Holcim Q4: Record Results; More Upside Likely

Summary

- It was a record year for Holcim and we are even more positive for the future.

- Holcim is replicating its roofing strategy in the EU.

- New buyback, dividend up by 14%, and higher guidance. Our buy target is then confirmed.

yullz

Holcim (OTCPK:HCMLF)(OTCPK:HCMLY) delivered another strong set of numbers and since our initiation of coverage based on a Multiple Arbitrage Opportunity Thanks To the Firestone Acquisition, Holcim is up by more than 30% (including its juicy dividend payment). It is important to report that Holcim is making the necessary step to restructure its portfolio and improve its earnings profitability. Today, we are not providing our usual buy case recap, but we comment on the main key takeaways:

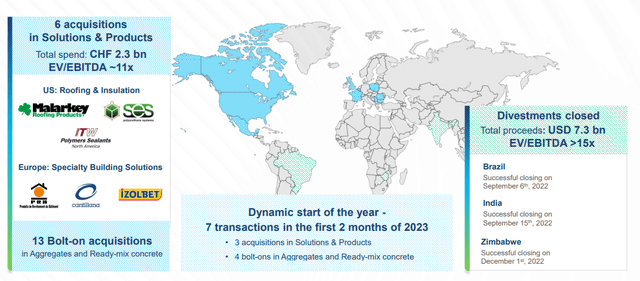

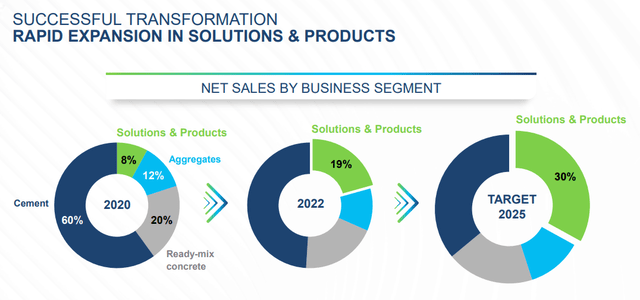

- Starting with Solutions & Products' performance, the division reached 20% of the company's net sales in 2022 and delivered a recurring EBIT margin of 20%. Holcim is making the necessary steps towards its portfolio transformation with six acquisitions in the Solutions & Products division. Based on the management target, the segment is well on track to deliver 30% in total sales by 2025 (Fig 1);

- Point 1) is also coupled with Holcim Portfolio optimization. Important to note are Holcim's cement and ready-mix disinvestments in Brazil and India. The total transaction enterprise values totaled almost CHF 7.5 billion, with the Indian company sold at an EV/EBITDA multiple of more than 14.5x. These proceeds should materially lower Holcim's implied earnings volatility and FX development;

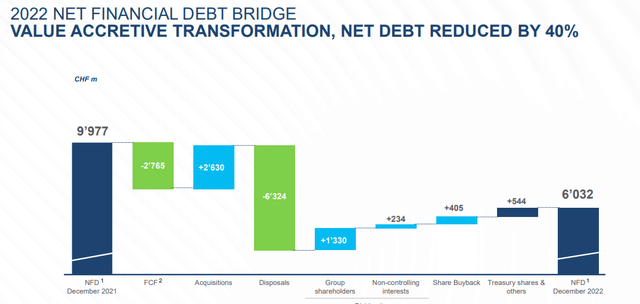

- Thanks to the recent disposal, Holcim's debt was further reduced and the company reached a record-low leverage ratio now at 0.9x on the Net debt/EBITDA (Fig 2). Aside from the expected saving in interest expenses, this will further support future bolt-on acquisitions and will provide an upgrade review of credit agency ratings. In our number, we already incorporated the Holcim settlement agreement with the Department of Justice for a total payment of $777.8 million;

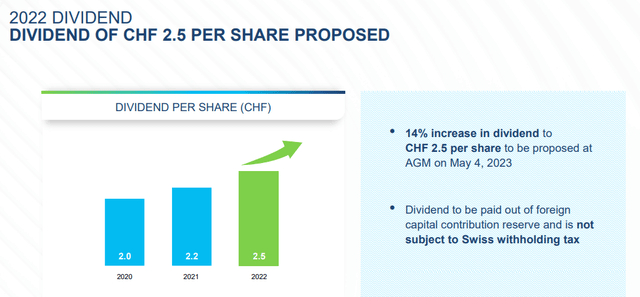

Still related to our buy rating, we were optimistic about a step up in shareholders' remuneration. Thanks to the performance achieved, Holcim is proposing a dividend per share increase of 14% on a yearly basis to CHF 2.50 (Fig 3). In addition, if approved, the company aims to share buyback a maximum amount of CHF 2 billion or up to 40 million shares in 2023;

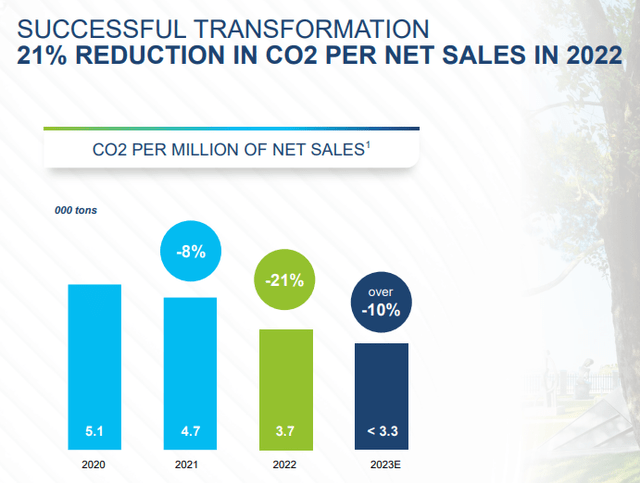

- In addition, we should also report the strong green acceleration made by the company. Indeed, Holcim achieved a 21% reduction of CO2 per net sales compared to the 2021 numbers. Green CAPEX reached CHF 403 million and was up by 15% versus the previous year's end (Fig 4).

Holcim Solutions & Products sales evolution

Source: Holcim Q4 and FY 2022 results presentation (Fig 1)

(Fig 2)

(Fig 3)

(Fig 4)

Conclusion and Valuation

Looking at the aggregate level, Holcim was able to deliver record year results with recurring EBIT reaching CHF 4.7 billion, signing a plus +7.2% on a like-for-like basis. Aside from the strong margins in the roofing business, we also note a positive evolution of price over cost for the cement & aggregates division. The successful business transformation is entering a new phase, and Holcim already announced a new roofing acquisition i.e. Duro-Last, a leader in the North American market after Firestone. Holcim is also replicating the roofing strategy in Continental Europe, closing a deal with a German roofing leader called FDT. The company is already well ahead of its targets and continues to raise the bar. For 2023, we expect net sales up by 5%, an FCF of more than CHF 3 billion, and an EBITDA before lease of at least CHF 7 billion. We were already ahead of the Wall Street consensus, so we decided to reaffirm our valuation of CHF 67 per share ($14.5 in ADR) based on an EV/EBITDA multiple of 6.5x.

You can also check our quarterly update here: Q1, Q2, and Q3.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HCMLF, HCMLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.