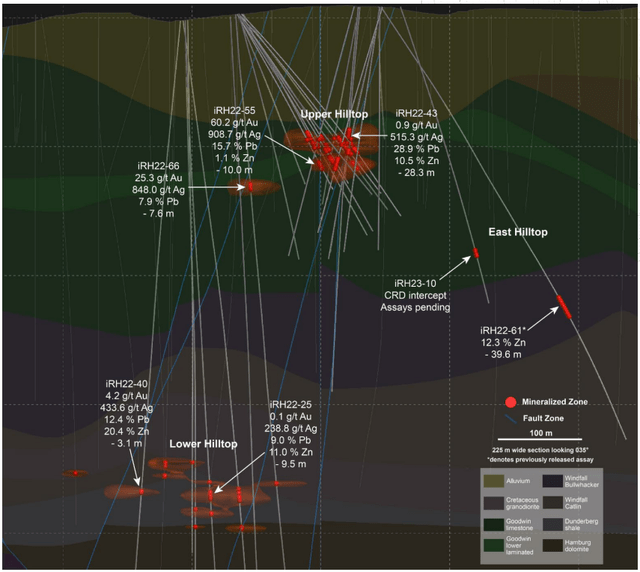

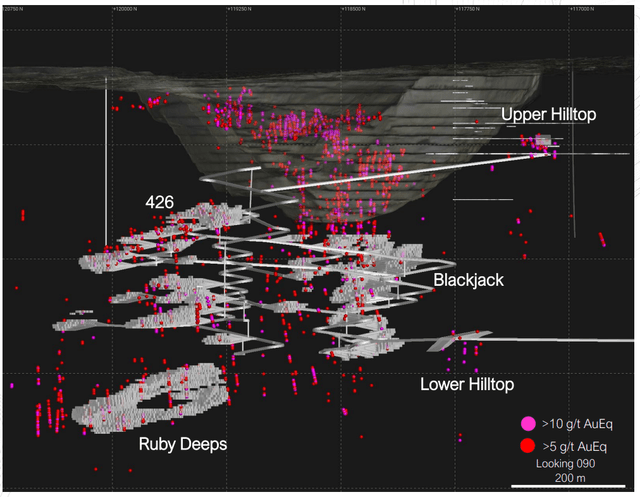

For anyone unfamiliar with small-cap gold producer i-80 Gold, the company quickly put itself on the map last year when it hit one of the best intercepts on a gram-meter basis sector-wide, reporting 10.0 meters of ~80 grams per ton gold-equivalent in iRH-22-55. This intercept confirmed the discovery of two new zones of CRD mineralization just south of the Archimedes Pit at Hilltop, known as the Upper Hilltop Zone (higher-grade) and the Lower Hilltop Zone. Some of the highlight intercepts and current drilling are shown below, with the best intercept in the most recent news release (hole iRH22-66) hitting 7.6 meters of 7.9% lead, 848 grams per ton of silver, and 25.3 grams per ton of gold, or ~40 grams per ton gold-equivalent.

Upper and Lower Hilltop Drilling (Company Presentation)

The average intercept into Upper Hilltop in its most recent release boasted a grade of roughly ~13 grams per ton gold-equivalent or a rock value of ~$700/ton, which is below the average for the bonanza grade intercepts out of Upper Hilltop in the company's November release (top-3 intercepts averaged ~43 grams per ton gold-equivalent or ~$2,250/ton rock value). However, they don't need to beat these grades to have a world-class discovery on their hands, and this would be a Fosterville-like discovery from a grade standpoint if they find a way to continue delivering holes like iRH-22-55 and IRH-22-66. In fact, even assuming what I would argue to be a conservative average grade of ~20 grams per ton at Upper Hilltop, this could one of the highest-grade discoveries globally over the past several years.

Just as importantly, the intercepts are over very mineable widths (7.0+ meters). To put this in comparison, and even assuming Osisko Mining's (OTCPK:OBNNF) Windfall deposit sees a 15% positive grade reconciliation given the success of bulk samples, Upper Hilltop may have fewer tons, but better mining widths and much higher grades (~16.0 grams per ton gold-equivalent diluted grade vs. ~10.3 grams per ton at Windfall which assumes positive grade reconciliation).

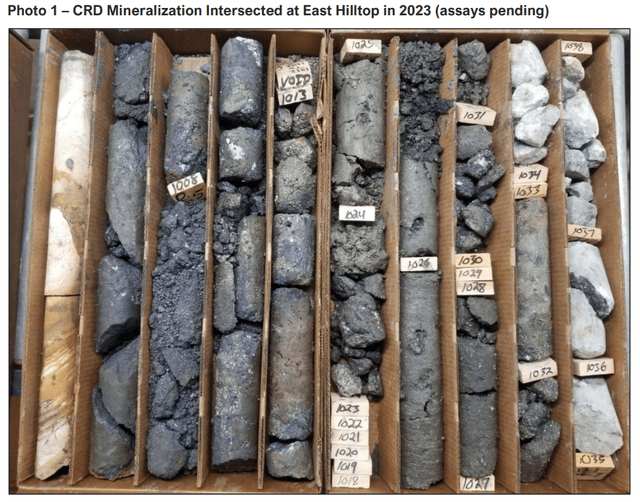

While these recent intercepts that confirm that previous drilling wasn't a lucky fluke is quite exciting, it's also worth noting that the company isn't having any trouble intersecting high grades when it steps out to the east, with iRH22-61 hitting a very thick intercept of skarn mineralization (39.6 meters at 12.3% zinc), and iRH23-10 is looking to fill in this gap with the company encountering additional CRD mineralization in this hole where assays are pending. Assuming the grades in this hole are favorable and the company can confirm the presence of high-grade mineralization east of Hilltop, this could expand the strike length to ~500 meters, a very significant footprint given the grades here which can result in very meaningful resource growth as tons of material start to add up.

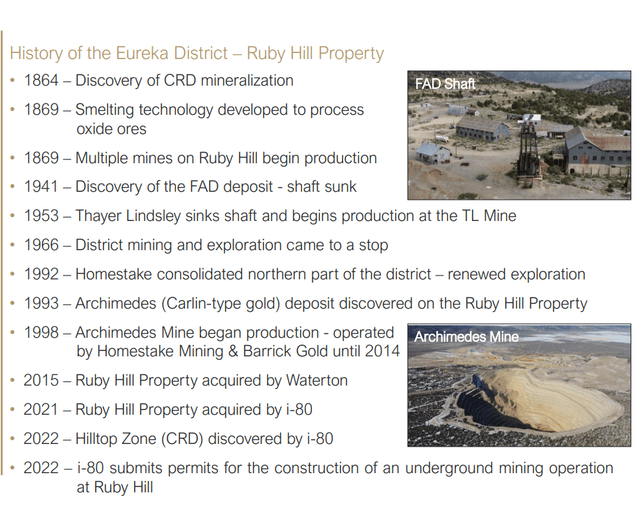

Eureka District/Ruby Hill Property - HistoryEureka District/Ruby Hill Property History (Company Presentation)

Before digging into Hilltop further, it's worth discussing the Eureka District, which has a long history of polymetallic mining that began in the 1860s. These mines were among the highest-grade globally for carbonate replacement deposit [CRD] mineralization. As detailed by Lambert Molinelli & Co. in work written in the 1870s, the population of the town of Eureka was less than 100 in 1869, but increased to 2,000 by October 1870, 4,000 by the fall of 1872, and soared to more than 7,000 in 1879, eventually growing to the second in Nevada State in population and resources. The torrid pace of population growth can be attributed to the start of mining in 1869, with the total bullion yield of the Eureka District coming in at "less than $100,000". This figure steadily increased to more than $10 million by 1878 with 900 miners in the town of Ruby Hill (four kilometers west of Eureka) and multiple smelting furnaces in Eureka to process the ore, with capacities ranging from 40 to 60 tons.

As stated by Lambert Molinelli & Co. in his work:

"The main cause of the unexampled prosperity of the mining interests of Eureka is to be found in the character of the ores. They are self-fluxing. They carry from 15 to 60 percent of lead and sufficient iron and silica to obviate the necessity of importing foreign material for smelting purposes. Eureka is the only known mining district possessing this important advantage. The Silver Lick, previous to litigation, produced a large quantity of ore, yielding several hundred thousand dollars. Although many others (mines) in the district have done wonderfully well, the Richmond and Eureka Consolidated have of course been the largest and best paying properties, having disbursed many millions in dividends.

Notwithstanding this large production, it is generally thought that these mines have yet to see their best days, all the other more promising properties in the district having as yet hardly entered upon the great success that probably awaits them in the near future." "One of the most encouraging features is that these rich bodies have been found at the lowest depth penetrated on the lode, having been reached at a distance of one thousand feet below the surface, and its proportions in that direction are as yet only a matter of conjecture. This provides that the mineral deposits in the district are not, as formerly argued, merely surface bodies, liable to give out as explorations were carried on, but rather that the great belt on Ruby Hill and its contents are permanent, and will be found in greater proportions as further depth is attained".

- Eureka And Its Resources - A Complete History of Eureka Country, Nevada - Lambert Molinelli & Co

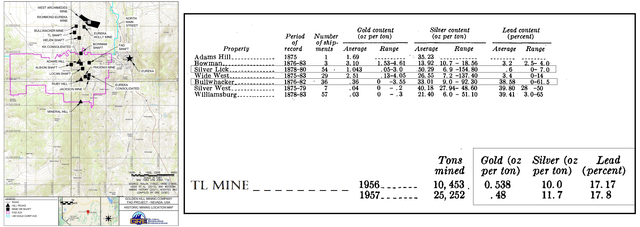

The last excerpt is certainly encouraging, with Molinelli & Co. highlighting that there appears to be further potential at depth and given the more archaic mining methods of the 1870s to 1960s, the old-timers mining the area were mostly going after the low hanging fruit before production ceased in the 1960s. To provide some context, we can look at the three historic mines that lie on i-80 Gold's property and their grades mined from a report of the Eureka Mining District Nevada by Thomas B. Nolan. As shown below, the mines on i-80 Gold's ground were Silver Lick, Bullwhacker, Holly, and the TL Mine, with the latter named after Thayer Lindsley, who would sink a shaft and begin production here in 1953.

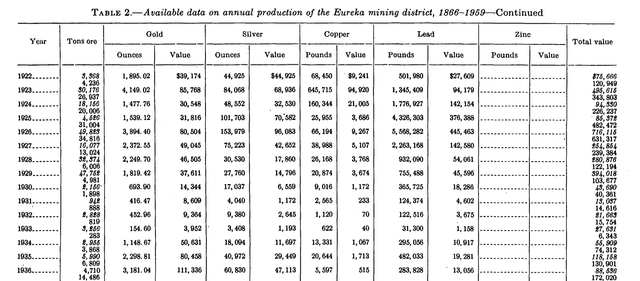

Historic Mining Location Map, Historical Production (Shipments, Tons Mined, Grades)Historic Mining Location Map, Historical Production, Eureka Mining District (Eureka Mining District of Nevada, Western Mining History - Nolan, Vikre, Hoge et. Al, GRE)

From historic records of average grades, Bullwhacker averaged ~$2,000/ton rock at today's prices (0.36 ounces per ton gold, 33 ounces per ton silver, 38% lead), the TL Mine averaged 0.43 ounces per ton gold, 11.5 ounces per ton silver, and 17% lead with additional zinc credits and the Silver Lick Mine averaged 0.23 ounces per ton gold, 28.7 ounces per ton silver, and 37% lead according to some sources, but periods of record from 1878-1880 appear to highlight higher grades (1.04 ounces per ton gold, 50 ounces per ton silver, and 0.6% lead). To the south on the neighboring property, the Ruby Hill Mine boasted reported grades of 21 ounces per ton of silver, 15% lead, and 0.89 ounces per ton of gold, translating to ~45 grams per ton gold-equivalent or ~$2,300/ton rock values at today's prices.

To put the grades of the Ruby Hill Mine on the southern adjoining property just two kilometers in perspective, its historic reported grades would be in line with Fosterville during its heydays (2017-2021) with an average head grade of ~28.0 grams per tonne of gold), but that's purely on a gold basis and ignores the additional and material silver (21.1 ounces per ton) and base metal credits (15% lead). On a gold-equivalent basis, the Ruby Hill Mine just to the south was actually richer than Fosterville at 40+ grams per ton gold. Hence, while this project may not have received the attention it deserved, this is one of the richest areas from a grade standpoint globally based on historic mined grades.

Some investors might be skeptical that i-80 Gold can continue making these discoveries on its newly acquired Ruby Hill Project that could ultimately have a $1.0+ billion NPV (5%) if exploration success continues. However, it's important to note while the CRD mineralization south of the Archimedes Pit is a new discovery, it's simply following in the footsteps of earlier discoveries by previous miners and prospectors and benefiting from an opportunity that was overlooked by previous operators when they owned the project given that they were focused on near-surface Carlin-style gold mineralization and weren't focused on the base metal potential. And, while the focus was on CRD mineralization, the old-timers appear to have left lots behind, given that this area being explored was covered by 60 to 120 meters of overburden.

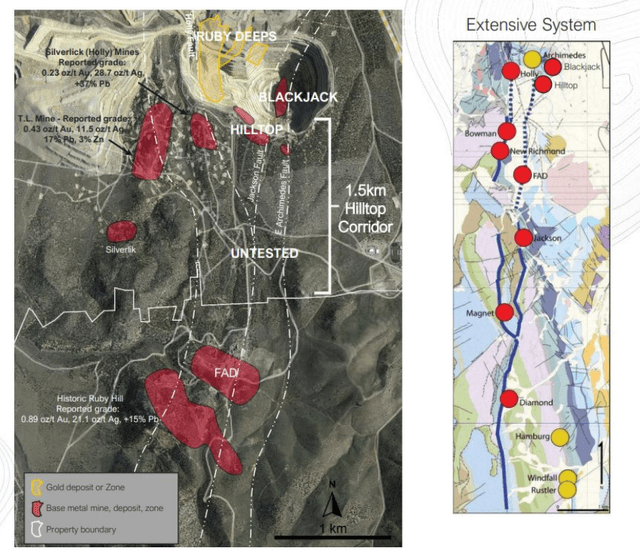

The Untested Hilltop Corridor

One of the most important takeaways from developments over the past six months is that there is a ~600-meter wide and multi-kilometer long corridor that is largely untested due to it being under alluvial cover which stretches from i-80's Archimedes Pit onto Paycore Minerals' (OTCPK:PYCMF) ground to the south. Given the drilling success to date wherever i-80 points its drills (South Blackjack, East Hilltop, Upper Hilltop, Lower Hilltop), I would argue that there is a high probability that i-80 could make an additional high-grade CRD discovery on the property, and this appears to be largely ignored by the market. In fact, i-80 noted in its most recent presentation that it's seeing significant alteration and mineralization in holes testing its new 4H target, suggesting the pending assays at this new much larger target could be quite favorable.

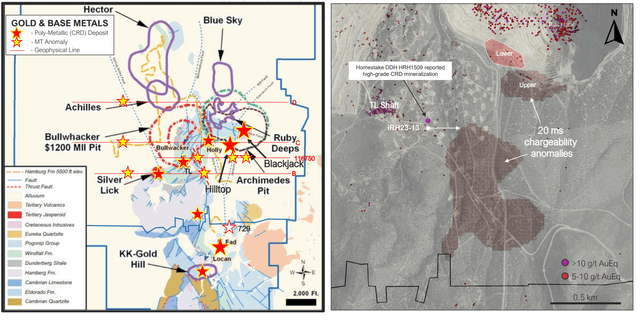

i-80 Gold - 1.5 Kilometer Hilltop Corridor & CRD/Gold Deposits in DistrictUntested Hilltop Corridor & Base Metal/Gold Deposits (Company Presentation)

The belief that more CRD discoveries will be made is reinforced by Paycore hitting incredible grades at the south end of this corridor, intersecting 12.5 meters of ~22% zinc, ~1.5% lead, ~155 grams per ton silver, and 1.06 grams per ton gold in September, and following this up with an impressive 27.4 meters of 10% zinc, 1% lead, 79 grams per ton silver, and 8.0 grams per ton gold earlier this month.

As i-80 Gold detailed in a recent presentation, CRD and skarn mineralization appears to be closely associated with Titan MT and IP geophysical anomalies, and the company has identified multiple anomalies that it plans to test this year. One of these is the Spring Valley target which lies to the north of the past-producing Silver Lick Mine along Line D (red horizontal line on left image). Another target is downdip of the Upper Hilltop Zone which is currently being tested with holes drilled into the newly interpreted East Hilltop. The most exciting target, though, appears to be the 4H target, which is massive relative to Upper and Lower Hilltop and sits just east of where Homestake hit high-grade CRD mineralization in past drilling.

Geophysical Targeting - MT Anomalies & Polymetallic CRD Deposits (Company Presentation)

As shown above, this target (depending on the size of one's monitor) is the size of a pear relative to Lower and Upper Hilltop which are the size of grapes of cherries by comparison, respectively. Hence, if the company were to hit high-grade CRD mineralization here, this would be a game-changer on top of what is already an incredible discovery. The reason is that the anomaly is humongous in size relative to Upper and Lower Hilltop and could host several million tons of material which would give the company a second multi-million ton polymetallic deposit in addition to Blackjack, with the possibility to sequence Upper Hilltop first to speed up the payback and potentially look to expand the plant down the road to 1,500 - 2,200 tons per day using free cash flow.

So, what's the opportunity here?

Based on a scoping study completed last year that explored converting the existing CIL Plant to a floatation plant, i-80 Gold could accomplish this for ~$70 million (assuming 10% cost escalation), placing upfront capex to develop a small-scale polymetallic operation at sub $120 million when factoring in mine development. Even using a 750 ton per day throughput rate and starting at Upper Hilltop with an average grade of ~19 grams per ton of gold (first three years), we could see average payable production of ~117,000 gold-equivalent ounces [GEOs] which could generate upwards of $80 million in free cash flow per year. However, it's important that this is based on a miniscule scale operation, and even at an 8.0x 2-year forward free cash flow multiple, Hilltop/Blackjack alone could cover i-80 Gold's current valuation.

It's still premature to discuss larger production scenarios given that there's no resources in place here yet to give a better idea of grades/tons, but an expansion to 1,500 tons per day could lift payable production to ~161,000 GEOs per annum at a lower grade of 13.5 grams per ton gold. Longer-term, and assuming the tons are there to support it, an expansion to 2,400 tons per day which is still a very modest sized operation could support production in excess of 250,000 GEOs per annum even at a lower grade (blended Blackjack and Hilltop) at industry-leading margins. So, this new opportunity for i-80 Gold could be a cash-flow machine and the market appears to be missing just how significant this could be for the company.

Finally, it's worth noting that while i-80 Gold has made impressive discoveries to date to add to an already significant resource base (~14.5 million ounces of gold resources + ~170 million ounces of silver), it's unique in the sense that most developers and producers looking to add 350,000+ ounces of annual production are looking at a minimum capex bill of $800 million. In the case of Nevada which is a top-ranked mining jurisdiction, it may not even be possible, given that achieving this scale with solely oxide material is unlikely (ex Nevada Gold Mines LLC) and building an autoclave/roaster in the state would require extensive permitting and well over $1.0 billion in capital even before mine development to access the material. With i-80 Gold owning one of these facilities, it has a significant competitive advantage.

Ruby Hill Development Plan (Company Presentation)

Plus, as the image above shows, it not only owns significant infrastructure at its sites (CIL Plant, Autoclave, Heap Leach pads), but the mineralization it's going after is accessible from an existing open-pit at Ruby Hill, making it much cheaper than sinking a shaft or completing significant underground development from surface at a greenfield project. So, while De Grey's (OTCPK:DGMLF) Mallina Gold Project, Osisko's Windfall, Vista's (VGZ) Mt. Todd, Perpetua's (PPTA) Stibnite and Kinross' (KGC) Great Bear may have scale, they're all years away from their first production with an average build cost north of $1.0 billion vs. Hilltop that could be developed for barely $120 million (floatation plant conversion and mine development) and could potentially be in production by H1 2026.

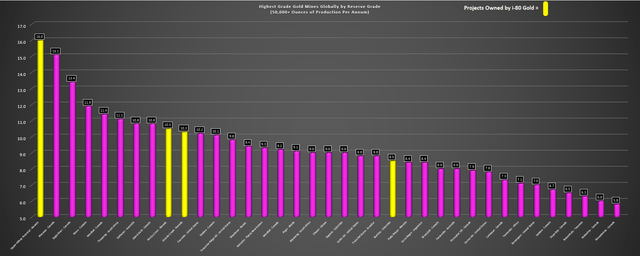

Highest Grade Gold Mines Globally (Reserve Grade) & Projects/Mined owned by i-80 Gold (Yellow) (Company Filings, Author's Chart & Estimates)

To summarize, i-80 Gold is somewhat of a unicorn. Not only is it the owner of what could be four of the highest-grade mines globally (Granite Creek Underground, Ruby Deeps, Hilltop, McCoy-Cove), but it has the ability to self-fund this growth with minimal share dilution. This is a similar position to K92 Mining (OTCQX:KNTNF) which has massively outperformed the sector, and also Kirkland Lake Gold, with both companies in the favorable position of making high-grade discoveries right next to existing infrastructure (Judd Vein, Swan Zone, respectively), and what i-80 Gold appears to be in the process of accomplishing with better grades than anticipated at Ruby Deeps (~8.50 grams per ton gold vs. ~6.5 grams per ton gold) and CRD discoveries just south of the Archimedes Pit at Ruby Hill.

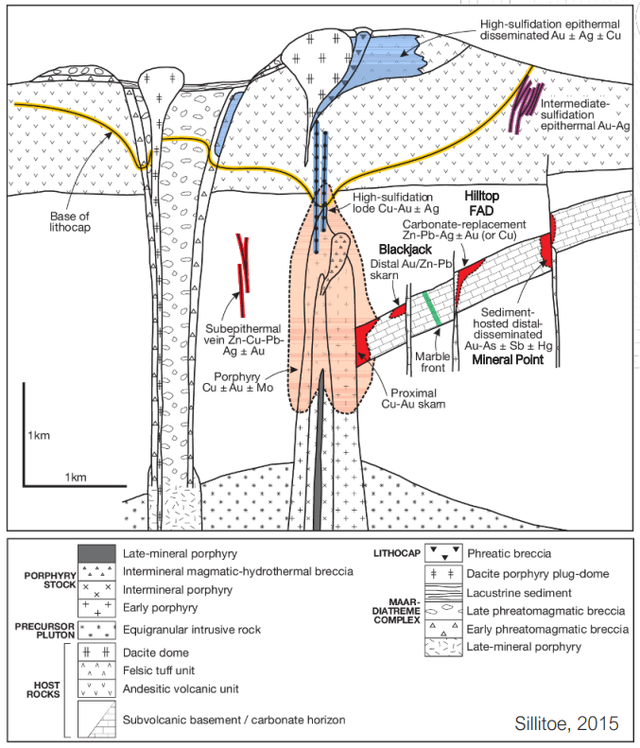

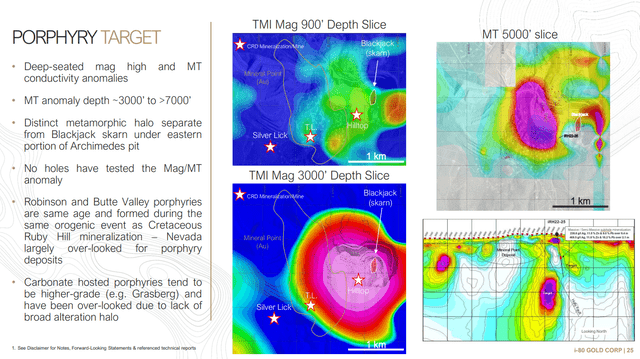

Growing Evidence Of A Potential Porphyry At Depth

While the existence of an ultra-high-grade CRD just south of the Archimedes Pit is quite exciting, as is the discovery of a potential southern strike extension to its skarn deposit at Blackjack (39.6 meters at 12.3% zinc) and what could be the presence of additional uncovered polymetallic deposits in the Hilltop Corridor, there appears to be growing evidence of a potential porphyry at depth. As i-80 Gold's CEO Ewan Downie stated in a recent interview:

"We think that the Ruby Hill Property has the textbook geological system for finding a major porphyry deposit. Ruby Hill has all the ingredients. We have the disseminated gold mineralization as you see at Mineral Point, the distal carbonate replacement deposit [CRD] mineralization like we're seeing at Hilltop and FAD, and the distal zinc-lead rich skarns that we have at Blackjack. So the big question is that we have all the ingredients for one of these massive systems; where is the porphyry?"

- i-80 Gold CEO, Ewan Downie

Geologic Model (Company Presentation)

Geophysical work has identified a major anomaly at the Archimedes Pit at depth, evidenced by mag-highs, with the possibility that this could be the porphyry source (yielding copper, gold, and molybdenum). There's already evidence of copper at the project, with copper values in Homestake's historical hole (HPC-1427: 5.8 meters at ~769 grams per ton of silver, ~13.9% lead, ~12.4% zinc, and 1.0% copper) and in holes drilled into the Blackjack deposit, such as HRC603 (~21.6 meters at ~57 grams per ton of silver, 0.2% lead, ~21.9% zinc, and 0.2% copper, and 1.8 grams per ton of gold). Finally, historical records suggest copper was mined in the district (shown below), and i-80 Gold's most recent batch of drill intercepts hit copper in the Lower Hilltop Zone, separate from Blackjack.

Historical Ore Production Eureka District (Eureka Mining District of Nevada - Nolan, Angel, Vanderburg, Thompson & West's History of Nevada)

Recently drilled hole iRH22-39 intersected 0.8% copper over 1.4 meters (in addition to ~22.3% lead/zinc and ~780 grams per ton of silver), plus an additional intercept of 1.8% copper over 1.1 meters with ~57% lead/zinc and 993 grams per ton of silver). Lastly, iRH22-40 intersected 0.60% copper over 3.1 meters in addition to ~33% lead/zinc, 4.2 grams per ton of gold, and 433 grams per ton of silver. Finally, the company has also seen evidence of molybdenum over narrower intercepts.

Ruby Hill Project - Porphyry Target (Company Presentation)

As the images above show, there is a massive magnetic anomaly at depth (~900 meters below surface) right under the Archimedes Pit, and the kicker is that carbonate-hosted porphyries can be much higher-grade than the average porphyry deposit, with one example being the Grasberg Mine in Indonesia. For those unfamiliar, the Grasberg Mine owned by Freeport (FCX) is a company maker, with production expected to be ~1.6 billion pounds of copper and ~1.6 million ounces of gold for the next five years, which is incredible for an asset that's already been in production for well over 30 years.

Although Nevada is mostly known for its gold production today, with Nevada Gold Mines LLC teaming up for ~3.2 million ounces of gold production last year and several other operations present in the state in smaller capacities (Jerritt Canyon, Marigold, Bald Mountain, Round Mountain), there's also copper in the state. In fact, the Robinson Mine is a massive operation that started as a gold/silver mine and is located in White Pine County (90 kilometers southeast of Ruby Hill). The Robinson Mine started as a gold/silver mine and is also a colossal operation located in White Pine County, Nevada, and large-scale copper mining has been ongoing for over a century with two brief hiatuses (1978-1985, 1999-2004). In the 1908-1978 period alone, Robinson produced ~4.0 billion pounds of copper and ~2.7 million ounces of gold.

In summary, I don't believe it's a stretch to assume that i-80 Gold could also have a porphyry on its hands at Ruby Hill, a project that is already home to refractory gold at depth (Ruby Deeps), oxide gold near-surface and underground (Mineral Point/426), and polymetallic mineralization (Blackjack/Hilltop). This is an enviable position to be in, and according to the company, drilling has begun to test this porphyry at depth, which, if present, could dwarf the value of all of i-80 Gold's current resources combined, especially if it were a higher-grade porphyry. For now, it's early to speculative, but this is certainly a nice and significant bonus to the investment thesis.

Putting It All Together

With ~$130 million in cash plus an option for a $100 million accordion (Orion), and $50+ million in potential proceeds from warrant exercises, i-80 Gold could have up to ~$280 million in liquidity, a significant amount of capital to pursue its aggressive growth plans in Nevada to become the #2 producer behind Nevada Gold Mines LLC. Plus, its Granite Creek Underground Mine is already in operation which will generate moderate cash flow this year with a meaningful step-up in production next year, placing i-80 Gold in a position to fund exploration and development with cash flow and without further share dilution unlike other juniors that don't have existing operations and must rely solely on share dilution in a less favorable market for raising capital.

Gold Hub & Spoke Model (Company Presentation)

Previously, i-80 Gold's #1 priority appeared to be developing a Hub & Spoke model with three mines with refractory ore (Ruby Deeps, McCoy Cove, Granite Creek) feeding a central autoclave (Lone Tree) that was acquired in an asset swap in 2021. However, with Hilltop emerging to be a higher-grade opportunity that is lower capex (~$70 million for floatation plant) vs. the planned autoclave refurbishment ($200+ million), i-80 Gold is in the unique position that it could explore sequencing Hilltop ahead of the autoclave restart, with a goal to fund the autoclave restart with free cash flow from Hilltop while it ensures it can get its mining rates up to fill the autoclave at Lone Tree (~2,800 tons per day).

If the company were to explore this option, this would be less taxing financially, meaning that i-80 Gold would achieve its growth with reduced leverage and could minimize share dilution, a positive in my view. Importantly, it doesn't change the growth profile of the company, with the ultimate goal being to become a 400,000-ounce plus producer in Nevada. This would be accomplished by producing 130,000 to 170,000 gold-equivalent ounces [GEOs] at Hilltop (grade and throughput dependent), ~240,0000 from its Gold Hub & Spoke model, and an additional ~30,000 ounces of oxide production from the Ogee Zone/426 Zone (Granite Creek Underground, Ruby Hill Underground).

Currently, it's not clear what avenue will be pursued first (Hilltop + floatation plant producing two concentrates or three mines feeding a central autoclave), but the foresight of the company to secure processing agreements (1,000 tons per day of refractory ore at NGM LLC's autoclaves and 750 tons per day of double-refractory ore at NGM LLC's roasters) was a key milestone. This is because the toll-milling agreement with NGM LLC allows it to generate moderate cash flow in the interim while it decides what its best option is (Granite Creek Underground refractory and oxide material shipped to NGM's Sage autoclave and heap leach pads). Of course, it also gives it double-refractory ore processing capability long-term, which is key to processing some of the high-grade ore from McCoy-Cove.

Overall, I see the optionality (ability to choose which opportunity to sequence first) as quite positive for two reasons:

- A low-capex, high-margin project like Hilltop helps to self-fund growth if sequenced ahead

- Upper Hilltop material and Blackjack material is above the water table at Ruby Hill, meaning less exhaustive permitting requirements and a quicker path to production

Meanwhile, from a bigger picture standpoint, the benefit is huge. Previously, i-80 Gold could have put its Gold Hub & Spoke model into operation at ~250,000 ounces per annum and potentially grown to 400,000-ounce per annum status by bringing Granite Creek Open Pit online (not to be confused with the currently producing Granite Creek Underground), or by bringing the lower-grade Mineral Point deposit into production. However, Hilltop could displace these opportunities and is much higher margin and lower capex, so the 400,000 ounce per annum opportunity could be lower capex, higher-margin, and potentially quicker to put in place. And, if i-80 Gold does choose to pursue either of these other opportunities, it now could have ~600,000 ounce per annum potential vs. a ceiling of ~400,000 ounces previously.

Assuming i-80 Gold can execute on this plan successfully (Gold Hub & Spoke model + Polymetallic opportunity), the company has the potential to grow annual GEO production from a conservative estimate of 45,000 ounces in 2023 to ~250,000 GEOs in 2026 and ~400,000 GEOs in 2028, representing a 77% compound annual production growth rate and a ~55% compound annual production growth rate, respectively, and it can be achieved with minimal share dilution, translating to significant cash flow and production growth per share. This makes i-80 Gold by far the highest-growth story sector-wide, and with growth potential of this magnitude, it doesn't need the gold price to cooperate to achieve a considerable upside re-rating.

Ruby Hill Project (Company Presentation)

Valuation

Based on an estimated net asset value of US$1.39 billion which ascribes only $150 million in value to its polymetallic opportunity vs. an estimated net asset value of ~$405 million (given that it's pre-resource and sparsely drilled), and a 1.1x P/NAV multiple given that this is one of the best exploration stories sector-wide, I see a fair value for i-80 Gold of ~$1.55 billion [US$4.90 per share]. Given that I am assigning limited value to the polymetallic potential on the property and zero value to further exploration upside (anomalies identified to date, including a possible porphyry at depth), I see upside to this price target. Measuring from a current share price of US$2.34, i-80 has 110% upside to fair value, making it one of the most undervalued gold producers in the market today.

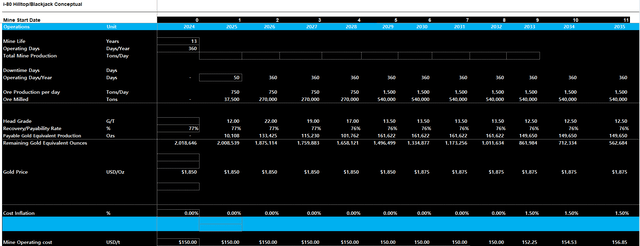

i-80 Gold - Hilltop/Blackjack Conceptual Mine Plan (Author's Table & Estimates)

The above potential mine plan is very preliminary and meant to provide a basic idea of the possible opportunity at Hilltop/Blackjack assuming a 750 ton per day processing rate to start, with expansion to 1,500 tons per day in Year 5 (2029).

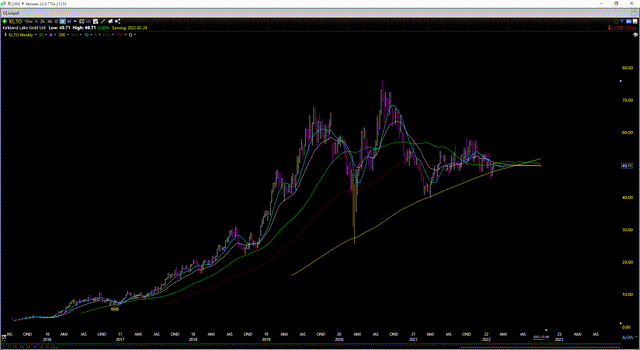

Assuming the Hilltop Corridor is even half as well-endowed as the rest of the Eureka District which had multiples mines with head grades north of 20+ grams per ton gold-equivalent, i-80 is likely to make at least one more major discovery on this property, adding critical mass and potentially justifying an expansion to 2,000+ tons per day vs. the 1,500 ton per day expansion I have modeled that can be funded with cash flow. In fact, if i-80 Gold does make a new CRD discovery which would increase the probability of 10+ million tons of high-grade polymetallic material on its property, I would expect the stock to command an even larger premium vs. peers given that it would further solidify its position as the highest-growth story sector-wide, and one of the highest-grade. The last company that sported this distinction regularly traded at 1.50x P/NAV or higher: Kirkland Lake Gold (stock performance shown below).

Kirkland Lake Gold Weekly Chart - 1000%+ Return In 4 Years (TC2000.com)

Finally, I'd be remiss not to point out that the gold opportunity is looking better than ever at Ruby Hill with a new high-grade hit (10.7 meters at 12.3 grams per ton of gold) along the newly tested Blanchard fault, and the company has already made a major discovery (South Pacific Zone) at its Granite Creek Underground Mine, which is conveniently on trend with a behemoth, the Turquoise Ridge Complex owned by Nevada Gold Mines LLC. This is a ~500,000-ounce per annum operation, with over 16 million ounces of gold resources, and an average underground grade of ~9.0 grams per ton of gold, but i-80 appears to have the higher-grade deposit to the southwest. For a deeper overview on Granite Creek, one can read this update:

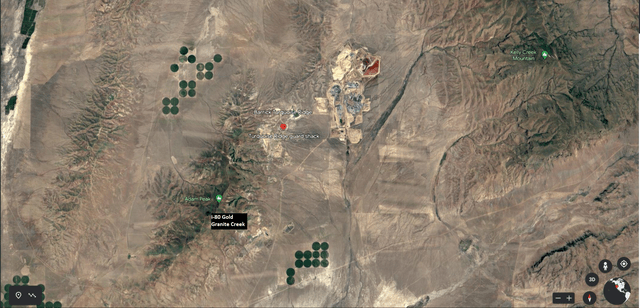

NGM - Turquoise Ridge Mine & i-80 Granite Creek Underground Mine (Google Earth)

Risks

Investing in small-cap gold producers and especially gold developers can be quite risky, and this is magnified in risk-off environments or when sentiment is poor sector-wide given that it can be more challenging to raise capital, and even if a company can raise capital, it doesn't help if it's highly dilutive to shareholders. Additionally, there are permitting risks, project execution risks, and, of course, commodity price risk. Fortunately, i-80 Gold is unique when it pertains to several risks that other developers and producers may face:

1. Financing: the company is well-capitalized with ~$130 million in cash and up to ~$280 million in liquidity, meaning it does not need to go back to the market for additional funding, suggesting a low risk of any material share dilution in the next 18 months. Adding to this point, if the polymetallic opportunity is sequenced ahead of the planned autoclave refurbishment, with the latter being more capital-intensive.

2. Permitting: i-80 is either partially or fully permitted at its assets and it is operating in a state where permits can take time, but the state is generally very favorable from a permitting standpoint. Plus, i-80 Gold has brownfields sites and relatively small footprints with high-grade mines feeding a central processing facility, suggesting low permitting risk.

3. Project Execution: i-80 Gold's predecessor company owned a larger-scale (~1,800 tons per day) underground mining operation (Mercedes), and the team assembled around the CEO has considerable Nevada mining experience, including Matthew Gili (President & COO), Todd Esplin (Technical Director), and Andy Cole (Senior Mining & Processing Advisor), and Tony Carroll (Project Director) with previous positions at Goldstrike (General Manager/Autoclave Superintendent & Metallurgical Services Superintendent, Capital Projects Manager), and Cortez (Executive General Manager) working for the world's largest gold producers. Hence, I see execution risk as low.

4. While commodity price risk is out of the company's control, I see i-80 Gold's risks as low in this area given that grade is king in mining and i-80 Gold looks like it could have four of the world's top-30 highest-grade mines when including Hilltop. These grades over very mineable widths mean lower unit costs, and while some companies may have to move projects into care & maintenance if we were to see the gold price stay below $1,650/oz for any extended period of time, I don't see this as the case for i-80 Gold which should have sub $1,125/oz AISC, more than 10% below the industry average.

Summary

i-80 Gold is in the process of graduating from developer/small-scale producer to junior producer status (50,000 to 150,000 ounces per annum), but the real opportunity here looks to be a mid-scale and high-grade producer in a top-3 mining jurisdiction ultimately capable of producing 380,000 to 600,000 ounces per annum. And as highlighted earlier, IAUX is unique in that its growth can leverage off existing infrastructure, it has ~$280 million in liquidity (assuming warrant exercises and Orion accordion) to pursue this growth, and it does not need to make any acquisitions with a development pipeline outside of its two highest priority opportunities that some mid-tier producers would salivate over (Mineral Point, Granite Creek Open Pit), let alone a company of i-80 Gold's size ($720 million fully-diluted market cap).

East Hilltop Target Mineralization (Company Presentation)

So, with i-80 Gold being a top-5 exploration story and the #1 growth story sector-wide, I would expect the stock to command a premium multiple vs. peers, especially as it checks off additional boxes and de-risks this growth profile (resource/reserve estimates and economic studies due for completion this year). To summarize, I see i-80 Gold as a steal at current levels, and I would be shocked if the stock continued to trade below US$2.40 given the significant exploration upside on two of its properties (Ruby Hill followed by Granite Creek), and multiple catalysts on deck this year and a very busy drill season focused on stepping out and growing i-80's resource base toward ~20 million GEOs.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of IAUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.