Realty Income: This Strong 4.7% Yield Won't Let You Down

Summary

- Realty Income covered its dividend with adjusted funds from operations in 4Q-22.

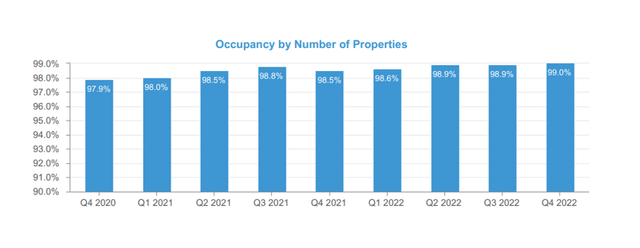

- The outlook for 2023 implies 1.5% YoY growth in the important AFFO metric.

- A 16x 2023E AFFO multiple doesn’t make Realty Income a bargain, but a premium valuation is justified.

Maxxa_Satori

In February, Realty Income Corporation (NYSE:O) experienced new stock price weakness. Having said that, the trust presented fourth-quarter results that once again highlighted the trust's AFFO resilience and strong lease metrics.

Realty Income expectedly covered its dividend pay-out with adjusted funds from operations in 4Q-22 and maintained a dividend pay-out ratio of 74%.

Realty Income increased its dividend by 2.4% to $0.2545 per share earlier this month, bringing the forward dividend yield to 4.7%.

While I consider Realty Income to be a Strong Buy below $60, I believe it is difficult to argue with the stock's value proposition: it remains a buy.

Portfolio Composition And Diversification

Realty Income is a leading net-lease real estate investment trust with a multibillion-dollar portfolio of properties. At the end of the fourth quarter, the trust's real estate assets included 12,237 properties, the majority of which were located in the United States (the trust also has real estate investments in the United Kingdom).

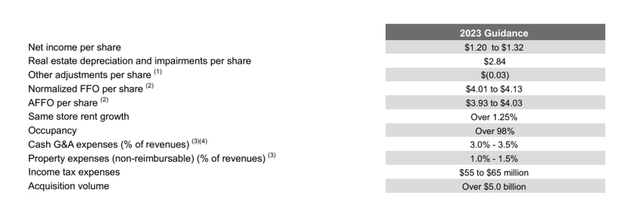

The REIT's landlord business is anchored in retail properties, which represented 11,872 real locations and 65% of total leasable square feet at the end of 2022. The portfolio also included industrial and gaming properties, but retail properties are where the real money is made.

As of December 31, 2022, the retail segment generated $2.8 billion in annualized rent for the trust, accounting for 81.9% of total contractual rent.

Property Type Composition (Realty Income)

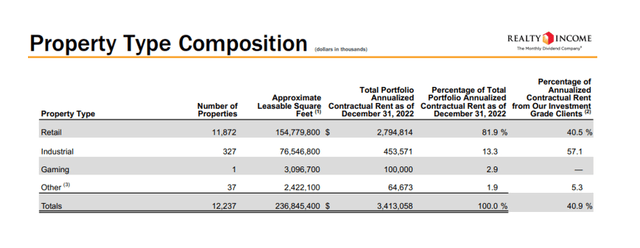

Approximately one-third of the trust's tenants are investment-grade, which means they are typically large retail chains with national coverage and strong balance sheets.

Dollar General is Realty Income's largest tenant, responsible for just about 4% of the trust's entire rental base. The twenty largest clients at Realty Income accounted for 40% of the company's annual rental income, with twelve of those twenty clients carrying investment-grade ratings.

Client Diversification (Realty Income)

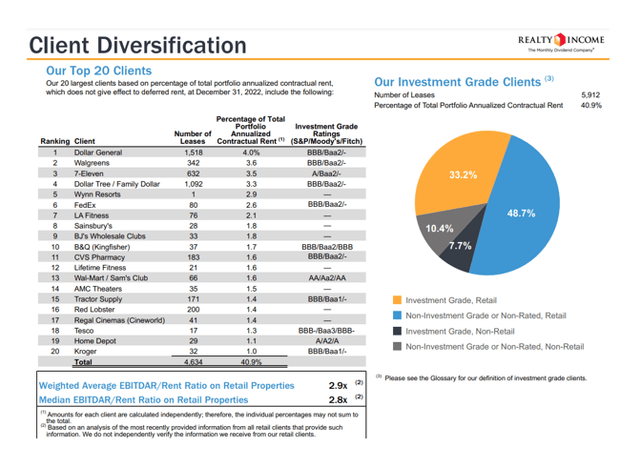

The financial success of Realty Income is heavily reliant on superior asset utilization. Assets in the real estate industry must 'sweat' and produce consistent returns in order for passive income investors to be paid. Realty Income accomplishes this through the acquisition and development of high-quality commercial real estate, as well as diligent property management.

The trust's occupancy increased 0.1% percentage points QoQ to 99.0% in 4Q-22, indicating a very well-leased real estate portfolio.

Occupancy By Number Of Properties (Realty Income)

Dividend Coverage Remained Very Solid

The monthly dividend is the primary attraction of a Realty Income investment, and the trust has demonstrated skill in growing its monthly dividend over a very long period of time. As a result, assessing Realty Income's dividend pay-out ratio is critical.

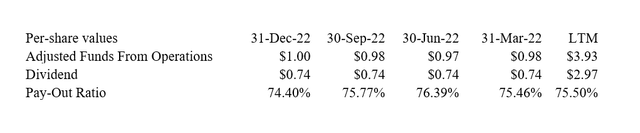

For years, Realty Income has covered its dividend with adjusted funds for operations. In the summary table below, I show Realty Income's dividend coverage metrics for the last four quarters, so while the time horizon is not very long, it gives you an accurate depiction of how well Realty Income's dividend has been covered by adjusted funds from operations and how little variability exists in the dividend coverage ratios over the last year.

Realty Income reported adjusted funds from operations of $1.00 per share in the fourth quarter, which compares favorably to a dividend payout of $0.744 per share.

The trust's dividend pay-out ratio in 4Q-22 was 74%, which is in line with the dividend pay-out ratios in the previous quarters as well as the dividend pay-out ratio of 76% in the previous year.

Dividend (Author Created Table Using Trust Information)

Realty Income increased its dividend payment from $0.2485 to $0.2545 per share in February, resulting in a new forward dividend yield of 4.7%. It was Realty Income's 119th dividend increase since 1994.

Quality Has Its Price

Realty Income is not a cheap net-lease real estate investment trust to own for passive income investors, and the premium is due to the fact that management has consistently delivered strong dividend coverage and portfolio performance over the years.

Realty Income expects adjusted funds from operations to be $3.93 to $4.03 per share in 2023, representing a 1.5% increase YoY.

Realty Income's stock is presently trading at $64.98, so the guidance implies an AFFO multiple of 16.3x which isn't that much of a premium to pay for Realty Income, in my view. During the pandemic, the trust's stock has traded at more than 20 times AFFO, and I believe the trust is deserving of a premium due to the consistency of its AFFO results over the last two decades.

Why Realty Income Could See A Lower Valuation

Inflation is unlikely to be a significant headwind for real estate investment trusts because, in an inflationary environment, real estate values and rents tend to rise, and investment spreads have remained stable as interest rates have risen since the 1990s.

A more serious headwind for Realty Income and the net-lease REIT sector in general would be a broad real estate recession, which could result in lower real estate values and slower AFFO growth.

My Conclusion

Realty Income has once again demonstrated that it is a well-managed net-lease commercial real estate investment trust with excellent management, high portfolio occupancy, and strong dividend coverage.

The recent dividend increase raises the forward dividend yield to 4.7%, which is an attractive yield for investors seeking passive income.

The trust's most important key metric, adjusted funds from operations, is also expected to grow in 2023, according to Realty Income's guidance.

While I prefer to buy Realty Income below $60 (which implies a higher margin of safety and allows me to sleep better), the strength of Realty Income's 4Q-22 results is difficult to dispute.

While not a Strong Buy at the moment, I consider Realty Income to be a solid buy for passive income investors.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.