No Value In The Shares Of No-Moat Wayfair

Summary

- Wayfair reported a 4.6% YoY decline in Q4 net revenue, while active customers dropped by 19% and repeat customer orders fell by 8%.

- Despite its second round of layoffs, I believe a third round is needed as the negative trend of 2022 is expected to continue in 2023.

- W lacks a competitive advantage due to the lack of pricing power, cost advantage, and switching costs in a commoditized retail category, as reflected in their high customer acquisition costs.

- I recommend staying away from the shares.

jetcityimage

In my article on Overstock (OSTK) in 2018, I referred to Wayfair Inc.'s (NYSE:W) aggressive marketing strategy. We see that this strategy is still implemented now, with a slight decline in acquisition cost during the pandemic but has now resumed. Despite the second round of layoffs of 1,750 workers, I believe it is insufficient to make W profitable in the long term, and in this article, I will argue why I see no value in the shares. Also, this article will review the Q4 & 2022 financial results and why I believe W stock lacks a competitive advantage.

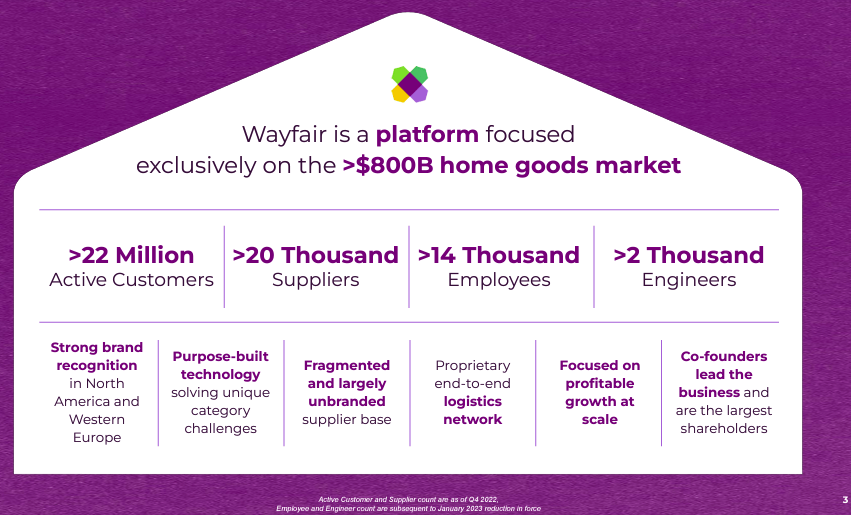

Shares of W fell by over 25% after reporting its fourth-quarter results on February 23rd. W experienced a 5% decline in fourth-quarter sales. Also, in Q4, active customers dropped by 19% to 22.1 million, and repeat customer orders fell by 8% to 8.5 million. Active customer numbers had already dropped by over 20% in the first three quarters of 2022. However, even with the increase in scale, W failed to make a profit in the quarter and generated a negative 2% adjusted EBITDA margin. I expect the negative trend to continue in 2023.

The Company

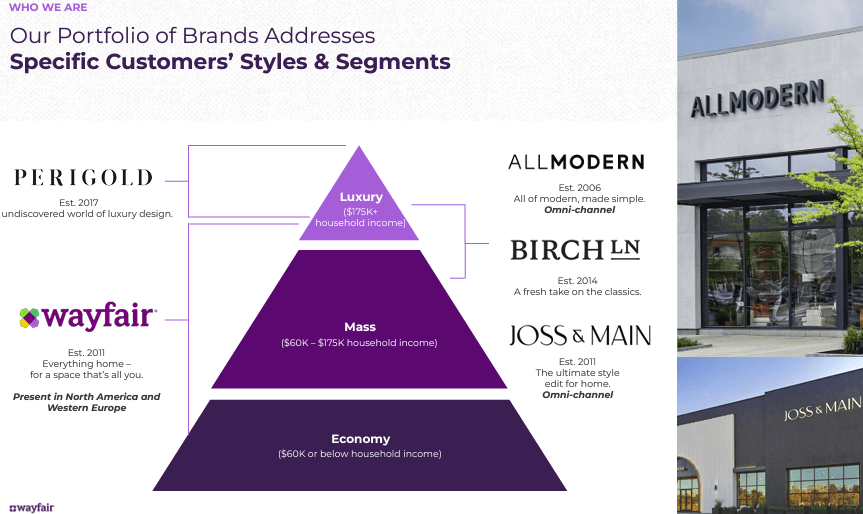

W is a multinational e-commerce company operating in the United States and Europe. As of the end of 2021, W provided a wide selection of more than 33 million home products, including furniture, decor, accent pieces, housewares, seasonal decorations, and other home goods. These products are offered under several popular brands, such as W, Joss & Main, AllModern, DwellStudio, Birch Lane, and Perigold. W was established in 2002 with a mission to assist individuals in finding the ideal products for their homes at reasonable prices.

Company presentation

Q4 results

In the fourth quarter of 2022, W's total net revenue amounted to $3.1 billion, a decline of 4.6% YoY. The U.S. net revenue was $2.7 billion, a decline of 1.8% YoY. The international net revenue was $415 million, a decline of 19.7% YoY. The gross profit was $893 million, equivalent to a gross margin of 28.8%. This resulted in a net loss of $351 million and an Adjusted EBITDA of negative $71 million. Operating activities provided net cash of $98 million, but Non-GAAP Free Cash Flow was negative $19 million. Cash, cash equivalents, and short-term investments totalled $1.3 billion.

Regarding customer metrics, the active customers totalled 22.1 million, a decrease of 19% YoY. The LTM net revenue per active customer was $553, an increase of 10.4% YoY. Orders per customer were 1.81 for Q4 2022, compared to 1.89 for Q4 2021. Orders delivered were 11 million, a decrease of 9.1% YoY. Repeat customers placed 77.4% of total orders delivered, compared to 76.3% in Q4 2021. Repeat customers placed 8.5 million orders, a decrease of 7.6% year over year.

Finally, the average order value was $283, compared to $269 for Q4 2021. In the quarter, 61.7% of total orders delivered were placed via a mobile device, compared to 59.0% in Q4 2021. The decline in revenue, net loss, and operating cash flow, along with the decline in active customers, repeat orders, and total orders delivered, indicate challenges faced by W in the quarter. However, the increase in LTM net revenue per active customer and the increase in average order value provides some positive signals.

2022 Highlights

Total net revenue for W amounted to $12.2 billion, a decrease of 10.9% YoY. The U.S. net revenue was $10.5 billion, a decline of 7% YoY, while the international net revenue was $1.8 billion, a drop of 28.7% YoY. Gross profit was $3.4 billion, equivalent to a gross margin of 28.0%. W incurred a net loss of $1.3 billion, and the Non-GAAP Adjusted EBITDA was negative $416 million. The net cash used in operating activities was $674 million, and the Non-GAAP Free Cash Flow was negative $1.1 billion.

Giants entering the space

The millennial generation is beginning to settle down and make major purchases, such as home furniture. While their needs are similar to previous generations, their purchase path will vastly differ as they prefer to buy online. That is why giants like Amazon (AMZN) entered the market 6 years ago and are intensifying the competition in the furniture market. I think AMZN’s capabilities and financials will allow it to be a tough competitor and provide offers to steal customers from W, such as the visual showroom.

W lacks Pricing Power, cost advantage, and there is no switching cost

They compete in a commoditized retail category with numerous brick-and-mortar and online competitors. This lack of competitive advantage is reflected in their customer acquisition costs.

Company presentation

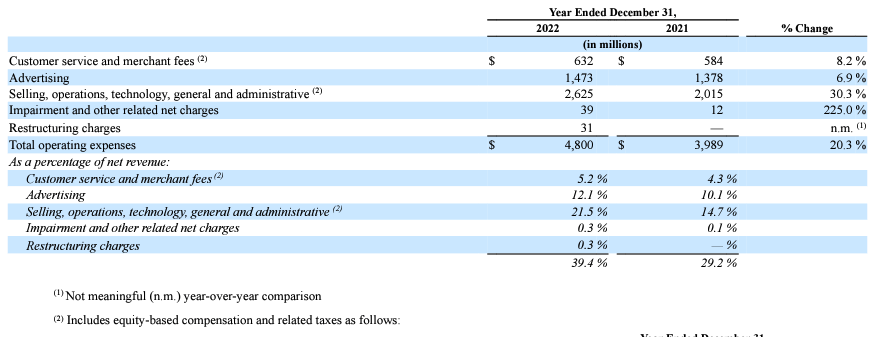

W continues to outspend its competitors in advertising. As a percentage of sales, in 2022, advertising increased by 200bps to 12.1%.

Company 10-K filing

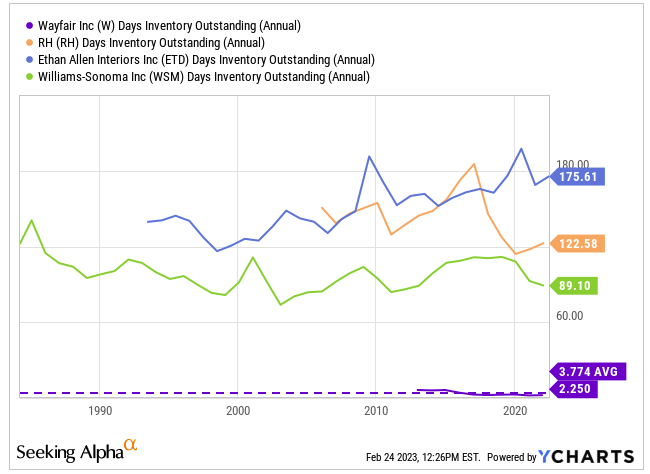

However, I believe that W's supply chain and cost structure are the key differentiators for this company. W has adopted an inventory-light model where it does not design or hold the inventory it sells. W's products are shipped directly from suppliers or through its fulfillment network, resulting in a higher inventory turnover rate than its peers.

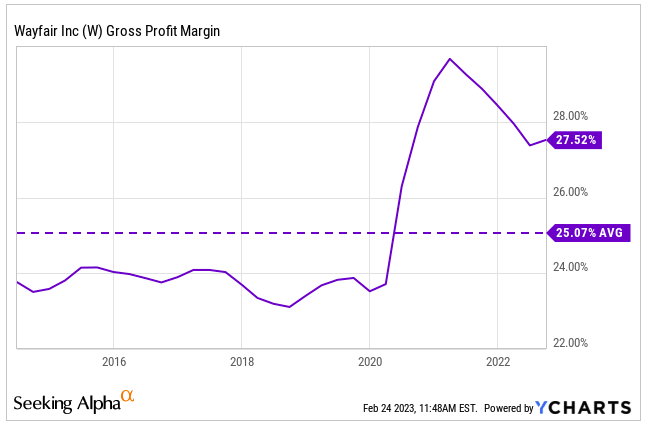

YCharts

While the last mile of delivery can be costly, W's process reduces the number of touches between order and delivery, reducing delivery time, and decreasing the risk of damage, which offsets other potential expenses. However, I believe all those savings are transferred via lower prices and discounts to consumers. In the online retailing industry, there are few barriers to entry, and competition is likely to remain promotional, with pricing being a significant factor.

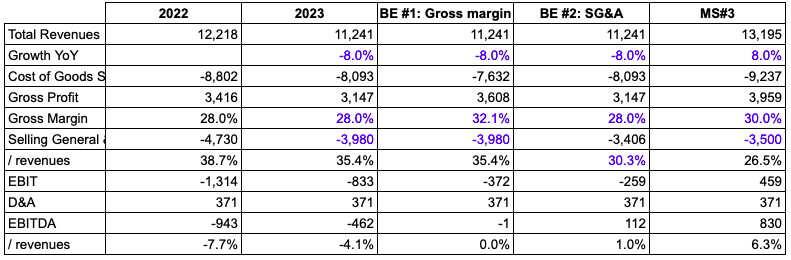

Bankruptcy highly probable

In 2022, revenues were $12.2 billion contrasted to costs of $13.5 billion ($8.8 billion in COGS and $4.7 billion in SG&A). The recent layoffs could bring down SG&A to $4 billion, but W needs to improve gross margins to break even. For 2023, I expect revenues to continue to decline, driven by the decreasing customer metrics we saw in Q4 2022. I estimate revenues to decline by 8% in 2023. Based on those assumptions, the gross margin should improve by 410bps to 32.1% (scenario BE#1 on the table) just to break even. The gross margin has never reached that level in the company's history.

YCharts

Assuming gross margin at similar levels to 2022, the company would need to cut on SG&A costs, including a third layoff, to save an additional $600 million (scenario BE#2 on the table).

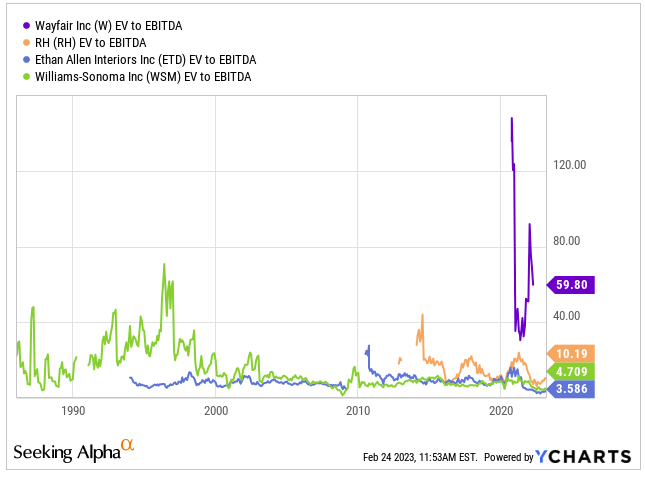

Historically, W has been trading at astronomical EV/EBITDA multiples, assuming double-digit revenue growth in the medium term. However, the multiple should return to more realistic levels if that growth halts. RH (RH) trades at 10x, while Ethan Allen Interiors (ETD) and Williams-Sonoma (WSM) trade at 3.6x and 4.7x, respectively. In the case of W, I think the fair multiple is 8.2x as it has better unit economics thanks to its supply chain and being an online retailer.

YCharts

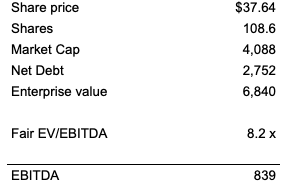

Based on the 8.2x multiple and the current share price, the implied EBITDA is $839 million.

Author estimates

To obtain that EBITDA, even if I assume revenues to grow 8% and gross margins to be 30%, W would need to reduce SG&A costs by a further $500 million (scenario MS#3).

Author estimates & company 10-k filings

As you can see, even to justify the current share price, many things have to go right and are very improbable; revenue growth of 8%, gross margin at an all-time high of 30%, and a further $500 million cost cut.

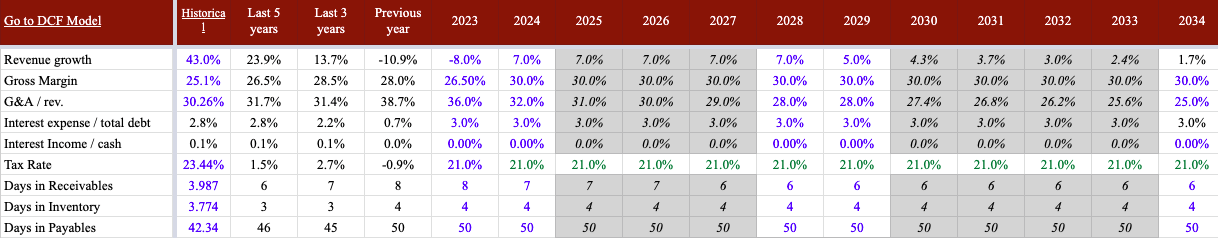

I believe the shares have no value as bankruptcy is imminent. However, in the optimistic scenario that W increases revenues, improves margins, and optimizes SG&A in the medium to long term, I see a best-case scenario valuation of $8 per share. The financial assumptions could be found below.

Author estimates & company 10-k filings

I used a cost of capital of 10% based on an unlevered beta corrected for cash of 1.28 (source).

Risk

The demand for W’s products depends on economic cycles, domestic home improvement market fluctuations, and consumer confidence. W benefits from low fixed expenses thanks to its almost 100% online presence. Still, it faces higher customer acquisition cost risks as rivals, including other online players like Amazon and physical retailers like Home Depot (HD) and Lowe's (LOW), push harder into the home furnishing category. These pressures could be amplified by peers' willingness to pass on the scale and other cost advantages in lower consumer prices, particularly in commodified categories.

However, the lack of switching costs means that promotions could lead consumers to change preferred vendors, potentially leading to lower margins. Over the near term, there is concern that the supply chain could intermittently be disrupted due to COVID-19, potentially hindering the availability of products and leading to stockouts.

The founders, Niraj Shah and Steven Conine continue to run the day-to-day business and own shares representing 77% of the voting power of outstanding capital stock, which limits outside shareholders’ abilities to influence corporate matters.

Conclusion

W has reported disappointing Q4 and 2022 financial results with declining sales and active customers. The company's aggressive marketing strategy and lack of competitive advantage have resulted in high customer acquisition costs, and it is facing intense competition from giants like Amazon. Despite the company's adoption of an inventory-light model, it has failed to make a profit, and its shares are overpriced. W is facing significant challenges and may continue to struggle in the future.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not recommend shorting the shares as the market may be irrational for longer than you can hold the short position. I recommend not holding the shares. If you have a risk appetite, I would consider looking at put options.