Etsy: Holding On To Covid Gains

Summary

- Etsy received a massive spike in business during the pandemic and has managed to hold on to its gains.

- The company is profitable, has multiple growth vectors, and has carved itself a moat around its core marketplace.

- There are a few warts, but Etsy looks to be a strong business for the long haul.

hapabapa

Etsy (NASDAQ:ETSY) is one of the companies I highlighted during Covid as a good long-term holding, despite the run-up. The company got a massive boost from pandemic lockdowns, and quickly became the go-to spot to buy personalized face masks. Many other companies have fallen flat since the economy re-opened, but Etsy has managed to hold onto the vast majority of its gains, and is well-positioned from here to drive meaningful growth.

The company has beaten the market despite having recently doubled when I first wrote. It's one of my core holdings in my IRA, and though I opened a position at ~$30 a share, I've added to it over time.

I want to revisit it here to look at the path forward. There's some pitfalls, including stock-based compensation (a true plague in the market these days), stalling merchandise volumes on the platform, and poor performance with acquisitions. However, the company has carved itself a moat around a differentiated e-commerce platform that reminds me at times of both TJX Companies (TJX) and Pinterest (PINS), while bringing the allure of a neighborhood craft fair online. Expense management is strong, and the company is generating significant and growing free cash flow.

Etsy has set itself apart in a number of ways. E-commerce is a tough business. Gone are the days of poor price transparency for customers. Even when shopping in a retail outlet, it takes a quick search to see if a product is cheaper at another store or online. However, Etsy's products aren't likely to be found anywhere else, and are often handmade. Additionally, via the built-in messaging platform, customers are able to get items personalized and engage in meaningful discussions with the creator they are purchasing from. This "humanizes" the process, and removes much of the competition from other e-commerce outlets.

The company offers assistance to bring sellers online, sells them advertising spots, processes payments on the platform, and offers shipping and seller services while taking a cut all along the way. The company's business model is therefore asset-light while maintaining a strong brand loyalty among its seller base.

Having used the platform, the company's investments into search have yielded positive results. Without SKU's and with most products unbranded, it's vital the company is able to properly categorize and get the right item in front of the customer based on keywords. It sounds rote at this point considering the buzzwords around the market on machine learning and AI, but Etsy's language model algorithm has assisted the company in driving this effort. The company has launched initiatives like Etsy Lens using image search, and uses curated collections to gather user data to more selectively advertise to customers. These curated collections are reminiscent of Pinterest boards, often centered around a life event or theme, which aids Etsy in associating products for the next customer down the line.

The company loves to comp over the previous 3 years. No doubt, 2020 was a transformative year, and it was no small feat for the company to hold on to its Covid gains. The real question now is where do they go from here?

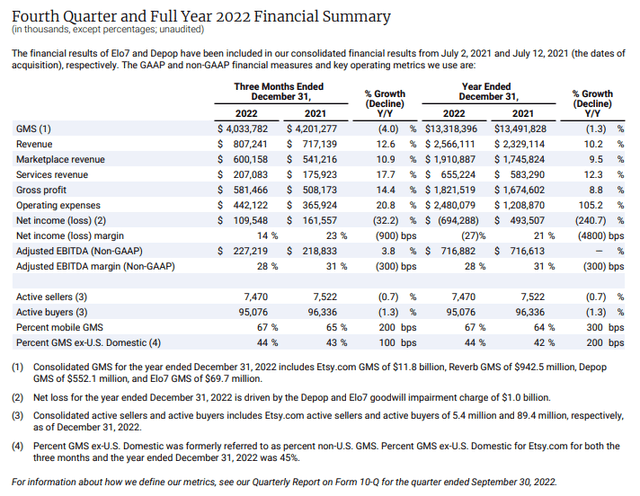

In the most recent quarterly earnings GMS was effectively flat on an FX-neutral basis. Revenues grew 12.6% on an increased take rate from transaction fees and 20% yoy growth in Etsy's Advertising business.

Flat GMS hasn't impacted the company too much considering the increased fees, but it will need to grow as we move forward. The products are almost entirely discretionary, so Etsy will feel the recessionary pinch as customers cut back. This will remain a key risk to the thesis, but most likely a short-term one tied to health of the overall economy.

Notable positives from the quarter included the company's increase in male customers. The cohort has grown 124% since 2019 (you have to love the three year comp's), and is an important growth driver considering the platform was initially female-dominated (and still is in the seller base). Additionally, Etsy has meaningfully grown habitual buyers over time, defined as a customer who shops 6 or more times and spends more than $200 a year on the platform. The company currently boasts 7.4M, who account for 40% of GMV, an increase of 194% since 2019. Finally, 24M dormant users reactivated in 2022, and this remains a key focus for management from here to maintain the health of the marketplace. In all, I'd look for positive indicators like these to feed GMS growth in the coming quarters.

Another positive from the earnings call was the company's update on its India operations. India is obviously a massive market, and it appears Etsy should find great success there culturally considering the handmade nature of its products. Here's some color from the call:

We have about 120,000 sellers now in India with about five million live listings, so we think that's a really encouraging start. And the big asset we bring is the opportunity for the sellers to export to other markets in a very affordable way. For $0.20, you can open a store in India and sell to the world, and so that's how we've been able to get a good number of sellers and listings. Now we are building the belt-and-suspenders to allow for a buyer experience in India as well.

And that requires shipping providers, that requires payments infrastructure. Making sure that we have all the right trust and safety, infrastructure for the Indian culture in the Indian market. And so that's the investment we've been making and the work that we've been doing. We're encouraged by the progress that we're making, and we're very excited about the future.

It's not worth counting the eggs before they hatch, but India could end up as a strong growth driver for the company, if they are able to overcome the cultural hurdles. Williams-Sonoma (WSM) has expanded operations there, as well, in partnership with a local franchisor. As the market matures, the sheer population of the country makes for an incredible opportunity.

Etsy is also now a top-10 e-commerce site in Germany and the UK, and notably a substantial portion of the company's transactions in those countries are now two-sided, meaning the customer and seller are both transacting in the same country.

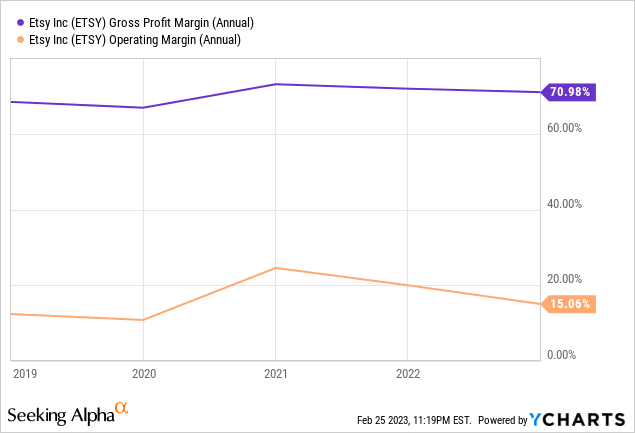

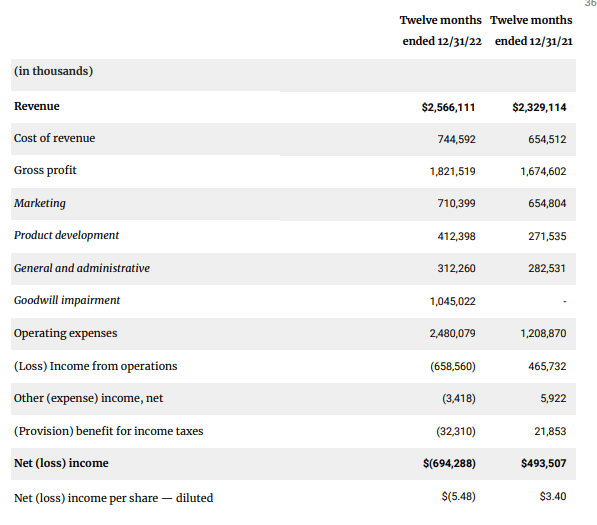

Margins have declined somewhat since the Covid bump. The company has normalized its product development spend (headcount), which increased 36% yoy to 16% of revenues. Additionally, the company invested 20% more in marketing this past year on TV and digital video advertising into the holiday quarter. Overall, the company is maintaining profitability and is very transparent about expenses in company releases.

Company Release

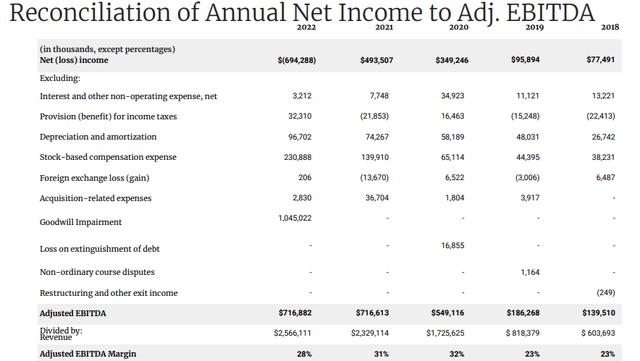

However, the specter of stock-based compensation remains. The company is repurchasing shares to minimize dilution, with a $600M authorization open currently. $230M in SBC this past year accounted for about a third of free cash flow, and is an important consideration since it's likely part of compensation packages and should be looked at by investors as an expense. This is generally one of the most important line items in tech when trying to decipher the adjusted EBITDA figure.

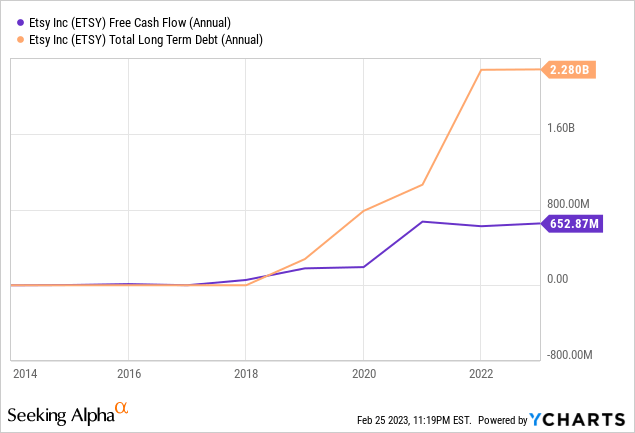

In spite of the SBC, Etsy was free cash flow positive in 2022, driving a healthy FCF conversion compared to EBITDA.

The other eyesore standing out on the release above is the goodwill impairment. It's related to the company's writedown of its Depop acquisition, which cost $1.625B and has now been devalued to more or less $600M.

The company's three acquisitions of Elo7 in Brazil, Reverb (used musical instruments), and Depop (vintage clothing) account for <12% of GMS for Etsy. Reverb is operating around breakeven, while Elo7 and Depop are slightly dilutive to margins and continue to operate at a loss.

The strategy is somewhat understandable, but the success of these acquisitions is very much in doubt considering the Depop writedown. None of them have rolled into the core Etsy marketplace, and I have doubts about the company's ability to generate significant returns off these investments. Elo7 is a top-10 ecommerce platform in Brazil, but it's a tough place to operate in. Going forward, I'd like to see Etsy refrain from additional acquisitions. It's not likely they find many tack-on type acquisitions, and obviously integration thus far has been difficult for the company. In a perfect world, Etsy would be able to drive the company's best practices and guide these marketplaces to the same success Etsy has seen.

Looking at the cash position, Etsy is sitting with $1.2B in cash on the balance sheet and has no liquidity concerns. Free cash flow is positive, and the company is converting EBITDA strongly with an eye on expenses. I'd anticipate meaningful free cash flow growth as the company scales GMS, which will be important to see in the coming quarters.

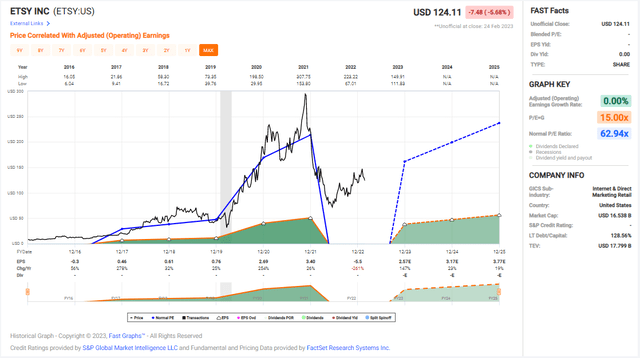

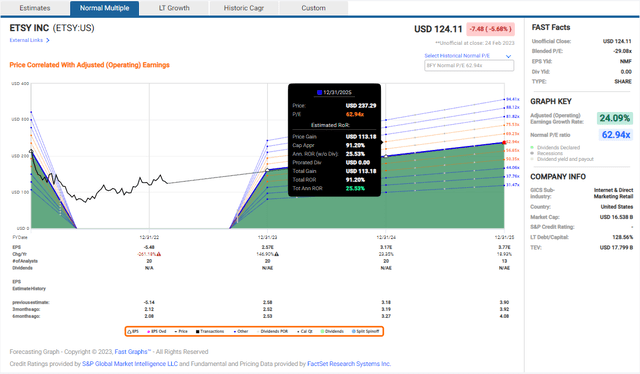

Looking at valuation, the most recent EPS drop is based on the company's goodwill writedown taking EPS to ($5.50) per share. Overall, the company is very expensive on a P/E basis, which isn't surprising.

Based on analyst estimates for earnings growth, and a normal P/E ratio of ~63X, an investment today could yield an annualized total return of around 25% annualized. This figure is not all that useful, but I want to show it for general clarity of the company's valuation. With a P/E ratio that high, compression and expansion over time could easily skew drastically in either direction.

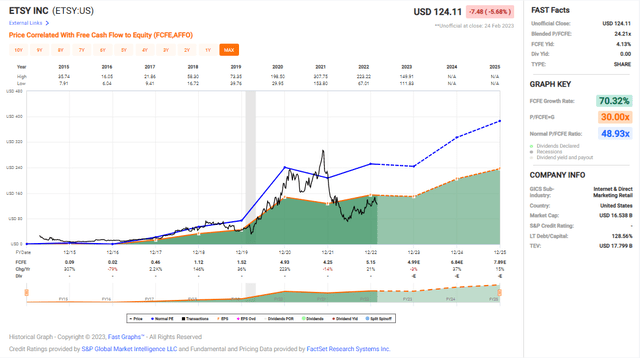

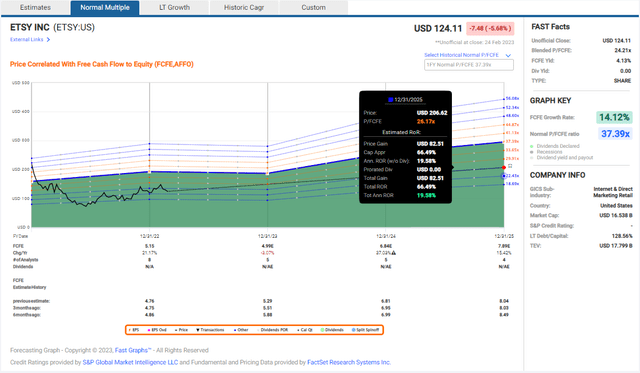

Free cash flow is an easier metric to see the company's growth through. As I discussed above, Etsy has a strong history of meaningfully converting its EBITDA to free cash flow, stock-based compensation notwithstanding. The company has compounded FCF at a 70% rate since going public (from a small base, obviously).

Based on analyst estimates for free cash flow growth and maintaining its current valuation (the average is less useful here considering the early days the company was public), an investment today could yield around 20% annualized total returns.

In all, I'm a fan of Etsy's business, and I think it's fairly valued today. There are some open questions and risks for investors to consider. The company's performance on acquisitions, slowing growth in GMS, and recessionary pressure are key points to watch going forward. However, Etsy's differentiated platform, strong operating history, and the ability to hold on to its Covid gains are indicators of a good management team and a business I want to own. Free cash flow growth looks robust, and so long as Etsy keeps SBC in check, I could see the company as a strong compounder that continues to beat the market into the future. Etsy is a buy.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ETSY, WSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.