Brady: Fundamentals Strong, But Less Margin Of Safety Now

Summary

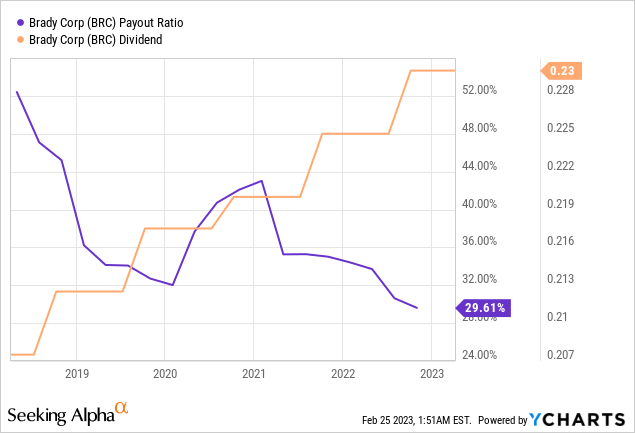

- Established in 1914, Brady Corporation has increased its dividend 37 consecutive years.

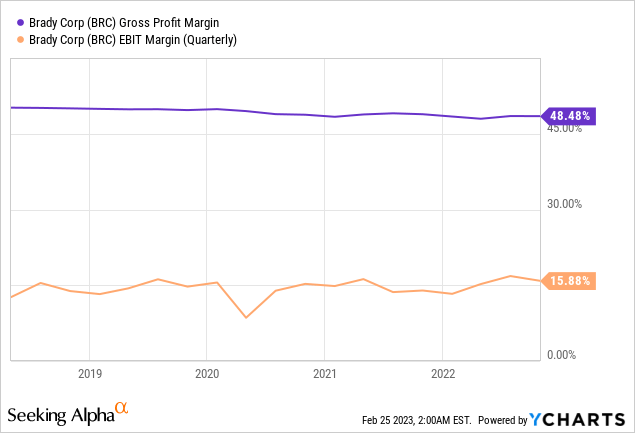

- Brady's products are relatively anti-cyclical, the business is stable and margins have been historically robust.

- New leadership, new organisation and new products could keep up the good momentum of earnings development.

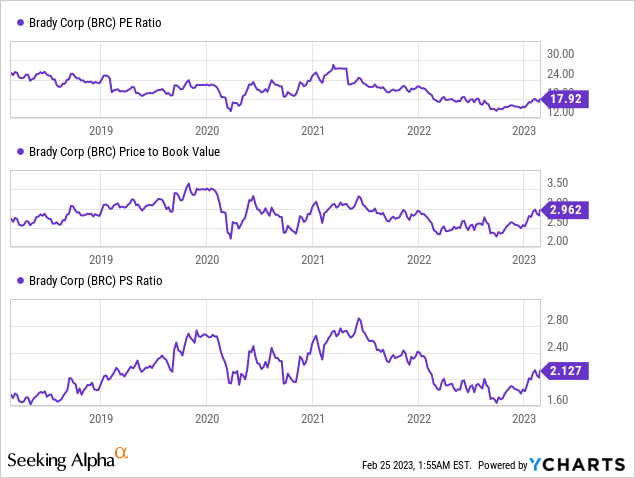

- Unfortunately, the stock price doesn't provide much margin of safety, but pullbacks could create a buy opportunity.

whitebalance.oatt/E+ via Getty Images

Brady (NYSE:BRC) is a classic example of a boring business. It manufactures signs, labels, label printers and safety products. Many of its products are small ticket items of which use could be even mandated by regulations. The company has been in the business since 1914 and increased its dividend for 37 consecutive years. Combined with a net cash position, growing sales and steady margins, Brady has a lot of staying power. The fundamentals of the business have been improving for many quarters. In a case of a pullback closer to fair value, Brady would be a buy.

Investors need to observe the performance of the acquisitions

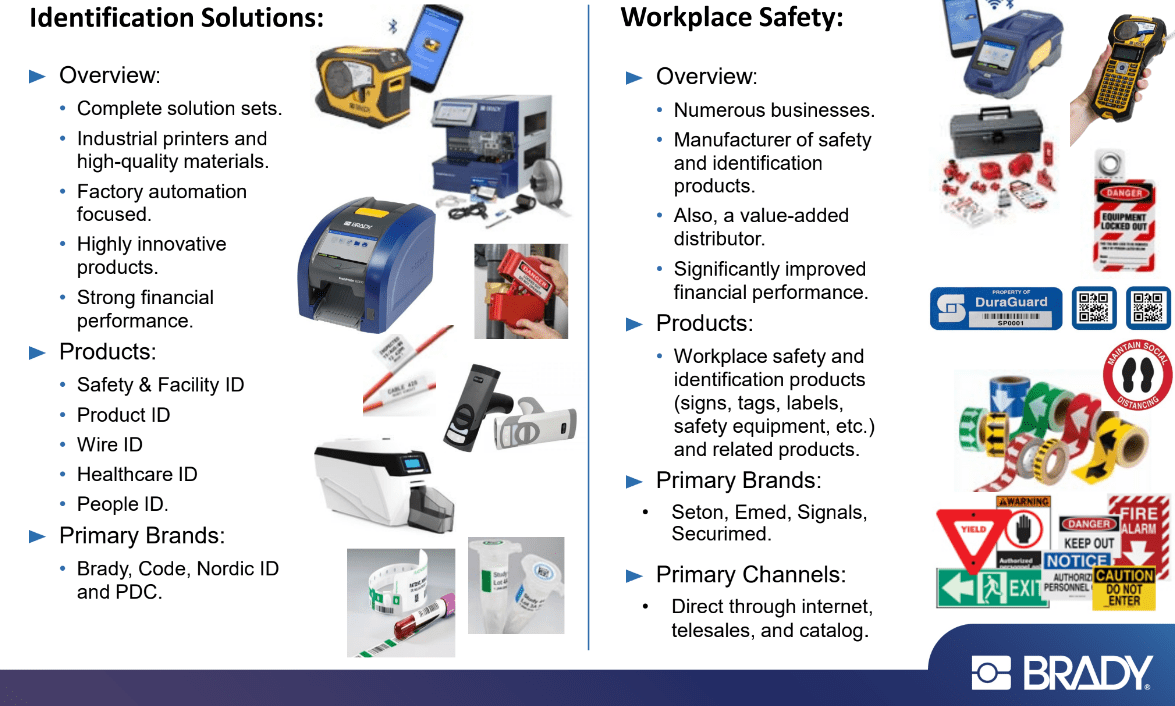

Today, it has a market cap of $2.6 billion, revenues of $1.3 billion and over 5700 employees. 53% of its revenues come from the United States and 30% from Europe. The business is divided into two segments: identification solutions (77%) and workplace safety (23%) The products are best illustrated by the picture below. The products are used for tracking items, verifying identity of people and increasing safety of workplaces. The products are sold under multiple brands.

Brady's business segments at the moment. (Brady's investor presentation.)

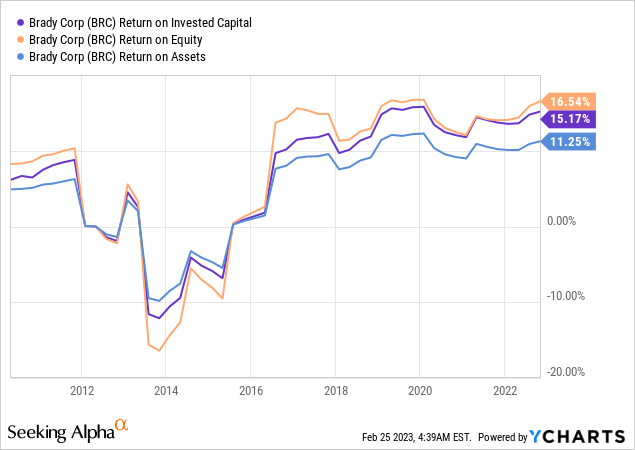

Nearly a decade ago the company made nearly two dozen value destructive acquisitions, but since 2014, under Michael Nauman’s management, Brady has made a successful correction as seen in figures of capital returns. One year ago the company named a new CEO to replace retiring Michael Nauman. Fortunately the replacement, Russell Shaller, came from inside the company. Shaller was for nearly 7 years the president of the identification solutions segment.

However, investors need to be cautious. The company has returned back to making acquisitions. In 2021 the company made three acquisitions spending approximately $250 million. One of them was U.S. based The Code Corporation for $173 million bringing in $50 million of sales and $10 million of EBITDA (Source). The target brought in the bar code scanners and software to Brady’s offering.

Brady also acquired a Finnish company called Nordic ID in order to tap into the RFID market. According to the public records, the revenues of Nordic ID have been stagnant since 2018 and profits increasingly negative. The 12 million euro purchase price doesn’t seem like a great deal for a company with annual revenues of 7 million euros and a loss of 3.4 million euros. We shall see in the spring if the company has made progress.

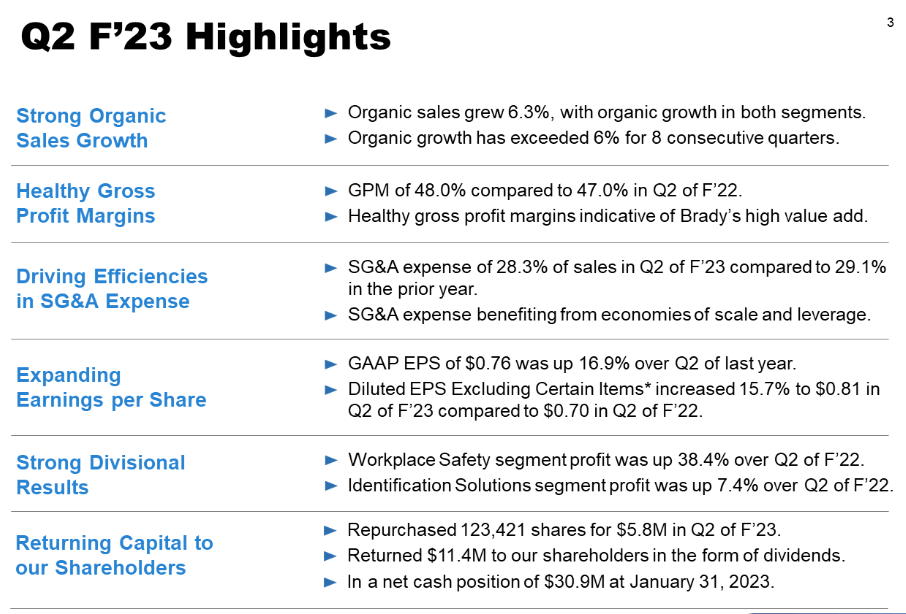

Q2 2023 earnings presentation (Company material)

On Friday 24th of February the company reported its Q2 2023 earnings. The quarter was the fifth consecutive exceeding the expectations, both the sales and earnings growing. Also, the efficiency continued to develop positively, gross margins took the turn to the right direction and the company continued buybacks.

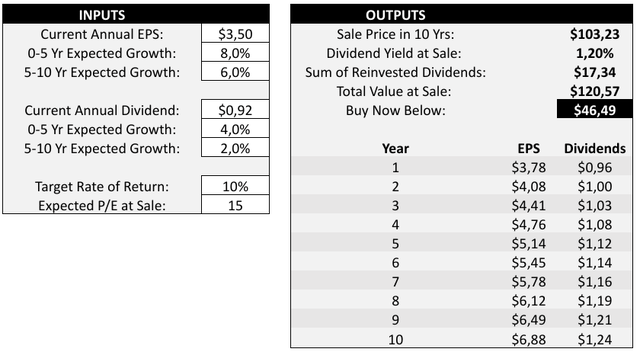

At the moment there's not much margin of safety

The fair value of the stock seems to be around $44-$46 per share. This assumes an 8% earnings growth rate for next five years and 6% thereafter. This is achievable if Brady lands between its 5 and 10 year EPS growth rates of 5% and 10%. The dividend growth rate is a little bit higher than the historical average reflecting the assumed EPS growth. The calculation further assumes a 10% discount rate and a P/E of 14-15 which would be reasonable historically and rather high earnings growth.

Fair value calculation. (Author, model by Lyn Alden Schwartzer)

The previous fiscal year was exceptional for Brady. Its revenues and earnings both spiked up from the historical range. Although the Q2 2023 was developing in a similar fashion, it is difficult to become overly optimistic. The current price implies continuation of double digit earnings growth and the multiples have slightly expanded. For this reason, in order to have enough safety margin, a more comfortable buy zone would be between $42-$44. If the company succeeds with its growth plans, these level might never come back though.

The average analyst target price currently is $60.3. Only three analysts follow the stock.

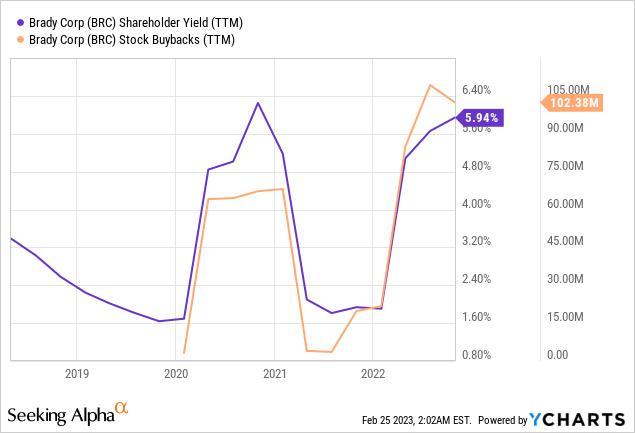

There’s no single foreseeable catalyst for taking Brady’s stock to a new level. Instead, there are several trends that could show results after several years in the making. Brady has been spending a larger share of its revenues on R&D, which hopefully generates incremental sales. Simultaneously Brady has been reducing the share of SG&A expenses increasing the efficiency and it has expanded its offering to RFID systems and EAN scanners. In combination with stock buybacks there could be a sustained enhancement of per share earnings.

Considering Brady’s stable business model and strong balance sheet, it would be surprising if the company wouldn’t make any acquisitions. Brady is quite clearly indicating so. If done right, maybe this time there would be value also for the shareholders of Brady. In the near term the currency headwinds could turn to tailwinds. Freight and material costs easing and price increases taking effect could bring the gross margin back to its normal level running nicely down to the bottom line.

Brady is about to reorganise itself to geographical business units instead of product segments. This is also a good development for a couple of reasons. First, the workplace solutions was much smaller than identification solutions. Second, Brady has plenty of international sales opportunities which will be better utilized in a geographical organisation.

There's room to increase the dividend

Brady has 37 years of dividend growth history under its belt. The current annualized dividend is $0.92 per share translating to a modest dividend yield of 1.75%. The yield is slightly below the four year average yield reported by Seeking Alpha. Against the forward earnings per share the payout is low at around 28%

Despite the acquisitions in 2021 the company still has a healthy balance sheet. The net cash position was declining for several quarters after bouncing up to $30 million in Q2 2023. Operating from a net cash position enables the company to weather any slowdown in the economy or engage in a new acquisition. Otherwise the company usually returns excess capital as buybacks creating a good shareholder yield.

Conclusion

With its long history Brady has proven its resiliency. Its margins are strong and steady and the business produces nicely free cash flow. The company has made three acquisitions which complement the existing business and could bring the company into accelerated growth. Now the company seems to either enjoy right management and execution, industry tailwinds or both. Whatever direction the winds blow, Brady is offering a decent shareholder yield.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.