Jacobs Solutions: Strong Backlog Should Further Fuel Growth And Transformation

Summary

- Jacobs Solutions has done quite well for itself in recent years, with its transformation yielding positive results.

- Strong backlog should push sales, profits, and cash flows higher moving forward as well.

- Shares aren't the cheapest, but they do seem to have some upside potential to them.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

japrz/iStock via Getty Images

Just like how people can change over time, companies can also change. These changes can be radical at times. Sometimes they are for the worse, and other times they are for the best. A case of one company that has undergone significant positive improvements in recent years can be seen by looking at Jacobs Solutions (NYSE:J). Changes made by the company aimed at creating value for investors, in the long run, has resulted in attractive revenue, profit, and cash flow growth. With backlog for the company at an all-time high and still growing, and shares of the business trading at reasonably attractive levels, I do think that it makes for a decent ‘buy’ candidate at this time.

Big changes

Today, the management team at Jacobs Solutions would describe the company as an enterprise focused on solving the problems that its clients have. These aren’t just any problems. They are very specific problems, such as those centered around cities, environments, and more. They also focus on things that have mission-critical outcomes, require operational advancement, and utilize significant amounts of scientific discovery and cutting-edge manufacturing. The company was not always this way though. Prior to 2019 when the business announced its intention to change, it largely focused on construction services, as well as certain services associated with aerospace, nuclear technology, chemicals, and more.

From that foundation, the company has turned into a rather diverse provider of services. To really understand the firm, it would be helpful to break it up into the three primary lines of business the company operates. The first of these is called Critical Mission Solutions. Through this segment, the company provides a wide variety of cyber, data analytics, systems and software application integration services and consulting, and more. It's even involved in enterprise-level IT operations, as well as activities such as engineering and design, software development, testing and mission integration services, and more. Largely, its customer base here involves government agencies. In fact, during the firm's 2022 fiscal year, 73% of the revenue under this segment came from agencies like the Department of Defense, the intelligence community, and more. During the company's 2022 fiscal year, this segment accounted for 35.7% of the firm's revenue and for 28.7% of its profits.

Next, we have the People & Places Solutions segment. This centers around end-to-end solutions for clients related to climate change, energy transition, connected mobility, integrated water management, smart cities, and even vaccine manufacturing. A lot of its activity is under this category include consulting, planning, architecture, design and engineering, and even infrastructure delivery services. It's also engaged in long-term maintenance contracts centered around the operation of its clients’ facilities. This segment is the largest for the company, accounting for 57.4% of revenue in 2022. It was also responsible for an impressive 55.6% of all profits. Finally, we have the PA Consulting segment, which includes the company's 65% stake in PA Consulting, an enterprise that offers end-to-end innovation for customers across a variety of industries such as consumer goods and manufacturing, defense and security, energy and utilities, financial services, health and life sciences, transportation, government, and more. This is the smallest portion of the company, accounting for only 6.9% of revenue and for 15.7% of profits in 2022.

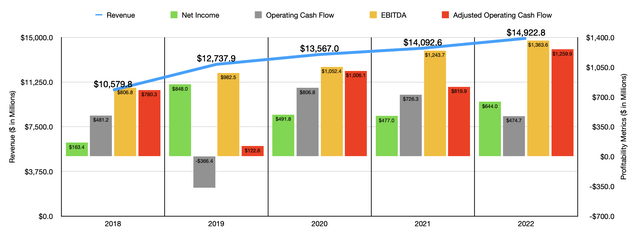

Over the past few years, the management team at Jacobs Solutions has done a really good job growing the company's top line. Revenue went from $10.6 billion in 2018 to $14.9 billion in 2022. It is worth noting that, in addition to benefiting from organic growth and bolt-on acquisitions for its two largest segments, a good portion of the revenue increase recently has come from the aforementioned purchase of its 65% stake in PA Consulting. Prior to 2021, the company generated no revenue from that business. But in 2022, sales from it totaled $1.1 billion. On the bottom line, the picture has been a bit mixed. Net income, for instance, has bounced around with no clear trend. At the low point over the past five years, it came in at $163.4 million. At the high point, it was $848 million. In 2022, it totaled $644 million. Other profitability metrics have also been mixed. Operating cash flow, as you can see in the chart above, remained in a very wild range in recent years. But if we adjust for changes in working capital, we get something resembling a little consistency. At least in this case, the general trend is toward growing cash flow, with the metric ultimately hitting nearly $1.26 billion in 2022. The best trend, however, comes from EBITDA. In each of the five years, this metric increased, rising from $806.8 million to $1.36 billion.

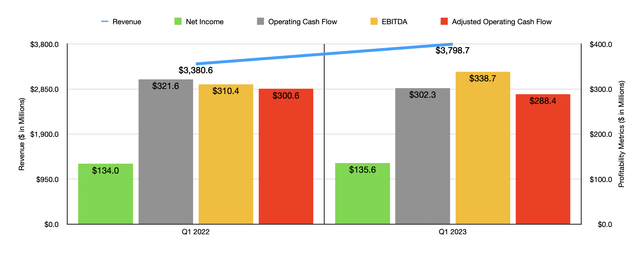

When it comes to the 2023 fiscal year, management has already provided data for the first quarter. Sales during this time came in just under $3.80 billion. This is a meaningful increase over the $3.38 billion reported one year earlier. This increase, totaling about 12.4% year over year, was driven by strength across the company's legacy operations. For instance, revenue under the Critical Mission Solutions segment jumped from $976.8 million to $1.08 billion. This, management said, was largely as a result of contracts that were awarded in late 2022. It was also in spite of a $33 million hit associated with foreign currency fluctuations compared to the $2.2 million benefit reported from that one year earlier. With this rise in revenue came generally higher profits. Net income, for instance, rose from $134 million to $135.6 million. It is true that operating cash flow worsened, declining from $321.6 million to $302.3 million. But if we adjust for changes in working capital, the decline would have been slightly less from $300.6 million to $288.4 million. Meanwhile, EBITDA for the company expanded from $310.4 million to $338.7 million. Profitability has been robust enough to encourage the company to initiate, in late January of this year, a new $1 billion share buyback program. Keep in mind that, in 2022 as a whole, the firm repurchased $281.9 million worth of shares.

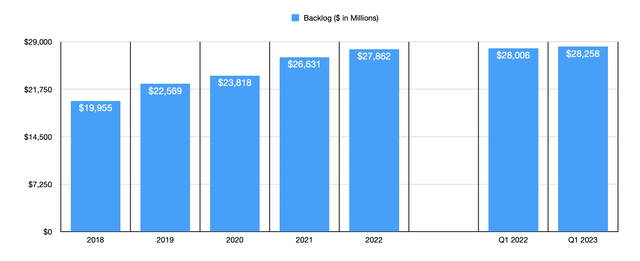

When it comes to 2023 in its entirety, management said that EBITDA should continue to grow, heading between $1.40 billion and $1.48 billion. Earnings per share are forecasted to be between $7.20 and $7.50. At the midpoint, that would translate to net income of $937.1 million if management does not buy back any additional stock. No guidance was given when it came to other profitability metrics. But if we assume a similar growth rate is what we should see with EBITDA at the midpoint, then we should anticipate a reading of around $1.33 billion for adjusted operating cash flow. Management didn't say what exactly should happen with revenue. But more likely than not, this metric will increase nicely. I say this not only because of the higher profit forecasts, but also because backlog for the company is at an all-time high. It ended the latest quarter at $28.26 billion. That's up from $28.01 billion reported one year earlier. Backlog does seem to be somewhat cyclical. I say this because it ended the 2022 fiscal year at $27.86 billion. And for context, at the end of 2018, it came in at only $19.96 billion. So the general trajectory here is definitely a positive. To make the picture even better, this backlog figure does not count a $3.2 billion contract that the company got from the Kennedy Space Center. This agreement extends the company's relationship that involves delivering high-technology solutions for human space exploration and scientific discovery at the center for 10 years. The nature of it largely revolves around managing the center’s launch infrastructure, as well as ground processing for NASA programs. They will also provide other services during this time as well.

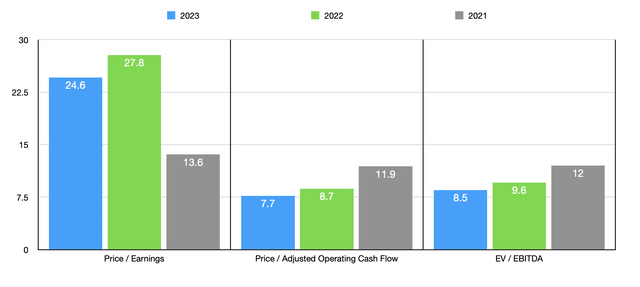

Using the data from 2022 and 2021, as well as the forecasts provided for 2023, I was easily able to value the company. The results can be seen in the chart above. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, the four companies with positive results ranged from a low of 19.3 to a high of 46. Meanwhile, the EV to EBITDA multiples for these companies was between 12.8 and 18.3. In both cases, two of the firms were cheaper than our target. Meanwhile, the price to operating cash flow multiple for these five companies was between 10.9 and 23.4. In this case, only one of the five firms was cheaper than Jacobs Solutions.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Jacobs Solutions | 23.6 | 12.1 | 13.3 |

| Booz Allen Hamilton Holding Corp. (BAH) | 29.8 | 20.5 | 18.3 |

| Leidos Holdings (LDOS) | 20.1 | 13.9 | 12.8 |

| Fluor Corp. (FLR) | N/A | 23.4 | 15.6 |

| KBR Inc. (KBR) | 46.0 | 21.4 | 17.6 |

| CACI International (CACI) | 19.3 | 10.9 | 13.0 |

Takeaway

By pretty much every measure, Jacobs Solutions strikes me as a really solid business that should continue to do well over the long run. The company's exposure to government contracts should help to insulate it from general market sentiment. It generates significant positive cash flow and is trading at levels that look attractive, both on an absolute basis and relative to similar firms. Given all of these factors, I have no problem rating the business a ‘buy’ right now.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.