Calliditas: Underfollowed Swedish Biotech Focusing On Rare Kidney Disease

Summary

- Calliditas Therapeutics is a commercial-stage biopharmaceutical company based in Sweden focused on developing and commercializing novel treatments for rare diseases.

- TARPEYO is the only disease-modifying therapy approved for IgAN.

- We expect TARPEYO's 2023 sales to be better than what the market expects, exceeding $120m.

- We initiate with a buy rating.

megaflopp/iStock via Getty Images

Background

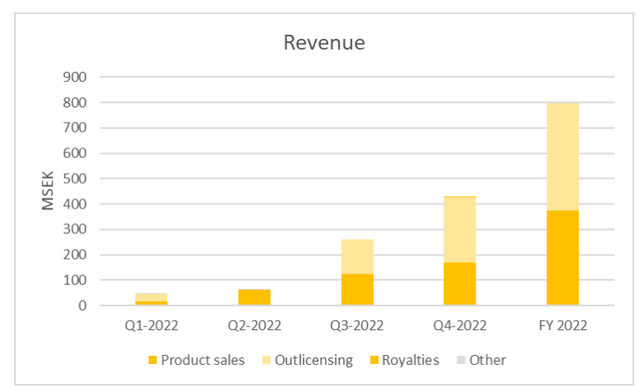

Calliditas Therapeutics (NASDAQ:CALT) is a Sweden-based commercial-stage biopharmaceutical company that specializes in developing and commercializing innovative treatments for rare diseases. The company's flagship product, TARPEYO (Nefecon), has received FDA and EMA approval for the treatment of IgA nephropathy (IgAN), a chronic autoimmune renal disease that can lead to end-stage renal disease. In 2022, TARPEYO achieved net sales of SEK229.3m (USD 21.8m), primarily from the US, where Calliditas is marketing the product in-house. Additionally, TARPEYO has secured a strategic partnership with EVEREST Medicine, a leading Chinese pharmaceutical company, and has received acceptance by the NMPA (Chinese FDA). In Japan, Viatris Pharmaceutical is marketing the product, and a mid-teens percentage royalty is expected to be paid to Calliditas. In February 2023, the MHRA granted conditional marketing authorization or CMA, and STADA is expected to market the product in the Swiss and UK markets. Calliditas Therapeutics has projected sales of USD 120-150m for 2023, further indicating the significant commercial potential of TARPEYO in treating IgAN.

Calliditas Sales FY2022 (Calliditas Sales FY2022)

TARPEYO, Nefecon is differentiated targeted budesonide targeting IgAN patients

TARPEYO is a lead commercial candidate of Calliditas Therapeutics.

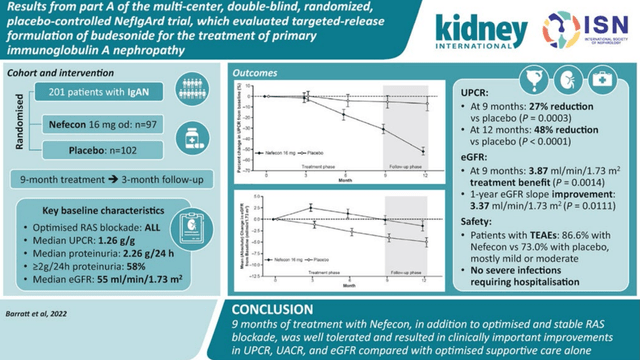

TARPEYO is approved under accelerated approval based on achieving its primary endpoint of reduction in proteinuria in Part A of the NeflgArd pivotal Phase 3 study, an ongoing, randomized, double-blind, placebo-controlled, multicenter study conducted to evaluate the efficacy and safety of TARPEYO 16 mg once daily vs placebo in adult patients with primary IgAN.1 The effect of TARPEYO was assessed in patients with biopsy-proven IgAN, eGFR ≥35 mL/min/1.73 m2, and proteinuria (defined as either ≥1 g/day or UPCR ≥0.8 g/g) who were on a stable dose of maximally-tolerated RAS inhibitor therapy.

Patients taking TARPEYO (n=97) showed a statistically significant 34% reduction in proteinuria from baseline vs 5% with RASi alone (n=102) at 9 months. The treatment effects for the primary endpoint of UPCR at 9 months were consistent across key subgroups, including key demographic and baseline disease characteristics.1

The most common adverse reactions (≥5%) in this study were hypertension, peripheral edema, muscle spasms, acne, dermatitis, weight increase, dyspnea, face edema, dyspepsia, fatigue, and hirsutism. Source: News Release

Overall, TARPEYO was well-tolerated in the study.

TARPEYO phase 3 Publication (TARPEYO phase 3 Publication)

Risks

Clinical trials: The success of Calliditas Therapeutics' drug candidates is highly dependent on the results of clinical trials, which can be unpredictable and subject to a variety of factors, including safety and efficacy concerns. Negative clinical trial results could have a significant impact on the company's stock price and future prospects.

Competition: Calliditas Therapeutics is operating in a highly competitive industry, with many other companies developing treatments for similar indications. This competition could limit the potential market share of Calliditas Therapeutics' drug candidates and impact their profitability.

Intellectual property: The company's success is dependent on the strength and enforceability of its intellectual property, including patents and trade secrets. Any challenges to the validity of these intellectual property rights could negatively impact the company's market position and profitability.

Regulatory approval: The approval process for new drugs is lengthy and uncertain, and regulatory agencies such as the FDA and EMA have the power to deny or delay the approval of drug candidates. Regulatory approval is necessary for the commercialization of Calliditas Therapeutics' drug candidates, and any delays or rejections could negatively impact the company's financial performance.

Financials: Calliditas Therapeutics is a clinical-stage biopharmaceutical company and, as such, has a limited operating history and significant expenses associated with drug development. The company has reported net losses in recent years, and any significant negative financial developments could impact the company's stock price and future prospects.

Conclusion

In conclusion, we recommend a buy rating for Calliditas Therapeutics based on several compelling factors. These include the differentiated IgAN asset Tarpeyo, which has demonstrated both proteinuria and eGFR benefits in IgAN patients, the favorable pricing and reimbursement dynamics with high pricing (>USD170k), and a high percentage of covered lives from private payers (more accessible and faster approval expected), and expected clinical catalysts in Phase 3 Part B during 2023. However, the short cash runway, with currently around USD 120m of cash on hand and FY 2022 OPEX of $120m, represents a moderate risk for the stock. Overall, we believe that Tarpeyo's unique mechanism of action and promising clinical results suggest strong commercial potential, and we expect the stock to trend higher during 2023-2024 as more investors recognize its significant value proposition beyond just a generic steroid.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Biotechvalley Insights (BTVI) is not a registered investment advisor, and the articles are not intended for retail investors. The content is for informational purposes only, and readers should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing in BTVI's articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in any jurisdiction where such solicitation or offer would be unlawful under the securities laws of that jurisdiction.

The research and reports published by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of BTVI's ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that BTVI entity believes to be accurate and reliable. However, this information is presented "as is" without warranty of any kind, whether express or implied. BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any information, and the results obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.