Investor Insanity Creates Huge Mispricing: 12.5% YTM On B. Riley Baby Bonds

Summary

- The YTM (yield to maturity) on B. Riley baby bonds has increased as much as 44% in just the last 3 weeks with YTMs up to 12.96%.

- A short attack (IMO without merit) caused RILY stock to drop but strangely the much safer baby bonds dropped much more. Thus, this excellent buying opportunity now exists.

- The 12.5+% YTM on RILY baby bonds versus the 8% current yield on RILY preferred stocks is one of the most egregious relative mispricing that I have ever seen.

- RILY could have a strong first quarter giving investors in their baby bonds a catalyst for a strong rally.

- We're currently running a sale at my private investing ideas service, Conservative Income Portfolio, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

SL_Photography

B. Riley Financial

Annual Report

B. Riley Financial (NASDAQ:RILY) is an investment bank that also has other operating businesses. It has been very successful in becoming a premier investment bank for small cap companies and is now one of the top 2 underwriters of smaller cap IPOs.

RILY common stock has been a fantastic investment over the last 10 years. It has risen around 1600% since the beginning of 2012. And that is despite a very large $10 per share in special dividends that RILY paid out in 2021 along with its regular dividend. When the market was strong, as in 2021, RILY earned over $15 per share. The bond and stock markets in 2022 have been the worst ever for a combined 60/40 stock and bond portfolio. Naturally RILY’s investment portfolio has suffered.

Because RILY is a cyclical growth stock, its reported earnings will be up and down with the markets but the long term trend has certainly been way up. And RILY’s core businesses have shown consistently strong cash flow so investors shouldn’t be overly focused on their investment portfolio which will be more volatile. Insurance companies and other businesses that hold investment portfolios have certainly also suffered. But again, that is not unexpected.

The Opportunity in RILY Baby Bonds

I am not going to go into detail on each of RILY’s 7 baby bonds. You can get that information from quantumonline.com. I am focused here on what has happened in the last 3 weeks since a short seller attack on RILY was released. Since then, strangely we have seen RILY baby bond prices shredded while riskier RILY common stock and preferred stocks have sold off to a much lesser degree.

This kind of reaction to the short attack is rather insane as certainly any truth to the short attack should hit the common stock most, and preferred stocks next, and the bonds should be hit the least as they have the protection of the common and preferred equity protecting it. At our Conservative Income Portfolio service, we are constantly looking for mispriced securities and this one looks hugely mispriced.

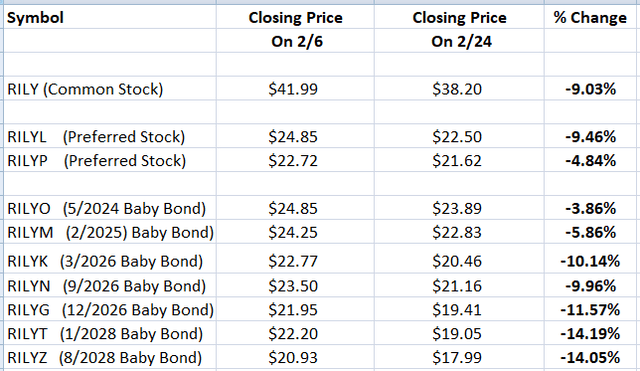

The following 2 charts below detail the insanity, especially the second chart.

The above chart shows the prices of each security at the February 6th close, before the short attack, and the current prices. And it also shows the percentage change in prices. As you can see, the common stock has fallen 9%, the 2 preferred stocks an average of 7%, but the bonds have fallen up to 14% in price with the longer duration bonds naturally falling the most. A normal price drop for the bonds would be more like 1 to 2% for the short term bonds, and 3 to 4% for the longer maturities given the drops in the common and preferred stocks. A bond dropping 14% when the common stock is down 9% makes absolutely no logical pricing sense.

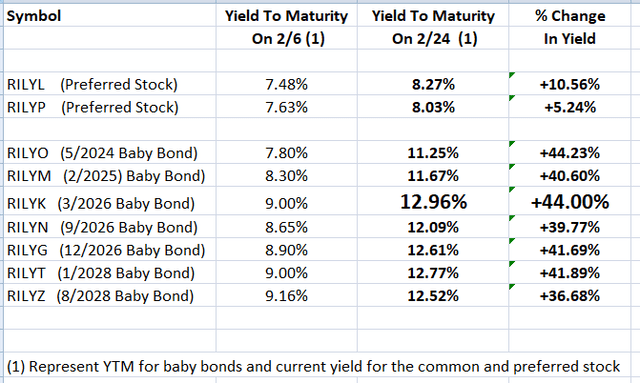

But this next chart really shows the massive disconnect between the common and preferred stocks and the baby bonds and how truly huge is the mispricing that we now have.

The “% Change In Yield” column, really drives home the insanity and opportunity that we have. You can see that the yield to maturities (YTMs) on RILY baby bonds have increased massively over 3 weeks, up around 40%, while the current yield on the preferred stocks have only risen an average of 7.9%. This is why I say that this is one of the most massive trading disconnects within the capital structure of a company that I have ever seen.

When relatively short term baby bonds, like the RILY baby bonds, drop in price, the YTMs shoot much higher. As we can see, RILYO, the shortest duration RILY baby bond, dropped in price less than $1.00, but that caused its YTM to jump 44% from 7.8% to 11.25%. And one of the longer duration bonds, RILYT, is up from 9% YTM to 12.77% in the past 3 weeks.

But the fact is that relatively short term baby bonds, like those of RILY, should never drop in price as much as the fixed-rate perpetual preferred stocks or common stock because price drops in the bonds create huge increases in the YTM while they increase the preferred stock yields to a much lesser extent. Yet due to investor insanity (or lack of understanding), RILY bonds did drop in price more than the preferred stocks.

Often I see less experienced investors looking at current yield on bonds rather than yield-to-maturity. That may be the case here and the reason why RILY baby bonds are at such relative bargain prices. If you are a bond investor that uses current yield in your investment decisions, I suggest that is a huge mistake. You are giving more experienced investors some great opportunities when you price bonds based on current yield and ignore the large capital gain that is built into bonds that trade well below par.

Normal Bond Yields Versus Preferred Stock Yields

The YTM on RILY baby bonds is currently more than 50% higher than the current yield on the RILY preferred stocks. Where else can one find this type of mispricing? I don’t know of anywhere. Normally, the YTM on bonds should be lower than the current yield on preferred stocks although minor exceptions may occur.

Symbol Bond YTM Preferred Stock Current Yield

EPR-E 7.00% (2026) 8.05%

ESGRO 6.35% (2029) 7.30%

ATH-B 5.60% (2028) 6.50%

BW-A 9.20% (2026) 11.50%

RLJ-A 7.30% (2026) 8.00%

RILYK 12.77% (2026) 8.15% RILYP/RILYL average yield

The above list is a random list of fixed-rate preferred stocks that I follow versus bonds from the same company. As you can see, it is normal for the bonds to offer a lower YTM than the current yield of the same company’s preferred stock due to their increased safety. So when RILY bonds have a YTM that is more than 50% higher than the current yield of its preferred stocks, that is a massive aberration. Either the preferred stock is grossly overvalued, the bonds are grossly undervalued, or some of both.

It is also interesting to note that preferred stock investors put the same 8% yield on the preferred stocks of RILY, EPR and RLJ but regarding the bonds investors are giving the RILY bonds a yield that is 78% higher than the yield on RLJ and EPR bonds. How does that make any sense?

When the market is pricing with absolutely no logic, there is opportunity to be had. Whether that is simply going long the undervalued security, shorting or selling the overvalued security, or initiating a pairs trade by going long the bonds and short the preferred stocks is up to each investor to determine. But when the huge increase in yield on the RILY bonds is not confirmed by a big drop in the common stock or preferred stock, that is a strong indication to me that the bonds are likely very undervalued and will likely rally in the near term. I will explain more on that later on. Regardless, anyone holding RILY preferred stocks should jump on the opportunity to improve safety and greatly improve yield by selling their preferred stocks and buying the baby bonds.

Safety

1

If we annualize RILY’s 4th quarter operating EBITDA, we get $404 million. And if we annualize their 4th quarter interest expense we get $175 million. So RILY is covering their interest expense by 2.3 times.

It is also interesting to note that RILY’s net interest income on loans and securities lending alone almost completely covers their interest expense.

2

The claims in the short attack are highly questionable. HDO did a nice article debunking some of the claims in the short attack. And the amount the shorts claim that RILY will lose on their investments in 2023 is a totally wild guess and strikes me as absurd. If they can predict what RILY’s investments will do in 2023, 1.5 months into the year, these guys are genius investors and should be shorting the investments that RILY owns and not shorting RILY as RILY’s investments are only part of the RILY story and ignores RILY’s strong operating business cash flow.

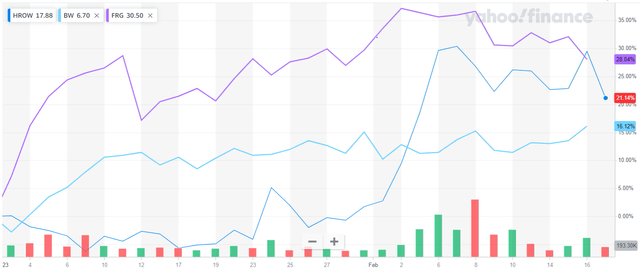

I follow 3 stocks that RILY has positions in because they have either preferred stocks and/or baby bonds. Those are Harrow Health (HROW), Babcock & Wilcox (BW) and Franchise Group (FRG).

Price Chart Since January 1, 2023

While RILY has not yet listed its end of year holdings, these 3 companies in which RILY has investments have been doing great since the start of 2023. As you can see they have gained on average over 20% in less than 2 months. So I don’t think the short attacker predictions for 2023 are off to a good start.

Additionally, RILY has some investments in crypto miners which I don’t personally like, but Bitcoin has soared 45% since the beginning of the year. This bodes very well for those investments. And even if these bitcoin investments go to zero, this is small potatoes and the baby bonds are not threatened. So first quarter earnings for RILY could be strong and be a catalyst for the baby bonds to rally strongly. Management said in RILY’s recent press release that:

“Capital Markets began to improve late in Q4 and this momentum has continued into Q1, which has us optimistic as our clients resume opportunistically accessing capital. We are also beginning to see increased activity in our Liquidation and Real Estate practices that are benefitting from pockets of distress.”

2022 was a terrible year for underwriting as IPOs were few and far between. But companies can’t wait forever and will have to refinance their debt and issue new bonds at some point. So their underwriting business has nowhere to go but up.

3

RILY generates a large amount of cash flow from its operations and it is not simply a common stock mutual fund as the shorts want to pretend (or the fake shorts who want a quick profit by scaring investors and who may already have covered their shorts for a quick buck). And the idea that RILY is a poor stock picker doesn’t hold up as they have broken even on their small cap investments over the last 2 years while the Russell 2000 was down 11%. And their longer term track record is super. 2022 was the second highest year of operating EBITDA for RILY in its history and given how terrible the market was and how few IPO’s there was, that says a lot about the stability of their operating businesses.

RILY has many operating businesses, and some that are counter cyclical. The fact that they have a liquidations business, an auction business and a restructuring business helps them when markets/economy are poor and helps to stabilize their earnings when underwriting is in a funk.

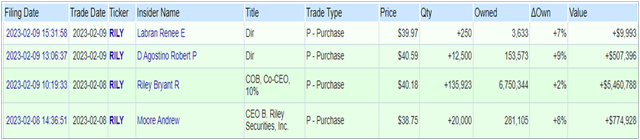

Insider Buying

RILY insiders turned this short attack into an opportunity to do some buying of their stock as they surely know their company better than those behind the short attack who may have simply wanted to make a quick profit off of the panic that followed their report. Who knows. Here are the insider buys:

As you can see, 4 insiders jumped on the opportunity to buy their stock within 1 or 2 days of the short report with CEO Bryant Riley buying close to 136,000 shares. Insiders, especially Riley, already own a large share of RILY common stock.

Which RILY Bond Is Best?

So you don’t have to keep scrolling up, here is the chart again.

As you can see from the 2nd from last column, RILYK stands out as the best baby bond in terms of YTM with almost a 13% YTM. That is a bit surprising as usually the longest term baby bonds have the highest YTMs. So at Friday’s closing prices, RILYK looks outstanding and looks to be undervalued versus the other RILY baby bonds. RILYK has also fallen the most in price of all the RILY baby bonds in the last 3 weeks, so the near term capital gains potential here is also excellent.

When I see what I believe is a great YTM and opportunity in bonds, as I obviously believe this is, I also like to lock in that yield for a long time. So personally, I have a position in RILYT. This gives me 5 years to collect a 12.77% return and because it trades close to $6.00 below par, it should provide large capital gains over the coming year if these bonds rally even back to where they were 3 weeks ago. And if it takes 6 months to get back to their price of 3 weeks ago, you will achieve a 20% total return over 6 months or a 40% annualized return.

But each can decide for him/herself which RILY bond they like and how long a maturity they want in their investment. All 7 of these baby bonds are very undervalued.

Comparing RILYK To Other Bonds With 13% YTMs

There are 3 baby bonds that I follow that also have similar yields to the RILY baby bonds. There are 2 bonds issued by Diversified Healthcare Trust (DHC), (DHCNI) and (DHCNL). These 2 baby bonds have YTMs around 12.6%. But they don’t mature until 2042 and 2046 and to make matters worse, DHC common stock sells for 91 cents. In less than 5 years DHC has gone straight down from $20.00 to $0.91. So relative to these bonds, the RILY bonds are grossly undervalued with a similar YTM.

The other baby bond is (GEGGL). It currently has a YTM of 13% with the common stock, Great Elm Group (GEG), selling at $2.18 with only a $65 million market capitalization. This company manages the BDC GECC, which has a terrible track record.

GECC is down from close to $60.00 to under $10.00 over the last 5 years.

While a speculative purchase in GEGGL may not be bad, the quality of RILY versus GEG and the historical record of RILY (great) versus GEG (bad) are night and day.

Summary/Conclusion

RILY has a phenomenal track record in its short 10 year (or so) history with its stock price rising 1600%. A very questionable short attack on RILY stock has given us a massive opportunity in the RILY baby bonds. In my opinion, this short attack is a “nothing burger”, but I want to thank the author of this short attack for giving me this opportunity to buy RILY bonds at hugely discounted prices. There was very little in this short attack that wasn’t already publicly known.

While all RILY securities took a knee-jerk price drop when this short report came out, as is typical on a short attack, strangely the safest securities from RILY (the baby bonds) sold off the most by far creating a gross relative mispricing. In just 3 weeks, the yield to maturity on RILY’s baby bonds has jumped around 40% while the current yield on RILY’s preferred stocks has increased only around 8%. For example, RILYK, which 3 weeks ago had a 9.0% YTM now has a YTM of almost 13%. This is an insane move when the common stock is down only 9%.

The RILY baby bonds are grossly undervalued relative to the RILY preferred stocks. In my investing life, I can’t recall ever seeing such a huge undervaluation of baby bonds versus the preferred stocks of the same company. While RILY baby bonds offer yields to maturity up to 12.96%, RILY’s 2 preferred stocks have an average current yield of only 7.9%. While normally you would expect the YTM on bonds to be around 15% lower than the current yield on the company’s preferred stock, the YTM on RILY bonds is actually 60% higher than the current yield on its preferred stocks. That is unheard of. This kind of mispricing presents a great opportunity and I strongly recommend that those owning RILY preferred stocks quickly swap into the baby bonds as this mispricing is not likely to last.

All 7 of the RILY baby bonds look attractive, but currently RILYK looks undervalued even relative to other RILY baby bonds. The price of RILYK has dropped the most and it has the highest YTM at 12.96% at Friday’s closing price. RILYK matures in 3 years. But because we have what I believe is a huge opportunity here, I want to lock in this high YTM for longer also. So personally I also have a position in RILYT which has a 12.77% YTM and doesn’t mature for 5 years. And trading nearly $6.00 below par, there is the potential for a large capital gain over the coming year which I believe we will see.

In terms of safety, RILY’s operating EBITDA covers interest expense 2.3 times with the baby bonds being covered by over $1 billion in common stock equity as well as the preferred stock equity. RILY’s liquidity is strong with $266 million in cash on the balance sheet, a large amount of public securities which can be sold if cash is needed, and a revolving line of credit that can also be tapped. RILY generates strong cash flow from its operating businesses which include counter cyclical businesses like a liquidation business, a restructuring business and an auction business which should help in a recession.

Lastly, 4 insiders jumped in and bought shares of RILY right after the short attack as they consider this short attack a buying opportunity as I do. And in the Q4 press release, Bryant Riley struck a bullish tone stating that their capital markets have seen a turn for the better starting in late 2022 until now. We could see a very nice first quarter earnings report from RILY which could be a catalyst for the baby bonds to move higher in price if the YTM on these bonds is not enough to wake up investors to this opportunity. If you simply look at current yield on these bonds, and ignore the embedded large capital gains that you will achieve, you are really missing the boat.

Are you looking to start building a Fixed Income Portfolio?

Conservative Income Portfolio targets the best Preferred Stocks and bonds with the highest margins of safety. We strongly believe that the next decade will belong to fixed income irrespective of whether you are conservative or aggressive in your approach! Get in on the ground floor of our recently started Bond and Preferred Stock Portfolios.

If undervalued fixed income securities, bond ladder, “pinned to par” investments and high yielding cash parking opportunities sound like music to your ears, check us out!

This article was written by

Trading preferred stocks and fixed income securities for more than 25 years and stocks in general for 35 years. Author of many Seeking Alpha articles and Editor's Picks articles.

Disclosure: I/we have a beneficial long position in the shares of RILYT, RILYK, RILYM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.