Medical Properties: The Strange Case Of Dr. Medical Properties And Mr. Hedgeye

Summary

- There has been a fierce debate around Medical Properties Trust, Inc. over the past year (generally) and over the past few days (specifically) since the company released its Q4 earnings.

- On one side, there are all those loyal, long-term shareholders who think they're holding onto a safe business with an easily covered dividend.

- On the other side, there's Hedgeye Risk Management, a noted short seller since mid-April 2022, seeing >75% downside, even after the stock already had lost 56% from its early-2022's high.

- Whether you're long or short - dismissing an opposite view just because it doesn't suit your very own position/view isn't only shallow but also a mistake.

- This idea was discussed in more depth with members of my private investing community, Wheel of Fortune. Learn More »

Hulton Archive

Medical Properties Trust, Inc. (NYSE:MPW) has made a lot of noise over the past week, since publishing its earnings for Q4.

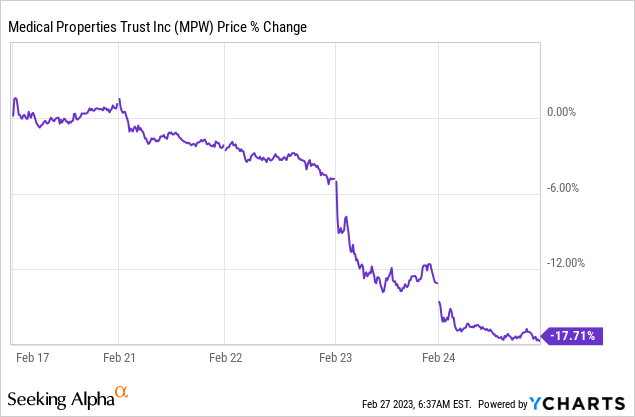

YCharts

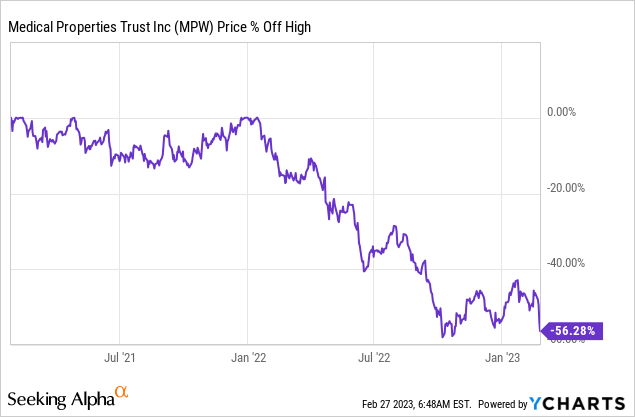

The stock lost (another) ~18% last week, and it's currently trading >56% below the most recent high it reached only about 13 months ago.

Everybody is already fully aware of the reasons behind this drop, ranging from macro/general market reasons (e.g., sluggish stock market over the past year, rising rates, slowing economy) to micro/company specific reasons (e.g., trouble with tenants, all sorts of legal dealing around sales/reorganization of assets/leases, and most of all - short-selling pressure).

In this article, instead of focusing on whether MPW stock is currently a "BUY" or a "SELL," we wish to focus on some of the misconceptions that we have bumped into while reading the threads along various recent articles.

Nonetheless, knowing that so many are interested (only) in the "bottom line" of the author's opinion, let us take this burden off the table straight away:

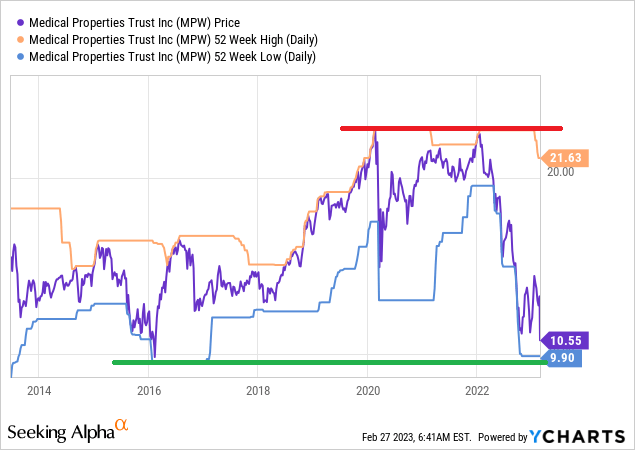

After halving from its 52-week high, and trading close to the long-term support, we believe that MPW is a (shall we add "cautious"?) BUY.

YCharts, Author

This rating deserves a separate article (and we might write one on that, too) but since we wish to focus on other aspects (not solely/necessarily the stock rating) we won't dive into this here.

1) Steward is an issue just as Prospect is

Sure, at the moment MPW has written off much more due to Prospect Medical Holdings than due to Steward Health Care.

Nonetheless, while Prospect is a "closed-end" issue - MPW knows what is at stake and the decision is mainly when and how much to write off - Steward is a "work in progress," and it's too early to know if and when (significant) write-offs will be needed.

If you take a look at MPW's earnings call from last week, you won't find the word "Malta" mentioned even once.

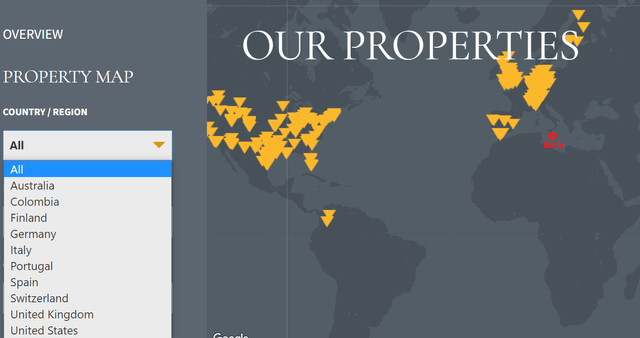

Nor will you find Malta being mentioned on the company's property map. (The red circle indicating where Malta is on the world's map is ours)

Medical Properties Trust - Property Map

Nonetheless, in case you've missed it, Malta is now a new issue. You can read more about this negative development, involving Steward, here.

Does this affect MPW? Sure it does, even if indirectly, by hurting a troubled tenant (of MPW) and putting on it more pressure.

To what extent does this affect MPW? This is where things are less clear.

On one hand, to this moment, MPW neither disclosed any involvement here nor announced anything related to the Maltese court ruling.

On the other hand, if you read the Viceroy Research's report (dated Feb. 8, 2023) it looks pretty obvious that MPW is a partner, not only a service provider.

Who do we need to believe? We don't know, however the two points we wish to make are as follows:

- Steward can be big of a deal just as Prospect is.

- One way or another, more write-offs are not only possible but we dare say likely.

2) Don't count on the official BV!

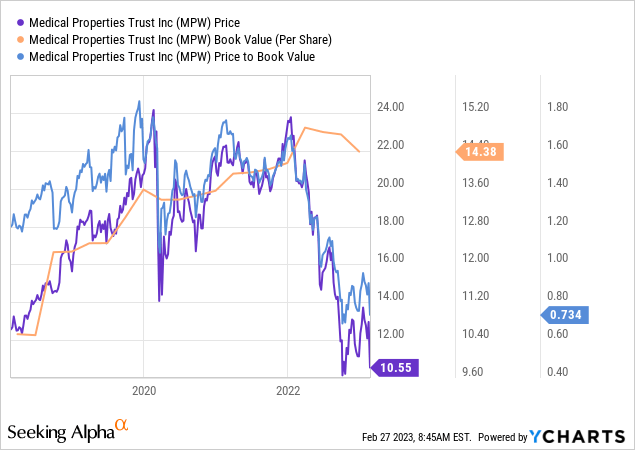

Book value ("BV") should be viewed as a "good indication," not as a "concrete, tangible, value" of a company, especially not one that is relying so heavily on appraisals and estimations like MPW.

We're not to say that the BV is meaningless, and we're implying that MPW's BV is off, but we do say that if you think the stock is worth ("at least" or "for sure") $14.38 just because that's the last reported BV, you're making a wild assumption, and you surely are not doing yourself (as an investor) a favor.

When a company starts writing off value, you know where/when it starts but you hardly ever know where/when it might end.

It's possible that MPW may have been super conservative and they may have already wiped so much value that no(t much) more value would need to be written off. But it's also possible that MPW has only taken an initial-immediate action based on a "base case"/reasonable scenario with the potential for more (bad news) to hit the road over the coming months. If so, the BV could very easily (and quickly) drop closer to where the stock price (currently) is rather the stock price rise closer to where the book value (at the end of Q4) is.

Putting it differently, you better not build your bull case (mainly) on the alleged BV.

3) MPW is no longer a top quality, safe, business

So many readers on Seeking Alpha are allured to the income component of real estate investment Trusts, or REITs, that sometimes it's scary to see the extent to which (otherwise, conservative) investors choose to ignore the forest (big picture) for the trees (dividend).

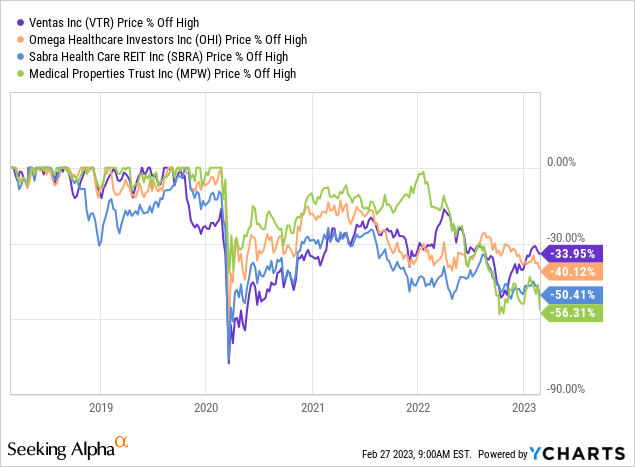

For many years, healthcare REITs were considered one of the safest pockets of the REIT-kingdom. Names like Ventas, Inc. (VTR), Omega Healthcare Investors, Inc. (OHI), and Sabra Health Care REIT, Inc. (SBRA) were viewed as great businesses that come with fairly low (surely below market average) risk.

Then came COVID and slowly but surely (ever since) these REITs realized that the good, old, story ("we lease, you pay") is no longer as simple as it used to be. More and more tenants (operators of health facilities) have become troubled/distressed tenants, and it's safe to say that over the past three years healthcare REITs offer more risk than the average market risk. [Once again, this deserves a separate article and we don't want to dive into this here]

MPW is simply a late victim, but certainly not a huge surprise.

A year ago, while VTR, OHI, and SBRA were all trading at least 1/3 below their respective 5-year highs, MPW was still trading near its 5-year high.

MPW is "catching up" and (as a matter of fact) it's catching up so quickly that it has taken the lead.

The MPW that you viewed as "safe/r" no longer exists, and you should adjust your position (and expectations) to the real/current risk.

4) The dividend is anything but safe

There are a few common mistakes that I see REIT investors making over and over again:

- REITs are obliged to distribute 90% of their taxable income. Taxable income isn't the same as FFO, AFFO or NFFO.

- Taxable income is something you can easily affect (and I say so as a former accountant).

- If the company is guiding for FFO/share that is greater than its distribution - the dividend is fully covered, thus "safe." Sure, the dividend might be (technically) "covered," but it doesn't mean that the company has any obligation to keep it at the same level. Coverage doesn't equate safety!

- You cut because you can, not because you need to. It's as simple as that.

MPW guided for NFFO of $1.50-$1.65 in 2023 and its current distribution is $1.16 (per annum) so the company should easily keep paying the (current) dividend, right?

Wrong!

First and foremost, boards of directors tend to pay what they believe is necessary, not what they can afford. Even if MPW can easily meet the $1.16 in 2023, its BoD may elect not to. Why? Because they can and because nobody would blame them for doing so right now.

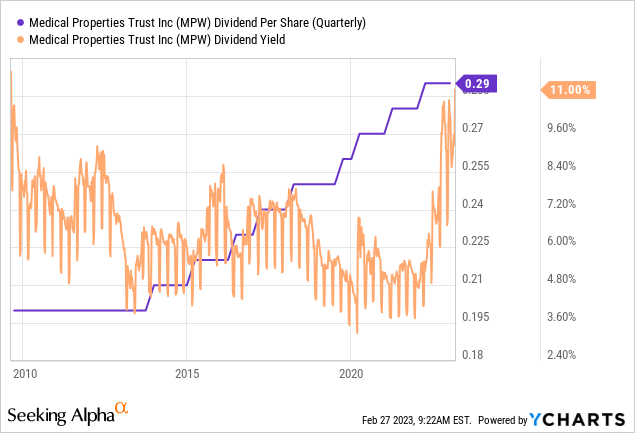

Secondly, since the end of the GFC, surely over the past decade, MPW hasn't paid such a high yield as it's paying today.

It's certainly possible that management will decide that there's little (to no-) value in the yield staying at 11%; 7%-8% would do just as much.

Thirdly, many may have forgotten, but if we look outside of MPW, things aren't great either: Higher rates, tightening monetary policy, slowing economic growth, risk of recession, etc. This is certainly a time for any company to think more about capital preservation, more than being a "dividend champion."

Lastly, going back to MPW's specific situation, the company has admitted to not getting rents from various tenants/projects and shared its willingness to take steps to ease some of the burden off its tenants. Naturally, the cash flow that MPW is seeing these days is significantly lower than it used to be, and it's also safe to assume that it's going to get worse. MPW itself shared that it would take (at least) 12-18 months for some of the current restructuring/reorganization processes to come to fruition and long this timeline MPW will need to share the burden.

Therefore, the company clearly is operating in cash preservation mode and there's nothing easier (for a company) to preserve cash than to stop distributing it to shareholders.

Do we believe a cut is imminent? No, we don't for two main reasons:

- MPW is still making enough to support its dividend at current levels, and so if they believe that they can be back on the saddle towards the end of 2024 - they might be better off avoiding cutting and letting this temporary phase pass.

- The stock has already more than halved since early 2022 and investors are shaky as is. Add to that the short selling pressure (more on that hereinafter) and it's clear that a dividend cut will only add fuel to the negative sentiment. From a reputation, resilience, and (most important) perception, MPW would be better off not cutting its dividend, putting a stick in the nay-sayers' wheels and lifting the mood/trust of worrisome shareholders.

Either way, we say: If you want to cut - cut, don't stretch it.

MPW would make a colossal mistake if it intends to cut but postpone the announcement for the next quarter. For the sake of the stock price, it's better for all bad news to be handed to investors all at once rather than in pieces throughout 2023.

Last but not least (regarding the dividend), it may not be such a bad idea to cut the dividend at this point, especially if such an announcement would be associated with an aggressive stock repurchasing program and/or debt reduction. Investors might actually appreciate such a move, and let's face it: if you're long, MPW paying 11% or "only" 7%-8% shouldn't be a "game changer" for you more than the well-being and sustainability of the business (as a whole) is.

5) Dismissing short sellers is a big mistake. Big. Huge.

Remember that we started by saying that we believe MPW to be a BUY at this point? We mainly did so to support what we're about to say now.

We welcome any opinion about any stock, whether we hold it or not, and whether we think positively or negatively about it.

With that in mind, we also welcome short sellers. Not only do they make for a better (more balanced) market, but short sellers are often the (much needed) kid who call "The Emperor's New Clothes" what they truly are.

Fact is, Hedgeye Risk Management has made a great call about MPW.

Fact is, you may dislike (or like for that matter) their report, but you can't disagree (or agree for that matter) with it entirely; hardly any report is 100% false/fiction (or 100% true/factual for that matter).

Fact is, a report laying the case for a short sale is no different than a report laying the long case. It's funny how so many claim that short sellers have (a hidden?) "agenda" or try to "manipulate" the stock price. I mean, what is the difference between a long analysis to a short analysis? Do you expect someone to write a report that doesn't support his/her view? Come you people, don't treat short sellers as if they're any different than long buyers. If anything, and from personal experience, short sellers are working a lot harder on their analyses and require to walk an extra mile (or two) to make money than longs. So please, stop the whining, finger pointing, and blame. The only thing short sellers might be guilty as charged is not serving your very own position with their analysis, but that's not a crime, and it would be extremely unwise from your end to dismiss a short seller's analysis just because it doesn't suit your own position/view.

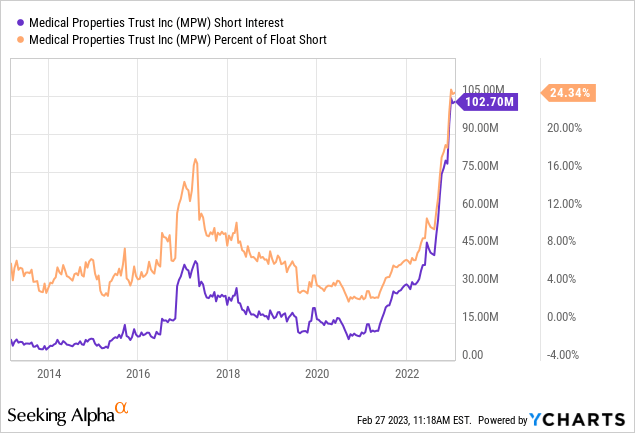

Fact is, Hedgeye has caused many investors to rethink their (bullish) stance and/or join the bearish call.

In spite of us having a positive view about the stock right now, we follow "The Call @ Hedgeye" (e.g. Oct 21, 2022 and Feb. 24, 2023) and we use their view to challenge our own.

And since short sellers have an agenda just like buyers do, short sellers are looking to make money just like buyers do. The last thing you can say about short sellers is that they're stupid or irrational.

Last Friday, Hedgeye made a call for MPW to be worth $3. Do they really believe MPW is heading to $3? I strongly doubt it, and I surely disagree with it.

But again, this is no different from so many analysts throwing sky-high price targets ("PTs") into the air every day. Do they all believe in these PTs? Probably not. Do they intend to wait (to sell) until the stock hits this PT? Very unlikely.

Similarly, Hedgeye isn't going to wait for $3 to take profit on MWP. I can assure you that. As a matter of fact, I'm pretty sure that unless the stock falls significantly (say >20%) over the next month or two - they're likely to cover sometime soon, be it $10.55, $11, $10, or even somewhere in the mid $9s.

Why so? Because they've already made their profit... Because they've no reason to push this for too long (Short selling is a risky business that works during shorter time-frames than longs do)... and because the cost (of shorting) is rising alongside the (rising) short interest (simply put, the more people join their trade - the more costly it becomes).

Short sellers have both good and bad reputations:

- "Good" = They are often the ones who expose cases of fraud and/or misconduct.

- "Bad = They sometimes use semi-baked (or even non-baked) allegations that mainly/solely aim at serving their position and not necessarily fully and truly reflect a company's situation.

In this case, we don't find Hedgeye to be involved in any wrongdoing, but they simply keep pushing their view, something they're entitled to do even if it serves their position. As long as one uses facts and reasonable assumptions - we can argue about the conclusion, but we can't (and mustn't) kill the messenger for delivering a message we don't like to hear.

Funds Macro Portfolio ("FMP") can be found on both our services: Wheel of Fortune ("WoF") and Macro Trading Factory ("MTF").

The main differences between the two services is that while MTF is solely about FMP, on WoF you would receive >250/year trading alerts, lots of data, posts, and discussions.

If you're passionate about the markets, a DIY type of investor, who finds great interest in running your own 'show' - you'd love WoF.

If you have no time, desire, and/or knowledge to actively-manage your portfolio - MTF is a perfect, calm, low maintenance, solution for you.

This article was written by

On a strictly formal note...

The Fortune Teller ("TFT") is a well-known contributor on Seeking Alpha ("SA"), and a top blogger according to TipRanks, with over 30 years of deep and direct market experience.

TFT is the leading moderator of two services on SA: Wheel of Fortune and Macro Trading Factory (led by TFT's "mirage identity" called The Macro Teller, or "TMT")

TFT is an account that represents a business which is mostly focuses on portfolio- and asset- management. The business is run by two principles that (among the two of them) hold BAs in Accounting & Economics, and Compute Sciences, as well as MBAs. One of the two is also a licensed CPA (although many years have gone by since he was practicing), and has/had been a licensed investment adviser in various countries, including the US (Series 7 & 66).

On a combined basis, the two principles lived and worked for at least three years in three other-different countries/continents, holding senior-managerial positions across various industries/activities:

On one hand/principal, IT, R&D, Cloud, AI/ML, Security/Fraud, Scalability, Enterprise Software, Agile Methodologies, and Mobile Applications.

On the other hand/principal, Accounting, Banking, Wealth Management, Portfolio Management and Fund Management.

Currently, they run a business which is mainly focusing on active portfolio/fund/asset management as well as providing consulting/advisory services. The business, co-founded in 2011, is also occasionally getting involved in real estate and early-stage (start-up) investments.

The people who work in and for this business are an integral and essential part of the services that we offer on SA Marketplace platform: Wheel of Fortune, and Market Trading Factory. While TFT (or TMT for that matter) is the single "face" behind these services, it's important for readers/subscribers to know that what they get is not a "one-man-show" rather the end-result of an ongoing, relentless, team effort.

We strongly believe that successful investors must have/perform Discipline, Patience, and Consistency (or "DCP"). We adhere to those rigorously.

The contributor RoseNose is both a contributing and promoting author for Macro Trading Factory.

On a more personal note...

We're advising and consulting to private individuals, mostly (U)HNWI that we had been serving through many years of working within the private banking, wealth management and asset management arenas. This activity focuses on the long run and it's mostly based on a Buy & Hold strategy.

Risk management is part of our DNA and while we normally take LONG-naked positions, we play defense too, by occasionally hedging our positions, in order to protect the downside.

We cover all asset-classes by mostly focusing on cash cows and high dividend paying "machines" that may generate high (total) returns: Interest-sensitive, income-generating, instruments, e.g. Bonds, REITs, BDCs, Preferred Shares, MLPs, etc. combined with a variety of high-risk, growth and value stocks.

We believe in, and invest for, the long run but we're very minded of the short run too. While it's possible to make a massive-quick "kill", here and there, good things usually come in small packages (and over time); so do returns. Therefore, we (hope but) don't expect our investments to double in value over a short period of time. We do, however, aim at outperforming the S&P 500, on a risk adjusted basis, and to deliver positive returns on an absolute basis, i.e. regardless of markets' returns and directions.

Note: "Aim" doesn't equate guarantee!!! We can't, and never will, promise a positive return!!! Everything that we do is on a "best effort" basis, without any assurance that the actual results would meet our good intentions.

Timing is Everything! While investors can't time the market, we believe that this applies only to the long term. In the short-term (a couple of months) one can and should pick the right moment and the right entry point, based on his subjective-personal preferences, risk aversion and goals. Long-term, strategy/macro, investment decisions can't be timed while short-term, implementation/micro, investment decision, can!

When it comes to investments and trading we believe that the most important virtues are healthy common sense, general wisdom, sufficient research, vast experience, strive for excellence, ongoing willingness to learn, minimum ego, maximum patience, ability to withstand (enormous) pressure/s, strict discipline and a lot of luck!...

Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: TipRanks: BUY MPW.