RingCentral: After Post-Earnings Nosedive, Stock Looks More Attractive

Summary

- RingCentral's stock plunged after missing Q4 results and issuing cautious guidance.

- Risks such as contract renewals and competition remain, but so do opportunities such as a new AWS partnership.

- RNG stock looks attractively priced after the pullback.

JHVEPhoto

RingCentral's (NYSE:RNG) stock took a huge hit after its recent earnings disappointment. However, the stock is starting to look attractive prices, and the company still has potential growth opportunities ahead within the Contact Center space and with a new AWS partnership.

Company Profile

RNG is a provider of cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions. Its platform works across a variety of devices including smartphones, tablets, PCs, and desk phones.

The company’s main offering is its Unified Communications as a Service (UCaaS) solution called RingCentral MVP. The UCaaS platform includes a cloud phone system, text, and video solution that allow for high-definition voice, call management, mobile applications, business SMS and MMS, fax, team messaging and collaboration, and audio/video/web conferencing capabilities. MVP is also integrated into other business productivity apps such as Slack, Salesforce.com, HubSpot, and Microsoft 365.

RNG sells its offering via subscriptions. Monthly rates vary depending on the level of functionality, services, and number of users. The company says its solution requires little to no hardware costs and that new users can be quickly added regardless of their location.

RNG also offers several specialized UCaaS solutions. Chief among them is its solution for contact centers, which it offers in partnership with NICE Ltd. (NICE). The company said its “RingCentral Contact Center is a collaborative contact center solution that delivers AI powered omni-channel and workforce engagement solution with integrated RingCentral MVP.” In addition, it has a smart video meeting service that integrates with team messaging, file sharing, contact, task, and calendar management.

The UCaaS provider serves a wide range of industries, with no customer representing more than 10% of revenue. Customers range in size from SMBs to enterprises.

RNG primarily sells its subscriptions through a direct salesforce. It also uses a network of distributors and resellers.

Opportunities

RNG is riding the solid trends of bring your own device (BYOD), remote work, and distributed workforces. Today’s workforce no longer just goes to an office and communicates with colleagues in a single location. Business communication is taking place with colleagues and customers in various locations, whether at home, in the office, or with another office in a completely different part of the world.

Because workforces are so spread out and communication is done through a variety of company-owned and personal devices, it’s important for companies to have a unified system that is both secure and scalable. Voice-over-internet-protocol (VOIP) is an important part of UCaaS as it allows firms to set up phone functions via the internet without the need to add landlines. However, communication doesn’t stop there and the use of video conferences and text are also on the rise.

Contact centers are another adjacent area that is very important. At a conference in December, CEO Vladimir Shmunis described it as a market that is smaller than UCaaS but earlier in its digital transformation and thus can grow more quickly. The company currently has a partnership with NICE where it integrates NICE’s InContact product into its UCaaS platform. This has been a growing part of RNG's business, and now has a $300 million ARR. On its Q4 call, COO Mo Katibeh said:

“Our Contact Center brings together the world's leading UC and CC. In the latest 2022 Gartner Critical Capabilities for Unified Communications as a Service worldwide report, RingCentral ranked first in the UC with integrated Contact Center use case, ahead of 11 other vendors. And the reason why is tightly integrated functionality that benefits customers of all sizes with unique, differentiated experiences. First, for agents, our integrated solution offers seamless access to other non-Contact Center employees across the business and the ability to share simple context for the interaction. And two, for supervisors, our performance management solution, Contact Center Pulse, provides real-time alerts on agent performance KPIs using our messaging technology. This allows supervisors to react to changing interaction volumes and agent performance instantly. Our customers also get an end-to-end experience with seamless billing, faster implementation and integrated support.”

Offering vertical-specific solutions is another opportunity for RNG. The company has done a nice job here in areas like health care, where it can address industry-specific issues like HIPPA compliance.

A recently announced partnership with AWS is another opportunity. The cloud service provider will offer RingCentral MVP and RingCentral Contact Center to its customers. The partnership will begin in North America, and then expand to international markets.

Meanwhile, the company is looking for AI to be a driver in the future. On the Q4 call, Shmunis said:

“And now there is a new megatrend emerging that is potentially even more disruptive, namely AI. While the power of large language model AI has recently captured the imagination of the broader public, we are proud to have been 1 of the first in our industry to deploy these types of solutions. We're leveraging AI to make real-time communications more intelligent, seamless and effective. Noise reduction, active cancellation, virtual backgrounds, meeting transcriptions, summaries and highlights are just a few examples of how we use AI to further enhance our users' experiences and productivity.

Moving forward, we will continue to invest in AI across our portfolio. You will see us launching new products that leverage AI to improve efficiency of collaboration for knowledge workers, improve the efficacy of our contact center for agents and supervisors and improve the productivity for front-line workers. We expect these investments will further cement our leadership position in the age of AI. Stay tuned for exciting new product announcements throughout 2023.”

Risks

While the UCaaS opportunity is large, there are a lot of players in the space. Notable names include Vonage, 8x8 (EGHT), Zoom (ZM), and Nextiva. Meanwhile, tech giants Microsoft (MSFT) and Cisco (CSCO) also have UCaaS offerings. The popular Microsoft Teams is relatively cheap and often packaged with its other services, while CSCO got into UCaaS many years ago with its 2007 acquisition of Webex.

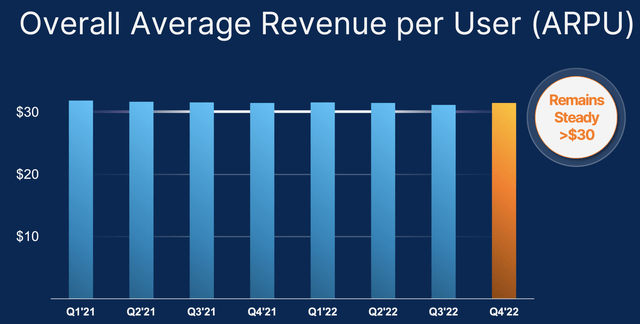

Competition has helped keep ARPU in check, which has remained pretty steady at RNG over the past two years. It’s not going down, which is good, but it also hasn’t been expanding despite RNG’s innovation.

The current macro environment is also impacting RNG, with deal sizes and timing current headwinds. On its Q4 call, the company noted that cycle times have elongate and deal sizes have shrunk.

Evercore recently noted that this year is a heavy renewal year for RNG. While companies generally don't like to switch ingrained providers, it remains a risk, especially are corporations tighten their belts.

Meanwhile, its partner Avaya earlier this month filed an expedited, prepackaged financial restructuring via Chapter 11. While the two companies expanded and extended their agreement to help drive migration to Avaya Cloud Office by RingCentral, there will be some disruptions as Avaya recapitalizes and emerges from bankruptcy.

Valuation

Based on the 2023 EBITDA consensus of $487.4 million, RNG trades at an EV/EBITDA multiple of about 10x. Based on the 2024 EBITDA estimate of $590.4 million, it trades at just over 8x.

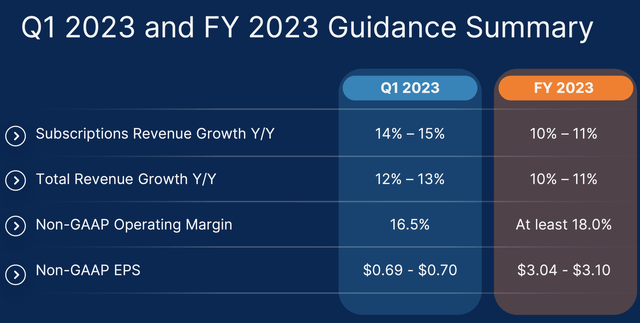

The company is projected to grow revenue between 10-12% in 2023 and 2024.

This compares to rivals EGHT, which trades at 16x, and ZM, which is valued at around 10x. Both are projected to grow revenue less than RNG in the next two years.

Conclusion

While growth is slowing, RNG is still forecasting solid double-digit revenue growth that is nicely above what analysts are projecting for peers. Meanwhile, it trades at a large valuation discount to its closest competitor EGHT. While it doesn’t have its own propriety contact center solution like EGHT, this part of its business is growing nicely and represents a good opportunity with plenty of runway ahead.

The stock took a huge hit after its Q4 results and full-year guidance came up short of expectations, and the stock price has continued to trend lower since. As a quick review, Q4 revenue of $525 million missed the $528 million consensus, and full-year guidance calling for revenues of $2.18-$2.2 billion was below analyst exceptions for revenue of $2.33 billion. Meanwhile, risks remain as competition heats up with MSFT and ZM, and contracts come up for renewal.

From a valuation perspective, however, RNG stock looks pretty attractively priced, and it looks like the company has set the bar reasonably low for 2023. The stock has upside to $45 if it can hit its numbers, which would be about a 12x EV/EBITDA multiple.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.