Realty Income's Results: The Good, The Bad, The Ugly

Summary

- Realty Income just released its full year results.

- Its 2022 results were very good, but the guidance for 2023 is concerning.

- We share our thoughts and highlight some other REITs.

- We're currently running a sale at my private investing ideas service, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

blackred/E+ via Getty Images

Realty Income (NYSE:O) is a popular REIT that pays a monthly dividend that has been hiked for over 20 years in a row.

It just released its full-year results and issued its guidance for 2023.

There was some good, but also some concerning news.

Let's start with the good news:

The Good

2022 was a very good year for Realty Income.

Its AFFO per share increased its 9.2% for the full year, which is spectacular for them. Typically, they are happy if they are able to grow by around 5%.

They were able to grow by so much thanks to major acquisitions that they sourced in recent years:

- The merger with Vereit is still yielding synergies

- The acquisition of a major casino for $1.7 billion

- The acquisition of a 185-property portfolio from CIM Real Estate for nearly a billion

Realty Income

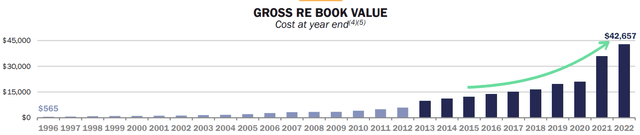

Last year alone, they acquired ~$9 billion worth of properties. That's a new record for the company and it contributed to a great year.

The Bad

The rent hikes of the company are expected to remain below average in the net lease sector.

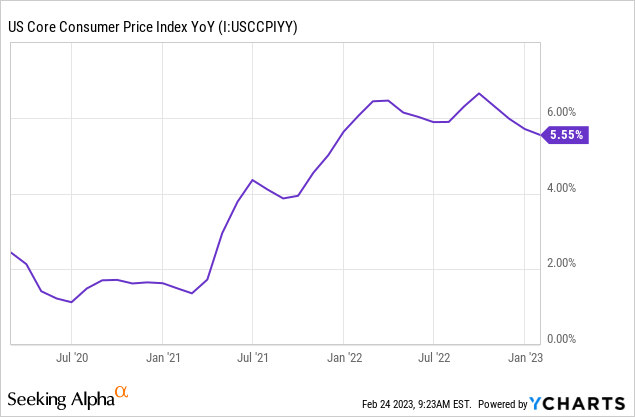

Its same property rents are expected to rise by just 1.25% in 2023, and that's despite still facing high inflation:

Its close peers enjoy faster rent growth because they have larger contractual fixed hikes and/or CPI adjustments in their leases.

| Realty Income | Realty Income | High-quality Net Lease Peer Group (VICI, EPRT, WPC) |

| Rent escalations (2023) | 1.25% | 1.7% - 2% |

| CPI adjustments | No | VICI and WPC: yes. EPRT: no, but it has larger fixed rent hikes to compensate |

As a result, Realty Income is a lot more dependent on new property acquisitions to grow, but unfortunately, this is now getting harder:

The Ugly

In 2023, Realty Income has guided to grow its AFFO per share by just 1.5%, which is even less than what we expected.

Why so little?

Well, it is getting a lot harder for Realty Income to grow externally because of its huge size and the now much smaller investment spreads.

Just look at how big Realty Income has become:

This makes it harder for them to grow because the impact of new acquisitions is now much smaller on the bottom line.

They need to source a huge amount of accretive deals to grow, but this is now getting a lot harder because the cost of capital has risen and few investors are willing to transact.

As a result, Realty Income expects nearly 2x smaller investment volume in 2023, despite now being a lot larger than in early 2022.

Just recently, the company raised some debt with a ~5% interest rate, but its new acquisitions have historically had a 5-6% cap rate.

This also forces Realty Income to chase higher yields in other property sectors that they may not know quite as well:

Illustrating this philosophy was the acquisition of our first gaming asset, the Wynn Encore Boston Harbor, which contributed to a record quarter for property-level acquisitions during the fourth quarter of approximately $3.9 billion. In addition, since the start of the fourth quarter, we have acquired properties in several distinct verticals for future potential growth, including investments in properties related to the consumer-centric medical industry, a debut transaction in Italy, and the formation of a real estate development partnership with a leading vertical farming operator. [emphasis added]

Realty Income is very well managed and I don't doubt that these moves make sense, but it increases risks since they don't have long track records in these sectors.

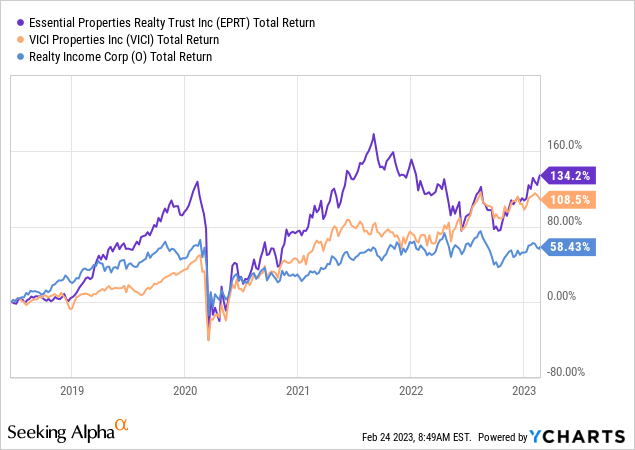

And despite that, they still won't be able to grow meaningfully in 2023. Its close peers are able to grow far faster because they have larger rent escalations, they are smaller in size, and they earn higher spreads in different sub-segments of the net lease sector.

To give you an example: Essential Properties Realty Trust (EPRT) is expected to grow its AFFO per share by 5% in 2023.

Conclusion

Realty Income remains a great REIT if you are a retiree who needs steady monthly income. Its Class A portfolio is leased to high-quality tenants such as Dollar General (DG), Walgreens (WBA), FedEx (FDX), and Walmart (WMT), and they should keep paying their rent even in a recession.

But if you are focused on total returns, I want to reiterate that Realty Income isn't the right choice in the net lease property sector.

Its growth is not keeping up with that of peers like EPRT and VICI and therefore, its future total returns will likely remain inferior.

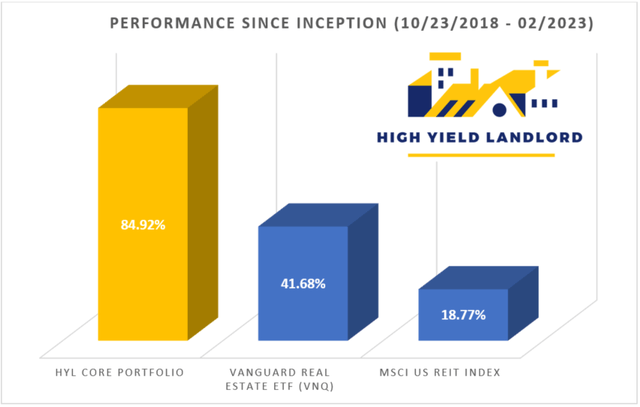

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of O; WPC; EPRT; VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.