Lundin Mining: Long-Term Buy, But Headwinds Ahead

Summary

- Lundin Mining just posted largely satisfactory results for the full year 2022.

- Margins are being squeezed, because of higher production costs, as a result of inflationary pressures.

- Lundin Mining is a growth story, with a solid pipeline of projects in development, in particular its recently acquired Josemaria project.

- Given the quality of its portfolio, inexpensive valuation and strategy of growing production of strategic metals without significant dilution, I see Lundin Mining as one of the best copper miners to hold long-term.

- Nonetheless, the near-term outlook remains clouded by metal price weakness and margin contraction.

David Baileys/iStock via Getty Images

Introduction

Lundin Mining (OTCPK:LUNMF) (TSX:LUN:CA) just reported its fourth quarter and full year 2022 financial results. Results were solid. The company has a significant pipeline of projects under development, offering leverage to future industrial commodity prices, copper in particular. Crucially, it has the pristine balance sheet to finance future growth mostly from internal cash flow. The Lundin family has a track record of following similar successful strategies, combining opportunistic growth with a commitment to return capital to shareholders: Lundin Mining is paying an above average dividend (in addition to its buyback program), while at the same time planning to almost double its production over the current decade, after its strategic acquisition of the Josemaria project in April 2022.

Nonetheless, the near-term future is clouded by compressing margins and a weak outlook for industrial metals. Production costs are creeping up, because of inflationary pressures related to diesel, basic materials and labor. At the same time, the copper price has weakened substantially compared to its March 2022 peak. After a rebound motivated by the Chinese post-covid reopening trade, copper continues to look vulnerable in the near-term. Activity in the Chinese construction sector has not picked up yet, and looks unlikely to return quickly to its pre-covid levels, barring significant fiscal stimulus from the Chinese authorities. In the US, recent data points suggest that inflation may not have peaked yet, thus giving the Federal Reserve further space to tighten monetary policy in the coming months, increasing the odds of a recession. In the medium-term, new primary sources of copper are expected to come online over the next few years, so that the copper market is projected to remain roughly balanced through 2026. It is only from the second half of the decade that the increase in demand from green technologies and electrification is forecasted to move the needle. Therefore, with costs increasing and the copper price facing headwinds, margins are being eroded.

Given its growth prospects, robust balance sheet, leverage to copper prices and inexpensive valuation, I continue to consider Lundin Mining a long-term buy. Nonetheless, for the reasons mentioned above, caution is advisable in relation to the current state of the copper market. Commodities are often heralded as an inflation hedge; while this might be true in the long term, it is rarely a linear process, and the law of supply and demand trumps any other concern in the short term. In addition, Lundin Mining is facing, like other copper miners, significant inflation pressures, that are raising cash costs and causing margins to contract. Thus, I do not see a significant margin of safety at current prices and better entry points are likely to occur during 2023.

2022 results

Lundin Mining has a global portfolio of assets focused on copper and other industrial metals. The company is predominantly leveraged to copper prices, with zinc, nickel and gold also providing important contributions. In 2022, copper was responsible for around 63% of total revenues, zinc for 12%, nickel for 12%, and gold for 7%. Overall, the company produced 250 thousand tons of copper and 400 thousand tons of copper-equivalent, for a total of over $3 billion in sales, of which $810 million during Q4, when metal prices strengthened compared with the previous quarter. Production volumes were almost unchanged compared with 2021, while revenues were marginally down from $3.3 billion, mainly because of lower copper prices.

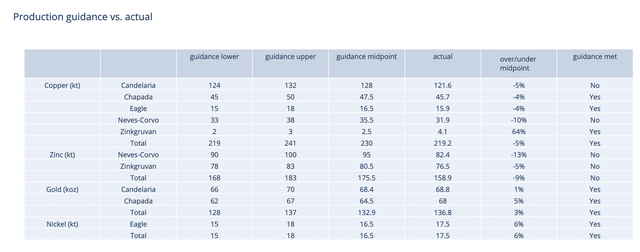

Guidance was met for all main metals, excluding zinc, where it was narrowly missed. The following table compares the actual final results with the original guidance; it also provides a breakdown by mine.

Production guidance vs. actual (Author's computation)

Looking at copper production, Candelaria was modestly below guidance, mostly because of the loss of the Alcaparrosa mine. Readers will remember that last August the mine was closed, following the discovery of a huge sinkhole. The news received quite a lot of attention in international media; however, it proved to be quite inconsequential for the overall bottom line. Alcaparrosa is responsible for around 4-6 thousand tons of copper production per year, around 3% of Candelaria total production. In addition, work is continuing on the Candelaria underground expansion project, also known as CUGEP. The underground expansion could add around 20 thousand tons of production, or around 13% from current levels. Neves-Corvo was also below guidance, due to lower grades and recoveries, while Chapada and Eagle met guidance, but were below its midpoint.

Turning to zinc, production was below guidance both at Neves-Corvo and Zinkgruvan, but overall 10% higher compared with the previous year. At Zinkgruvan, production was negatively impacted by lower than expected grades and short term resequencing of the mine plan. Production at Neves-Corvo was 25% higher compared with 2021, but still below guidance, because of delays in the "Zinc Expansion Project", also known as ZEP. Ramp up of ZEP is now tracking well according to the revised plan.

Gold production was close to the upper end of guidance, with Chapada in particular exceeding the range. Nickel production was also strong, near the top end of the guidance range, thanks to solid performance from Eagle.

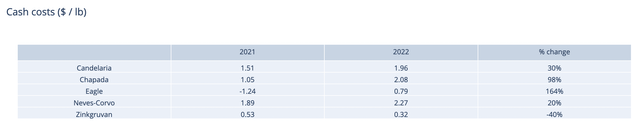

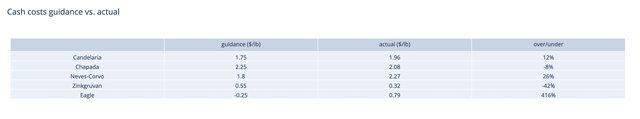

Moving on to the production costs, the effect of inflationary pressures is quite evident. The first table below shows cash costs per pound of metal, broken down by mine, in 2021 vs. 2022; the second table shows a comparison between guided and actual cash costs for 2022.

Cash costs 2021 vs. 2022, $ / lb (Author's computation) Cash costs guidance vs. actual, $ / lb (Author's computation)

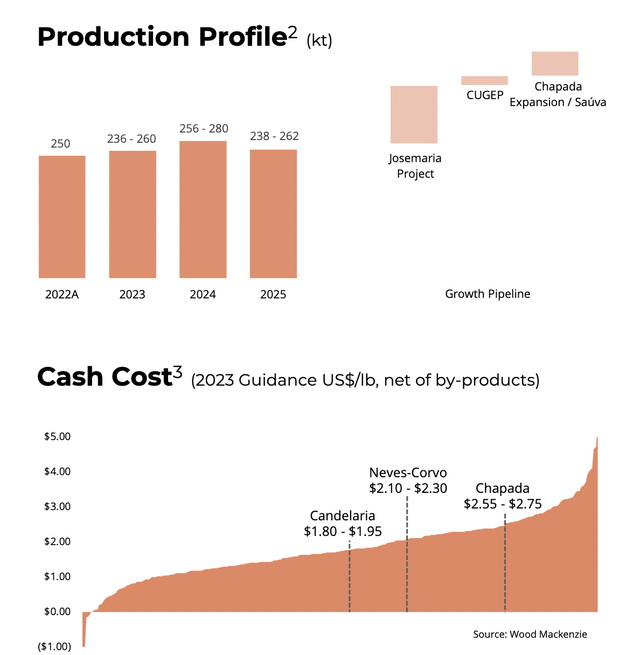

With the exception of Zinkgruvan, cash costs have increased significantly. This is partly the result of lower metal prices, which translates into lower byproduct credits, but also of inflationary pressures. Electricity and diesel costs are responsible for the most important increases. The cost of labor is also rising: for instance, Candelaria's cash costs of $1.96 per pound include a one-off of $0.27 per pound, as the company reached new three-year labor agreements and paid $20 million in bonuses at the end of Q4. Going forward, Candelaria is going to benefit from 50% electricity prices, starting from January 1. Still, for 2023 cash costs are projected to fall within the range of $1.80 to $1.95 per pound of copper, which is 25% higher compared with 2021.

Cash costs at Chapada were better than expected because of greater gold recoveries, but significantly higher than the previous year. The company is guiding for still higher cash costs for 2023, in the range of $2.55 to $2.75, because of lower production and higher consumable prices.

At Neves-Corvo, costs were also higher than expected, mostly because of higher electricity prices in Portugal, and a slower ramp up of ZEP. In 2023, cash cost guidance is for $2.10 to $2.30 per pound of copper, benefiting from higher metal volumes.

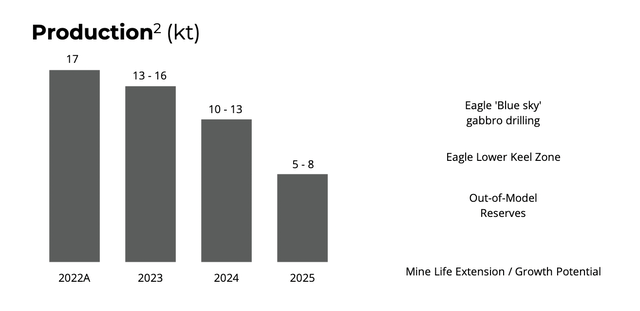

Eagle was also above target, as a result of lower by-product copper prices, combined with inflationary pressures and lower sales. In 2023, cash cost guidance is for $1.50 to $1.65 per pound of nickel, because of expected lower production.

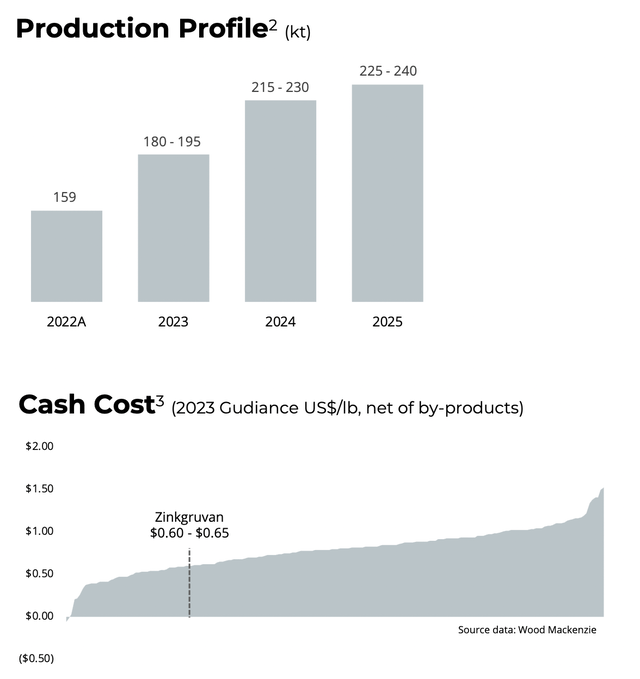

Zinkgruvan was the clear outperformer, with cash costs of only $0.32 per pound, because of greater than expected copper recoveries and stronger USD/SEK exchange rate. In 2023, cash costs are projected to rise to $0.60 to $0.65 per pound of zinc.

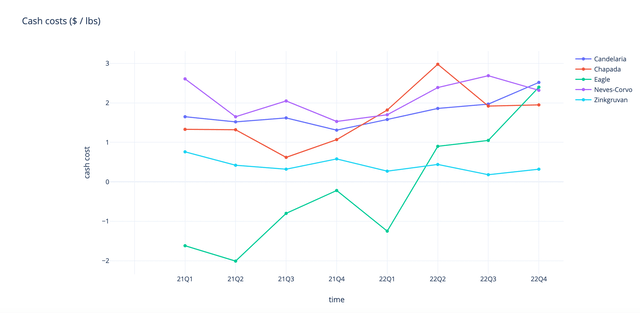

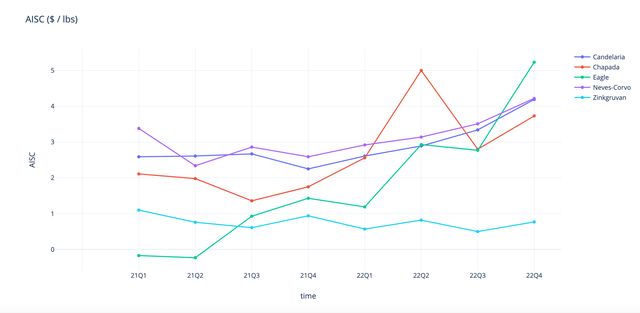

Metrics like cash costs are quite noisy and difficult to extrapolate to the future; nonetheless, inflation has permanently raised the costs of production, and thus compressed margins. The overall trend can also be seen from the following plots, showing cash costs and AISC on a quarter by quarter basis.

Cash costs trend (Author's computation) AISC trend (Author's computation)

AISC reflect sustaining capital expenditures of $640 million for 2022, mostly in line with guidance. There were also around $200 million in expansionary capital expenditures in 2022, related to ZEP and advancement of the Josemaria project.

Overall, Lundin Mining 2022 operational performance is satisfactory, but less than stellar, mostly reaching production targets, but largely failing to control costs. This is certainly the result of the inherent complexity of the projects, which can often lead to delays and lower recoveries, but mostly of persistent inflation. The latter is a global phenomenon, pushing up the global cost curve. This is why I argued in a recent article that physical copper may outperform producers over the next decade.

A look at the future

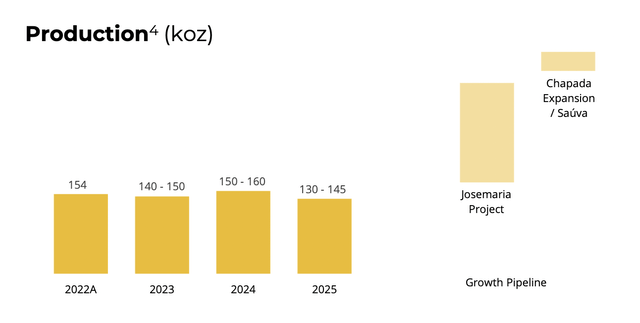

Starting with copper, guidance for 2023 is little changed from the current level of around 250 thousand tons. However, looking ahead, the recently acquired Josemaria project will add more than 150 thousand tons per year. Candelaria underground expansion, or CUGEP, will add around 20 thousand tons. Finally, there is also the new exciting copper-gold discovery at Sauva, near the Chapada mine, which was announced only last February.

Updated cash costs for 2023 are shown in relation to other producers in the picture below. It is likely that the cash curve shown does not reflect recent inflationary pressures. Still, with copper trading around $4 per pound, Lundin Mining copper assets are well-positioned.

Lundin Mining copper production profile (Company's presentation)

The true game changer in the pipeline is the Josemaria project. Initially estimated to cost around $4 billion to develop, it will be the subject of an updated technical report, to be released in H2 2023. Meanwhile, engineering work is continuing and is approximately 40% complete, after a $170 million investment in 2022. A further $400 million in capital expenditures are planned for 2023.

Zinc production is forecast to increase by around 50%, to the range of 225 thousand to 240 thousand tons by 2025. This is mostly the result of the ramp-up of the ZEP project at Neves-Corvo, and also an improvement in grades from the truly world-class Zinkgruvan asset in Sweden.

Lundin Mining zinc production profile (Company's presentation)

On the other hand, nickel production is forecasted to fall; however, production plans do not include the mineralization of the Lower Keel zone, as well as a significant amount of lower-grade mineralization in the Upper Keel zone, at the Eagle mine.

Lundin Mining nickel production profile (Company's presentation)

Gold production is projected to rise significantly over the next few years. The Josemaria project alone, in particular, will increase gold production by around 150%.

Lundin Mining gold production profile (Company's presentation)

Summarizing, Lundin Mining has a portfolio of valuable assets, as well as an exciting pipeline of growth projects. The company is making significant investments in future production, which inevitably are going to impact its free cash flow metrics. For 2023, the company is guiding for around $1.1 billion in capital expenditures, of which 700 are for sustaining production and the rest mostly to further advance its Josemaria project. The company has a robust balance sheet to finance its strategy: it is currently in a modest net debt position of around $14 million, with liquidity of around $1.7 billion. It remains committed to return capital to shareholders through the cycle, via both buybacks and dividends.

Conclusion

Lundin Mining is a solid bet to gain exposure to base metal prices, copper in particular. Despite a difficult year, marked by macroeconomic fears, high volatility in metal prices, inflationary pressures, and site-specific operational challenges, it has managed to substantially achieve its guidance. The company is pursuing an ambitious strategy of future growth, via a rich pipeline of projects, centered around its recent Josemaria acquisition. With basically no debt, significant liquidity at hand, and adjusted operating cash flow of around $1 billion per year, such a strategy can be financed internally. Lundin Mining is my main long-term holding to capitalize on the future copper bull market, but I remain cautious in the near-term and see better entry points ahead, because of a challenged outlook for industrial metals.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of LUN:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.