GBAB: A Year Later, The Fund's Outlook Remains Challenging

Summary

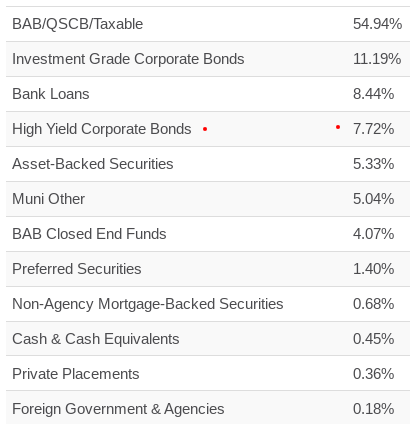

- I saw some value in GBAB a year ago, but that thesis did not pan out. With 2023 off to a rocky start, I think caution is warranted here.

- The fund's diversity is a plus, but it brings about risk with high yield exposure. This can amplify the yield but pose challenges if the economy deteriorates.

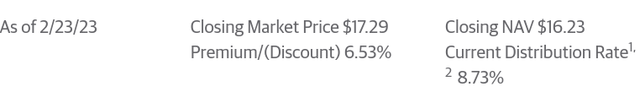

- The premium to NAV is concerning, given that GBAB stood at a marked discount this time last year.

- The income metrics are weak, suggesting a distribution cut is likely in the year ahead.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

isayildiz/iStock via Getty Images

Main Thesis & Background

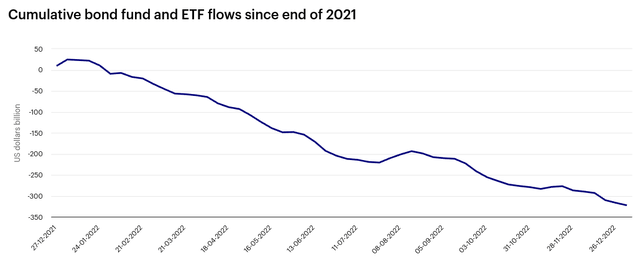

The purpose of this article is to evaluate the Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust (NYSE:GBAB) as an investment option. This fund offers exposure in taxable municipal bonds, with a primary investment objective to "provide current income with a secondary objective of long-term capital appreciation". In practice, this is a diversified fund, but with a heavy allocation towards taxable muni bonds, along with a healthy portion of bank loans and other high yield credit products.

I saw some value in GBAB last year when the bond and credit markets started to sell-off. Suffice to say - this was not a good call. The broader equity and income markets fell throughout 2022 resulting in a negative return for both:

Fund Performance (Seeking Alpha)

This type of drop would normally indicate a buy opportunity for me, but in this case I have concerns. I think the fund's high yield may bring in some buyers but I generally think a more risk-off approach makes sense. This is the reason for my downgrade to "neutral" for this fund, and I will explain the logic behind it in detail below.

Why Consider Bonds At All?

To start, I want to discuss why anyone would even be considering fixed-income at all right now. After a disastrous 2022, the sector has seen a rebound in early 2023, although some of those gains have slipped away as inflation has remained persistent. This has led the Fed to reiterate its rate-hiking plans and forced a re-set on investor expectations with regards to the benchmark rate.

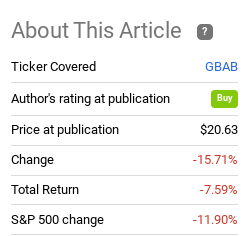

Even in this climate there are reasons to consider bonds (and GBAB by extension). For one, the fact that it is so unloved points to a buy opportunity. While that may sound counter-intuitive, that is the point. Bonds, in any sector, are a bit of a contrarian play right now. This is because investors have fled this investment idea consistently to the point where buying in now could offer potential alpha when investors do decide to rotate back in.

Bond Flows - Negative For Most of 2022 (Invesco)

The idea being that buying as everyone is selling allows investors to front-run the eventual rotation back in to the sector. This signals to me that a contrarian play could have quite a bit of value here and that is something to seriously consider.

GBAB's Diversity A Plus

If one is indeed then considering bonds, GBAB may catch their eye. While I generally lump GBAB in with its taxable muni peers - the Nuveen Taxable Municipal Income Fund (NBB) and the BlackRock Taxable Municipal Bond Trust (BBN) - it actually isn't a direct peer. That is because those two funds focus almost exclusively on taxable muni debt and GBAB does not.

In fact, there is more to GBAB than meets the eye because even its name says "investment grade debt" may give investors the wrong impression. Is the fund mostly IG-rated. Yes. But it also holds high yield bonds as well. I'm not saying this is bad because it does give the fund some diversity. But it is an important point of reference because that may surprise someone who only looks at the fund's name and does not dig deeper:

GBAB's Sector Breakdown (Guggenheim)

I bring this up because if someone is looking for a one stop shop with respect to fixed-income, this could be the play. GBAB gives investors exposure to a variety of sectors and allows them to capture the elevated yields from numerous parts of the fixed-income market:

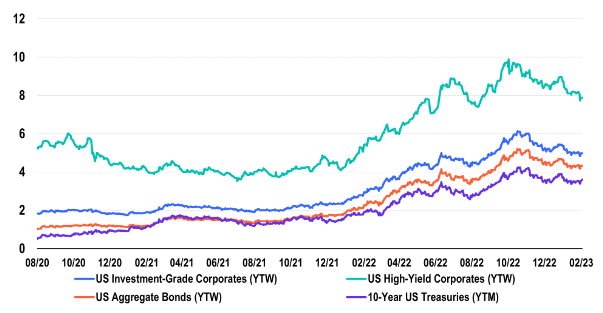

Fixed-Income Yields (Various Sectors) (Franklin Templeton)

Can yields push higher from here? Absolutely - and they very well might if the Fed keeps pushing rates higher. But on a historical basis these are reasonable entry points. Nobody can guarantee gains from buying at these levels, but the income is high enough in relative terms to present a reasonable risk-reward proposition in my opinion.

Why The Concern? Valuation A Sore Spot

As I noted early on in this review I have a neutral/hold rating on GBAB. I have just discussed a few reasons why someone would want to buy GBAB - so let's now discuss the rationale behind the caution. A primary driver of this is the fund's valuation, which is always an important attribute for myself personally. Looking back to February 2022, GBAB had a discount to NAV around 4%. At time of writing, despite a 7.5% loss since that time, GBAB has now seen this metric climb to a premium of 6.5%:

The takeaway I draw here is straightforward. GBAB is no longer "cheap", and actually is starting to look quite pricey. Right now I want value, and GBAB is short on it at current prices.

Steady Income - A Warning Sign?

When looking at GBAB it is hard to find a direct peer. As I mentioned, BBN and NBB are the closest in terms of being "taxable muni" focused. So GBAB aligns fairly closely with them since roughly 2/3 of its portfolio focuses on that sector. Still, its diversity sets it apart and can explain the performance divergence between these funds over the past year. To illustrate, while GBAB has fared poorly, that pales in comparison to the collective drops by NBB and BBN:

1-Year Performance (Google Finance)

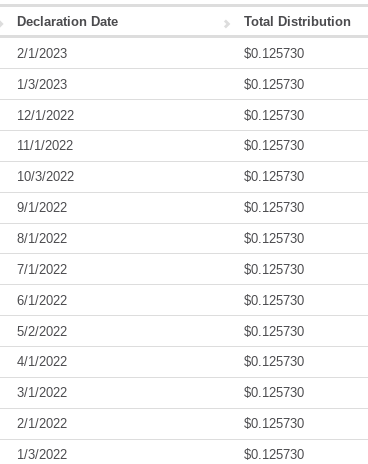

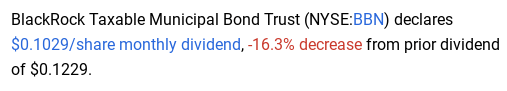

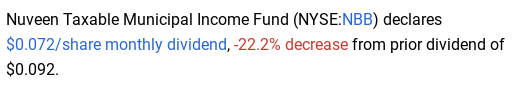

It would be easy to write this off solely on the different portfolios. But that only explains part of it. Another reason for the differential is the income story. While GBAB has kept its income steady since the beginning of 2022 until now, NBB has seen two income cuts and BBN one, as shown below, respectively:

GBAB's Income Stream (Guggenheim) BBN's Distribution Cut Announcement in December (Seeking Alpha) NBB's Distribution Cut Announcement in January (Seeking Alpha)

On the surface this looks like a good backdrop for GBAB. So - that begs the question - why the concern on my part?

The reason being is I don't see how much longer GBAB can keep up this consistency. I am impressed by the income's resilience over the past year and believe its out-performance is justified because of it. But if I were to buy the fund now I am concerned about an upcoming income cut (as opposed to continuing to be impressed by a lack of one last year). This is important because I believe BBN and NBB have both seen their share prices re-set a bit on the backdrop of these cuts. If GBAB sees a similar cut, it too will likely sell-off. That presents an opportunity for patient investors, but also a risk for current holders of the fund.

The simple logic here is that GBAB is being pressured by the same macro-forces as all other leveraged CEFs. An inverted yield curve is making short-term borrowing more expensive while simultaneously limiting opportunities on the longer-end of the curve. That doesn't bode well for using leverage to amplify returns. In fact, it can have the opposite effect as 2022 showed us.

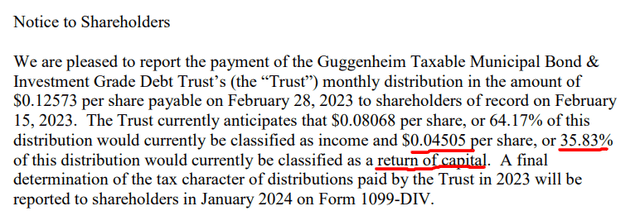

This is not fear mongering either. By GBAB's own financial reports we see the fund is struggling to earn enough in income to cover the current distribution rate. The most recent distribution is being paid by almost 36% return of capital. That is not a good sign for long-term health of the income stream:

GBAB's Return Of Capital (Guggenheim)

I surmise an income cut to be on the horizon at some point in 2023. That will most likely lead to a market sell-off, especially because GBAB is trading at a premium to its underlying price. This is central to downgrading this from a "buy". I think patience will be rewarded here and buying in before the eventual distribution cut will prove to be a mistake.

The Fed's Pause Is Near

I will wrap up the review by reminding readers that 2023 is almost certain to be more favorable for bonds than last year. Given how poor 2022 was, that is not a bold prediction! But the challenge remains inflation and Fed rate hike tightening, so it won't be smooth sailing necessarily.

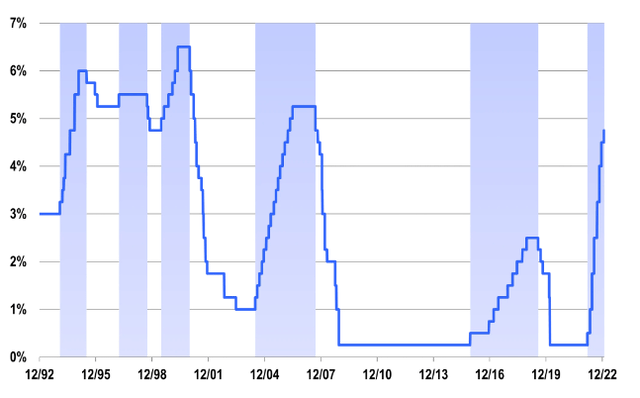

Despite those concerns I am not alarmed at the risk-reward potential for fixed-income, whether in the taxable muni realm or otherwise. If the Fed keeps raising its benchmark rate that will be a headwind, but I see maybe .50 basis points left because a pause. Inflation could change this outlook if it remains stickier than expected, but history shows us the Fed is nearing its 30-year high. Will the Fed push past these historical precedents? Perhaps. But I genuinely don't see 2023 as the year to experiment with rates higher than 6%:

Fed Funds Rate (Federal Reserve)

The conclusion I draw here is the market and the economy are not ready and able to handle rates in excess of 6% whether the Fed wants it to or not. Even 5.5% is going to be a challenge. This tells me the Fed has 1-2 moves left (depending on if it continues with .25 basis point hikes or .50 basis points). When it does hit its ceiling, that pause will prove a boon for fixed-income broadly. That offers an important tailwind for GBAB in the second half of 2023, along with all the other leveraged credit funds I follow and write about.

Bottom-line

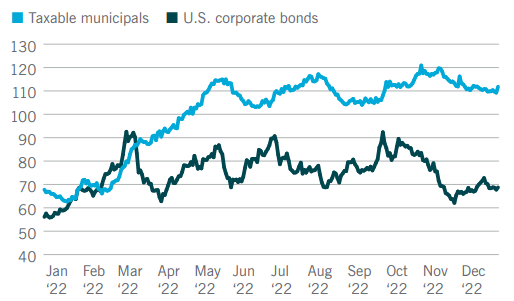

GBAB could benefit from a broad investor return to fixed-income. This is especially true given its taxable muni focus. While taxable munis don't have the same tax advantages as their exempt counterparts, there is value in the sector compared to taxable corporate bonds. Spreads have widened for each, but at a greater scale for taxable munis, signaling inherent value:

Relative Spreads (Investment Grade) (Bloomberg)

In addition, GBAB's yield remains high and its diversification is a notable benefit. All of these factors play in its favor.

But I have concerns as well. The fund's premium to NAV indicates a lack of value on the open market. Further, while the steady distribution could be interpreted as a sign of strength I think it means a cut is on the way in the short-term. If true, volatility will ensue that should open up better entry points. For these reasons, caution reigns supreme for me. I think a "hold" rating is the right call and suggest readers approach any new positions very selectively at this time.

Consider the Income Lab

This article was written by

I've been an investor since 2008, which was an invaluable and humbling experience. This is central to my strategy of looking for quality, value, and diversification - generally staying away from risky/over-hyped ideas. I won't pump any investment nor discuss a topic I don't genuinely follow / research. In that spirit, I list my portfolio here for transparency.

I'm a native New Yorker and I work for a major U.S. bank. I escaped to North Carolina for graduate school and I don't see myself ever leaving. I was a D1 athlete in college (men's tennis) and compete competitively to this day. My Bachelor's and MBA are both in Finance.

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU / BUI; VDE, RYE; KBWB; XRT

Non-US: EWC; EWU; EIRL; EWA

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, BBN, PDO, PCK, VCV, PML

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Disclosure: I/we have a beneficial long position in the shares of NEA, PML, PCK, VCV, BBN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.