Ignore The Headlines, Buy EPR Properties

Summary

- The company has been hit hard - first by Covid, then by high rates, and finally by the bankruptcy of its third biggest tenants.

- Still, it delivered significant growth in 2022 and is very well positioned to handle the problems it faces with a very strong liquidity position.

- The company pays a well-covered 8% dividend on common stock as well as preferred shares which can provide additional protection to income-oriented investors.

- EPR stock is worth a BUY even when assuming that EPR never sees another dime from space rented to Regal.

RgStudio

Dear readers/followers,

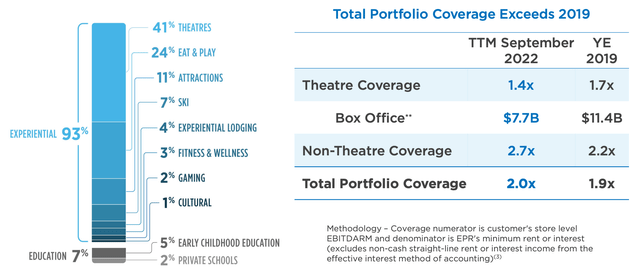

Today I want to analyze EPR Properties (NYSE:EPR) which is a REIT focused on experiential real estate. The company owns 363 properties worth $6.7 Billion in the US and Canada and leases their properties to over 200 tenants. It is very heavily weighted towards movie theatres (41% of revenue), followed by the eat & play concept (mainly Topgolf and Go karts) which accounts for further 24% of revenue. Lastly the company also has exposure to amusement parks, ski resorts and other attractions. Notably, the company has been trying to reduce their exposure to theatres and education and focus more on the remaining segments - this has been reaffirmed by recent acquisitions, but the transition has been very slow.

The stock has been under pressure ever since Covid shut-downs started in early 2020. In addition to high interest rates, EPR currently faces two issues that have investors worried.

Issue #1: Secular decline in movie theatres

Movie theatres were closed during Covid and although sales have picked up since, they are still significantly below pre-pandemic levels. Operators are doing everything they can to get people back in as they transform the customer experience through expanded food and beverage concepts, luxury seating and the latest technology. EPR tries to make the case in their presentation that the emergence of streaming is not real threat as people tend to stream shows but prefer to see major movie releases in cinemas. Personally, I think movie theatres are here to stay and as long as operators stay on top of recent trends and curate the experience accordingly, I believe that people will continue to go to movies. With that said I'd welcome higher exposure to other experiential types of properties.

Regardless of where the industry heads in the future, poor performance over the past two years has resulted in Regal (a major tenant accounting for 12.6% of revenue) filing for protection under Chapter 11 in September 2022. This caused the stock price to fall by almost 20% as investors panicked. As bad as it is, Regal actually continues to pay rent for now, but since there are no guarantees that this will continue, EPR recognizes the revenue on a cash basis. Regal's parent company tried to sell the whole business, but that hasn't been successful. The situation will likely have to get resolved through some kind of a restructuring scheme which is set for a vote on May 30. With this uncertainty in the way, I don't expect the stock to rally before it gets resolved.

Issue #2: Weakening consumer spending

The fact that the entire portfolio is centered about people going out and spending money on experiences makes the company quite susceptible to an economic slowdown. If the economy falls into a recession and unemployment increases, people will likely cut their spending on non-essential things - including going to movies, eating out and going on vacation. While I am not very bearish on the US economy and think that a potential recession would be rather mild, investors should keep in mind that EPR is likely to struggle in that kind of environment.

Financials

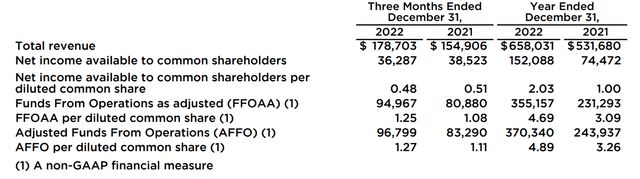

EPR has a solid portfolio with occupancy of 97% and despite the headlines, the company posted really impressive numbers for 2022. In particular, total revenue increased by 24% YoY driving an increase in AFFO of 50% YoY to $4.89 per share. Due to the uncertainty related to Regal's bankruptcy proceedings, the Company did not provide 2023 earnings guidance. Earnings guidance is expected to be provided subsequent to the resolution of such proceedings. Analysts expect FFO to be basically flat for the next two to three years.

The company has continued to invest in its experiential portfolio to decrease the relative exposure to movie theatres. In 2022, with $402.5 Million spent on acquisitions and development. Further $250 Million has been committed to growing the portfolio over the next two years.

With regards to its balance sheet, EPR has plenty of liquidity with cash on hand of $110 million and unsecured revolving credit facility of $1.0 Billion (unused to date). Their debt maturity profile is also very good, with no maturities in 2023 and only $136 Million due in 2024. This gives the company plenty of time to sort out Regal's bankruptcy and weather the high interest rate environment that we have now. The entire debt amount has a fixed interest rate that averages 4.32% - a little on the higher side, but given that the company has no debt to refinance over the next two years, I am ok with it.

The company pays a monthly dividend of $0.275 ($3.3 per year) translating into a dividend yield of 8.0%. With an AFFO of $4.89, this dividend is well covered with a payout ratio of 65%. Even if the negotiations with Regal fail and the company loses 12.6% of revenue, the dividend would still be covered!

The company also offers three series of preferred shares that yield between 7.4% and 7.9%. These could be of interest to investors that live off their portfolio as the dividend is likely safer with the preferred shares (for example during Covid they stopped dividends on common stock but continued to pay them on preferred shares). Personally I'll stick with the common stock due to a bigger upside potential.

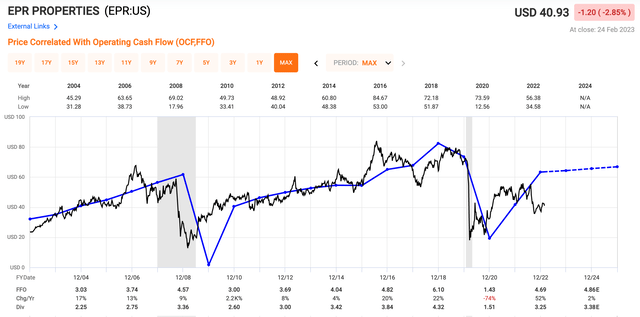

Valuation

The company is currently cheap as it only trades at a P/FFO of 8.7x compared to a historical average of 13.5x. Some discount is justified given the uncertainties related to Regal, but with very strong results in 2022 and a great balance sheet/liquidity position, it is hard not to be bullish at this level. Even with FFO expected to remain flat until 2025, if the stock normalizes by then, investor will earn a 16% annual return from multiple expansion alone as the price reaches a PT of $63 per share. Add to this the 8% dividend, that's unlikely to get cut in my opinion, and you have a stock with a potential 24% annual return over the next three years.

If we assume the worst case scenario that Regal doesn't pay another dime and EPR doesn't find a new tenant for the properties, FFO will decrease by 12% to $4.13 per share. Multiplying this by a multiple of 13.5x we get a worst case PT of $55 per share which is still 37% above the current share price (11% annualized return). Any way you look at it, the company is undervalued.

So with that said, what can we reasonably expect from EPR?

- 8% dividend yield

- 0% FFO growth for the next two to three years

- 11% annual return from multiple expansion as the company normalizes (assuming worst case scenario)

- -> total return of 17% per year (that's solid alpha)

Remember how I look to generate alpha:

- start with a thesis why a given industry/sector should outperform

- stay overweight in those sectors for as long as the thesis is valid

- look for companies with sound fundamentals that are either undervalued or fairly valued with exceptional growth prospects

- if a company becomes overvalued, trim the position, and rotate into another stock/sector that is still undervalued

- if a company becomes increasingly undervalued and the thesis is still valid, add to the position

- generate alpha and repeat

My total return then comes from the dividend yield, EPS growth and multiple expansion as the valuation normalizes over time. I always target a total return in excess of market returns (>8%) to generate alpha.

What things do I look for when selecting individual stocks to buy?

- strong and safe fundamentals

- good management teams with a track-record of caring about shareholders

- healthy EPS growth

- well-covered dividend

- discount relative to peers and/or historical fair multiples

- other catalysts

Verdict

The investment comes down to whether or not you think the Regal bankruptcy will get resolved and how you see the movie theatre as a whole going forward. Personally, I really like EPR's experiential portfolio and although I am not thrilled about the movie theatre exposure, I think that the industry will do fine going forward as long as operators innovate. I will keep a close eye on Regal's bankruptcy proceedings.

EPR's financial position is very strong. They delivered strong results in 2022 and I really like their balance sheet (with $1.2 in liquidity and no major debt maturities until 2025) which will enable them to deal with the Regal bankruptcy as well as a period of high interest rates. The company is trading at a major discount and could earn up to 16% a year from multiple expansion alone when the valuation normalizes. On top of this investors will enjoy a well covered 8% yield, for a total annual return of 24%. Even in the worst case scenario assuming EPR never sees another dime from space rented to Regal, total annual return would reach 17%. While I recognize that there are some risks, mainly related to an overall movie theatre decline and an economic slowdown, I believe the company is very undervalued and well positioned to generate alpha. Therefore I rate EPR stock as a "BUY" here at $41 per share with a PT of $55 per share (based on the worst case scenario).

This article was written by

Disclosure: I/we have a beneficial long position in the shares of EPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.