RPT Realty: The Preferreds Offer A 7% Yield Forever

Summary

- RPT's preferreds are paying out a 7% yield in perpetuity.

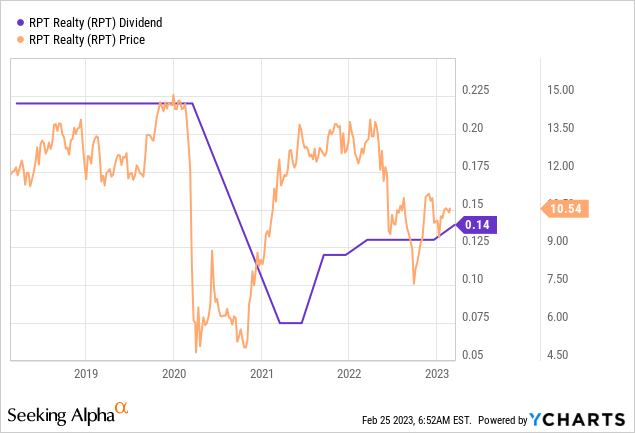

- The commons currently offer a 5.2% yield, which has been recovering since its suspension early during the pandemic.

- Fiscal 2022 fourth quarter earnings saw FFO at $0.24 per share, up from $0.16 per share in the year-ago quarter.

jmsilva/iStock Unreleased via Getty Images

RPT Realty (NYSE:RPT) last paid a quarterly cash dividend of $0.14 per share, a 7.7% increase from the prior payout, for a 5.3% yield. The sustained recovery of this on the back of a retail property portfolio that has proved resilient forms the core near-to-medium-term focus of RPT's common shareholders who have now seen three dividend raises since 2021. There are more raises on their way as FFO for the REIT's last reported fiscal 2022 fourth quarter came in at $0.24 per share for a 58.3% payout ratio.

Hence, even with rising Fed funds rates exerting pressure on cap rates with REIT bears also flagging possible recession risks as a reason to avoid retail property, the relatively healthy payout provides slack for future dividend raises. RPT held a property portfolio worth $3.6 billion as of the end of its fourth quarter. This included at least 44 wholly-owned shopping centers and other retail properties owned through joint ventures which all had an aggregate 15 million square feet of gross leasable area.

A Focus On Leasing

The REIT signed 69 leases covering 500,000 square feet during its fourth quarter to bring its total for the full fiscal year to 2.2 million square feet, the highest annual leasing volume since 2014. This meant their leased rate grew to reach 93.8%, up by 70 basis points over the year-ago period. Further, RPT has 390 basis points of occupancy growth embedded in its lease rate which means there is over $11 million of rent and recovery income yet to be realized.

Overall, strong leasing during the quarter drove net income for the quarter of $56.8 million, or $0.63 per share, an increase from a loss of $0.15 per share in the year-ago period. Funds from operations came in at $22.7 million, around $0.24 per share. This was up 50% from FFO of $0.16 per share in the year-ago quarter.

Total equity as of the end of the fourth quarter was $978.7 million, up sequentially from $912.6 million in the prior third quarter with the REIT's book value at $10.15 per share. Book value was up 8.55% from $9.35 in the year-ago comp and is below the current price of the commons by around $0.39 per share. Critically, this premium to book highlights enthusiasm by bulls around the REIT. Total equity is likely set for a continued move higher even against the specter of a recession.

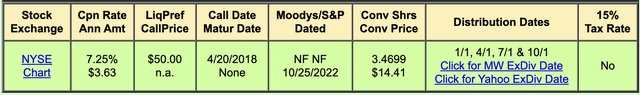

Exploring The Convertible Series D Preferreds

RPT's 7.25% Series D Cumulative Convertible Perpetual Preferred Shares (NYSE:RPT.PD) pay out a $3.63 coupon for a 7.2% yield on cost, around 191 basis points higher than the yield available on the commons. Preferreds providing a higher yield than the commons is a somewhat uncommon setup as it opens up an opportunity for higher income wrapped within a fundamentally more stable security.

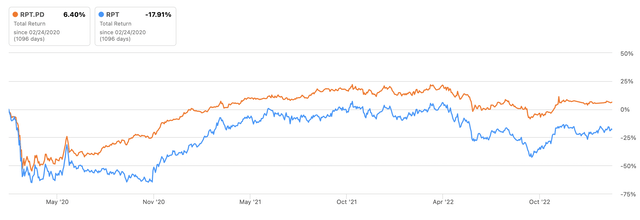

Indeed, the preferreds sit higher on the capital structure than the commons in their claim to earnings. This meant the pandemic-era disruption went unnoticed by the preferreds holders with RPT's wholesale FFO losses from stay-at-home orders being plugged by the dividends taken from the common shareholders. Hence, the Series D has in recent years outperformed the commons markedly from a total return perspective.

The commons are down 18% over the last 3 years against a gain of 6.4% for the preferreds. Over the last 12 months, the preferreds are down 5.18% versus a loss of 13.38% for the commons. However, this performance dichotomy is less likely this year with the preferreds trading above their par value and with the recovery of the payouts to common shareholders well underway.

It's important to note that the quarterly paying and convertible preferreds are perpetual and are trading nearly half a decade past their April 20, 2018 redemption date. To force a conversion, RPT's commons would have to exceed by 130% its $14.41 per share conversion price for 20 of any 30 consecutive trading days. For RPT to be able to remove the preferreds from its capital structure and save $1.7 million per quarter in dividend payments, its common share price would have to be at least $18.74. This is a level 78% higher than the current price.

The Series D essentially represents forever income with a move to its forceful conversion price likely to be somewhat of a distant concept within the next three to five years. The REIT would have to realize an incredibly high compound annual growth rate of 12.2% to reach its conversion price within the next five years, an unlikely rate of return. Hence, both securities present value to two types of investors. The preferreds are for the more risk-averse happy to collect a just over 7% yield every year in perpetuity while the commons offer the potential of near to medium-term dividend growth and an uplift in price on the back of this as book value continues to grow. I'm neutral on taking a position in either security but see both as buys.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.