SoFi: I Sold My Position But I'll Be Back

Summary

- SoFi's goal to reach positive GAAP net income later in the second half of this year would represent a watershed moment for the fintech firm.

- Broader macroeconomic concerns will likely continue to define returns until this point.

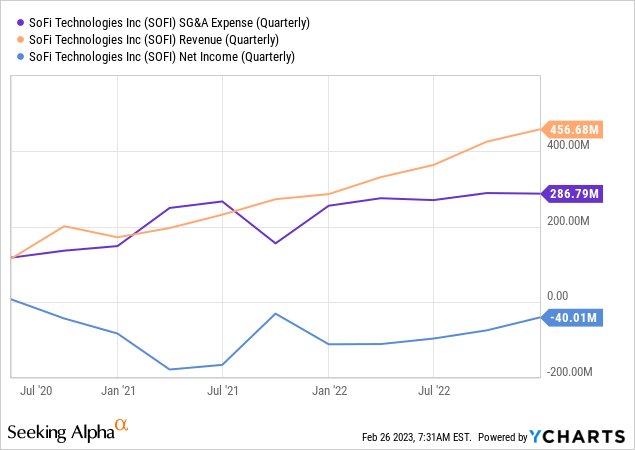

- The current trajectory of revenue growth and SG&A expenses point to enhanced operational gearing and the possibility of achieving positive net income earlier than the current plan.

Richard Drury/DigitalVision via Getty Images

SoFi (NASDAQ:SOFI) was one of my core pandemic-era picks and I started building a position when it was still a Chamath Palihapitiya-sponsored special purpose acquisition company called Social Capital Hedosophia. I jumped on the recent earnings-inspired rally to close out my full position at a small overall profit with the view that the current macroeconomic environment will remain hostile for longer.

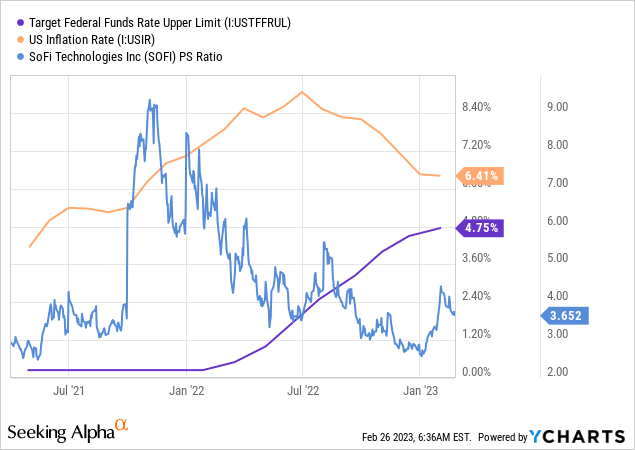

SoFi has almost always outperformed earnings expectations but its commons would stage a muted response in the weeks after. This has been the core defining feature of the post-pandemic inflation-led stock market zeitgeist. Once rapacious animal spirits have been frozen in time with earnings reports replaced by FOMC meeting minutes as the core driver of near-term stock market returns. To be clear, I sold SoFi because 2023 is likely set to see a continuation of the inflation and Fed funds rate dynamic that characterized much of 2022. Russia's war on Ukraine and the subsequent energy crisis highly defined returns and will critically continue to form the backdrop for the near-term outlook for fintech.

Revenue Ramps Up As Flywheel Pulls In New Members

SoFi's last reported earnings for its fiscal 2022 fourth quarter saw adjusted net revenue come in at $443.42 million, a 58.4% increase from the year-ago comp and a beat by $17.58 million on consensus estimates. Growth continues to be driven by new members pulled in by the company's diverse and competitive financial products. Indeed, SoFi recently launched Pay in 4, a buy now pay later offering that allows its members to split a purchase of $50 to $500 into four, interest-free payments.

SoFi

The company also added the option to trade options to its investing app and is planning new products for 2023. SoFi added 480,000 new members during the fourth quarter to bring its total to 5.2 million, a 51% increase over the year-ago period. New products rose 53% year-over-year, with 695,000 new products added in the fourth quarter, to reach a total of 7.9 million.

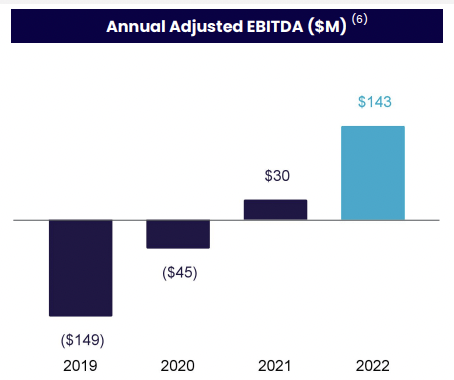

The core takeaway from the quarter was profitability. Adjusted EBITDA came in at $70 million, up sequentially from $44 million in the third quarter. This meant annual adjusted EBITDA for the full year 2022 came in at $143 million, up from a loss of $149 million in the year just before the pandemic.

SoFi

This ramp of adjusted EBITDA on the back of greater operational gearing represents the most pertinent and visceral part of the bullish thesis. Essentially, revenue is ramping up as new members get pulled into the platform and as SG&A expenses flatline to mould a clear roadmap for net profits.

Net loss is now on a sustained upward march. A loss of $40 million for the fourth quarter was a material improvement from a loss of $121.2 million in the year-ago comp. The trendline is pointing up and management was upbeat during their earnings call on the outlook for the business to achieve a positive GAAP net income in the fourth quarter of 2023. Bears, who form the just over 10% short interest, would highlight that this is already being priced into the current declining stock price. However, reaching net profit for the first time would be a watershed moment for SoFi and would act to detach the performance of its commons from the vagaries of the stock market.

Deposits Ramp Up To Reduce Cost Of Funding

SoFi Money reached $7.3 billion in deposits as of the end of the quarter, up 46% sequentially from the prior third quarter. This drove savings of 190 basis points on its cost of funds against using other sources of debt to fund loans. SoFi is now guiding for fiscal 2023 first quarter adjusted net revenue to come in at $440 million at the top end, a growth of 37% over the year-ago comp. Adjusted EBITDA is also set to come in at $45 million for the quarter with margins expected to be between 9% to 10%.

For the full year 2023, adjusted net revenue will not be lower than $1.93 billion with adjusted EBITDA set to come in between $260 million to $280 million. It's important to note that SoFi has a storied history of respectively beating its guidance and there's a specter for the bears of net profits being achievable before the stated quarter. With a current market cap of $5.96 billion, SoFi's forward price-to-sales ratio stands at around 3x. Whether or not this is too steep a price to pay will depend on context. As a bull, a 3x multiple on revenue that's likely to outperform is healthy. In the era before the pandemic fintech regularly traded at revenue multiples in the 5x to 7x range. Hence, whilst I've sold out of my SoFi position, the opportunity remains and I'll rebuild this later in the year.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.