Teekay Tankers: Higher For Longer

Summary

- Teekay Tankers has one of the largest fleet of oil tankers operating in the spot market.

- Tanker rates stay elevated due to Russian oil disruptions.

- With little global fleet growth until 2025, tanker rates can stay elevated for years.

Dikuch

I was one of the first analysts to turn bullish on Teekay Tankers (NYSE:TNK) last July and reiterated by bullish thesis in November 2022. My initial thesis was predicated on Russian crude oil that used to be exported to Europe being redirected to faraway countries like India and China, lengthening the time on water, increasing tanker utilization and driving up tanker rates.

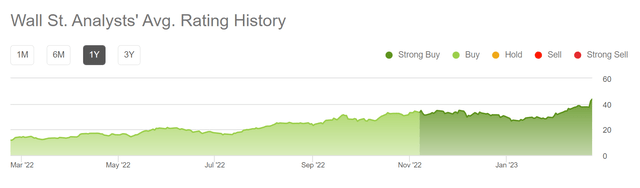

In the ensuing months since I wrote my initial article, my thesis played out as expected and Wall Street jumped onto the my thesis, raising their rating on TNK to a strong buy (Figure 1).

Figure 1 - Wall Street rating on TNK (Seeking Alpha)

After a doubling of the stock since my initial article, do I still consider TNK a buy at this time?

Figure 2 - TNK stock price (Seeking Alpha)

Brief Company Overview

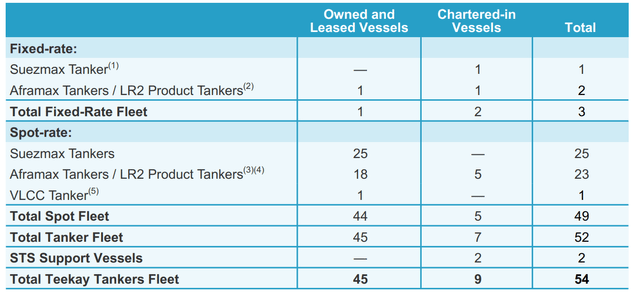

First, for those new to the Teekay Tankers story, Teekay Tankers was founded in 1973 by Torben Karlshoej (hence the T.K. initials) and currently operates a fleet of 45 product and oil tankers, including 25 Suezmax, 18 Aframax/LR2 and 1 VLCC oil tanker (Figure 1). TNK also has 9 time chartered-in (i.e. TNK has chartered the vessels from their owners at a fixed rate) tankers.

Figure 3 - TNK fleet as of February 17, 2023 (TNK Q4/2022 earnings release)

TNK's tankers are mostly engaged in the spot market, although the company does opportunistically lock in longer-term time charters at attractive rates.

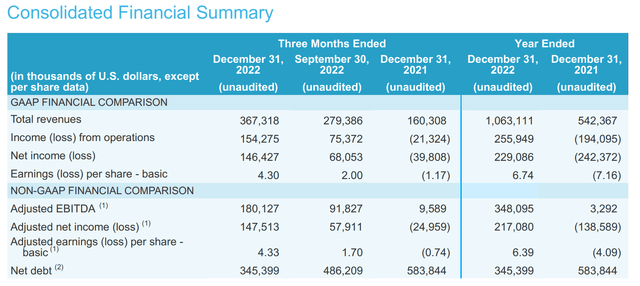

Fantastic End To 2022

On February 23rd, TNK reported their fiscal fourth quarter results for 2022. Strong fourth quarter tanker spot rates and TNK's operating leverage allowed the company to report GAAP net income of $146 million (vs. a net loss of $40 million in Q4/21) or $4.30 / share (vs. a net loss of 1.17 YoY), the highest quarterly net income in the company's history (Figure 4).

Figure 4 - TNK Q4/22 financial summary (TNK Q4/2022 earnings report)

For the full year, TNK reported $229 million in net income or $6.74 / share.

Revisiting Bullish Tanker Thesis

A quick refresher for those who are not familiar with my bullish crude tanker thesis, I believe spot tanker rates will remain 'higher for longer' due to EU sanctions on Russian crude oil imports.

Historically, Russian crude oil and oil product exports were sent to nearby ports like the Port of Rotterdam in the Netherlands. However, due to Russia's invasion of Ukraine, the EU has banned the import of Russian Oil since late 2022, so European refineries have to replace nearby Russian crude with long haul crude from the Atlantic basin and the Middle East. Furthermore, sanctioned Russian crude have to redirected to faraway countries like China and India, which do not participate in the ban.

Essentially, the seaborne crude oil market is replacing short-haul 5-day voyages between St. Petersburg and Rotterdam with long-haul voyages between St. Petersburg to India and Houston to Rotterdam (Figure 5).

Figure 5 - Changes in crude trade patterns due to Russian oil ban (TNK investor presentation)

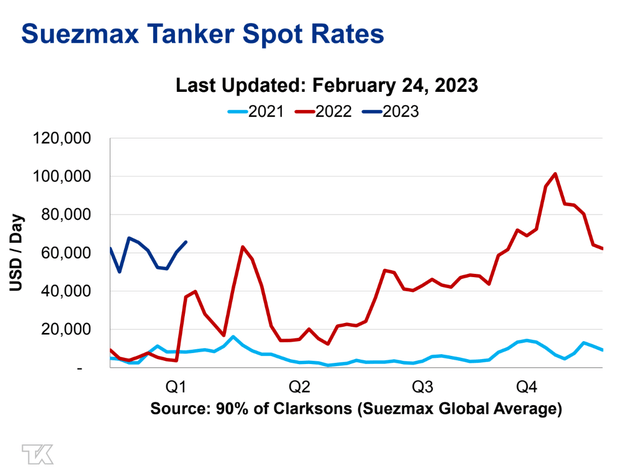

As a result of the change in crude trade patterns, spot tanker rates have shot up in recent quarters and remain elevated heading into 2023 (Figure 6).

Figure 6 - Tanker rates remain elevated into 2023 (Teekay Market Insights)

Investors who want to keep up to date with spot tanker rates should bookmark Teekay's weekly 'Market Insights' report.

Teekay Capitalizing On Strong Tanker Rates

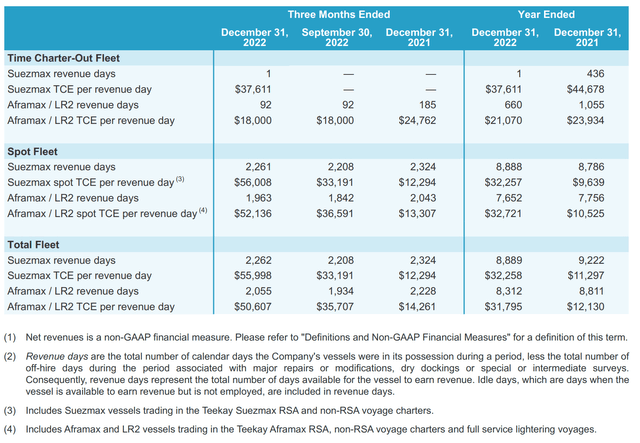

TNK's fleet earned exceptionally strong Suezmax Time Charter Equivalent ("TCE") rates of $56k / day and Aframax/LR2 TCE rates of $51k / day in the fourth quarter (Figure 7). This was a large improvement from $33k and $36k in Q3/22, and $12k and $14k in Q4/21 respectively.

Figure 7 - TNK 2022 operating performance (TNK Q4/2022 earnings release)

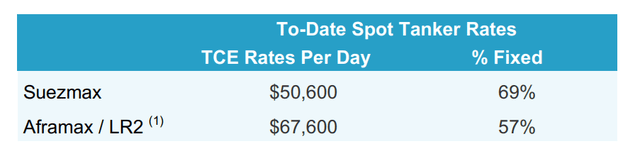

So far in Q1/23, TNK have secured $51k / day for 69% of its spot Suezmax fleet and $68k / day for 57% of its Aframax / LR2 fleet, suggesting that strong tanker rates will continue in 2023 (Figure 8).

Figure 8 - Early indication is Q1/23 will be even better (TNK Q4/2022 earnings release)

Using Time-Charter To Expand Fleet Increases Operating Leverage / Risk

As mentioned above, although TNK mostly operates in the spot market, the company does opportunistically play in the time-charter space as well.

Since November 2022, TNK has entered into three time charter-in agreements with contract lengths ranging from 24 to 54 months at an average rate of $33k / day, and has chartered-out two vessels with periods ranging from 12-26 months at an average rate of $43.5k / day.

In total, the company have doubled its charter-in fleet to 8 vessels at an average of $24.3k / day, plus one newbuild eco-Aframax that was delivered in January 2023 at a 7-year time charter-in contract rate of $18.7k / day.

If spot rates remain high, then chartering-in vessels make sense, as TNK can pay $24k / day to the owners while earning spot rates of in excess of $50k / day. However, having a large time chartered-in fleet can also expose the company to significant operating risks in the event that tanker rates decline. So a large charter-in fleet can be a sign of management's confidence in the sustainability of tanker rates.

Are Rates Sustainable?

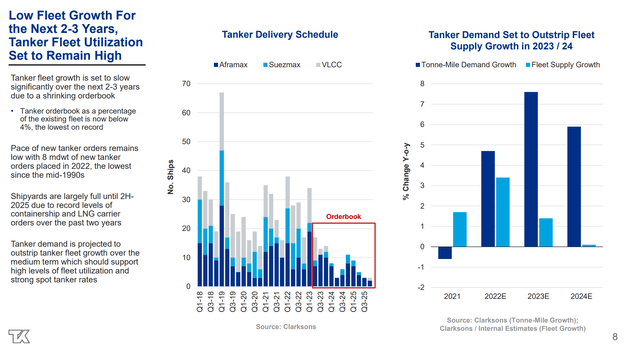

Historically, the curse of the tanker business is that high tanker rates incentivizes shipowners to order newbuilds, which swamp the markets all at the same time, causing a crash in tanker rates. However, the current cycle appears to be quite different, as newbuild orders remain historically low despite high tanker rates (Figure 9).

Figure 9 - Global fleet growth remain muted (TNK investor presentation)

Fleet growth is expected to remain low for the next 2-3 years because shipyards are currently full until 2025 building containerships and LNG carriers that were ordered in the past few years. Recall, crude oil prices briefly dipped negative in 2020, scaring away oil tanker investors while, soaring containership and LNG tanker rates are building to a potential crash in the coming years.

Therefore, with the Russian oil ban potentially lasting for years, we may see a multi-year period of elevated tanker rates.

TNK Is A Money Printer At Current Rates

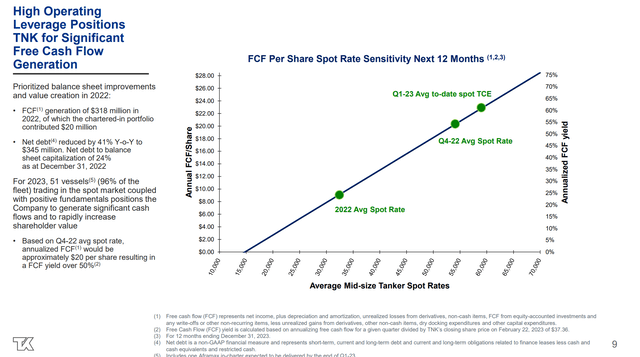

The crude tanker business have incredible operating leverage as costs are relatively fixed, so when we get periods of high tanker rates, the business can generate tremendous amounts of free cash flow. For example, according to the company's estimates, for every $5,000 increase in tanker rates above the company's $15,000 free cash flow breakeven level, TNK can generate $0.65 per quarter, or $2.60 per year of FCF / share.

If spot tanker rates can average ~$55k / day like in Q4/22, TNK can generate over $20 / share in FCF or more than 50% free cash flow yield (Figure 10).

Figure 10 - TNK is a cash flow machine at current rates (TNK investor presentation)

When Will Management Return Capital To Shareholders

As shown in figure 10 above, if tanker rates remain elevated, TNK is a money printing machine. So the natural question is what is management's capital allocation policy?

So far, the company is choosing to pay down debt and buy back vessels it had previously sold under sale and lease-back agreements. In 2022, TNK generated $318 million in FCF and reduced net debt by 41% to $345 million. However, if the company can generate $20 / share in FCF in 2023 (or ~$700 million in FCF), then the company could be debt free by the middle of the year. At that point, what will management do?

On this topic, management sounded coy on the earnings call, merely stating that:

So as we sit down with our Board, we will be talking about 2023 and what we do with the cash. Part of that discussion will be around the third leg or the third phase that I think Stewart has spoken about on previous call last year about building that financial capacity to be able to do some significant fleet renewal when the opportunity arises. But I think we also can talk about other options. So that is certainly something that we plan to do.

Teekay will prioritize renewing its fleet (i.e. newbuilds or acquisition of younger vessels), but with high cash generation in the next few quarters, management and the board can look at other avenues to maximize shareholder value. As a reminder, the next board meeting is in March so investors may see some developments on this topic with the first quarter earnings report.

Risks To Teekay

While I think tanker rates will remain 'higher for longer', investors need to keep in mind that high inflation may push the global economy into recession in 2023, which could dent crude oil demand. If OPEC responds to weak demand with further production cuts, that could hurt tanker demand and tanker rates.

There is also a risk that flush with cash, Teekay management could do foolish things such as acquire a competitor at a huge premium or order multiple newbuilds at the top of the market. Management in this industry have been notoriously bad stewards of capital, so investors need to watch out.

Conclusion

In conclusion, my 'higher for longer' thesis on tanker rates continue to play out and I remain bullish on Teekay Tankers. At current tanker rates, the company is a free cash flow machine and management hinted that they may look at various capital return options in the coming quarters.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TNK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.