Celanese Corporation: Opportunity May Arise Soon

Summary

- Celanese Corporation may face margin headwinds in 2023.

- High inventory is a concern and will take a while to sell.

- CE stock is overvalued based on valuation metrics and a free cash flow model.

Manuta/iStock via Getty Images

Celanese Corporation's (NYSE:CE) growth may be slowing in the face of rising economic headwinds in the U.S. and across the globe. The Fed may continue to raise interest rates further, increasing the pressure on consumers and companies. Although the company's high debt is not a concern in the short term, the company has to prioritize debt payments. The company is focused on reducing debt, but it will take time, and the economy must cooperate. New investors may be better off avoiding the stock until there is clarity on the economy's direction. The stock may be a buy if it drops below $100. Existing investors may consider selling covered calls to generate income.

Margins may be under pressure in 2023

The company generated net sales of $2.34 billion in Q4 2022 compared to $2.27 billion in Q4 2021, a growth of 2.99%. The company's Engineered Materials segment grew sales from $707 million in Q4 2021 to $1,237 million in Q4 2022, a 74% growth rate. But, the company's Acetyl Chain segment saw a decline in sales from $1,590 million in Q4 2021 to $1,135 million in Q4 2022, a loss of 28.6%. Since the Acetyl Chain segment is a significant contributor to the company's profits, a decline in sales reduced operating earnings to $204 million in Q4 2022 from $539 million in the same quarter of the previous year, a 62% reduction in profits.

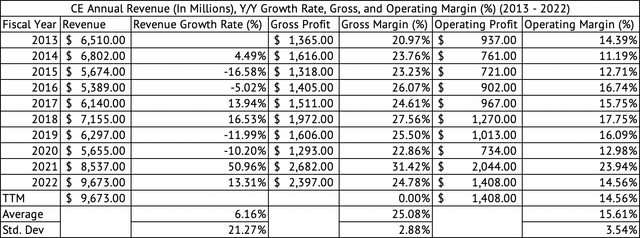

The company's annual gross margins have averaged 25.08% since 2013, with a standard deviation of 2.8% (Exhibit 1). But, its gross margins were 31.4% in 2021, robust due to a surge in demand. The company may not be able to repeat its 2021 performance. If we exclude the 2021 gross margins, the company's average since 2013 drops to 24.3%, and its standard deviation drops to 1.9%. It may be best to assume a 24% long-term gross margin. The standard deviation of 1.9% can be considered low, indicating a stable profit profile for the company.

Exhibit 1:

Celanese Corporation Annual Revenue, Gross, and Operating Margin (Seeking Alpha, Author Compilation)

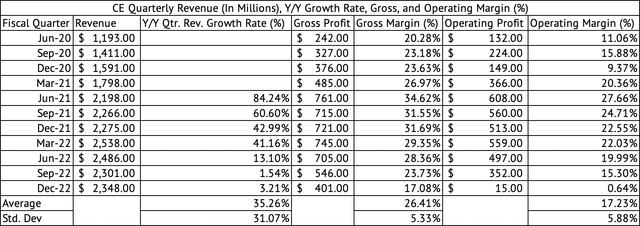

Similarly, the company's average quarterly gross margins since June 2020 were boosted by extraordinary performance during 2021 (Exhibit 2). The company's average gross margin was 23.6% when excluding 2021, compared to 26.4% when 2021 is included, a substantial difference of 280 basis points. Investors may see margins closer to the quarterly average of 23.6% in the short term, given the prevailing headwind to the economy and the company's high inventory.

Exhibit 2:

Celanese Corporation Quarterly Revenue, Gross, and Operating Margin (%) (Seeking Alpha, Author Compilation)

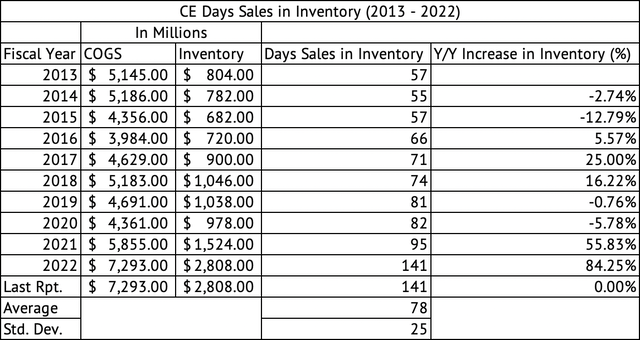

High Inventory costs

The company was carrying high inventory at the end of 2022, with its days' sales in inventory at 141 days compared to its average of 78 (Exhibit 3). These high inventory costs may be due to cost increases and its merger with Dupont's division. Irrespective of the reasons behind its high inventory costs, the company may take a hit on margins as it sells through this inventory.

Exhibit 3:

Celanese Corporation Day's Sales in Inventory (Seeking Alpha, Author Calculations)

Many companies across various sectors have seen a dramatic increase in inventory costs (Exhibit 4). But, other companies' inventory levels pale compared to Celanese's. The company's current inventory is two standard deviations above its mean over the past decade.

Exhibit 4:

Day's Sales in Inventory for KMB, MDLZ, SNA, CC, IFF, HRL (Seeking Alpha, Author Calculations)

Celanese carries a high debt load

In November 2022, the company paid $11 billion to acquire most of Dupont's Mobility & Materials business. This acquisition has substantially increased the debt load for the company. At the end of 2022, the company carried $14.6 billion in total debt and a net debt after the cash of $13.17 billion (Exhibit 5). The company's operating cash after subtracting CapEx and dividends were $966 million, and the EBITDA was $2.6 billion in 2022. The company's free cash flow was $1.263 billion in 2022. In short, the company is carrying a debt-to-free-cash-flow multiple of 11.5x, a high debt load.

Exhibit 5:

Celanese Corporation Debt (Seeking Alpha, Author Compilation)

Fortunately, the company's weighted average interest rate was an ultra-low 1.3% at the end of 2021. The company's debt schedule shows that between 2023 and 2025, the company has $5.7 billion in debt coming due. The company is focused on reducing its debt load and currently working on redomiciling the debt in the U.S. The company is selling assets to pay down some of the debt.

Either fully valued or overvalued, but not cheap

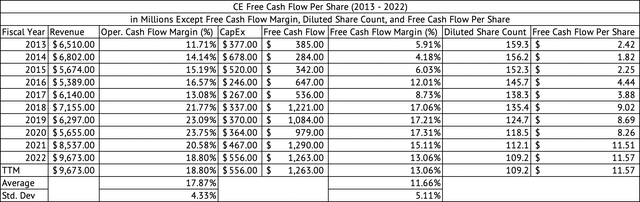

The company trades at a forward GAAP PE of 10.1x compared to its sector median of 15x and its five-year average of 11.5x. But, it is trading at an expensive GAAP Price/Earning-to-Growth ratio of 3.3x. But the company looks inexpensive from a free-cash-flow [FCF] yield perspective. The company's FCF per share was $11.57 in 2022, amounting to a yield of 9.8% (Exhibit 6 ).

Exhibit 6:

Celanese Corporation Free Cash Flow Per Share (Seeking Alpha, Author Calculations)

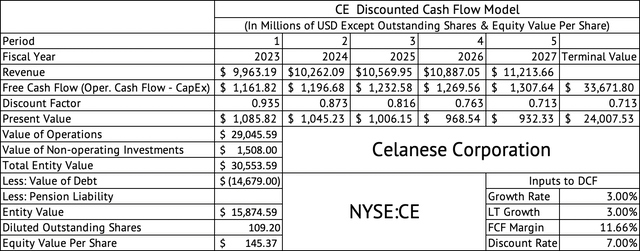

A discounted cash flow model assuming a long-term growth rate of 3%, an 11.6% FCF margin, and a 7% discount rate yields a per-share value of $145 (Exhibit 7). The stock looks cheap based on these metrics. A 7% discount rate assumption may be on the low end, given that the company may have to refinance its debt and pay a much higher interest rate in the future. A 9% or 10% discount rate would be more appropriate for the company long-term. A 9% discount rate puts the per share equity value at $56, a long way from $145 and its current price of $117.

Exhibit 7:

Celanese Corporation Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

This analysis shows the enormous negative influence the company's debt is having on its valuation. The company may be overvalued, considering the discounted cash flow model and the valuation metrics. The U.S. economic growth has slowed considerably in the past few quarters. The U.S. economy grew at a 2.7% pace in the last quarter of 2022.

The housing market is in a deep recession. Fannie Mae reported that the housing market would slow down appreciably in the coming month due to a combination of high-interest rates and low availability of homes for sale. The housing market's troubles may just be starting.

Many companies gouged on low-interest debt during the zero-interest rate period of the past decade. But much of that debt is due in 2025 or beyond, so these companies will do OK today. A weak economy puts pressure on cash flows and makes debt payments hard. This debt overhang in the economy may haunt companies in the coming years.

The consumer is also adding to their debt load, hitting $16.9 trillion at the end of 2022, a record. Consumer delinquencies are rising, and more Americans than ever have a monthly payment on their car that exceeds $1000 or more. Given the global economy's various risks, I recently noted that the volatility index (VIX) is subdued, trading at or below 20. Since then, the VIX has jumped to 23.4 before settling at 21.6.

The Federal Reserve is poised to make further interest rate hikes. The 2-year U.S. Treasury jumped from 4.09% on February 1 to 4.81% on February 24. Fannie Mae noted that mortgage rates, which slipped from 7.3% in November to 5.9% in early February, have spiked to 6.81% in the past three weeks. While interest rates are nowhere close to stabilizing, the U.S. consumer and the economy continue to weaken. The Conference Board Leading Economic Index [LEI] indicates that the U.S. may enter a recession soon.

With the 2-year U.S. Treasury yielding 4.8%, investors can make a good return on U.S. Treasuries. Long gone are the days when cash was trash. Many companies look overvalued based on a slowing economy, high-interest rates, and high debt. We may need a correction in valuation before stocks can be considered cheap. The company's dividend yield of 2.3% is too low for the current rate environment. The company paid $297 million, well covered by its operating cash flow of $1.8 billion in 2022.

Good price momentum

The company had good price momentum over the past three months, returning 10.13%. The materials sector has returned just 0.83% over the same period. Existing stock owners, with substantial gains, can sell covered calls on Celanese to generate an income. March 17, 2023, $120 strike price calls last sold for $2.79 [Friday, February 24, 2023]. That call premium puts the yield at 2.3%, an excellent yield. Investors may be better off selling calls when there is positive momentum with the premiums climbing. The call will be assigned if the stock rises above $120. But, the stock's momentum would have to increase further from the current levels. The company's stock has no short-term catalyst, given that it released earnings on February 23. At this point, only the market's momentum can carry the stock higher.

The economy might be entering a period of uncertainty and slow growth which may affect Celanese's prospects. The stock is overvalued based on the PEG ratio and a discounted cash flow model. The company's inventory costs have increased dramatically, which will take a while to sell, potentially affecting margins in the first half of 2023. Celanese Corporation has to reduce its high debt load. Existing investors with gains on the stock may consider selling covered calls to generate income. New investors may have to wait. Further increases in interest rates may put pressure on the markets giving investors a buying opportunity.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.