Tyson Foods: Further Pressure Ahead Although Large Downside Priced In

Summary

- Tyson Foods' sales bounced back from early last year's slump, and continue investing in its operation upgrades.

- Its financials are deteriorating too quickly in recent quarters due to increased capex and costs.

- The details of the company's recently announced acquisition of William Sausage remain to be seen, as how the company plans on integrating and expanding its food servicing portfolio.

RiverNorthPhotography

Investment Thesis

Tyson Foods (NYSE:TSN) has recovered from the slump last year in revenue. However, it is facing pressure on both its declining earnings and increasing capex. The integration and profitability from the recent acquisition of William Sausage remain to be seen, but the spending will be inevitable. The management needs to halt the trend, or further pressure is likely. Our fair valuations indicate that a large downside has been priced in by the current stock price, yet further decline is still possible.

Company Overview

Tyson Foods was founded in 1935 by John W. Tyson and has been led by the family for four generations. The company has grown into one of the world's largest food processing companies in protein. Its CFO, John R. Tyson, is the latest leader from the family in management. The company is headquartered in Springdale, Arkansas. Its reportable segments are Beef, Pork, Chicken, and Prepared Foods.

Strength

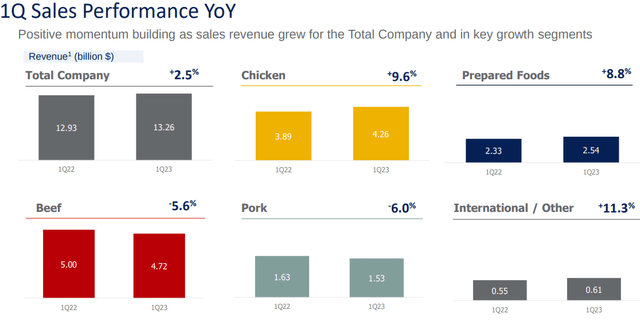

Tyson Foods has one of the most extensive sales networks in protein and meat processors; 17% of its sales were made through Walmart's (WMT) stores. The company maintained strong sales growth throughout last year's volatile period from the impact of the bird flu. In its latest Q1 2023 sales performance, its total revenue grew 2.5%, and chicken staged the biggest comeback of 9.6% on a YoY basis.

Tyson Sales Performance YoY Q1 FY 2023 (Company Q1 FY 2023 Presentation)

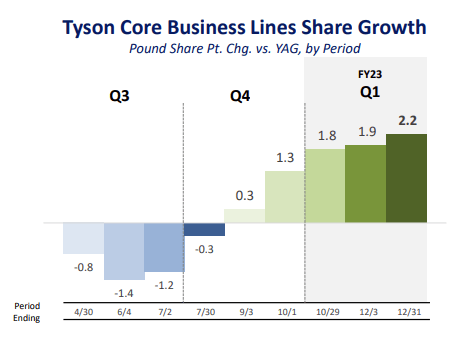

Tyson's core business is a turnaround story. After falling negatively in the first half, it gradually struck back and logged positive growth in all months of Q1 FY 2023.

Tyson Core Business Line Share Growth (Company Q1 FY 2023 Presentation)

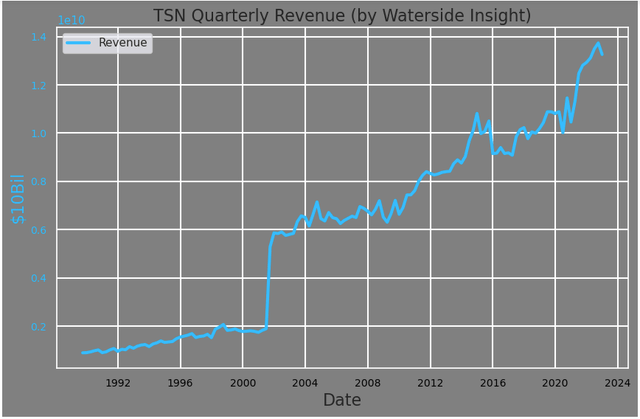

Overall, the company's revenue growth has been strong in recent years. Currently, it stands at one of the highest levels in its history.

Tyson Quarterly Revenue (Calculated and Charted by Waterside Insight with data from the company)

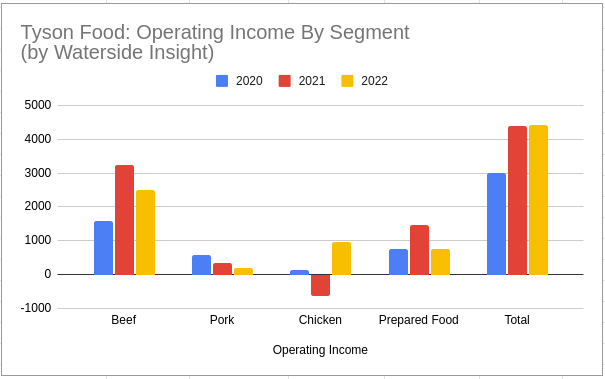

To look at its past three years' history of operating income by segment, the chicken still stood out as a recovery story, while its biggest segment, beef, slipped. Overall, its total operating income was flat but grew more than 30% compared to 2020.

Tyson Operating Income by Segment (Calculated and Charted by Waterside Insight with data from the company)

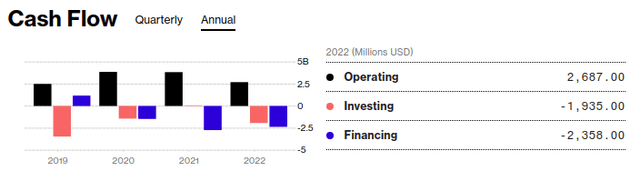

The company's operating cash flow remains strong, but cash flow from investing and financing has been a drag. Due to the company's scale and the sustainability and modernization issues facing the meat processing industry, it is not surprising that Tyson made a large investment in its property, plant, and equipment last year, with over $1.89 billion alone in the investing activities. This investment could help the company's growth in the long term.

Tyson Cash Flow Breakdown (Bloomberg)

The company just announced an agreement to acquire William Sausage Company, which provides retail and food services to customers with fresh and fully cooked sausage, bacon, and sandwiches. The company did not disclose the terms of the acquisition, and the deal is subject to regulatory approval. But in its Q3 earnings call, its CFO said, "Our comprehensive food service portfolio has the opportunity to grow by regaining lost customers and broadening our customer base.", and also mentioned, "we have an opportunity to innovate, expand and acquire into new spaces through new offerings". William Sausage's annual revenue was estimated to be $98 million in 2021. According to the announcement, there are 500 employees, so the revenue per employee is about $196,000. The same metric for Tyson's existing employees is about $377,528 per employee. If the acquisition went through as expected, Tyson would need to double William's capacity and revenue with similar labor costs to make this deal worthwhile. Of course, this is only one way to see this deal. Tyson could have other integration and expansion plan. It will be interesting to see more details.

Weakness/Risks

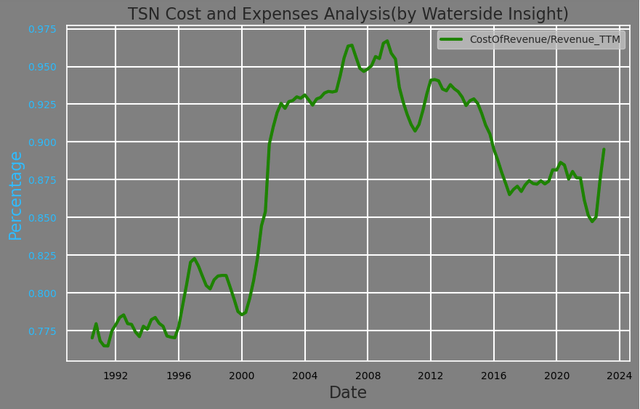

In the recent quarter, its cost of revenue as a percentage of revenue has turned up.

Tyson Cost of Revenue (Calculated and Charted by Waterside Insight with data from the company)

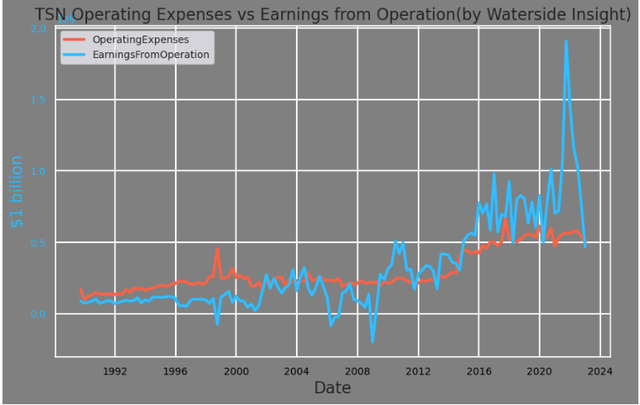

As a result, its earnings from operation fell down to $320 million in Q4, below the operating expenses of $488 million in the latest quarter, although its operating expenses haven't increased much. This has wiped out most of the gain by the earnings over expenses in the past 7 years, back to their similar levels in 2015. Investors could expect further erosion if earnings don't improve from here.

Tyson Operating Expenses Vs Earnings From Operation (Calculated and Charted by Waterside Insight with data from the company)

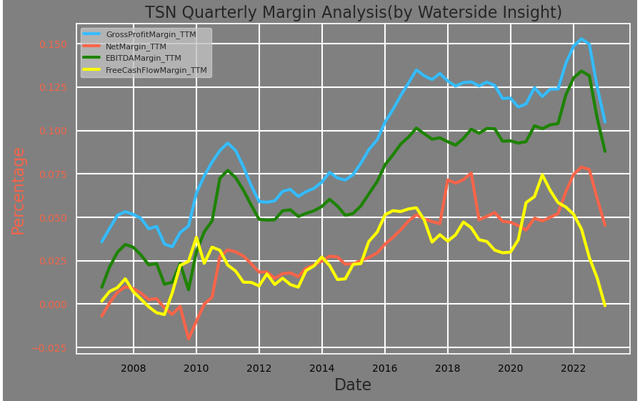

Most of its margin metrics have turned downward to about the 2016 level; particularly, its free cash flow margin has turned negative.

Tyson Margin Analysis (Calculated and Charted by Waterside Insight with data from the company)

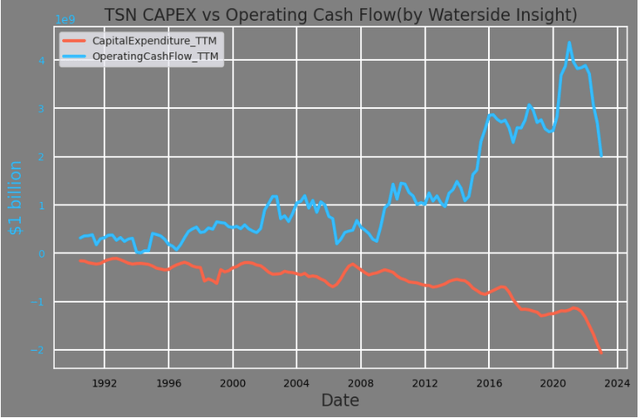

The company's capital expenditure has continuously increased to its highest level. During the last earnings call, it gave the higher end of the guidance for this year's capex to be at $2.5 billion. If this guidance is realized, then it's likely to pressure its free cash flow further unless operating cash flow improves.

Tyson Capex vs Operating Cash Flow (Calculated and Charted by Waterside Insight with data from company)

Overall, Tyson has increased its capex and costs while its earnings have regressed back down. Unless the acquisition of William can provide immediate cash flow relief and revenue boost, this may not be the right time to go on a spending spree for Tyson. As we can see, during stressful times such as '08-'09, its earnings fell far below its operating expenses, as expenses and costs tend to be more fixed than earnings.

In addition, the company's gross margin drop reflects the ongoing industry headwinds, such as labor, food safety, greenhouse gas emission, and sustainability that require more spending to lay a long-term sustainable growth foundation. Tyson has been making a lot of progress on all fronts, including winning a reward as "Keepers of American Dreams" for its efforts in providing adequate support for its immigrant workers. But given the challenges ahead, perhaps the expectation of its gross profit should be lowered for the medium term. The company's sales and revenue are already at historical highs; given the macro environment, more top-line growth will be hard to come by. To improve its financials, the company needs to preserve cash for continuous growth and tighten its belt to lower spending and expenses within its existing capacity. It could mean some more pain ahead.

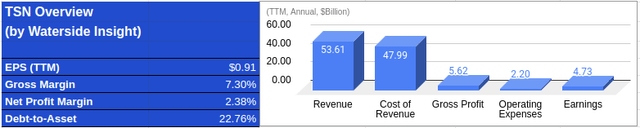

Financial Overview

Tyson Financial Overview (Calculated and Charted by Waterside Insight with data from the company)

Valuation

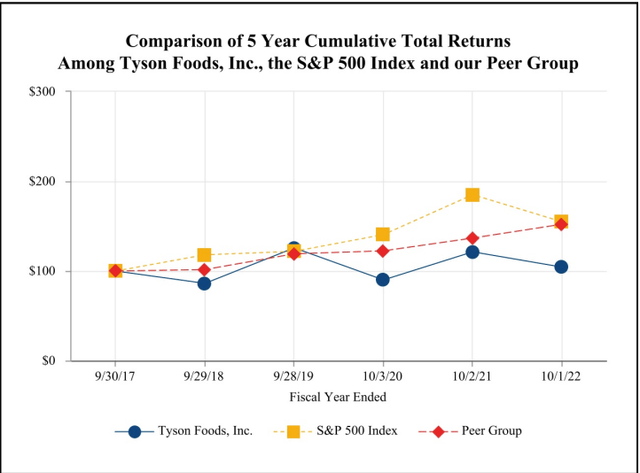

If only looking at Tyson stock's price since 2015, it doesn't look like the steady and reliable nature of the consumer staple products it carries, as the volatility is quite high and the swings are double-digits on both ways. As a result, its cumulative total return has fared below its peer group and the broader market.

Tyson 5 Year Cumulative Return (Company 2022 10K)

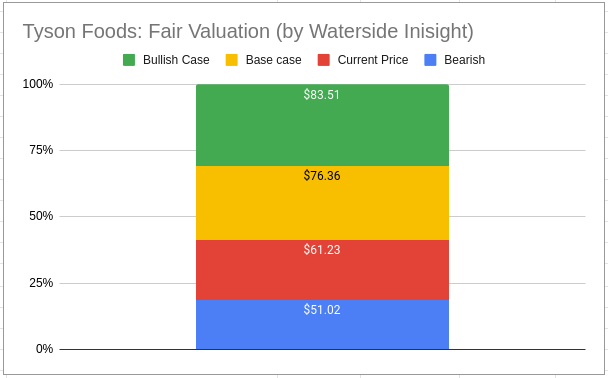

Considering all the analysis above, we assessed the company's fair value with a ten-year projection forward using our proprietary models. In our bullish case, we priced in more downside risks for '23 and '24 due to its expected spending and challenging macro environment, but the company rebound in growth with volatility remains; it was valued at $83.51. In our bearish case, the company experienced a bigger downside in '23 and '24, although with the strong rebound, its growth volatility kept it range-bound, as the company sorted out more regulatory facing the industry and continues to upgrade to a more sustainable growth model; it was valued at $51.02. In our base case, the company's downside is similar to the bullish case, but the rebound is milder afterward; it was valued at $76.36. After reaching the top of $100, the stock's price has fallen by over 40%. In comparison with our fair valuation, we can see at the current level, the market has priced in a fair amount of downside and is tilted towards the bearish side. But it is possible it hasn't bottomed yet.

Tyson Fair Value (Calculated and Charted by Waterside Insight with data from the company)

Conclusion

Tyson Foods has strong production and networks that help with robust revenue growth along with the protein demand from consumers. With continuous efforts to invest back in its production process, it also stands to gain in the long term. But the company's financials have deteriorated too quickly, with costs and expenses piling up and earnings dropped. It probably shouldn't make more aggressive expansion plans before evaluating and improving its existing capacity in order to preserve cash flow and margin. In anticipating a more challenging macro environment on top of its current declining operating earnings, we think more downside remains, although a large part of it has been priced in the market. We would recommend a hold at this point.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.