ONE Gas: A Buy For Long-Term Growth And Income

Summary

- ONE Gas recently announced its annual dividend increase, making it nine straight years of dividend growth.

- The natural gas distribution company has a solid balance sheet and good prospects for continued growth.

- The recent pullback in price has created an attractive entry point for investors.

marketlan

Introduction

ONE Gas, Inc. (NYSE:OGS) is a natural gas distribution company headquartered in Tulsa, Oklahoma. It is one of the largest natural gas utilities in the United States, with more than 2.2 million customers and 64,000 miles of pipelines in Oklahoma, Kansas, and Texas.

The company has a somewhat limited history as a public company. It began trading publicly in 2014 after being spun out from ONOEK, Inc. (OKE) when it decided to separate its midstream and distribution businesses. This provided investors with a 100% regulated natural gas utility located in the heartland of the US.

Regulated Utility Means Stable Earnings

Being a regulated utility creates some limitations on growth, but it also provides some nice benefits for the company.

- It creates a legal monopoly on services in the market the utility operates in.

- It provides a guaranteed rate of return on investment for the utility.

- Utilities are "must-have" services that consumers will be willing to pay for regardless of economic conditions.

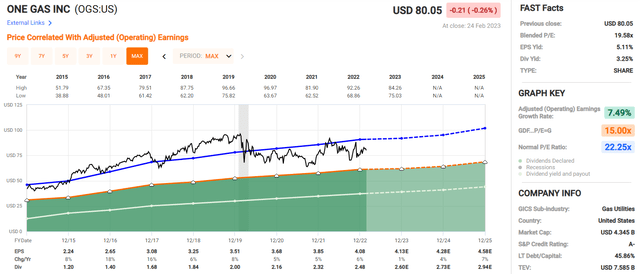

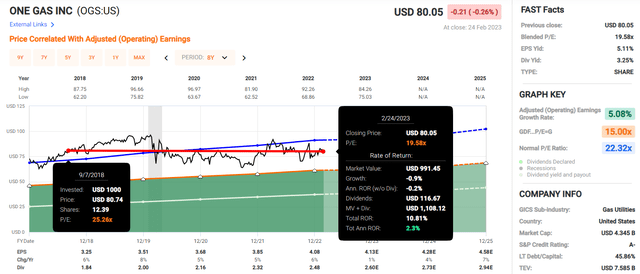

This steady and stable earnings growth is apparent when looking at the FAST Graphs of the company. ONE Gas has grown earnings by 5% or better every year since it went public. While analysts are currently forecasting just 1% growth in 2023, growth is expected to pick back up again after that.

ONE Gas FAST Graphs (By Author)

This consistency is what makes utilities such great long-term investments for income investors. Being able to count on dividends being paid through booms and busts while also seeing annual income growth is important when relying on that income for retirement.

History of Dividend Growth

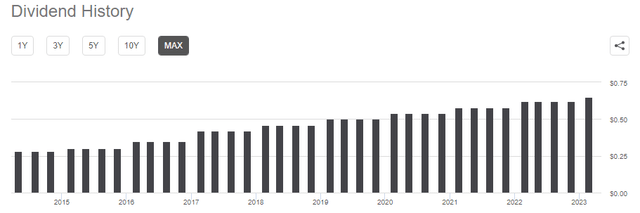

Like its parent company, ONE Gas has demonstrated a commitment to paying a generous and growing dividend. It began paying dividends immediately after going public and has grown the payout every year since.

It has grown the dividend from the original rate of $0.28 in 2014 to $0.65 with its most recent declaration, an increase of 132%.

OGS Dividend Payout History (Graphic by Seeking Alpha)

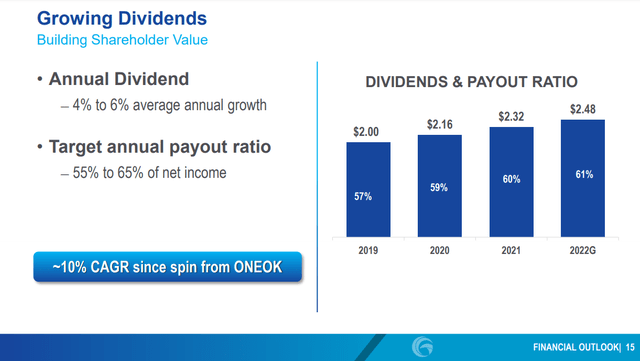

The company has given every indication that it will continue growing the dividend. During the company's December investor presentation, management guided for 4-6% annual dividend growth and a targeted payout ratio of 55-65% of net income.

OGS December Investor Presentation, Pg. 15 (OGS Investor Relations Website)

Analysts are projecting $4.13 in earnings for 2023, which results in a payout ratio of 63% at the new dividend rate. This could result in a year or two of dividend growth on the lower end of the range to get the payout ratio back down to the mid-range of guidance. However, the mid-single-digit dividend growth combined with a yield of 3.25% is an attractive option for income investors.

Future Growth Prospects Remain Solid

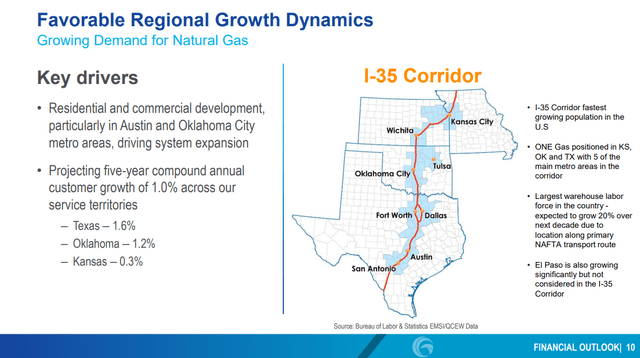

The recent slowdown in growth isn't ideal, but I don't believe it's a terminal drop. The I35 corridor which ONE Gas serves is the fastest-growing population center in the US. It is a hub for energy and chemical production and is a major trade corridor between Canada and Mexico.

OGS December Investor Presentation, Pg. 10 (OGS Investor Relations Website)

This growth in industry and population is a strong tailwind for energy demand growth, which should continue to benefit ONE Gas.

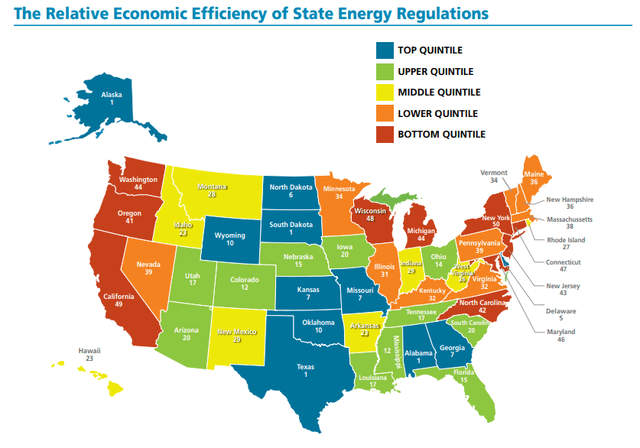

Another positive is the regulatory environment in the states in which ONE Gas operates. According to the Pacific Research Institute, the three states all rank in the top ten for efficiency of state energy regulations.

Economic Efficiency of State Regulations (Pacific Research Institute)

Between the economic growth opportunities and welcoming operating environment, ONE Gas sits in the sweet spot of the country for growth as a regulated gas utility.

Attractive Valuation

ONE Gas stock currently trades at ~$80, which is the same level it traded at in the fall of 2018. This drop in price happened while earnings grew from $3.25 to $4.08, resulting in the PE multiple contracting from 25.26 to 19.58.

OGS FAST Graphs Valuation (Chart From FAST Graphs)

This compares with a "Normal" PE ratio of 22.32, which indicates that shares are 12% undervalued on a comparative basis.

This drop in valuation may have some valid reasons, however. The market may be discounting shares due to the recent slowing of growth. Also, higher interest rates are also offering other options for income investors, which reduces demand for dividend-paying companies.

While higher interest rates may be with us for a while, I believe the slower growth rate is a temporary concern. The reduced earnings were largely blamed on last year's severe winter storm Uri, which was a one-time event. As growth normalizes back to a 4-6% rate, I expect the PE multiple to expand back to its typical level as well.

Financial Strength

ONE Gas is considered to be a strong company financially, as it holds an A- credit rating from S&P and an A3 rating from Moody's.

This compares favorably with its peers in the utility sector. Of the companies I follow, none have a higher S&P credit rating.

The A- credit rating is shared by the likes of American Electric Power (AEP), Consolidated Edison (ED), Alliant Energy (LNT), NextEra Energy (NEE), WEC Energy Group (WEC), and Xcel Energy (XEL), companies that are considered some of the highest quality in the sector.

Closing Thoughts

ONE Gas, Inc. is a company with a short history but is one with the potential to be a solid long-term holding in a portfolio. It has executed well during its nine years of existence, and management appears committed to growing company earnings and dividends going forward.

It operates in one of the best regions of the country for growth and regulatory environment and has the financial wherewithal to maintain operations and fund future growth.

ONE Gas doesn't have the reputation or following of some of the other blue chip utilities, but has all of the ingredients to become one in the future.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer by trade and am not a professional investment adviser or financial analyst. This article is not an endorsement of the stocks mentioned. Please perform your own due diligence before you decide to trade any securities or other products.