Southwestern Energy: The Comeback Kid

Summary

- In this article, we start by discussing the return of the natural gas bull case after more than a decade of depressing prices, hurting producers like Southwestern Energy.

- Southwestern Energy is back, as it uses higher prices to quickly reduce debt, while longer-term tailwinds like LNG provide opportunities to improve pricing and reduce hedges.

- I believe that SWN is significantly undervalued. However, it remains a highly speculative and volatile stock.

mysticenergy/E+ via Getty Images

Introduction

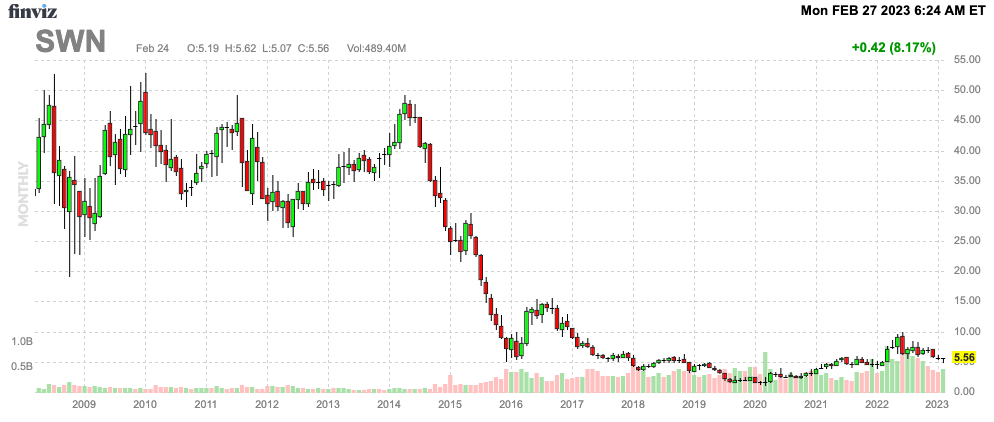

The other day, when I was working my way through my oil and gas research, I found out that I had never covered Southwestern Energy (NYSE:SWN), a company I have followed since the day I started trading more than 12 years ago. Southwestern Energy was one of the stocks that always seemed to be in a downtrend, as it was in the wrong place at the wrong time. Natural gas production growth was so high that demand didn't keep up. When adding several commodity crashes, it's no surprise that SWN has a terrible track record of shareholder value generation.

That said, the company is a comeback kid. The natural gas bull case is back, its debt load is quickly being lowered, and management is making smart decisions when it comes to the company's future in LNG and cutting production when it matters most.

As I have never covered the company on Seeking Alpha (or anywhere else), it's time to dive in, as I will give you my thoughts on the improved SWN company using its just-released quarterly earnings and my view on natural gas.

Natural Gas Is Back

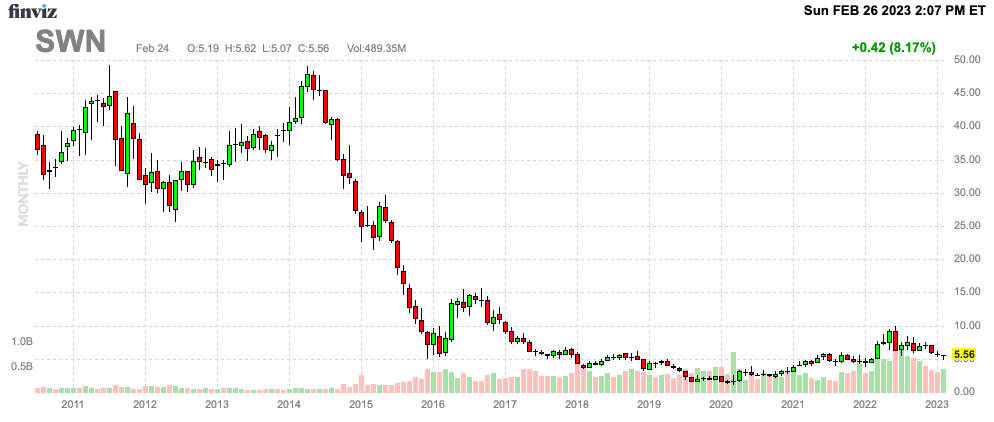

The long-term SWN stock price chart is downright ugly.

FINVIZ

Essentially, the SWN chart is a tale of two major macroeconomic themes. On the one hand, we have a company that fell victim to its industry's success.

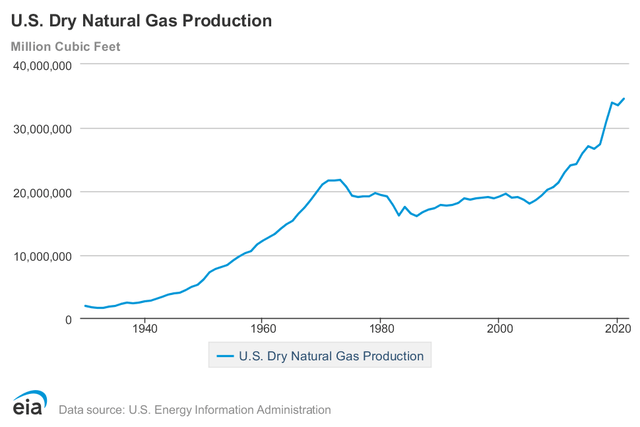

Thanks to the natural gas shale revolution in the early 2000s, natural gas production exploded from roughly 20 trillion cubic feet per year in the year 2000 to currently roughly 35 trillion cubic feet. When oil production accelerated too after the Great Financial Crisis, we got an environment where supply growth was just too strong compared to demand growth.

Energy Information Administration

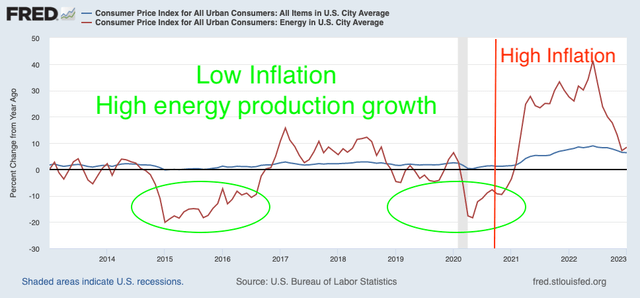

On the other hand, what was bad news for companies like Southwestern was good news for the US and its consumers, as cheap energy was able to keep inflation subdued. Subdued inflation and accommodative Central Banks (not just in the US) provided tremendous returns for investors buying growth stocks.

I visualized this in the chart below. Pre-2021, energy inflation was more often than not a driver of deflation.

Federal Reserve Bank of St. Louis (Author Annotations)

Now, that is changing.

Using the EIA's own estimates, we can expect natural gas prices to remain elevated versus pre-pandemic years.

Energy Inflation Administration

This is what the EIA said in its most recent forecast:

In our January Short-Term Energy Outlook (STEO), we forecast the natural gas spot price at the U.S. benchmark Henry Hub will average $4.90 per million British thermal units (MMBtu) in 2023, more than $1.50/MMBtu lower than the 2022 average. We expect prices to stay nearly the same in 2024 as dry natural gas production continues to grow in the United States and outpaces domestic natural gas demand and exports for most of the year.

It looks like we're going back to normal as the EIA sees outperforming supply growth.

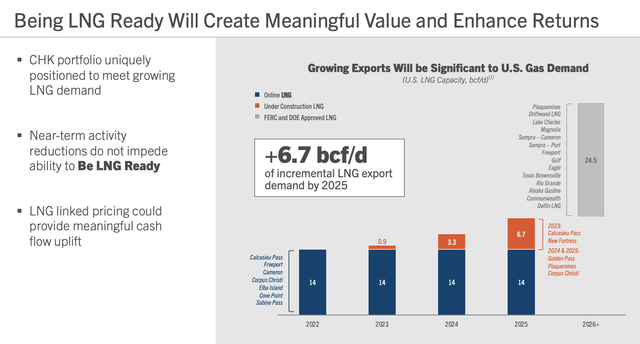

That said, the organization covered domestic demand. International demand is where it becomes really interesting. On top of slowing supply growth, international demand is accelerating. In 2022, the US was capable of exporting 14 billion cubic feet of natural gas per day. That number will soon accelerate to 20 billion cubic feet.

After 2026, another 24.5 billion cubic feet is set to be added to daily demand, according to SWN competitor Chesapeake Energy (CHK), which I discussed in this article.

Chesapeake Energy

In other words, there is a terrific case to be made for long-term above-average natural gas prices in the United States.

That's why SWN is now turning into a comeback kid.

The Comeback Kid

Headquartered in Spring (Houston area), Texas, Chesapeake is a major operator in the Haynesville and Appalachia natural gas basins. Appalachia operations cover West Virginia, Pennsylvania, and Ohio. In this area, the company is mainly focused on the Marcellus Shale, the Utica, and the Upper Devonian unconventional reservoirs.

Southwestern Energy

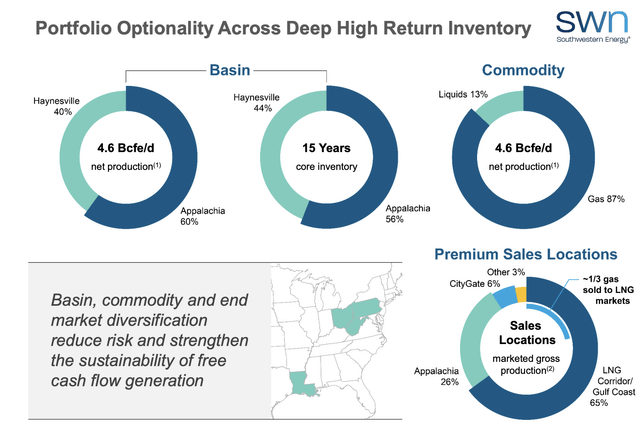

87% of the company's production is natural gas. The company has 15 years of core inventory. And 56% of this is located in the Appalachian Basin, which accounted for 60% of 2022 production when the company produced 4.6 billion cubic feet equivalent per day (bcfe/d).

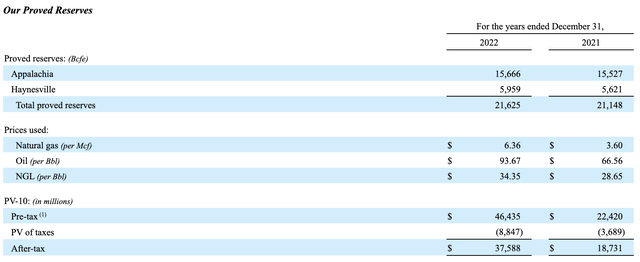

The company's proven reserves are roughly 21.6 trillion cfe, which is up from 21.1 trillion in 2021. This results in an after-tax PV-10 of $37.6 billion.

After-tax PV-10 is a measure used in the oil and gas industry to estimate the present value of future oil and gas revenues after accounting for taxes and discounting at a specified rate. PV-10 is an acronym for "present value at a 10% discount rate."

Southwestern has an enterprise value of $10.4 billion, based on its $6.1 billion market cap and $4.3 billion in expected 2023 net debt.

In other words, one could buy $37.6 billion in reserves for $10.4 billion. That's like buying a dollar for 28 cents.

Unfortunately, it's not that easy. As one can see below, the company's 2021 PV-10 was $18.7 billion. That's half of what it was in 2022. The main driver of the surge isn't slightly higher proven reserves but much better than expected pricing. In an environment of elevated prices, the company's PV-10 trades at prices that suggest a significant undervaluation of SWN shares.

Southwestern Energy (SEC 2022 10-K)

With that said, while I believe that we're in a period of prolonged above-average energy prices, there's more to it.

SWN isn't the struggling gas producer it was in the past.

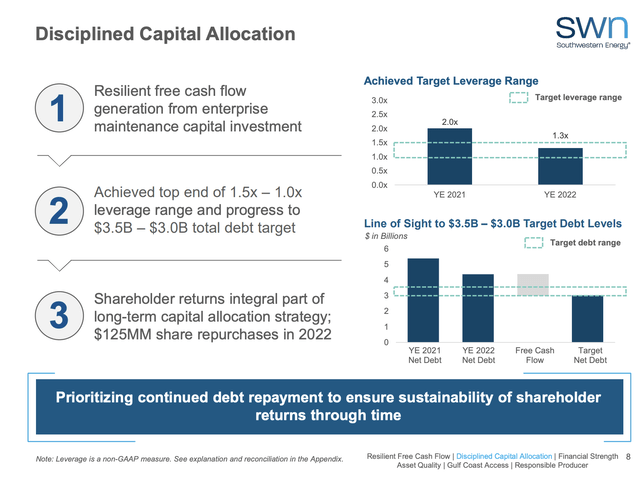

Like almost all of its peers, the company has used the past few years to its benefit. Thanks to its disciplined capital allocation, the company has lowered its leverage ratio to 1.3x EBITDA. That number was 2.0x EBITDA in 2021.

Southwestern Energy

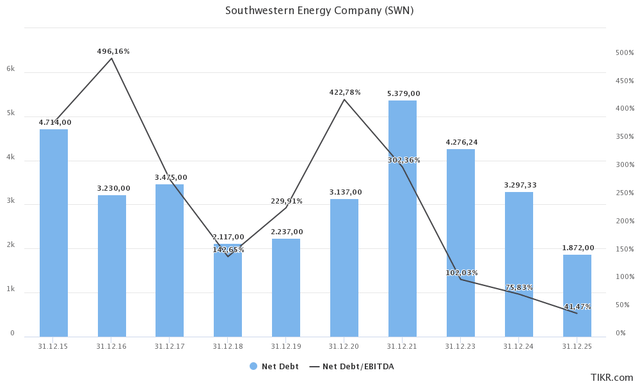

As the chart below shows, the company used higher prices to rapidly reduce net debt. This is expected to continue, as analysts expect net debt to be lowered to less than $2.0 billion in 2025. Based on conservative EBITDA estimates, this would end up in a net debt ratio of less than 0.5x EBITDA. Please note that 2022 is excluded from the chart below. I noticed that some services are slow to include new data. It's not perfect, but it doesn't matter too much for the sake of what I'm trying to explain here.

TIKR.com

While companies with stronger balance sheets returned cash through dividends, SWN was mainly focused on debt reduction. In 2022, the company reduced gross debt by more than $1 billion. It also repurchased shares worth $125 million. However, for now, that does not have a major impact.

Moreover, the company benefits from the fact that it has no maturities until 2025. This buys the company a lot of time, especially given the challenges that come with the current high-rate environment. Note that the company's balance sheet has a BB+ rating, with two of the three major rating agencies applying a positive outlook. The company is now one step away from being investment grade.

Southwestern Energy

Moreover, as a result of natural gas price volatility, drillers are reducing output. EQT Corp. (EQT) and Chesapeake Energy are reducing output. The same goes for Southwestern.

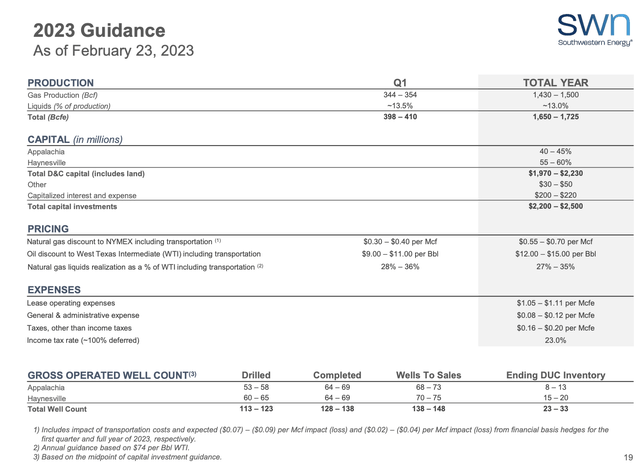

During the earnings call, the company explained its production plans in light of the current market conditions. They stated that they had taken proactive steps to moderate planned activity and associated full-year capital by reducing the drilling program by an average of two rigs compared to the previous year. As a result of these measures, they expect a 2% to 3% decline in production at the midpoint of their guidance.

Any further adjustment to their production plans will be based on a multi-year outlook for commodity prices and what they believe will best progress their longer-term business and financial objectives. Overall, the company is taking a cautious approach to its production plans in response to current market conditions while also ensuring they are well-positioned to capitalize on future opportunities.

Southwestern Energy

Moreover, it needs to be mentioned that the company has hedged a big portion of its production.

The company has hedged 64% of its 2023 natural gas production. 39% of 2024 production has also been hedged. These hedges will be reduced gradually as financial health improves.

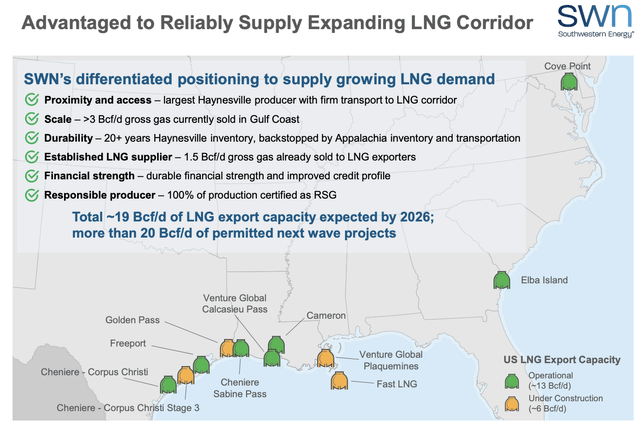

Adding to that, SWN is capitalizing on the aforementioned uptrend in LNG demand.

Southwestern Energy

The company currently supplies 1.5 billion cubic feet (bcf) of natural gas per day to LNG exporters, making them the largest supplier in the area. They believe they are well positioned to supply increasing energy demand and capitalize on longer-term natural gas fundamentals.

The company also highlighted the relative contraction in the balancing mechanism for the natural gas market over the last decade. While U.S. natural gas supply and demand have more than doubled, natural gas storage capacity has remained flat. This means that smaller changes in relative supply and demand can drive quicker and more significant changes in pricing.

Looking ahead, the company expects that structurally constructive natural gas supply and demand dynamics will remain strong, driven by energy security and global decarbonization. They highlighted the imminent return to service of the Freeport facilities, which will add an additional 6 Bcf per day of U.S. LNG export capacity. SWN is well positioned to benefit from these developments with their proximity to the U.S. Gulf Coast and direct access to the growing LNG corridor through their firm transportation portfolio, enabling delivery of natural gas from across their business.

Valuation and Personal Opinion

SWN is trading at 4.1x 2023E normalized EPS and 2.5x 2023E EBITDA. Both of these numbers are extremely undervalued. Chesapeake Energy, for example, is trading at 7x EPS. In this case, SWN is cheaper as the company isn't paying a dividend, it's mainly focused on debt reduction, and subject to higher hedges. Investors betting on higher energy prices are better off buying a company that comes with a (high) dividend, higher buybacks, and a balance sheet that is already healthy. Hence, my favorite natural gas pick is Antero Resources (AR), which I explain in this article.

FINVIZ

I believe that SWN could double when natural gas prices rise again. Even if I'm right, the stock would not be overvalued.

That said, SWN is still a comeback play. Meaning, it's a good trade for people who want to buy undervalued comeback stories.

However, in my humble opinion, there are other fantastic stocks in a better position. That's why I'm not buying SWN.

Takeaway

After discussing Southwestern Energy in this article, I believe the company has turned the corner after years of disappointing shareholder returns. With the rapid reduction of debt, the balance sheet is now much healthier, and access to LNG terminals will provide long-term pricing benefits. Additionally, the expected long-term bullish case in natural gas makes the company seriously undervalued in light of its earnings power and proven resources, especially if hedges come down in the years ahead.

Therefore, I consider SWN shares to be a great investment option for those seeking undervalued energy exposure with the potential for a turnaround.

However, as an investor, I prefer to buy companies that align more with my risk profile and strategy, and that are currently in a stronger financial position.

So, please bear in mind the above-average volatility and related risk when doing your own research.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.