Thomson Reuters: Strong Growth In Cash And Earnings Despite Macroeconomic Pressures

Summary

- Thomson Reuters has seen a slight plateau in growth across the Tax & Accounting Professionals segment.

- However, cash and earnings growth continue to remain strong.

- I take a bullish view on Thomson Reuters.

Pascal Le Segretain

Investment Thesis: I take a bullish view on Thomson Reuters (NYSE:TRI) due to strong growth in cash and earnings, as well as strong revenue growth across the "Big 3" segments.

In a previous article back in November, I made the argument that Thomson Reuters is in a good position to see long-term growth on the basis of strong performance across its business segments, as well as a decrease in the company's long-term debt relative to total assets.

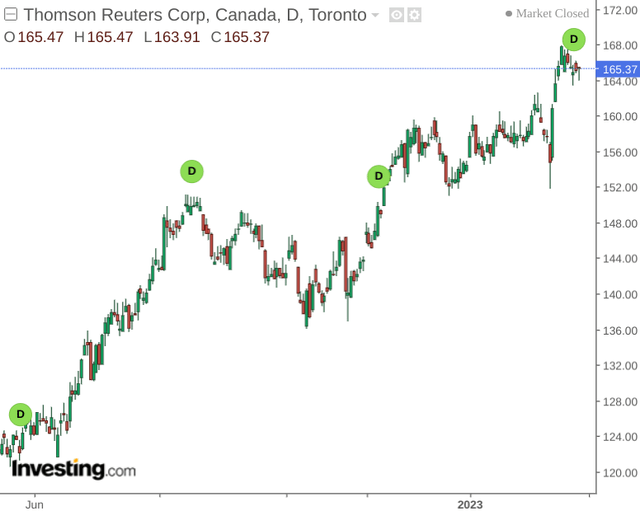

The stock is up by nearly 7% since my last article:

The purpose of this article is to assess whether the upside we have been seeing in the stock can continue, particularly taking the most recent quarterly performance into consideration.

Performance

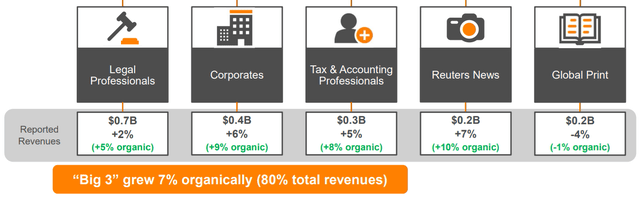

When looking at most recent revenue performance for the fourth-quarter of 2022, we can see that Reuters News showed the most growth on a percentage basis - while that of Legal Professionals (the largest segment by revenue) showed the second-lowest growth on this basis after that of Global Print:

Thomson Reuters: 2022 Fourth Quarter and Full-Year Results

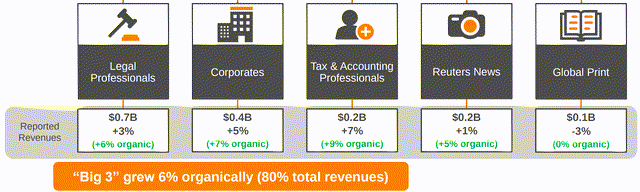

In contrast to that of the previous quarter, we can see that growth for Reuters News was significantly lower on a percentage basis at 1%, while Tax & Accounting Professionals showed the highest percentage growth at 7%.

Thomson Reuters: Third Quarter 2022 Results

In this regard, we can see that while performance across the Tax & Accounting Professionals segment has continued to remain respectable when comparing to that of other segments, growth is starting to plateau somewhat.

Specifically, Thomson Reuters' 2023 State of the Tax Professionals Report details how accountancy firms are increasingly looking to streamline their operations to remain competitive in the current marketplace.

For instance, KPMG was recently the first of the Big Four accounting firms to reduce headcount in the United States - downsizing its workforce by 2%. The company cited that while the Advisory segment of the business had driven outsized growth in recent years, uncertainty affecting certain parts of the segment had led to a reduction in headcount.

While recent macroeconomic events such as Western sanctions on Russia along with the increasing regulatory oversight over cryptocurrencies have to date necessitated increased expertise and associated technology solutions across these areas, a broad decline in global growth could lead to a consolidation of demand in this area.

From a balance sheet standpoint, we can see that the company's long-term debt to total assets has declined further, which is encouraging.

| Sep 2019 | Sep 2022 | Dec 2022 | |

| Long-term indebtedness | 3229 | 3700 | 3114 |

| Total assets | 15984 | 21162 | 21711 |

| Long-term debt to total assets ratio | 20.00% | 17.00% | 14.34% |

Source: Thomson Reuters Q3 2019, Q3 2022 and Q4 2022 Financial Results and provided in millions of U.S. dollars, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

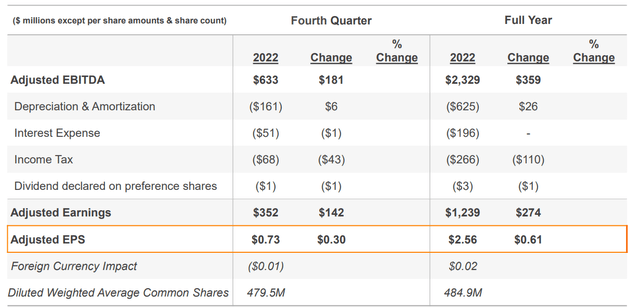

Moreover, adjusted earnings per share is up strongly from that of last year:

Thomson Reuters: 2022 Fourth-Quarter and Full Year Results

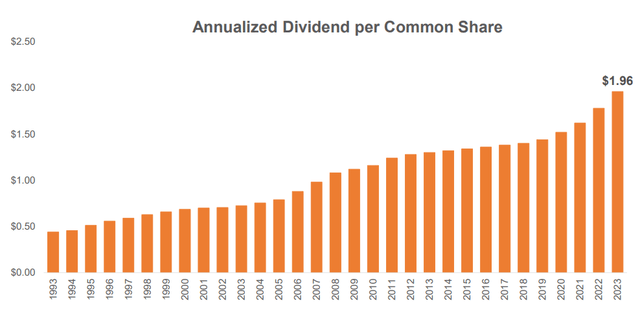

Cash and cash equivalents are also up from $778 million in December 2021 to $1.069 billion in December 2022. Additionally, the company has also grown its dividend by 10% for 2023 - marking 30 consecutive years of dividend rises:

Thomson Reuters: 2022 Fourth Quarter and Full-Year Results

In this regard, while we have seen a slight dip in growth across Tax & Accounting Professionals, the "Big 3" segments continued to see 7% organic growth and I take the view that the company is in a strong financial position to weather a potential plateau in growth across the Tax & Accounting Professionals segment.

Risks and Looking Forward

In my view, the main risk to Thomson Reuters at this time is the possibility of a strong macroeconomic slowdown in global growth further weakening demand across the company's traditionally high-revenue segments such as Legal Professionals and Tax & Accounting Professionals.

Given that Thomson Reuters cites Tax & Accounting Professionals as the company's most seasonal business with 60% of the segment's overall revenues generated in the first and fourth quarters of the year.

In this regard, I take the view that investors will be paying close attention to performance across this segment in the next quarter. Should we see organic growth continue to maintain strength in spite of macroeconomic pressures, then this could be a catalyst for further upside.

Conclusion

To conclude, Thomson Reuters continues to remain in a strong financial position and overall revenue growth continues to remain robust. In spite of a slight decline in growth across the Tax & Accounting Professionals segment, I take the view that the company has the capacity to withstand a temporary slowdown in revenue growth. I continue to take a bullish view on Thomson Reuters.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.