MercadoLibre: Double Earnings Beat With 2 Huge Growth Engines

Summary

- MercaodLibre is the largest e-commerce company in Latin America and has a rapidly growing fintech segment.

- The company reported strong financial results for the fourth quarter of 2022, as it beat both revenue and earnings growth estimates.

- Its advertising business has grown by 5x over the past 3 years and has the potential to become the 3rd major growth engine, following an "Amazon" style blueprint.

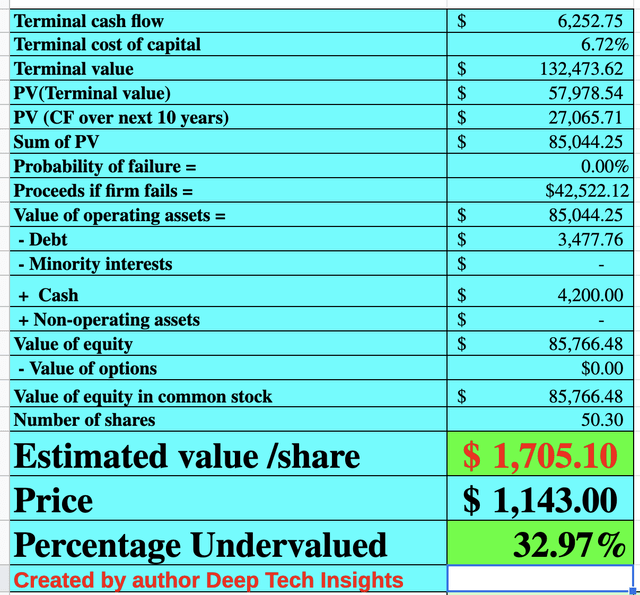

- MELI stock is undervalued intrinsically according to my discounted cash flow valuation model.

Leila Melhado

MercadoLibre (NASDAQ:MELI) is the largest e-commerce company in Latin America and is often known as the "Amazon" of the region. However, what many investors may not be aware of is MercadoLibre has grown to become just as much of a fintech as an e-commerce company. In fact, its fintech segment contributed to a staggering 43% of its total revenue in Q4,22. This was driven by a huge increase in revenue by 93% year over year to ~$1.3 billion (on an FX-neutral basis). Given the large "unbanked" population in Latin America, the region is poised for huge growth. The Neobanking market alone forecast to grow revenue at a rapid 29.5% in 2024, according to Statista data (for South America). In the fourth quarter of 2022, MercadoLibre has also shown it is benefiting from these trends as the company beat both top and bottom-line estimates for growth. In this post, I'm going to break down the company's financials by business segment, before revealing my valuation model for MELI stock, let's dive in.

Fourth Quarter Financials

MercadoLibre reported strong financial results for the fourth quarter of 2022. Its consolidated net revenue was $3 billion, which increased by 41% year over year or a rapid 56% on a constant currency basis. This growth rate was slightly slower than in the past couple of quarters, but not significantly so which is a positive sign given the tepid economic backdrop. Earnings per share were $3.25 in Q4,22, which beat analyst forecasts by over 30%, which was fantastic. In addition, this EPS figure was up by over 100% from its negative figure of minus $0.92 reported in Q4,21. This was driven by improvements in operating leverage for merchandise sales and rapid growth in its advertising business (which I will discuss more on later).

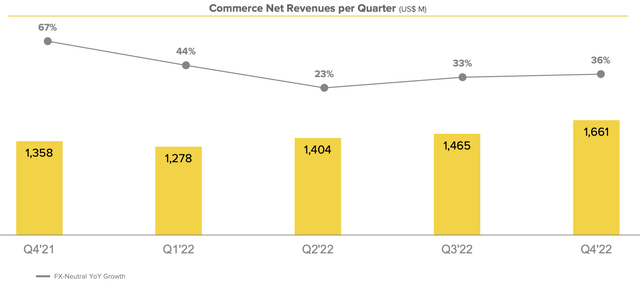

Breaking down revenue by segment, Commerce contributed to $1.66 billion in revenue, which increased by close to 36% year over year, on a foreign exchange rate neutral basis.

Commerce Revenue (Q4,22 report)

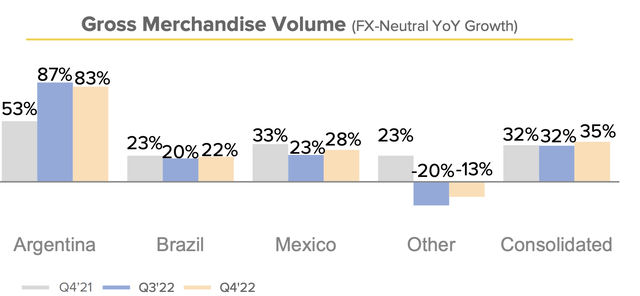

This result was driven by solid Gross Merchandise volume [GMV] growth with the largest country in South America (Brazil), reporting solid GMV growth of 22% year over year, which was a positive. On the chart below, it looks as though Argentina was also a strong market with 83% GMV growth reported. Although I believe this number may be slightly skewed as on a U.S. dollar basis, GMV growth was just 13% year over year and items sold declined by minus 1% year over year.

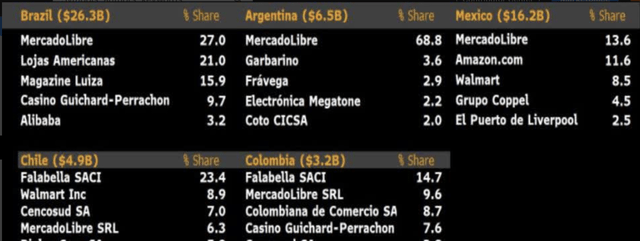

According to Bloomberg data from Q2,2022 (apologies I don't have the link), MercadoLibre was a dominant market leader in Argentina with ~68.8% market share, and thus a recent slowdown would not be a major worry as MercadoLibre is so far ahead. I imagine the company has continued to build its lead in South America's most valuable market, Brazil (with 27% market share reported prior) due to strong growth in items sold, up 11% year over year.

Over in Mexico, the company has faced tougher competition from western rivals such as Amazon (AMZN), which had ~11.6% market share, and Walmart (WMT), which had ~8.5% market share, making those players a close second and third to MercadoLibre. Despite this, the company grew its GMV by a rapid 28% in Q4,22 in Mexico, which was helped by a record "El Buen Fin" campaign, which is similar to Black Friday in the U.S. Thus, Mexico was surprisingly the fastest-growing market for the company (by Items sold) with a 27% increase year over year. Given the tough competition in that country, this is a major positive, because previously, I thought if MercadoLibre would "lose" in any country, it would be Mexico.

E-commerce market share (Bloomberg data)

Moving onto the smaller country of Chile, MELI reported a GMV growth improvement on a sequential basis, with positive volume growth. This region looks to have been impacted mainly by macroeconomic factors. According to one study, Chile's GDP growth reduced to just 0.3% in Q3,22 and is expected to contract in 2023. A positive is, for the year of 2024, a rebound is expected. The positive is this is a fairly small market, relative to Brazil and MELI was rated as the number four player with ~6.3% market share, as per the above Bloomberg data. I believe Colombia could be a more interesting market in the short term, as MELI previously had a 9.6% market share (rating it second in the country). In addition, its GDP is expected to grow by 1.2% in 2023. This is down massively from the prior growth rate of 8.1% in 2022 but is still better than the negative GDP growth expected for most countries in 2023.

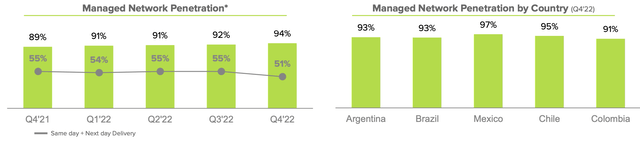

Logistics Penetration

A key competitive advantage of MercadoLibre is its vast logistics and fulfillment center network, Mercado "Envios", which means "shipping" in Spanish. This network enables the company to operate at a greater scale and efficiency than many other new entrants into the market. As of the fourth quarter, the company reported Logisitcs network penetration of a huge 93.6%, which increased by 417bps year over year. To give you an idea of the benefits of this scale, the company reported "stable" net shipping costs as a percentage of GMV, despite supply chain constraints and general inflation. The company even reported an improvement in its shipping cost for Mexico, on the back of super-high penetration of 97%, which is the highest of all the countries where MELI operates. Another huge benefit is ~51% of consumers in South America are in a sufficient radius to be eligible same day or next-day delivery. Thus, this is a huge consumer benefit that very few companies can offer. For example, Amazon in the U.S. and many parts of the world (apart from most of South America), has built an immensely strong value proposition surrounding its "next day" delivery option.

Advertising Opportunity?

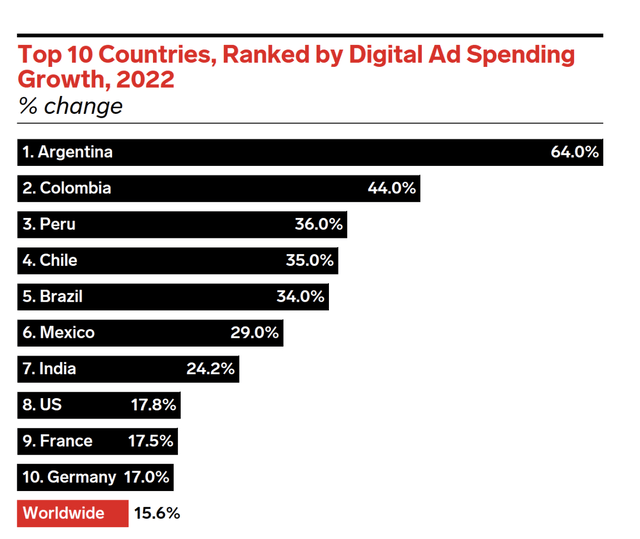

A lucrative business that I don't see many people talking about is Mercado's Ads business, which has grown by 5x over the past three years. Although this is still a small business (1.4% of GMV), it has huge potential. For instance, one study by Mordor Intelligence forecasts an 8.34% growth rate in the programmatic advertising market. In addition, Argentina experienced a rapid 64% increase in its digital advertising spend in 2022. Given this is a country where MercadoLibre leads (and is dominant), this offers huge potential.

Advertising Latin America (Insider Intelligence)

It is also useful to look at Amazon's efforts in digital advertising as a baseline. In the fourth quarter of 2022, Amazon reported $11.6 billion in advertising sales, which increased by a rapid 19% year over year, to a staggering $11.6 billion. To put things into perspective, Amazon has ~7% market share of the global advertising market. I believe MercadoLibre could simply use Amazon as a blueprint for its own advertising model (as they have done with the e-commerce business). In the Q4 earnings call, Management announced plans to launch their own DSP or Demand Side Platform in 2023 and aim to develop further technical advancements. As a former Digital marketing director, I am keenly aware that success in "Adtech" takes time and it's about developing state-of-the-art targeting with an efficient bidding process (as Meta and Google (GOOG, GOOGL) have done). The initial technology requires investment and experimentation but afterward can be extremely lucrative.

Fintech Growth Engine

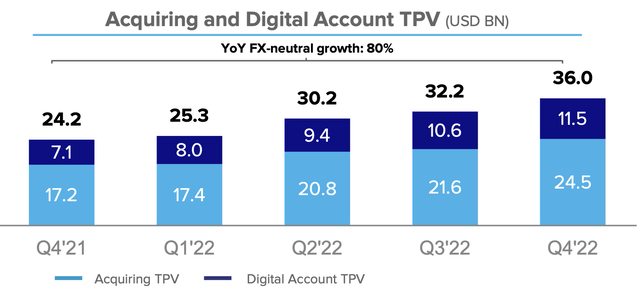

As mentioned in the introduction, MercadoLibre has grown its fintech business rapidly and it now contributes to close to 43% of total revenue, which is substantial. In the fourth quarter of 2022, its unique active fintech users rose by a rapid 27% year over year, while its total payment volume [TPV] increased by a solid 40% YoY or a blistering 80% on an FX-neutral basis.

Total Payment volume (Q4,22 report)

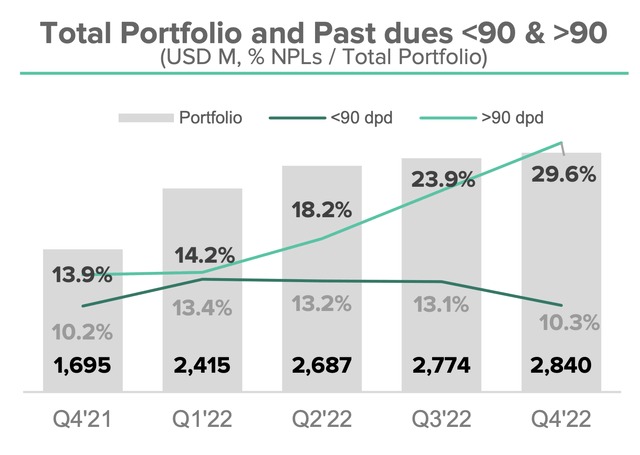

Recently, the company has announced plans to transition "Mercado Pago" from a payments wallet to a "full service" digital account. This includes a Credit card business, which reported strong growth in the third quarter of 2022. A key metric to watch given the uncertain economic environment is the percentage of loans less than 90 days due. In this case, that metric has declined from 13.1% in Q3,22 to 10.3% in Q4,22, which is a positive sign and driven by management asset optimization. However, the risk is the loans greater than 90 days overdue continued to grow, which was a negative sign. The good news is this looks to have been mostly driven by past "bad debts", which was before changes were implemented. In addition, as new credit originations have slowed down, this figure looks worse as a percentage of the total.

Total Portfolio (Q4,22 report)

MercadoLibre has a strong balance sheet overall with $1.9 billion in cash and cash equivalents in addition to ~$2.3 billion in short-term investments. In terms of debt, the company has ~$2.6 billion in "loans payable and other financial liabilities", which is categorized as "long-term debt" and thus manageable. Especially, as its net debt to EBITDA ratio has declined from 3.66x in Q3,22 to 2.07x by Q4,22.

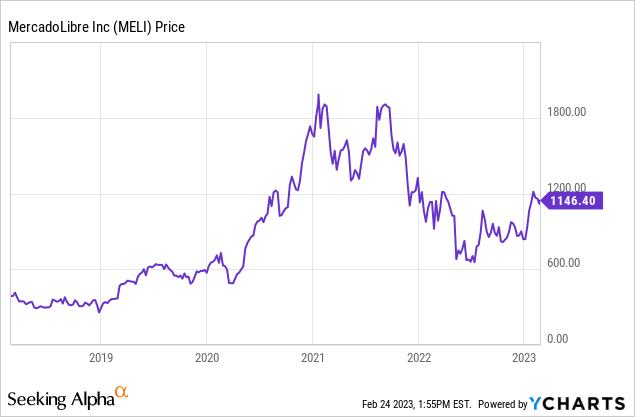

Valuation and Forecasts

In order to value MercadoLibre, I have plugged its latest financial data into my discounted cash flow valuation model. I have forecast 22% revenue growth for "next year", which is referring to the full year of 2023 in my model. This is fairly conservative given the company previously grew its revenue by a rapid 41% year over year in the recent quarter. I have been prudent with my estimate for a couple of reasons. Firstly, we are now comparing the growth from a larger total base and thus mathematically it will be naturally less as a percentage, even if the same "dollar value" of growth is added next year. Secondly, many of the slowing growth in GDP and e-commerce reported globally (and in South America) will likely impact consumer demand.

Management also reported they had seen signs of market issues (with regards to credit) and thus have been less aggressively growing their loan portfolio. Finally, my style of valuation tends to focus on being "conservative" and then if a stock is still undervalued, that is a bonus.

MercadoLibre stock valuation (Created by author Deep Tech Insights)

For years 2 to 5, I have forecast improved revenue growth of 28% per year. I expect this to be driven by an improvement in economic conditions, as well as continued growth and e-commerce leadership across its main markets (Brazil, Argentina) in addition to growth in Mexico and emerging countries such as Colombia and perhaps Chile if the economic situation improves. I also believe management will aggressively start to grow its loan book value again, as signs of economic strength will likely be shown post-2024, as per previously-cited economic forecasts.

I have also forecast a pre-tax operating margin of 19% over the next 8 years. This is based upon continued operating leverage (as per the current trend) and continued growth in the high-margin advertising business.

MercadoLibre stock valuation 2 (Created by author Deep Tech Insights)

Given these factors, I get a fair value of $1,705 per share. MELI stock is trading at ~$1,143 per share at the time of writing, and thus, it is ~33% undervalued.

The company also trades at a price-to-sales ratio = 5.91, which is close to 55% cheaper than its 5-year average.

Risks

Recession/lower consumer demand

As mentioned prior, each Latin American country has different forecasts regarding GDP growth and a possible recession. However, according to a report by S&P Global, the continent's GDP growth is expected to sharply decelerate from 3.3% to just 1.5% in 2023. The report also indicates that "recession risks" are increasing due to central banks raising interest rates in order to help curb inflation (similar to what we are seeing in the U.S.) Long story short, this could result in a pullback in e-commerce and possibly an uptick in non-performing loans [NPLs] for MELI.

Final Thoughts

MercadoLibre is a thriving e-commerce company that has built up its fintech business to drive a substantial portion of overall revenue. Given the large unbanked population in Latin America, I forecast this business to continue its strong growth trajectory. In addition, MercadoLibre's early-stage advertising business could grow to become a lucrative part of the business in the future. Given my valuation model and forecasts indicate the stock is undervalued intrinsically, I will give MELI stock a "buy" rating. However, I wouldn't be surprised if we saw some volatility throughout 2023 (due to economic conditions), especially given MercadoLibre's credit portfolio.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.