XES: Oil & Gas Services ETF Can Continue Outperforming

Summary

- XES invests across oil & gas equipment and services companies.

- The industry is benefiting from a strong investing cycle by energy producers following a record year for the sector.

- The fund is well positioned to continue delivering positive returns benefiting from several market tailwinds.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

curraheeshutter

The SPDR S&P Oil & Gas Equipment & Services ETF (NYSEARCA:XES) provides targeted exposure to the leading companies within this critical segment of the energy sector. Following a record year for oil & gas producers benefiting from elevated pricing, the setup in place is a push to continue investing toward more output and future growth supporting a positive outlook for equipment and services providers.

Indeed, even as energy prices are down from highs, the attraction here is a sense that the companies within XES are less directly exposed to the near-term oil and gas volatility. Favorably, XES has outperformed several sector benchmarks and we expect that positive momentum to continue. Fundamental factors including firming margins and climbing profitability can mark the next leg higher for XES in 2023.

What is the XES ETF?

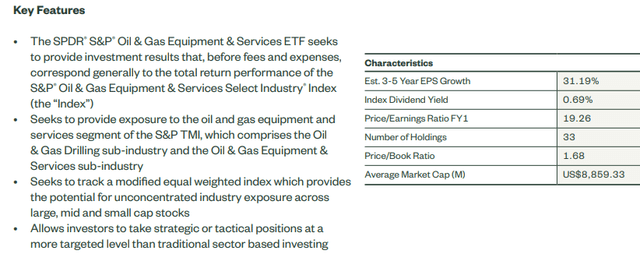

XES tracks the combination of the S&P Oil & Gas Equipment & Services Select Industry Index and the Drilling sub-Index. These companies contribute to a wide range of activities across the supply chain such as exploration, extraction, transportation, and refining of crude oil and natural gas. The fund and underlying index use a modified equal-weighting methodology that is float-adjusted.

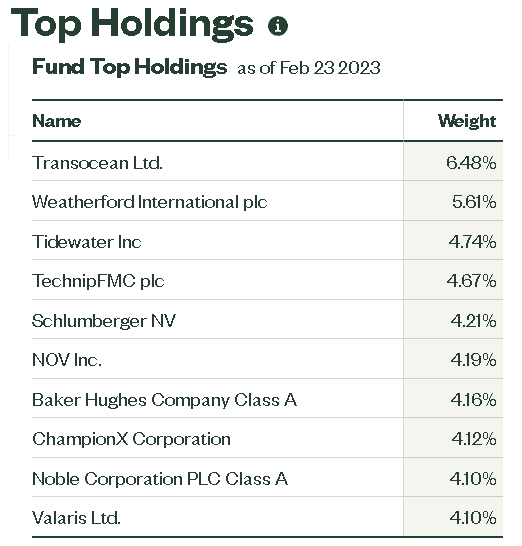

The portfolio has 33 holdings with Transocean Ltd (RIG) as the largest current position with a 6.5% weighting. RIG is recognized as one of the world's largest offshore drilling contractors, alongside Schlumberger NV (SLB) with a 4.2% weighting.

While several names focus on outsourcing drilling equipment and related engineering services, there is a broader diversity of the types of activities companies are leading in. A push toward the integration of tech in seismic data and geological analysis, alongside the use of robotics, are some of the high-level themes of the industry with TechnipFMC PLC (FTI) as an example specializing in "subsea activities".

source: State Street

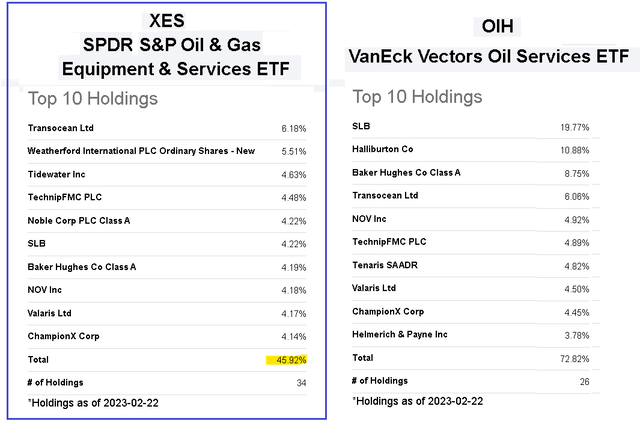

Keep in mind that XES is not the only ETF in this category. We can bring up the larger VanEck Vector Oil Services ETF (OIH), which has $2.3 billion in AUM compared to around $530 million in XES. While both cover many of the same oil services stocks, one advantage of XES is that it is less concentrated among the top holdings compared to OIH. The top 10 holdings in XES represent 46% of the fund compared to 73% in OIH.

For example, SLB and Halliburton Co. (HAL), alone represent nearly 30% of OIH through a market-cap-based methodology, compared to just 8% in XES with the modified equal-weight weighting model. By this measure, a wider range of companies plays a larger role in contributing to the XES's return performance.

XES Performance

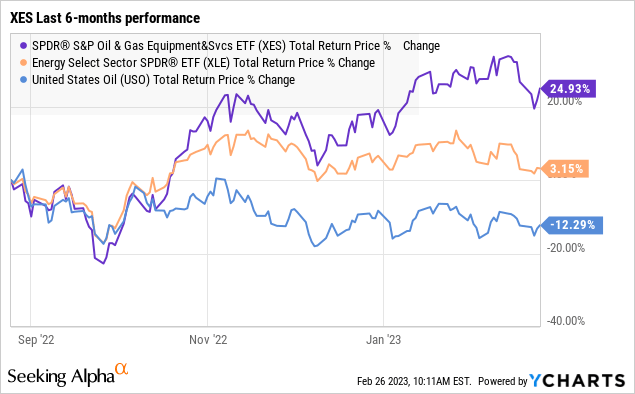

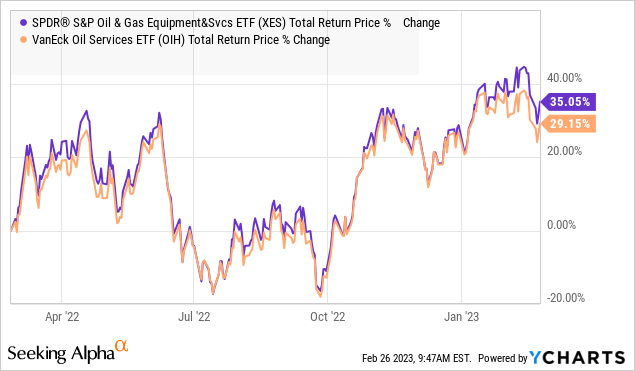

Over the past year, XES has returned 35% compared to 29% from OIH. Going back further the performance spread is mixed with OIH leading in different time frames, although our takeaway is that XES often outperforms OIH, particularly during industry bull markets, with some of the more volatile small-caps in the fund leading higher.

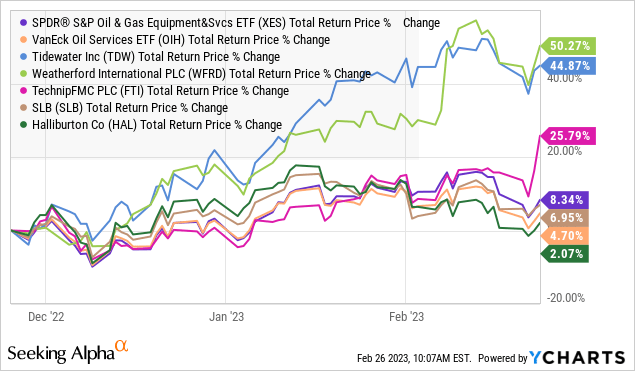

In other words, OIH would be more dependent on the factors driving SLB and HAL, while XES should better capture the overall trends of the broader industry. Over the past three months where some of the top holdings in XES like Weatherford International PLC (WFRD) and Tidewater Inc (TDW) have broken out higher, gaining 50% and 45% each respectively, SLB and HAL have a smaller gain only in the single digits.

XES Price Forecast

The story for oil & gas equipment & services providers has been the earnings momentum that is expected to continue. The understanding is that this group is driven by the Capex spending cycle from the producers that are flush with cash in what remains a favorable market pricing environment even considering the recent pullback.

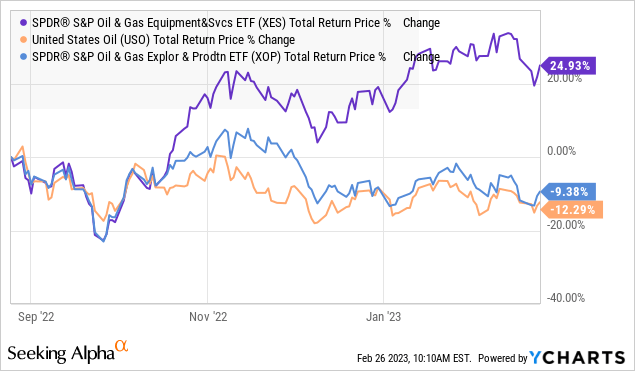

This means that beyond the daily volatility in oil and gas, the companies within XES are generating steady cash flows based on orders and contracts put into place last year as E&P companies moved to expand output. This dynamic is evident as XES has diverged higher compared to the price of crude oil (USO) and the alternative SPDR S&P Oil & Gas Exploration and Production ETF (XOP) which are down in recent months.

Within the bullish case, we see room for margins by XES to outperform based on the combination of easing supply chain disruptions that previously impacted the availability of equipment going back to manufacturing bottlenecks observers in 2020 and into last year. Lower inflationary pressures on the cost side should be positive for earnings.

From there, there is also the potential that oil & gas commodity prices can rebound higher, from our view that the level in crude around $75 per barrel is technically oversold. A sustained rally from here could take hold either with evidence of stronger global growth conditions on the demand side, or lower production increases going forward. Considering what is still a volatile situation in Eastern Europe, it's fair to say that risks are tilted to the upside.

While sharply higher oil and gas prices would likely be more positive for E&P names, XES would nevertheless benefit from a new wave of positive sentiment toward the sector. In the current environment, we sense XES has a more balanced setup that should keep the momentum positive. Overall, we like the fund that is well-positioned to keep delivering positive returns.

In terms of risks, the concern would be for a deeper deterioration of the macro outlook. Sharply lower trends of industrial activity in key regions beyond North America like Asia-Pacific or Europe would open the door for a leg lower in energy prices and force a correction in XES. On the downside, $70 is an important area of support for the fund to hold.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XES over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.