Teekay Tankers: More Upside Likely Following An Earnings Blowout

Summary

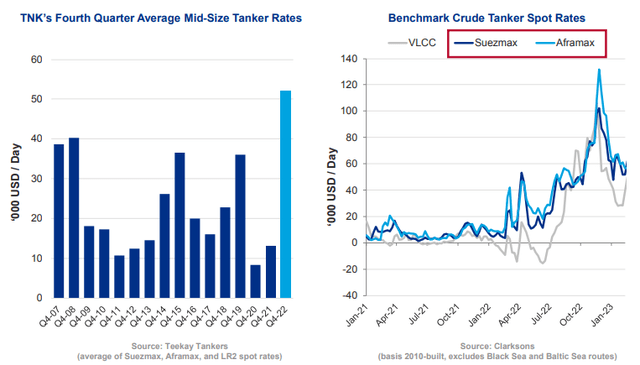

- Global crude shipping rates went parabolic at times in 2022 but now appear to have peaked.

- Even still, Teekay Tankers should continue to generate ample free cash flow even if we assume a big drop in said rates.

- I see more upside based on valuation and the charts.

HeliRy

Global supply chains are easing, but crude oil tanker rates surged late last year. The top is probably in, but that doesn’t mean some stocks in the space cannot keep generating strong free cash flow. One stock reported massive profits for its Q4 last week, and I see more upside due to technical momentum and even a value case in Teekay Tankers.

Global Oil Shipping Rates Soar, But Now Falling

Teekay Tankers

According to Bank of America Global Research, Teekay Tankers (NYSE:TNK) is one of the world's largest tanker owners and operators. It owns 44 mid-sized tanker vessels and is a 50% joint-owner of one VLCC, charters-in 9, for an operational fleet of 54 tankers (our 54 includes 2 STS support vessels). The company owns a combination of Suezmax, Aframax, Product Tankers, support ships, and a 50% JV stake in one VLCC tanker.

The Canada-based $1.5 billion market cap Oil, Gas & Consumable Fuels industry company within the Energy sector trades at a low 6.5 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. Teekay reported very strong earnings in last week’s Q4 report. Revenue was exceptionally strong at $367 million – more than $155 million above consensus.

The firm in its presentation reported a whopping $4.84 of free cash flow per share just in the fourth quarter alone – a period that saw the highest shipping rates ever, according to CEO Kevin Mackay. More upside potential stems from China’s reopening and better-than-expected global growth. Still, there’s significant risk with global shippers and Teekay specifically.

Teekay is highly exposed to spot rate prices which can go through booms and busts. As global supply chains ease, I expect tanker rates to have peaked, pressuring TNK earnings going forward. What’s more, if OPEC cuts oil production, that would be a downside risk to Teekay. The company is, though, taking steps to reduce its debt burden, which shows capital discipline.

TNK Q4: Color on Quarter

Teekay Tankers

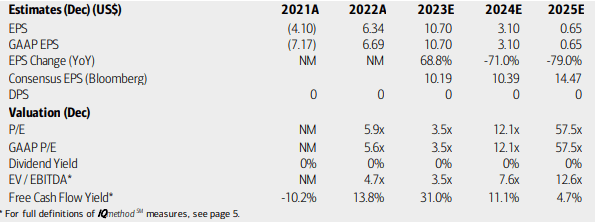

On valuation, analysts at BofA see earnings surging this year amid favorable shipping rates to which the firm is highly levered. Longer routes have been a boon to Teekay following Russia’s invasion of Ukraine a year ago. With exposure to near-term rates, earnings are going to be volatile. While BofA sees a steep drop in per-share profits in 2024 and 2025, the Bloomberg consensus forecast is much more upbeat with earnings growth ahead. No dividends are expected to be paid on this small cap.

Even amid an earnings drop should BofA’s cautious stance play out, TNK still generates positive free cash flow while trading a low current P/Es and a below-market EV/EBITDA ratio. Overall, with the recent surge in the share price, if we assume a historically normal 5x EV/EBITDA for the stock, then shares might have 20% more upside.

Teekay Tankers: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

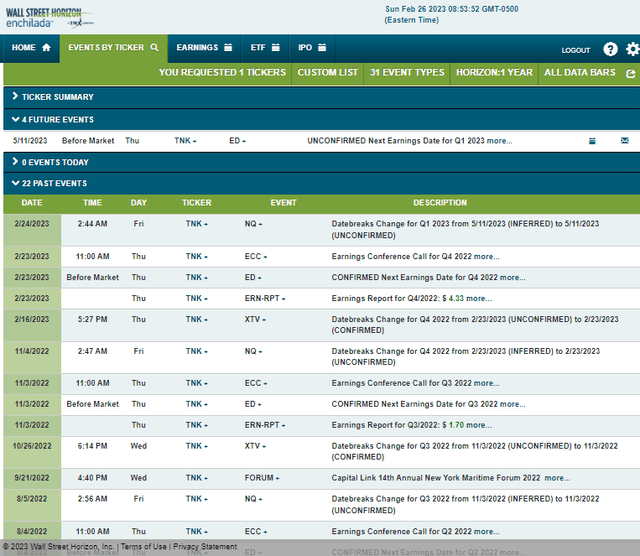

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Thursday, May 11 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

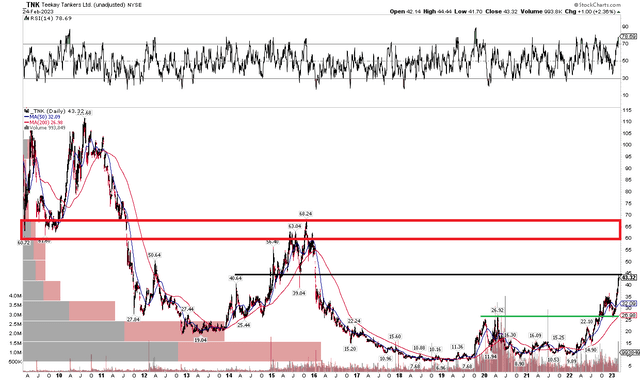

The Technical Take

TNK blew past earnings expectations, and the stock has moved up commensurably. Notice in the long-term chart below that shares have thrust to their highest levels in more than 7 years. I see resistance in the $60s, but there’s another technical feature that should be considered. Teekay has support in the $26 to $27 range after basing in the high single digits. That range, call it $18, should then be added on top of the $27 former resistance level to arrive at a measured move price target of $45.

That is just about where TNK stock trades as of last week’s close. What I also see is that TNK has a successful “throwback” to support after initially jumping into the mid $30s late last year. The retest of $26 was solid. So here we are – I would not be surprised to see more upside to the low $60s but we might first see a pause in the mid-$40s. With big recent volume, a long play on momentum works, and adding to it on a dip into the upper $30s is a prudent play.

TNK: Achieves Price Objective, Resistance in the $60s, Support $35

Stockcharts.com

The Bottom Line

Teekay is a highly volatile small-cap name in a risky industry. As such, a position should be smaller compared to other more blue-chip stocks. Nibbling here and buying more in the upper $30s, targeting around $60 appears to be a good play in my technical view while the valuation, albeit uncertain, suggests the stock could rise further.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.