USA Compression Partners, LP: 7-10% Yields, Record Q4 2022 Revenues, Higher 2023 Outlook

Summary

- USAC had record revenues in Q4, up 19%, with EBITDA up 14%.

- Its common units yield 10%, with a K-1.

- USAC has a high-yield alternative with no K-1.

- This idea was discussed in more depth with members of my private investing community, Hidden Dividend Stocks Plus. Learn More »

lappes

Looking for more security in your high-yield income investments, and no K-1?

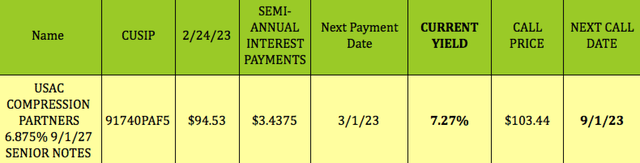

We've owned the common units of USA Compression Partners, LP (NYSE:USAC) off and on for years. However, even though the common units have a high ~10% yield, we recently bought the USAC 9/1/2027 6.875% Senior Notes in an effort to gain more security, via a higher rank in the creditor pile.

These notes pay $3.4375 in semi-annual interest next week on 3/1/23. Their current yield is 7.27%.

Hidden Dividend Stocks Plus

The next call price is $103.438, on 9/1/2023. We doubt that USAC will call them in - it'd cost them $750M, but, here's your potential profit if they were to call them in on 9/1/2023. (Like other debt issues, they trade with accrued interest, so the 3/1/23 interest payment would be a wash.)

With the notes at $94.53, your capital gain would be $8.91, and you'd receive one net semi-annual $3.4375 interest payment, for a net profit of ~$12.35. The total return would be 13% in ~9 months, or ~25% annualized:

Hidden Dividend Stocks Plus

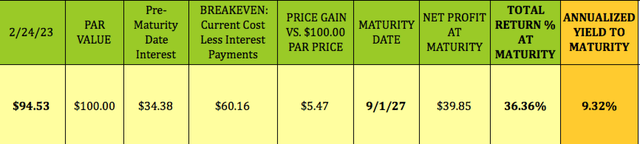

Holding these Notes till their maturity redemption would bring a total return of $39.85, comprised of $34.38 in semi-annual Interest payments, and a capital gain of $5.47. The total return/Yield to Maturity is ~36.36% in ~4.7 years, or 9.32% annualized:

Hidden Dividend Stocks Plus

Company Profile:

USAC is a limited partnership that provides natural gas compression services in terms of total compression fleet horsepower. It offers compression services to oil companies and independent producers, processors, gatherers, and transporters of natural gas and crude oil, as well as operates stations.

It primarily focuses on providing natural gas compression services to infrastructure applications, including centralized natural gas gathering systems and processing facilities. The company is headquartered in Austin, Texas.

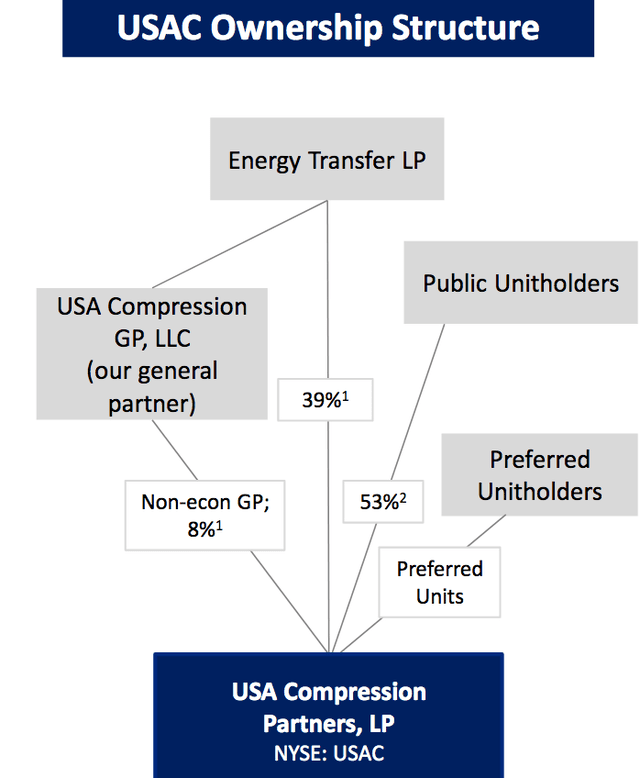

USAC is partially owned by Energy Transfer (ET), which owns 39%. (The HDS+ portfolio also has a position in (ET.PE) preferred units.)

USAC site

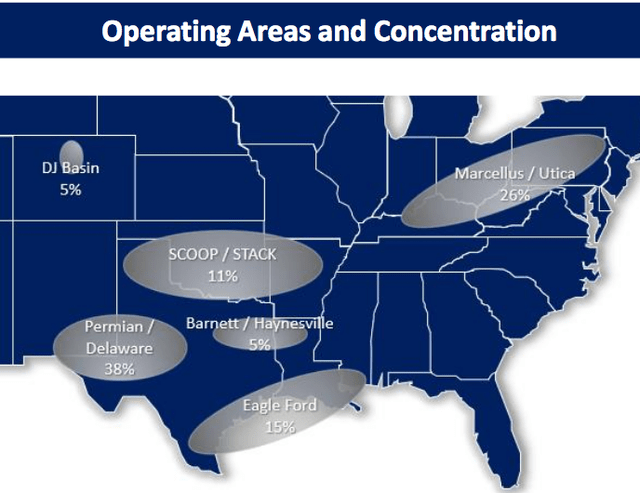

USAC's equipment is used in all of the major natural gas producing regions, with 38% of the fleet deployed in the dynamic Permian Basin, and 26% in the very active Marcellus/Utica basins. It focuses on large horsepower units, which have strong demand, and also tend to be sticky, as customers must pay for removing them from their site, which is expensive.

USAC site

Customer Base:

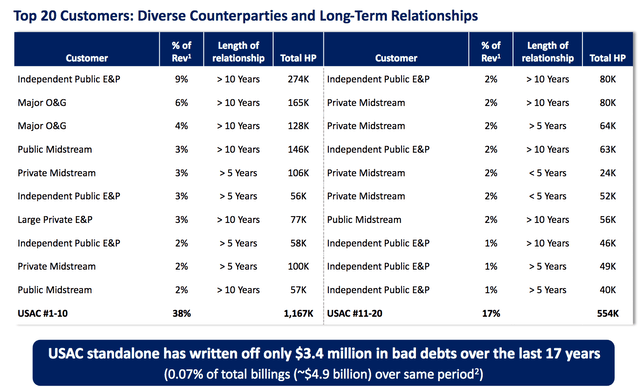

Natural gas prices have fallen in 2023 due to a mild winter. However, USAC's earnings aren't tied to the price of natural gas - it works on fee-based long-term contracts, and has long-term relationships with its diverse group of customers.

Those long relationships, and the fact that compression is vital to natural gas producers, has helped USAC to keep bad debt at a very low 0.07% of its total billings over the last 17 years.

As noted by CEO Long on the Q4 '22 Call, "So long as crude oil production remains economic, producers will continue to produce oil along with associated gas volumes that require compression services to ensure proper and responsible natural gas takeaway."

USAC site

Earnings:

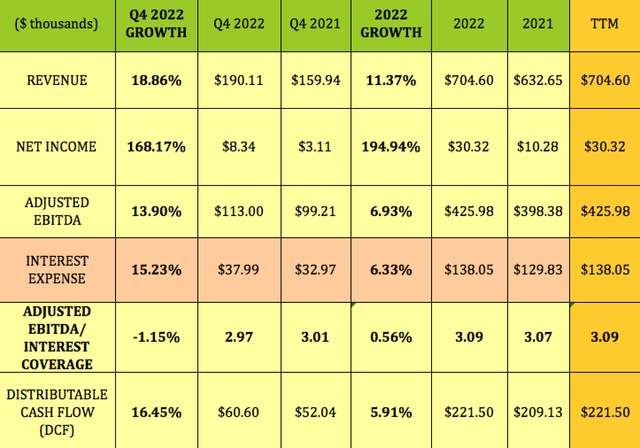

USAC had record revenues in Q4 '22 - they rose ~19% vs. Q4 '21. Net Income jumped 168%, while Adjusted EBITDA rose ~14%, and DCF rose 16.5%. Like most companies, USAC's Interest Expenses also rose in Q4 and full year 2022, but the increase in EBITDA kept Interest coverage ~steady at 3.09X, vs. 3.07X in 2021:

Hidden Dividend Stocks Plus

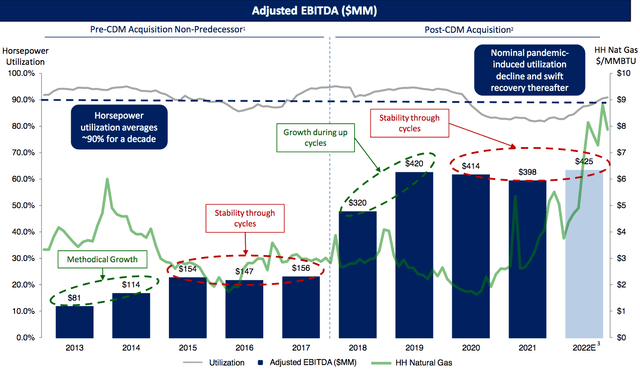

Long term, USAC has been through many boom and bust cycles, but, since compression is a vital part of getting natural gas out of the ground, the utilization of USAC's horsepower fleet has been steady, averaging over 92% since 2012.

Even in the energy pullback of 2015-2017, USAC's EBITDA was stable, running between $147 to $157M annually. EBITDA's lowest point was $398M, in pandemic-pressured 2021, but it improved to ~$426M for full-year 2022.

USAC site

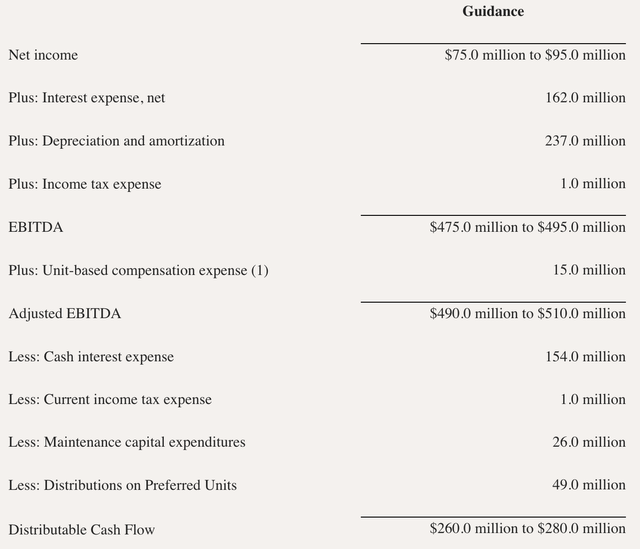

2023 Guidance:

Management issued upbeat guidance for 2023, with midpoint Net Income expected to rise from $30M to $85M, a 183% jump. Adjusted EBITDA midpoint guidance is for $485M, up ~14%. Interest expense is forecast at $162M, which implies a ~3X Interest Coverage ratio, down slightly vs. 3.09X for 2022, but still solid.

USAC site

Taxes:

Although USAC is an LP that issues K-1s for its common and preferred distributions, we receive interest on the 9/1/2027 Notes, so no K-1 issues come up at tax time.

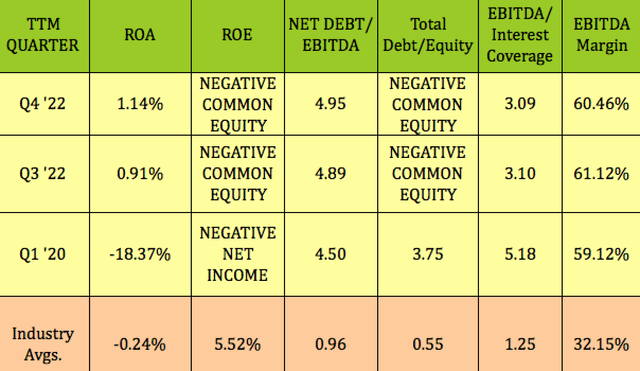

Profitability and Leverage:

USAC usually has negative equity balances, which eliminates ROE and Debt/Equity ratios. ROA improved slightly in Q4 '22, and is higher than the industry average. While USAC's Net Debt/EBITDA leverage is higher than average, its EBITDA/Interest coverage is much stronger, at 3.09X vs. the industry average of 1.25X. Its ~60% EBITDA Margin is also much higher than average.

Hidden Dividend Stocks Plus

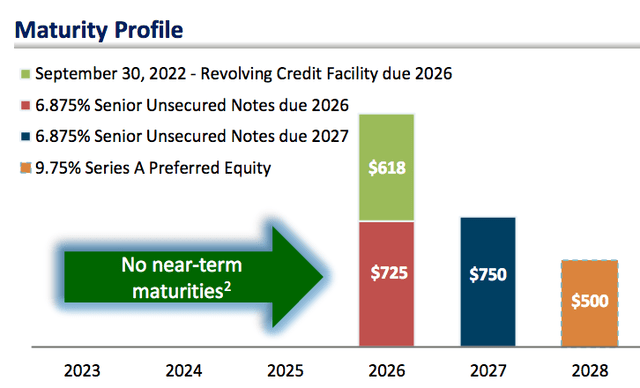

Debt and Liquidity:

As of Dec. 31, 2022, USAC was in compliance with all covenants under its $1.6B revolving credit facility. It had outstanding borrowings under the revolving credit facility of $646M, $954M of availability and available borrowing capacity of $333.1M.

As of 12/31/22, the outstanding aggregate principal amount of the Partnership’s 6.875% senior notes due 2026 and 6.875% senior notes due 2027 was $725M and $750M, respectively.

USAC has no debt maturities until 2026, when its 2026 Notes and Credit Revolver come due:

USAC site

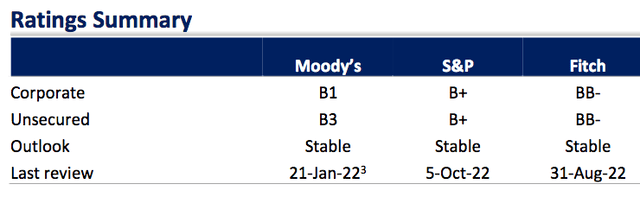

The 9/1/2027 Notes are rated B3 Stable by Moody's, and B+ Stable by Standard & Poor's:

USAC site

Parting Thoughts:

We see the recent pullback in USAC's 9/1/27 Senior Notes as an opportunity - we bought more of them. Interest coverage should remain steady in 2023. We rate them a BUY up to $100.00. If you're looking to avoid a K-1, and move higher up USAC's security ladder, these notes can fill the bill.

"Existing market tightness for compression assets provides us tremendous flexibility to lock in attractive service rates or remain flexible enough to opportunistically high grade return." (Q4 earnings call)

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

Find out now how our portfolio is beating the market in 2023.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Disclosure: I/we have a beneficial long position in the shares of USAC SENIOR NOTES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.