BSJN: Absence Of Matched Maturity Collateral Case Study

Summary

- Invesco BulletShares 2023 High Yield Corporate Bond ETF is an exchange traded fund.

- The fund is composed of high-yield bonds and has a term structure (it will terminate on or about Dec. 15, 2023).

- Currently, over 40% of the fund collateral matures later than the fund's December 2023 maturity date, introducing market risk in the structure.

- The fund has a 6% 30-day SEC yield and an 8.5 standard deviation (3-year look-back).

- When matched maturity term funds approach their termination date, investors can usually ride the fund's yield given the full return of principal - it is not the case for BSJN, where market risk is still present in the structure.

Olena Lishchyshyna

Thesis

Invesco BulletShares 2023 High Yield Corporate Bond ETF (NASDAQ:BSJN) is an exchange traded fund. The vehicle falls in the term fund category, having a defined maturity:

The Invesco BulletShares 2023 High Yield Corporate Bond ETF is based on the Nasdaq BulletShares USD High Yield Corporate Bond 2023 Index. The Fund will invest at least 80% of its total assets in corporate bonds that comprise the Index. The Index seeks to measure the performance of a portfolio of US dollar-denominated, high yield corporate bonds with effective maturities in 2023. The Fund does not purchase all of the securities in the Index; instead, the Fund utilizes a "sampling" methodology to seek to achieve its investment objective. The Fund and the Index are rebalanced monthly. The Fund has a designated year of maturity of 2023 and will terminate on or about Dec. 15, 2023. See the prospectus for more information.

Currently, over 40% of the fund collateral matures later than the fund's December 2023 maturity date. That is a bit outside the stated goal above, where the Index is supposed to measure the performance of high yield corporate bonds with effective maturities in 2023.

When matched maturity term funds approach their termination date, investors can usually ride the fund's yield given the full return of the principal. It is not the case here, with market risk still present in the structure. That basically translates into uncertainty on where the fund NAV will be at the end of the year, and whether the current 6% 30-day SEC yield can be considered a safe distribution.

If we have another leg down in this market, we will see the fund's NAV lose value, and it could negate a large part of the dividend yield. This set-up makes this fund unappealing as a cash parking vehicle for investors who are not already in the name. We would argue that even investors who have holdings here can crystalize their gains and go for true risk-free instruments yielding close to 5% for the rest of the year.

Holdings

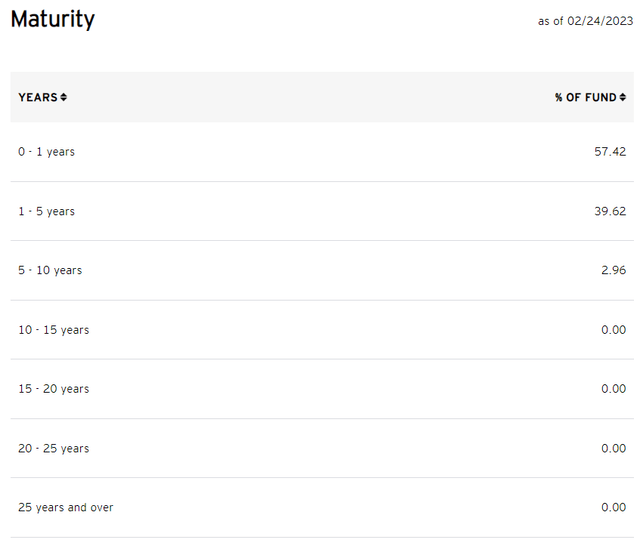

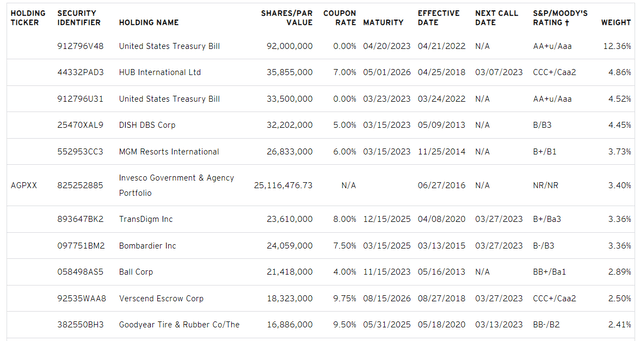

When looking at a detailed table of the holdings, we can notice that a large proportion of the bonds are not maturing in 2023:

Maturity Ladder (Fund Fact Sheet)

In effect, over 40% of the fund collateral matures later than the fund's December 2023 maturity date. Let us have a look at some actual names in the portfolio:

Fund Collateral (Fund Website)

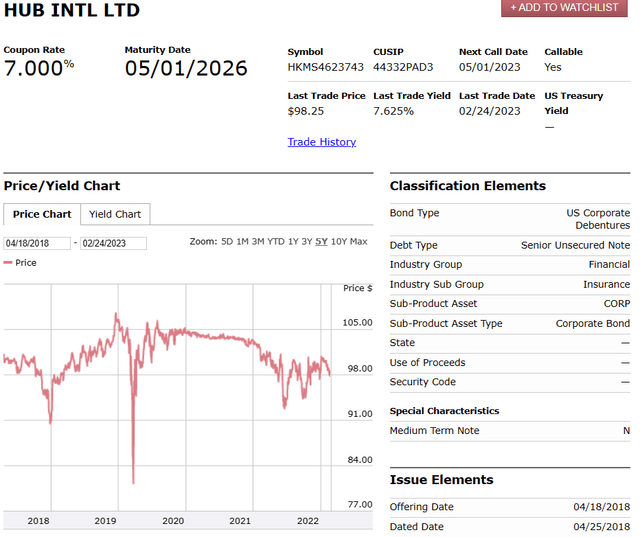

To better understand what the lack of a maturity-matched collateral actually means, let us have a closer look at one of the bonds from the above table, namely the HUB International (CUSIP: 44332PAD3) bond:

A matched maturity structure ensures the principal of the underlying bonds is always received at par upon structure maturity (absent any defaults). When the collateral does not have the same maturity date, we can have instances such as the one above with Hub, where we do not really know where the bond will be from a price perspective upon liquidation date. Under the current market conditions, the bond is trading at 98 cents/dollar. If we get another leg down in this market, that price could become much lower. Probably low 90s if the 2022 sensitivity is a good indicator.

Conversely, if the market rallies substantially into year-end, the fund could theoretically be able to divest this security above par, thus generating a gain for the structure. The point is that we do not know, nor does the manager. The lack of maturity matching introduces market risk in the current structure. We do not like this because it is more of a trading endeavor rather than fundamental analysis.

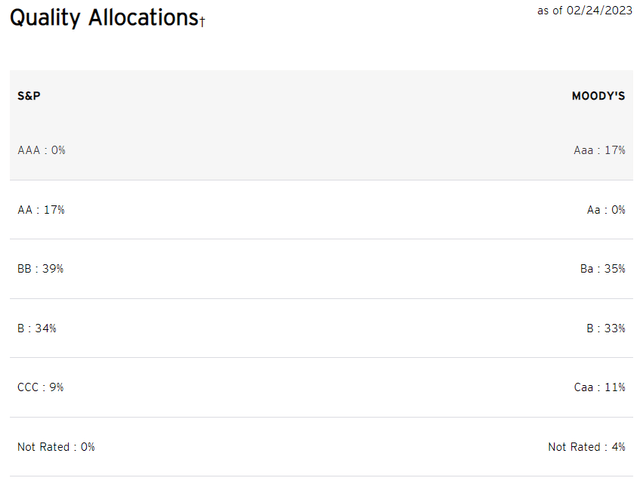

The current collateral is mostly composed of BB and B names:

The fund holds its cash in Treasury notes and Bills, hence the 17% allocation to AAA assets.

Performance

We can see the duration/credit spread impact on the fund's performance in the past year:

As rates rose and credit spreads widened last year, the fund was down -4% during 2022 (on a total return basis - i.e., dividends included) before recovering.

The total return picture since inception is interesting:

We can see a nice upwards sloping total return line for the fund since inception. However, it is interesting to note that on a total return basis, the vehicle is very close to where it was in December 2021, when it also sported a life-to-date total return of 52%. When the collateral runs market risk, it can lose value, like it did in 2022. That means that an investor can basically end up not generating any returns even as the fund approaches its maturity date.

Conclusion

BSJN is a fixed income ETF. The fund invests in U.S. high yield bonds and has a term maturity in December 2023. The fund's collateral however is not maturity matched. That means that over 40% of the current portfolio exhibits maturity dates after December 2023. This feature has introduced market risk in the structure, with the fund's negative NAV performance in the past year offsetting most of the dividend income. The same dynamics can be expected for the rest of 2023, with another leg down in this bear market having the capability to pull the NAV lower. The lack of maturity matching between the collateral and the fund structure introduces unwarranted volatility, and does not make this name a suitable choice as a cash parking vehicle in our view, even if the fund is set to liquidate in ten months.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.