Alibaba: You Haven't Seen Anything Yet

Summary

- Alibaba released a relatively decent earnings report for Q3.

- Nevertheless, several risks are likely to prevent the business from growing at an aggressive rate even though its shares themselves trade at a discount to the fair value.

- The increase in geopolitical risks is also making it hard to justify a long-term long position in the company.

- Looking for a helping hand in the market? Members of BlackSquare Capital get exclusive ideas and guidance to navigate any climate. Learn More »

Andrew Burton

While the reopening of China certainly is going to have a positive effect on Alibaba (NYSE:BABA), there are still several major red flags that make it hard to justify a long-term long position in the company. Even though Alibaba's shares continue to trade at a discount to the business's fair value, the decline of profits from the company's stake in Ant Group coupled with weak growth of the cloud business along with the increase of geopolitical risks discourages adding its shares to the portfolio of long-term investors. As such, I continue to believe that Alibaba is uninvestable at this stage even after the release of a relatively decent earnings report for Q3.

Back To Growth?

Last week, Alibaba released its earnings report for Q3 which covers three months from October to December. At first, it seems that it's a good report as the company managed to increase its revenues by 2% Y/Y in local currency. However, due to the devaluation of the yuan and the strong dollar, Alibaba's revenue in Q3'23 of $35.9 billion was down from $38 billion in Q3'22 in dollar terms. In Alibaba's defense though, a strong dollar has also negatively affected the performance of Western Big Tech firms such as Google (GOOG)(GOOGL) and Apple (AAPL) who also noted the negative foreign exchange impact on their recent financial results. At the same time, Alibaba managed to greatly improve its profitability during the quarter, which should be considered a major positive development for the business as the CCP-led crackdown in the past has significantly limited the company's ability to improve its bottom-line performance in recent years.

On top of that, the biggest growth catalyst of the quarter that is likely to help the company to retain its momentum in the foreseeable future is the reopening of China. Beijing's decision to abandon its zero-Covid policy at the end of 2022 has already led to the improvement of consumer sentiment and created an opportunity for Chinese-based businesses to recoup the losses from recent years. The street already expects Alibaba to perform much better in FY24 and fully return to growth since Beijing's pivot alone could ensure that the company's core commerce business is once again thriving.

Considering this, it's time to update Alibaba's DCF model to figure out what is the business's fair value in this new environment. Back in November, I already created a model that hasn't fully factored in the reopening of China as Beijing wasn't fully committed to pivoting on its domestic policy at the time. Back then, my model showed Alibaba's fair value to be $115.71 per share.

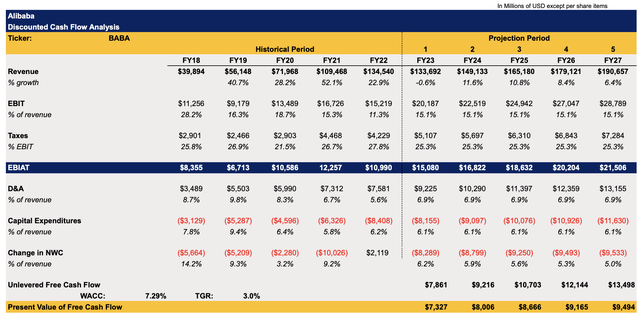

The biggest change in the updated model below is the improvement of the top-line performance in the following years as China's reopening creates an opportunity for Alibaba to perform much better than previously expected. All the other assumptions remain the same as the improvement of profitability has already been factored in the previous model, while the WACC rate of 7.29% also remained unchanged mostly due to the low-interest environment that China currently enjoys as Beijing continues to stimulate the economy after the relatively weak performance in 2022 caused primarily by lockdowns.

Alibaba's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

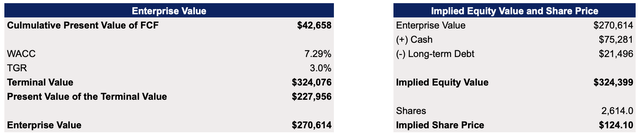

This updated model shows that Alibaba's enterprise value is $270 billion while its fair value is $124.10 per share, above the current market price of ~$90 per share at the time of this writing.

Alibaba's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

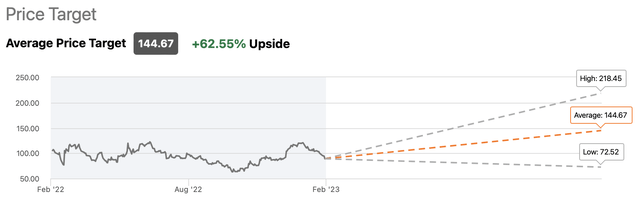

The updated model shows a higher fair value than before primarily thanks to the reopening of China that led to the upward revision of the revenues growth rate. At the same time, the new valuation is also slightly below the street consensus price target of $144.67 per share, but it's also greatly above the lowest rating of $72.52 per share.

Alibaba's Consensus Price Target (Seeking Alpha)

Even though I've stated numerous times in my previous articles that solely based on fundamentals Alibaba is trading at a discount to its fair value, the reasoning behind not purchasing the company's stock is due to external developments over which the management has no control whatsoever. Let's not forget that Alibaba has been trading below its fair value for over a year, yet it didn't stop its stock from further depreciating, and there are few reasons to believe that the situation will change anytime soon.

The Bigger Picture

Despite a relatively decent Q3 report, three major external developments are likely to negatively affect Alibaba's business over the long run even though the business has all the chances to retain its momentum in the short to near-term thanks to the reopening of China.

First of all, China's own central bank digital currency called the digital yuan continues to gain traction and extend its reach. In the past, I've already explained in great detail why the digital yuan is an existential threat to the Ant Group business in which Alibaba holds a 33% stake. Alibaba's own recent earnings report showed that profits from its stake in Ant Group were only $146 million, significantly down from $912 million a year ago. As Beijing continues to promote digital yuan for daily use, there's a case to be made that Alibaba won't be able to generate great returns from its stake in Ant Group, which in the end would negatively reflect on its own bottom-line performance in the following years.

Secondly, Alibaba's cloud business also continues to disappoint investors at a time when its western peers such as Amazon (AMZN) are able to grow their cloud businesses at a double-digit rate even in the current environment of a relatively strong dollar and macroeconomic uncertainty. In Q3'23 Alibaba's cloud business generated only $2.93 billion in revenues, down from $3.07 billion in Q3'22. Add to this the fact that export restrictions are already preventing Alibaba from purchasing some of the advanced Arm-based chips from western firms and it becomes obvious that there's a possibility that the company's cloud computing capabilities could become limited in the foreseeable future which could negatively affect the performance of the cloud business in the following quarters.

Last but not least, there's a risk that the pressure against owning the stocks of Chinese-based firms would not ease anytime soon. Even though in my recent article on Alibaba I've noted that it's likely that Sino-American relations improve in 2023 due to the change in China's foreign policy approach, the recent publication of reports which state that Beijing is exploring options on whether to provide military assistance to Moscow for its war efforts in Ukraine could nevertheless continue to pressure stocks of Chinese-based companies. The White House has already stated that such potential assistance will come at a real cost while at the same time earlier this month, it was already thinking about implementing a U.S. ban on investments in the Chinese tech sector.

Considering all of this, it seems that geopolitical risks would continue to outweigh the valuation argument in the following quarters and as such, the upside in Alibaba's stock is likely to remain limited in the foreseeable future.

The Bottom Line

Considering all of this, it makes sense to avoid investing in the company's shares for the long term, as several red flags described above are likely to outweigh any growth opportunities over the coming quarters and perhaps even years. While Alibaba nevertheless managed to report decent earnings results for Q3, I continue to believe that the upside of buying its shares even at the current below-the-fair value levels is limited as not all the downside is fully priced in to this day.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Brave New World Awaits You

The world is in disarray and it's time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it's worth it for you!

This article was written by

It was there that I started to combine my academic knowledge with a passion for investing to build an all-weather portfolio that could overcome periods of constant economic and political uncertainty. Given the systemic shocks that have been happening to Ukraine in the last decade, I saw firsthand what’s it like to live in an environment where there’s too much unpredictability and no guarantee that your endeavors won’t fail. Despite this, I managed to show strong returns and since 2015 have been sharing some of my ideas here on Seeking Alpha.

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.